Scott Olson/Getty Images News

Special thanks to @Harry in Korea for the tip…

Rumors, Reports, & “Geoeconomics”

In response to last week’s article and Editor’s Pick, Should Buffett Have Bought Samsung Instead Of TSMC?, I received a tip from a reader who suggested that Samsung has been exploring a spin-off of its foundry business. Such rumors have stretched back to 2016, when Apple dropped Samsung as a supplier. In the wake of this, a separation of design and manufacturing functions was seen as necessary for growth. They resurfaced in 2021, with Intel’s entry into the foundry business.

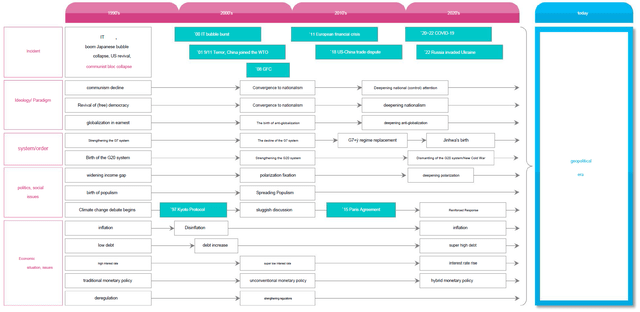

In July of 2022, the rumor mill was ignited yet again. A report from Samsung Securities, coauthored by analysts covering semiconductors and geopolitics, suggested a spin-off of Samsung’s foundry division as a way to cope with current geopolitical challenges, dubbed “geoeconomics”.

An excerpt from Samsung’s report on “Geoeconomics” (Samsung Securities; Translated by Google)

The report began with an unfiltered lesson in contemporary history, garnished with all sorts of opinions that are subject to censorship in the United States. The report references everything from Henry Kissinger and ‘transnational capital‘ to ‘the Carbon Boundary Adjustment Tax‘ and ‘the Fourth Industrial Revolution‘. It links globalization to the rise of populism and nationalism:

For those who lost their jobs due to the relocation of manufacturing production bases to emerging countries, income growth rates have stagnated and it is difficult to find other quality jobs due to low education levels. Globalization has only highlighted the failures of the lower middle class and manufacturing workers in developed countries…

…Nationalism and populism filled the void of ideology. Criticism of globalization stimulated the emergence of ‘populism’ within developed countries and combined with ‘nationalism’. Countries were divided from the pursuit of international common interests to the extreme priority of national interests.

…

The United States has pursued an engagement policy toward China since the Nixon administration. The initial goal of this policy was the separation of the Soviet Union and China during the Cold War, and ultimately the liberalization of China. The strategy was to transform China into a market economy and incorporate it into the US-centered international order, resulting in the liberalization of China’s political system and the abandonment of the Communist Party. However, this policy is evaluated as a failure. Rather, it is this perception of the US, that China uses–the US engagement policy–to acquire cutting-edge technology without permission, and eventually tries to become a hegemon.

-Samsung Securities (Translated by Google)

Comparing Trump in 2019 to Maxine Waters in 1999, it’s hard to say Samsung is wrong. The report goes on to note that China’s global influence has “greatly strengthened” as a result of the Covid-19 crisis, while the leadership of the G7 is “severely challenged.” The geopolitical overtones are the foundation for the thesis, that the economic paradigm is shifting from ‘security for economy, to economy for security.’

As an extension of this overarching thesis, Samsung Securities throws out the suggestion that Samsung could spin off its foundry division and list it on a US exchange, referencing a similar move by competitor SK Hynix (which bought Intel’s memory division in 2021). This suggestion became a fixation for the Donghak Ants, South Korea’s version of the WallStreetBets craze. The rumors were reportedly shrugged off by Samsung.

At ARM’s Length…

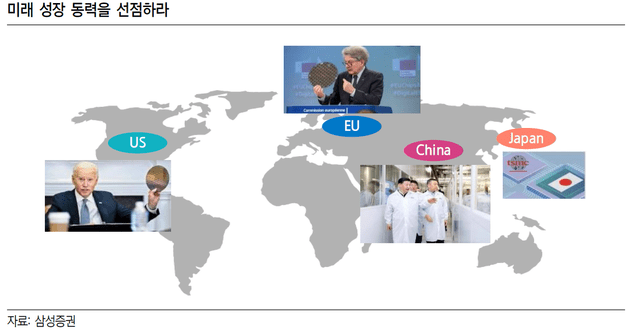

Can Intel Catch TSMC? The fact that US President Biden waved a wafer and said “Thank you, Samsung” and rushed to the Pyeongtaek plant right after arriving from a visit to Korea is an intuitive example of how important Samsung Electronics’ role will be in the future US semiconductor supremacy war.

-Samsung Securities (Translated by Google)

Another jolt of excitement came with Samsung Chairman Jay Lee’s visit to the UK in September. The official reason for the visit was in relation to the World Expo 2030, but this didn’t stop rumors that it was somehow related to a potential acquisition of ARM. This seemed incredibly farfetched, but just weeks later Jay Lee told the press that Masayoshi Son would soon visit South Korea and may “make a proposal” when asked if he had met with ARM executives while in the UK.

In early October, Masayoshi Son indeed met with Jay Lee. Masayoshi Son said beforehand that he intended to discuss a potential “strategic alliance” between ARM and Samsung. Local media later reported that ARM ‘did not make an investment proposal’, though the CEO of ARM attended the meeting. Both parties declined to comment, leaving room for further speculation.

What makes sense?

Samsung has a long history of strategic transactions, shuffling around the various pieces of a complex and sometimes overlapping business empire. For example, Samsung TechWin (now Hanwha Techwin) spun off its underperforming camera division in 2008. Another example, Samsung Electronics spun off Samsung Display in 2012, which then merged with Samsung Mobile Display.

I won’t go into a deep ‘comps analysis’ on a potential spin-off here, but will possibly write one in the future. I’ve already detailed Samsung Electronics’ discount relevant to peers in last week’s article. It’s certainly possible that breaking up Samsung Electronics, in combination with a NASDAQ listing, might close the valuation gap, unlocking some of the value. Perhaps the rest of the company would be valued as a cross between Apple and Whirlpool.

The logic of spinning off the foundry business is relatively straightforward and has little to do with unlocking shareholder value. Samsung competes with some of its foundry customers, and thus has an incentive to allow their IP to bleed into its own products. Apple accused Samsung of doing just that, and terminated its relationship with Samsung as a result.

Korean analysts have rebutted the claim that Samsung engages in IP theft, flatly denying it has ever happened. In the West, Samsung’s reputation is so poor that to suggest otherwise would be seen as naïve.

But perhaps it is merely a moot point. Would spinning the foundry division out of Samsung Electronics really calm such concerns? The concept seems more financial than operational, given the close degree of cooperation between Samsung’s vast empire. For example, Samsung Display was spun off, but can you tell?

Masayoshi Son walks with Jay Lee in July, 2019. (Korean Economic Daily)

On the other hand, an ARM acquisition would make more sense, a chess move that would upend the entire industry. It would bring everyone using ARM IP, including Apple, into close cooperation with Samsung. This would potentially tip the balance of power away from TSMC, which is able to leverage the ecosystem it has built with its partners. Most of TSMC’s customers use ARM’s software tools and instruction set architecture. Masayoshi Son has poured billions into advancing ARM’s capabilities, and as a result, advancing the industry as a whole.

The cold war has ended, but a more intense economic war has begun. In this new war, a country’s firepower will be determined by the level of its technology.

– Lee Kun-hee, Former Samsung Chairman

The most noteworthy issue in the confrontation between the US and China is control of the technology sector. In particular, the field that the US is paying attention to first is semiconductors.

-Samsung Securities, 2022

With that kind of reach, it’s safe to say that a sale of ARM to Samsung would have “geoeconomic” implications. My view is that, if feasible, it’s the right move from Samsung’s perspective. As I’ve argued previously, Samsung could unlock significant value by developing tighter hardware/software integration in a way that creates superior products. This is to say, following a strategy very similar to Apple, but across Samsung’s broad product mix that includes phones, tablets, appliances, TVs, laptops, desktops, AC units, and even cars.

It’s worth mentioning that cutting-edge chip designs for artificial intelligence use more complex memory designs, collocating memory with processor cores. This may give Samsung and ARM additional synergies, given that Samsung is the acknowledged leader in memory. “To catch TSMC, you have to be under the same roof with memory.“

This begs the question, would Samsung be allowed to acquire ARM? The US has the power to block a foreign-to-foreign merger, but Samsung’s vast scale relative to the Korean economy gives the company enormous political muscle.

Many will point to the ARM-Nvidia deal as a benchmark, and rule out the possibility of a Samsung-ARM deal. In my opinion, it is an imperfect comparison:

Intel was allowed to dominate the industry, as part of a cartel with Microsoft (which itself defeated an antitrust case). Intel lost its perch over the industry while blowing over $100B on buybacks, before begging the government for a bailout. Intel was then able to lobby the US Government (spending a “record sum”) to block a merger that was in the strategic interest of the US, for its own competitive advantage.

Intel CEO Pat Gelsinger addresses the press at the WH (left) | Biden visits an Intel construction site in Ohio (Right) (Cleveland.com; Axios Columbus)

Again, a merger that was in US strategic interests (but not in Intel’s best interests) was blocked at a time that the US has lost its leadership in semiconductor technology, spurring a geopolitical crisis. Was this corruption or just stupidity?

You be the judge… But it is likely that South Korea would throw its weight behind advancing its own national interests, in the event of a Samsung-ARM deal.

Conclusion

A report by Samsung Securities outlines emerging factions in the global economy. (Samsung Securities)

It will be very interesting to see how this plays out. As recently as this month, new rumors were swirling that Samsung Electronics would be split up as part of a broader reorganization effort. Swinging in the balance, a budding relationship with Intel (See here and here).

Intel CEO Pat Gelsinger and Jay Lee discussed potential collaboration earlier this year. Perhaps an alternative to a tie-up with ARM… Perhaps as a shrewd negotiation tactic at the table with Masa…

Do you think Samsung will spin off its foundry division? Do you think that Samsung is interested in ARM? Let me know your thoughts in the comments.

Be the first to comment