US Dollar Price, Chart, and Analysis

- US 2-year yields steady after their recent rally.

- US headline inflation is expected to hit 6.8% in November.

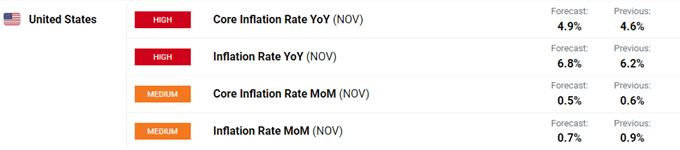

The US dollar is currently biding its time ahead of the latest look at US inflation on Friday which is expected to show price pressures hitting a fresh 30-year high. Over the recent weeks, the yield on the interest-rate sensitive US 2-year has moved sharply higher with traders currently pricing in a 100% chance of two 0.25% rate hikes next year and a 92% of three hikes. Next Wednesday’s FOMC rate decision and the latest dot plot will guide the US dollar over the next few months.

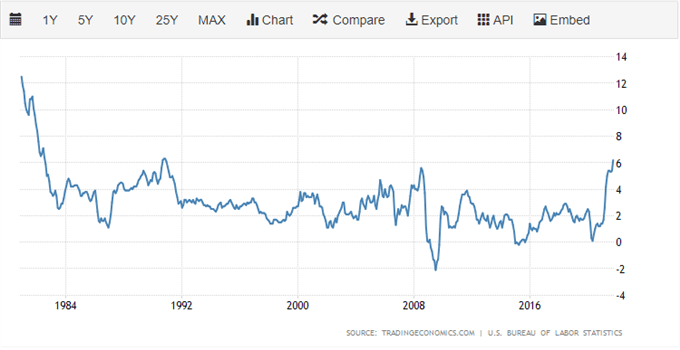

US headline inflation is currently running at a 30-year high of 6.2% and this is expected to rise further when the November inflation figures are released tomorrow. The market currently expects core US inflation to hit 6.8%, a fresh three-decade high, while the core figure is seen rising to 4.9% from 4.6% in October.

Headline US Inflation

Keep up to date with all market-moving data releases, events, and speeches by using the DailyFX Calendar

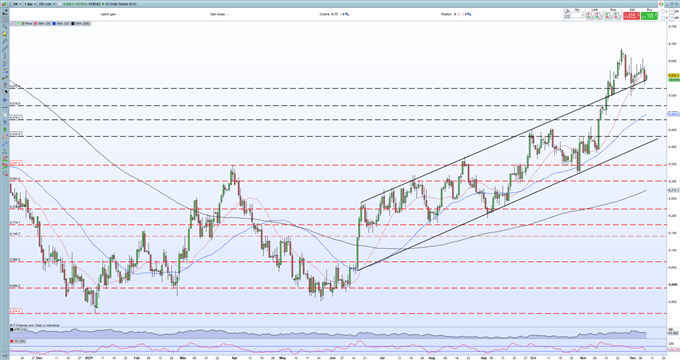

The daily US dollar (DXY) chart shows that the recent multi-month trend resistance line has now turned to support and the greenback is currently testing this trend support. The pattern of higher lows and higher highs from mid-2021 remains in place and this will likely remain the case over the coming months. Any sell-off will look to 95.50 for initial support and this level may prove difficult to break barring any unforeseen news. The US dollar is currently attempting to reclaim the 20-day simple moving average (96.09) and a break and hold above here will set up the greenback for a push to the 96.56/58 level.

US Dollar (DXY)Daily Price Chart December 9, 2021

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

Be the first to comment