- Equities Awaiting Catalyst

- USD Correcting with USD/JPY Tracks US Rates Higher

QUICK TAKE: Equities Mixed, USD Bears Unwind, US Rates Extend Gains

Equities:DJIA (+0.45%), S&P 500 (+0.65%), Nasdaq 100 (-0.1%)

Relatively choppy price action across the equity space for European bourses as the bullish sentiment fizzles out amid a lack of key catalysts. That said, US futures continue to hover around record highs. With the FOMC minutes providing little in the way of new information, focus now turns to tomorrow’s US NFP report. As a reminder, the US ADP showed a surprise contraction of 123k, however, the data hasn’t been a reliable indicator for NFP for quite some time. Nonetheless, it does emphasise the slowing momentum in jobs growth.

FX

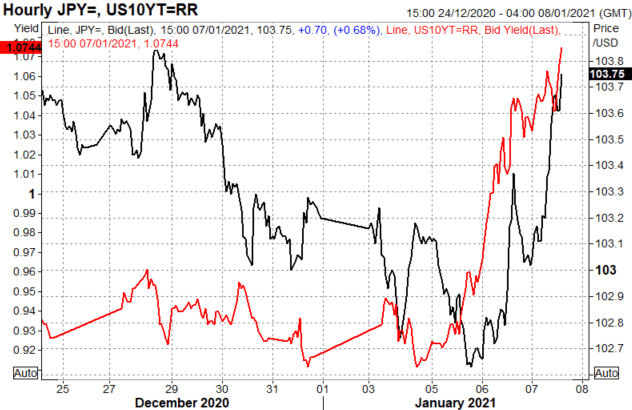

The US Dollar is on the front-foot as US yields continue to track higher with 10yrs up over 3bps on the day to 1.07%. However, it is important to keep in mind, that given the persistent downtrend in the greenback, it is natural for a corrective move, shaking out weak hands. Key resistance on the topside is the 90.00. That said, in light of the Democrat sweep, USD risks remain tilted to the downside.

Recommended by Justin McQueen

Download our fresh Q1 2021USD Forecast

Elsewhere, the Japanese Yen has extended on recent losses as the currency tracks US yields closely, which puts focus on resistance situated at 104.00. That said, the USD/JPY downtrend remains intact for now.

| Change in | Longs | Shorts | OI |

| Daily | -11% | 43% | 8% |

| Weekly | -8% | 75% | 18% |

USD/JPY vs US 10Y Yields

Source: Refinitiv

USD/JPY Chart: Daily Time Frame

Source: Refinitiv

Be the first to comment