baona

Investment Rationale

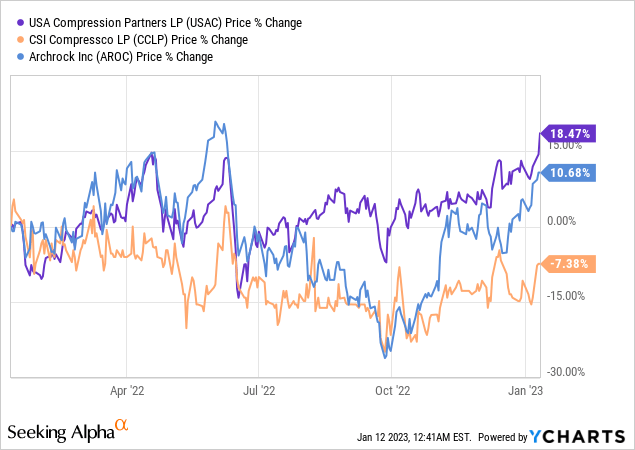

USA Compression Partners (NYSE:USAC) stock has gained the most in the past year as compared to its peers Archrock Inc. (AROC) and CSI Compressco (CCLP). The current energy market contributes towards strengthening of natural gas compression services demand and the company predicts strong long-term demand from its existing customers. Improvement in market conditions, planned operational improvements, and continued focus on capital discipline are some of the key drivers for the company’s future growth.

About the Company

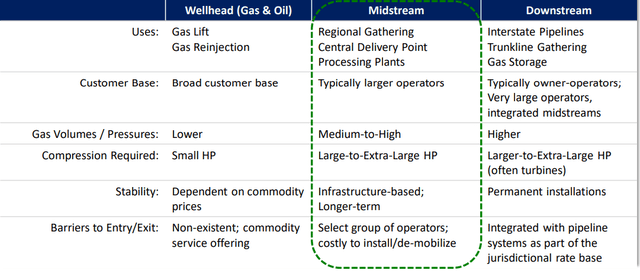

USA Compression Partners is a leading provider of natural gas compression services in the US and provides services to its customers under fixed-fee contracts. It provides natural gas compression services to infrastructure applications in high-volume gathering systems, processing facilities, and transportation applications. The company’s fleet consists of large horsepower equipment which can stay with the customers for a long period as compared to the smaller units.

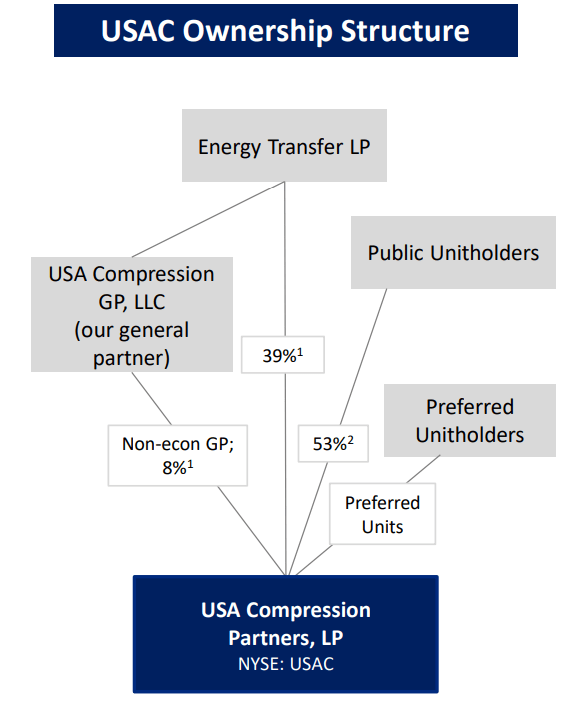

USA Compression Partners

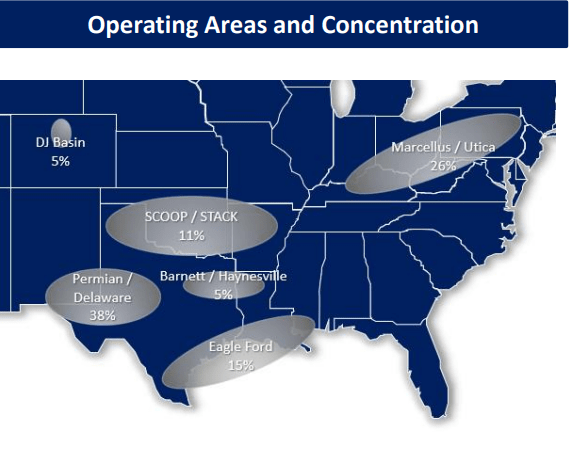

The compression services are provided by the company throughout the U.S., including the Utica, Marcellus, Permian Basin, Delaware Basin, Eagle Ford, and others. A summary of the company’s operating areas and concentration is shown below-

USA Compression Partners

Strong performance in Q3’2022

USA Compression Partners reported a strong performance in Q3’2022. Revenue rose around 13% on a YoY basis whereas net income soared from $4.1 million in Q3’2021 to $9.6 million in Q3’2022. The distributable cash flow for the quarter stood at $55.2 million as compared to $52 million recorded in Q3’2021. It was the 39th consecutive quarter that the company recorded a higher DCF. The EBITDA numbers gained around 10% while the distributable cash flow coverage improved from 1.02x to 1.07x. The company also recorded a decrease in the bank covenant leverage ratio from 4.9x to 4.84x. USAC’s robust results were supported by consistent improvements to its fleet utilization, which went beyond the 90% exit rate for the third quarter. This further improved the company’s quarter-over-quarter average price per horsepower per month.

Improving Financials

We calculated some financial ratios for USA Compression Partners for assessing the financial health of the company. According to the calculated liquidity, solvency, and profitability ratios, except for 2020, USAC has reported decent ratios and is functioning with healthy and growing financials. The current ratio has been constantly above 1 whereas the quick ratio also stands in a comfortable position.

The company’s debt climbed significantly in 2021 as compared to 2020. An 8.9% increase in the revolving credit facility pushed the overall debt levels up for the company. The debt to assets ratio is trending upward but is below one indicating manageable risk. The interest coverage ratio looks healthy indicating that the operating income can cover interest expense.

|

Financial Ratios |

2019 |

2020 |

2021 |

Q12022 |

Q22022 |

Q32022 |

|

Liquidity Ratios |

||||||

|

Current Ratio |

1.22 |

1.17 |

1.09 |

1.27 |

1.04 |

1.14 |

|

Quick Ratio |

0.73 |

0.67 |

0.64 |

0.73 |

0.61 |

0.56 |

|

Solvency Ratios |

||||||

|

Debt to Assets Ratio (Long Term Debt / Total Assets) |

0.50 |

0.65 |

0.71 |

0.74 |

0.74 |

0.78 |

|

Interest Coverage Ratio (Op. Income/ Interest Expense) |

1.32 |

-3.61 |

1.09 |

1.10 |

1.28 |

1.28 |

|

Profitability Ratios |

||||||

|

Net Profit Margin |

5.6% |

-89.1% |

1.6% |

2.0% |

5.3% |

5.3% |

|

Return on Equity |

3.3% |

-176.1% |

10.2% |

7.8% |

-75.3% |

-14.8% |

|

Return on Capital Employed |

4.8% |

4.7% |

4.7% |

1.4% |

1.7% |

1.8% |

The quarterly distributions declared per unit remained constant throughout all three years.

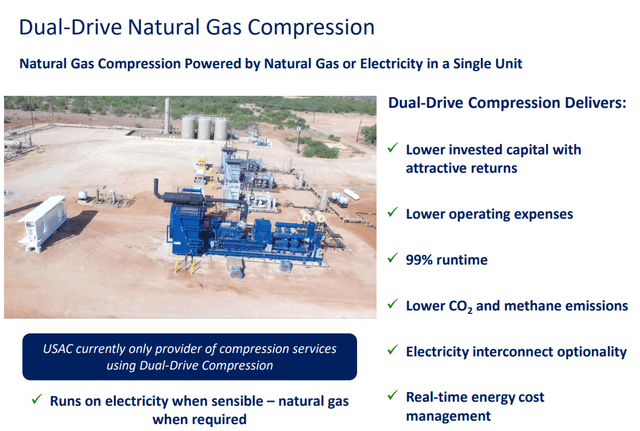

The Only Provider of Dual-Drive Natural Gas Compression

The dual-drive natural gas compressor is a key differentiator for USA Compression Partners. As the name suggests, a dual-drive unit can run on both natural gas and electric power. Depending on factors such as weather conditions or grid demand, this flexibility offers significant value to the customer. Customers are not forced to bear higher operational costs at times when using electric power doesn’t make sense. With increased electrification and build out of electric grid, the dual-drive unit system should get an added advantage.

The company has multi-year contracts to deploy its dual drive units, and it expects to deploy 20 to 50 units in 2023. USAC expects rising customer demand with time, as the customers get to see the units performing well operationally. These dual-drive units are reliable and cost-efficient, while also helping in reducing greenhouse gas emissions.

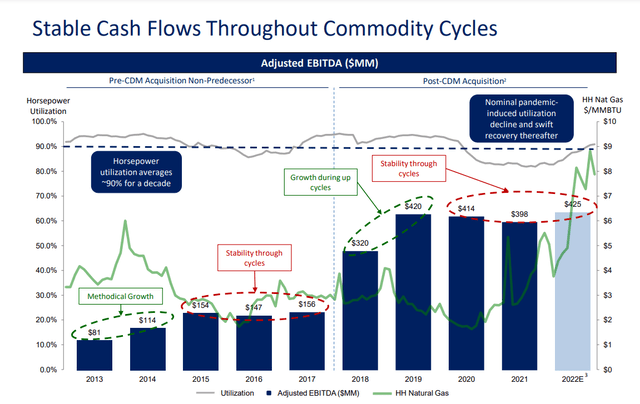

Stable Cash Flows Through Commodity Cycles

USAC provides services to its customers under fixed-fee contracts which have initial contract terms typically between six months and five years, depending on the application and location of the compression unit. The company primarily enters fixed-fee contracts where the company’s customers pay their monthly fee even during periods of restricted or disturbed throughput, resulting in stable, predictable cash flows. The company is not directly exposed to commodity price risk as the natural gas used as fuel by its compression units is supplied to the company by its customers free of cost. The beauty of the company’s business model is that the compression units are not hit by technological obsolescence. Hence, older assets can perform the same service as new assets, which allows the company to reprice them better in the market.

Besides, USAC’s focus on midstream applications aids the stability throughout commodity price cycles. It provides cash flow stability with counterparties.

Offering Higher Returns to the Shareholders

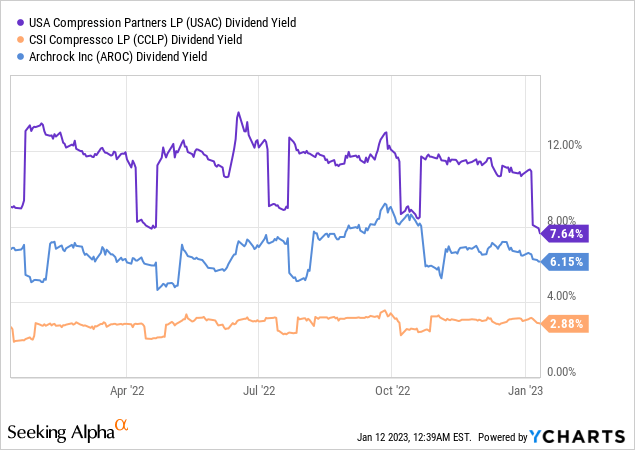

Compared to its peer companies namely Archrock Inc and CSI Compressco, USAC offers a higher dividend yield as seen in the below chart-

Robust demand for natural gas compression, stable cash flows, and reasonable leverage level should help USAC maintain its dividend payments in the coming years.

The company has also offered the highest share price return when compared to its peer companies in the past year.

Return on Equity and Return on Capital Employed offered by USAC are also the highest among the peer companies. The company has a stable distribution history with around $1.5 billion returned since its IPO.

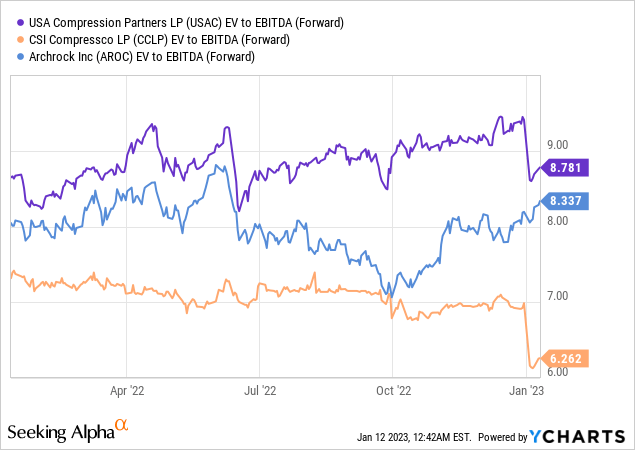

Reasonable and Stable Valuation

USAC’s market cap is higher than its peer companies Archrock Inc and CSI Compressco. According to the forward EV to EBITDA ratio, USAC stock appears to be trading at a premium. Healthier ROIC and stable dividend payments contribute to USAC’s premium valuation. Peer CSI Compressco has cut its dividend three times since 2015.

Seeking Alpha’s proprietary Quant Ratings rate USA Compression Partners as “Hold.” The stock is rated high on valuation but low on growth factors.

Risks

One of the risks for USA Compression Partners is that the level of net income generated is insufficient to reward the common shareholders with sufficient earnings per share. The company’s operations need to improve further in order to record a healthy EPS number. Secondly, any sustained reduction in the demand or production of natural gas can hurt the company’s services and its prices. This can in turn weigh on the revenues generated by the company as well as the cash available for distribution to unitholders. The company’s debt level, and rising interest rates, is likely to limit its flexibility in obtaining additional financing, pursuing other business opportunities, and paying distributions.

Conclusion

Natural Gas is the top requirement of US electrical power generation and compression is a critical part of the natural gas value chain. USAC has provided large horsepower compression services for over two decades. LNG exports, petrochemical feedstock, and power gen boost the usage of natural gas. The company offers higher dividend yield and returns to its shareholders as compared to its peers. It also has an edge over its competitors as USAC is the only provider of dual-drive natural gas compression. Also, the financials of the company are strong and growing. These factors make USAC stock attractive for dividend investors.

Be the first to comment