HT Ganzo

Important note: You are reading here an abridged version of an article published for exclusive subscribers of Beyond the Wall Investing on October 17 before the stock market opened. The publication took place before the news about Germany’s plans to extend the lifetime of three nuclear power plants was published, which looks like an indirect confirmation of my thesis and the arguments for it.

Introduction

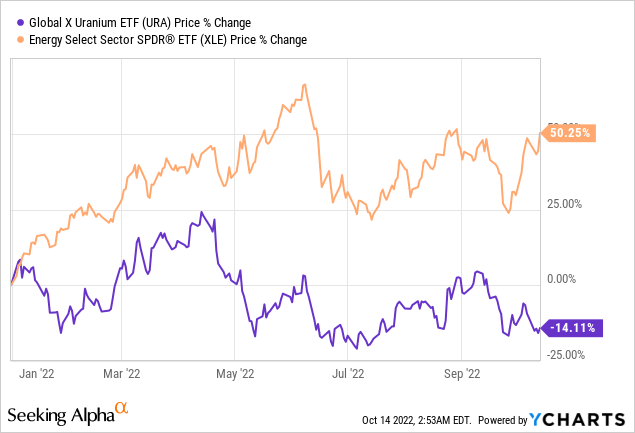

The uranium industry is the part of the Energy sector that has lagged far behind O&G since the beginning of the year, despite fairly strong support from energy-focused retail investors, as far as I see it.

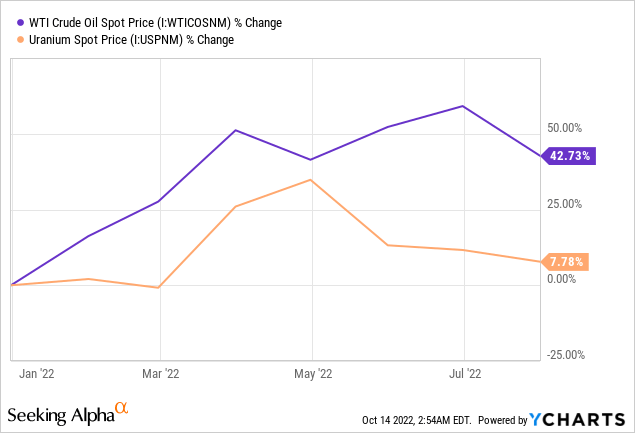

In addition to the individual risks of the companies within the above exchange-traded funds (“ETFs”), the underperformance of uranium stocks relative to, say, upstream O&G energy stocks is explained by a change in the price of the underlying asset – the increase in the price of oil (I’ll use WTI as a reference) significantly outpaces the increase in the spot price of uranium, the difference being about 5.5 times:

I decided to study and understand this topic in more detail – is it worth investing in uranium, and what is the best instrument to do so?

We at Beyond the Wall Investing use various professional sources from banks and funds, and this time we found them in abundance. I sought the opinion of managers who either invest themselves or are familiar with specialized funds that study only this industry. In addition, Morgan Stanley, Bank of America, and Citi Research all had something to say about this market and individual companies.

So, what’s the thesis?

After researching the industry and also some individual companies, I have concluded that the best instruments in this market, in my opinion, are the North Shore Global Uranium Mining ETF (NYSEARCA:URNM) and the Sprott Physical Uranium Trust (OTCPK:SRUUF). Each of them for their own reasons.

Why is the uranium industry going to soar?

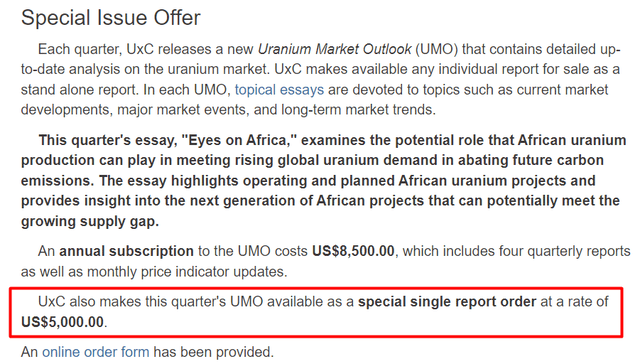

We are fortunate to have access to a fairly recent report from Citi Research that operates and cities UxC data, which costs $5,000 if bought separately.

Most of my thesis is based on the analysis of the Citi report (47 pages long), please bear this in mind. Let’s dive in.

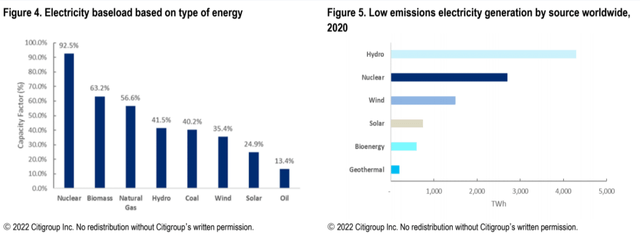

Today, when fossil fuel prices are reaching record highs and renewables are unreliable, nuclear energy is experiencing a “renaissance” and is expected to grow worldwide. Why? Because nuclear power plants are indeed one of the most environmentally friendly ways of generating electricity in the world, with the highest baseload compared to all other sources, including alternative ones:

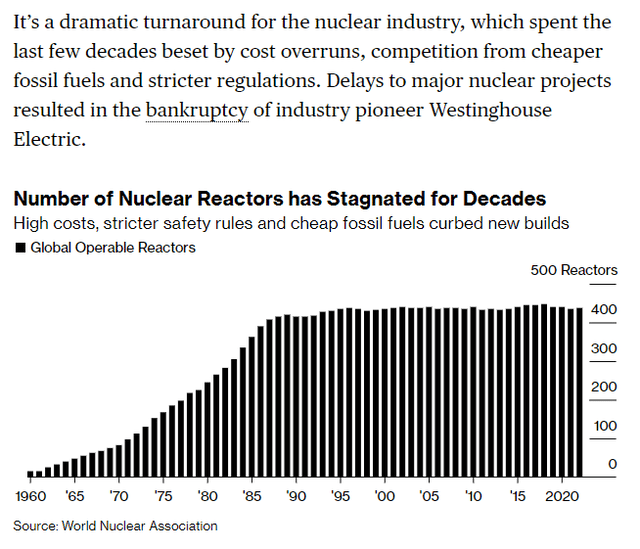

Nuclear energy has evolved since the 1960s, with advanced technologies being introduced at various stages of development. Currently, 442 reactors with a capacity of 413 gigawatts (GW) are operating in 32 countries. This capacity is expected to increase dramatically.

Because nuclear energy emerged in developed economies, the majority of nuclear power capacity is presently found in these countries (but ex-USSR is obviously an exemption here). Another issue is the European Union’s aging fleet, however, some reactors’ lives may be extended. In the United States, a 20-year extension is granted to 90% of reactors on average (the average reactor life is 40 years), which is both economically and technically possible. According to UxC, Asia will eventually account for a larger market share of nuclear capacity.

Citi, October 11 [with author’s notes]![Citi, October 11 [with author's notes]](https://static.seekingalpha.com/uploads/2022/10/13/49513514-16656463266985612.png)

According to Citi Research, 13 reactors have gone offline in the U.S. since 2013, with a 10GWe decrease in net capacity due to premature reactor shutdowns. The reasons for the loss of capacity vary from reactor to reactor, but competition from other fuels and lower electricity prices were the main reasons for the shutdowns in several regions.

Canada, France, Japan, Russia, Spain, Switzerland, the UK, and the U.S. are set to lose some capacity due to aging reactors by 2030, amounting to ~43GWe or 10% of UxC’s estimate of current global nuclear capacity. The downward trend in nuclear capacity in the US and parts of the EU has been clear from 2010 to 2030.

The Inflation Reduction Act is expected to provide financial support to struggling nuclear plants and reverse the trend of premature reactor shutdowns in the U.S. Regulations in IRA make the U.S. more competitive in the global market and, with the availability of funding for advanced technologies, attract further industry development. The European Union, South Korea, and Japan are also considering introducing similar legislation to remain competitive.

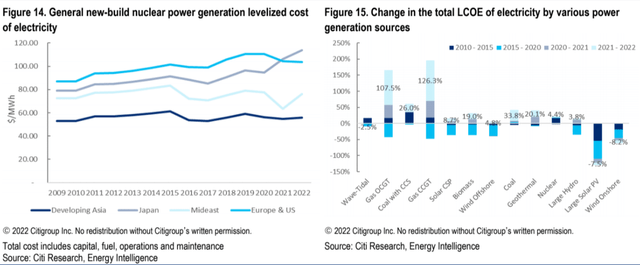

In my view, against the backdrop of terrible underinvestment in the O&G industry, new investments in the energy sector will flow more easily into the uranium industry because of the relatively lower Levelized cost of electricity (LCOE) – this is an important catalyst, in my opinion, to drive up the price of uranium going forward:

Advanced reactors (AR) and SMRs could also significantly reduce LCOE as the technology becomes scalable and commercially viable. One of the advantages of SMR reactors is that they reduce supply chain constraints and enable best construction practices while exploiting the economics of factory construction and enabling standardization. Overall, active expansion and deployment of SMR technology will occur on a larger scale globally after 2028 as concepts are accepted by regulators and must prove they are inherently safe and secure.

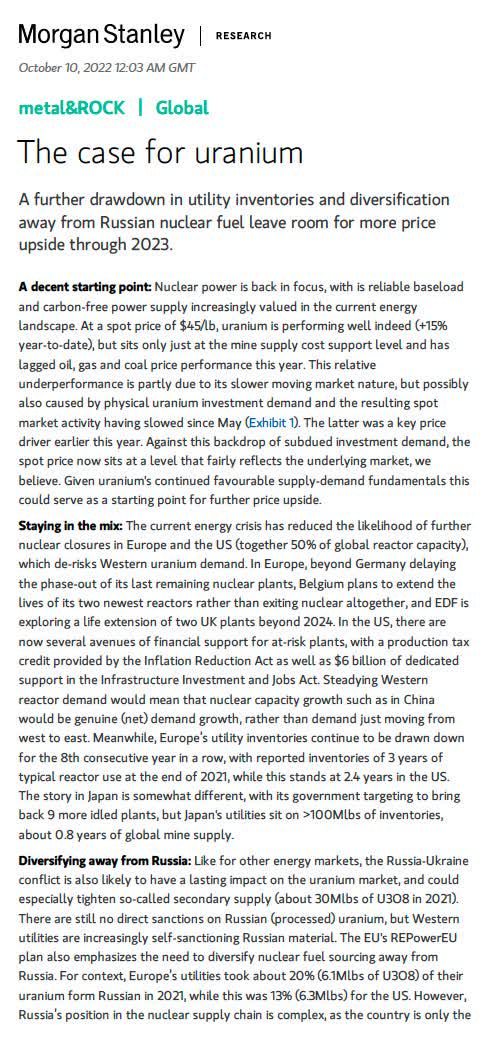

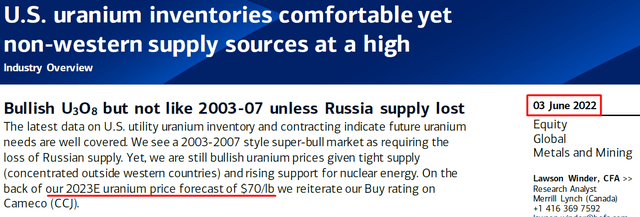

I think the demand for new reactors will be high, given the technological efficiency of nuclear power plants, which are becoming safer every year. Citi analysts wrote above that UxC expects old capacity in Europe to be retired – but this information is not consistent with practice. In reality, the retirements are now being delayed with a vengeance as countries try to move away from dependence on Russian natural gas. This is described in sufficient detail on the front page of Morgan Stanley’s recent report “The case for Uranium“:

Morgan Stanley, The case for uranium, Oct.10

Less disposal of reactors – higher demand for uranium (U308) – higher spot prices. In light of recent news about a possible ban on aluminum exports from Russia, the possibility of a similar move concerning Russian uranium is growing. Of course, the U.S. cannot get rid of Russia immediately, as 24% of all enriched uranium products (EUP) came into the country from there (2021 data). But the process has most likely already begun, and we are at a point of no return. In my opinion, a move away from Russia will be inevitable, which could be a strong catalyst for spot prices and boost some producers’ stock prices.

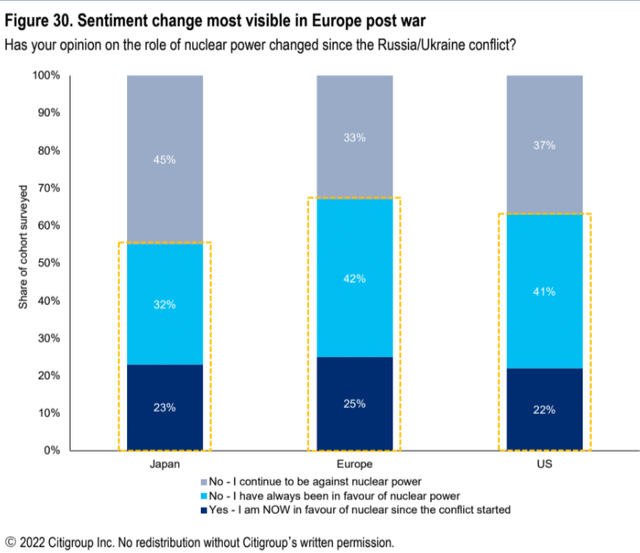

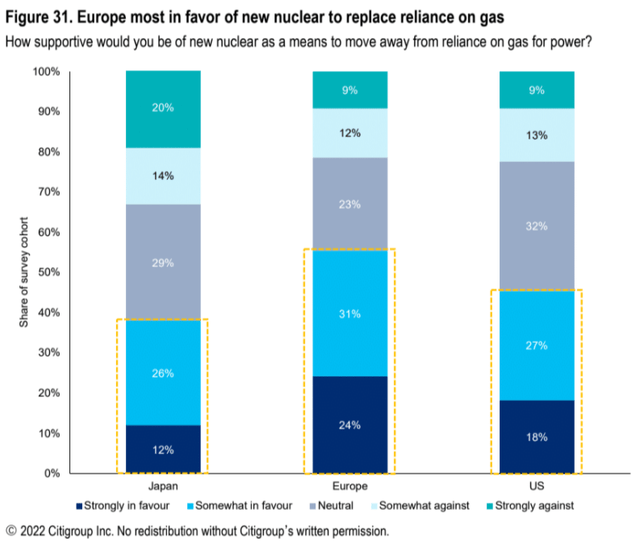

Moreover, according to Citi Lab’s survey, the mood of ordinary citizens – usually a strong headwind for the industry – is improving lately. People simply need electricity, and they are willing to reconsider their attitude toward uranium energy (which is actually quite safe).

Citi, October 11 Citi, October 11

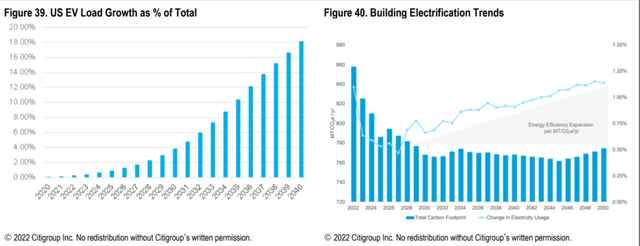

We must not forget the demand side – with the development of electric vehicles, which require a lot of electricity, analysts predict a rapid increase in demand for electrification, which I believe will not be possible without the rapid development of the uranium industry.

The highest rise in nuclear power is anticipated in Asia, Eastern Europe, Africa, and the Middle East. The International Energy Agency (IEA) predicts an increase to 812 GW in the net-zero scenario by 2050, whereas UxC estimates the growth might be closer to 600 GW in the baseline scenario.

Based on a supply and demand analysis, BofA analysts expected the spot price of uranium to reach $70 per pound in June. At that time, the price was $45, and now it is $50.6, TradingEconomics reports. If the analysts were right, the upside potential is 38.3%.

I will try to draw an intermediate line to all of the above. The situation in the industry at the moment is very similar to what the conventional energy sector has experienced in recent years – a variety of shocks, both economic and political (particularly pronounced in uranium), have caused Western enrichment companies not to invest in their CAPEX. There has been a perception of an oversupply of natural uranium in the industry for many years. And even now, there’s no shortage of uranium, because there’s plenty of the raw source in the world – that’s what Warren Irwin, the chief investment officer of Rosseau Asset Management, said in a recent Mining Stock Education podcast.

But as one Hong Kong asset manager shared, citing uranium energy investors, for many years the optimal business strategy for separators was to use more enrichment (gas centrifuges) with less natural uranium. Now it’s reversed – the lack of capacity is forcing them to “throw more cheap uranium into the centrifuge” to maximize the load, in simple terms. The enrichment companies have gone from being part-time sellers of natural uranium to net buyers. The balance in the uranium market has probably shifted, as it did in the O&G market a few months ago, in favor of a further increase in prices for the underlying sources.

This industry has quite long cycles (both up and down), and by all appearances, we have now entered a new bull cycle.

OK, where to look for value in the uranium space?

The truth is that it is a fairly heterogeneous industry and I think it is difficult to choose a contender because the risks are astronomical and the liquidity is inadequately low. As Mike Alkin and Guy Keller recently discussed on the Macro Voices podcast, the number of equity analysts who cover the industry, dropped dramatically after the Fukushima disaster in March 2011, which I think still affects the quality of information coming to the market.

If an investor is faced with the task of getting rid of idiosyncratic risk, there are several relatively liquid uranium ETFs on the market today – they can be represented in a short list:

- Global X Uranium ETF (URA) – $1.53B AUM, $49M of the 200-day average trading volume;

- North Shore Global Uranium Mining ETF – $861M AUM, $23.8M of the 200-day average trading volume;

- Sprott Physical Uranium Trust – $1.05B AUM, $5.79M of the 200-day average trading volume.

Here I think we should understand where the upside opportunity is backed for uranium companies. My thesis, synthesized from the equity research reports analyzed above, is that the disequilibrium in the uranium market should lead to an increase in the price of uranium itself. Therefore, it is logical to put a part on the uranium price. This is SRUUF.

However, as is often the case with commodity-oriented companies, when the price of commodities rises, the shares of such companies rise with a multiplier to the rise in that price.

Well, while theoretically true, this is not the case for uranium companies as many of them have been forced to a) raise new equity by diluting existing shareholders, b) raise new debt and worsen the quality of their balance sheets, and c) endure multiple contractions due to the macroeconomic shock we have experienced from high inflation and subsequent Fed actions.

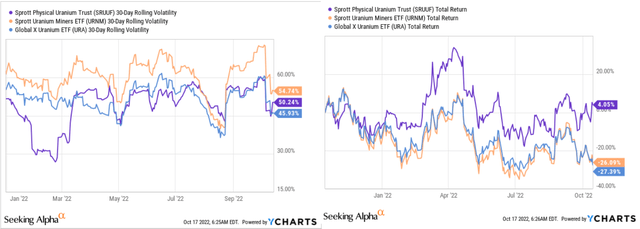

For this reason, with roughly the same volatility as equity ETFs, commodity-based SRUUF has outperformed the other two ETFs in terms of total return over the past year:

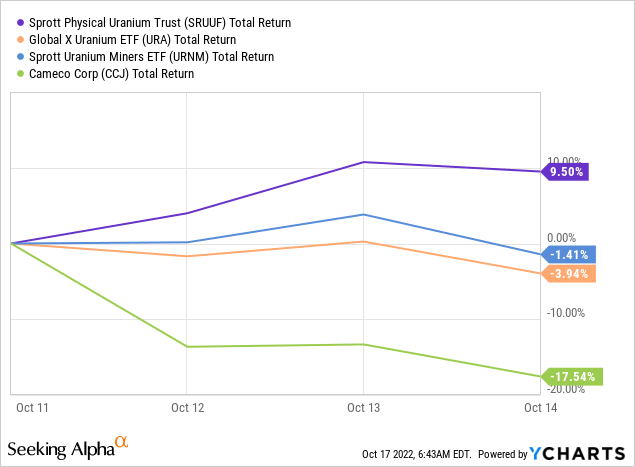

Guess how the 3 ETFs have been trading since Cameco’s (CCJ) Westinghouse takeover news came out on October 11 (the company’s stock is down 17.54% since then) – SRUUF is the only one now in a big plus:

Buying SRUUF provides investors with a natural hedge against equity risk, which is so desperately needed these days.

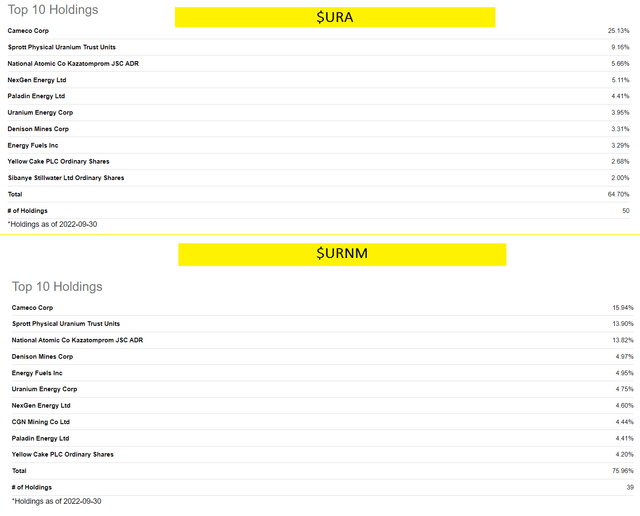

If you have a choice between URA and URNM – funds that are quite similar – I prefer URNM for the following reasons.

First, URNM’s policy is limited to allocating ~15% per company, while URA may allocate >25% to Cameco alone.

Second, URA does not have a sufficient allocation to Kazatomprom, the largest uranium company in the world. It may be that I am biased on this point, but I sincerely believe that the discount that exists between Kazatomprom and Cameco due to country and currency risks is too large and reflects market inefficiencies that should theoretically reward those who favor the Kazakh giant.

| Ratios / Company | Cameco | Kazatomprom |

| Price to Sales (TTM) | 6.6 | 3.74 |

| P/E (TTM) | 185.4 | 16.55 |

| Price to Book (MRQ) | 2.38 | 3.27 |

Source: Author’s compilation based on Investing.com‘s data

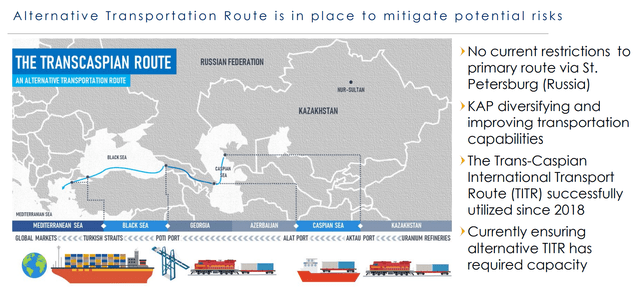

As I wrote in my recent article on Freedom Holding and Kaspi.kz, the shares of this region have suffered sharp declines since the beginning of the year, first due to the protests, then due to the risk of interruption of uranium supplies due to possible future sanctions against Russia – to date the main partner of the company. But a) the first risk is no longer relevant, and b) in my opinion, Kazakhstan’s leadership is making it clear to Putin that the country intends to walk away, and Kazatomprom in its recent IR presentation (1H 2022) points to alternative logistical routes as evidence that such a risk is unfounded:

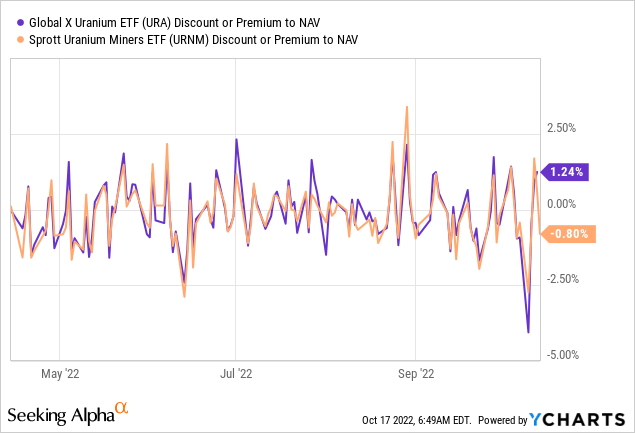

The third reason is the banal discount to NAV for URNM against the background of a premium to NAV for URA. In terms of medium-term positioning, I think URNM has a better chance of continuing to outperform URA.

Risks And Bottom Line

The current financial climate, central bank policies, a higher U.S. currency, and the danger of recession in some regions of the world might be obstacles to expanding nuclear capacity. The economics of new nuclear capacity and the government’s willingness to fund the buildout will be particularly impacted by financial costs which are rising all around.

The general safety of nuclear power and effective waste management are normally the limitations of the industry. Though regulators throughout the globe strengthened safety evaluations after the Fukushima-Daichi catastrophe in 2011 and implemented several extra measures to finish building new reactors that make use of the lessons gained from earlier mishaps.

Even though uranium energy is one of the safest in the world today, people still do not understand it and are afraid of it – which may create too much headwind for my thesis. This should be kept in mind by anyone who wants to buy shares of a company or an ETF in this industry.

Nevertheless, I believe that uranium energy will follow the O&G industry’s performance once institutional investors realize the determination of European regulators to switch to this type of fuel instead of Russian gas. The electrification of the world will continue to increase, and nuclear power plants remain one of the most efficient sources of power generation – we do not need to reinvent the wheel when it was invented and improved many decades before us. This is understood in Asia, which will continue to support the demand side for many years to come, regardless of the recession fears/facts or the indecision of the EU.

So I recommend considering SRUUF and URNM as potential strong buys for the medium term.

Thanks for reading! Please share your opinion in the comment section below!

Be the first to comment