LeoPatrizi/E+ via Getty Images

Urban Edge Properties (NYSE:UE) has an interest in about 76 retail real estate properties primarily along the Washington, D.C. to Boston corridor, with greater concentration to the New York metropolitan area.

Their continued focus on urban markets in the northeastern coastal states provides several advantages, such as a dense population and generally affluent trade areas. High barriers-to-entry in their target markets also serves as a shield to their current market position.

More specifically to retail, which is the company’s focus area, their operating locations benefit from strong customer demand and above average retail trends. In addition, the majority of the company’s rental income is derived from well-capitalized national or regional tenants operating in recession-resilient industries.

In Q3, results were highlighted by occupancy gains, further increases in their signed but not yet commenced (“SNO”) pipeline, and positive leasing updates. These developments were offset in part by weakened spreads and a cautious outlook in the near-term acquisition environment.

With shares down 25% YTD and at trading levels equating to 12.1x forward funds from operations (“FFO”), the stock is worth a further read. But it doesn’t offer much excitement in terms of upside. Though it remains a satisfactory hold for existing shareholders, others may be more inclined to deploy available capital elsewhere.

Stable Portfolio With Significant Pipeline Of Leases Pending Commencement

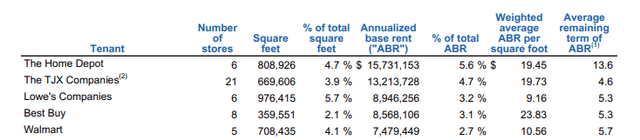

At the end of September 30, 2022, UE’s portfolio remained stable, with the same fundamental mix of tenants from prior quarters. Among their top twenty-five tenants, large, nationally recognized retailers, such as The Home Depot (HD) and The TJX Companies (TJX), accounted for the largest share of total annualized base rents (“ABR”), at 5.6% and 4.7%, respectively.

Q3FY22 Investor Supplement – Summary Of Top Five Tenants

The scale and overall leadership position of their top tenants, particularly among their top five, who collectively account for nearly 20% of ABR, provides a high degree confidence of continuing stability in the portfolio.

This stability is reflected in their occupancy levels, which ended the quarter at a leased rate of 94.7% on a same-store basis. This is down slightly, 20 basis points (“bps”), from the prior quarter, but it’s up 180bps YOY.

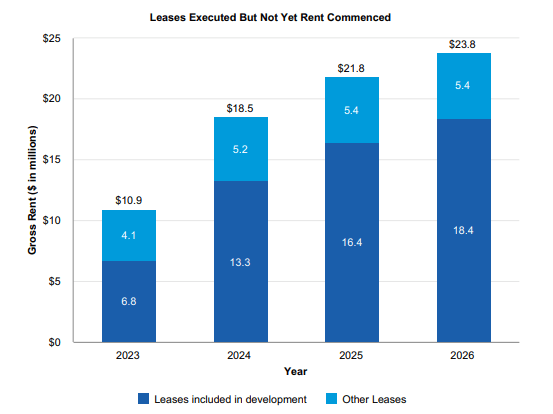

In addition, physical occupancy at period end was 90.1%, resulting in a current commencement spread of 460bps, which is down from the 490bps reported last quarter but still at elevated levels. In fact, despite the decline in the spread, the SNO pipeline actually increased to +$28M during the quarter from the +$23M reported in the prior period. This equates to about 12% of their current NOI.

Q3FY22 Investor Supplement – Summary Of Signed But Not Yet Completed Pipeline

And on top of this, the company also has about a million square feet of leases under negotiation representing about 10% of annualized NOI. Given current inflationary pressures and its ongoing impact on consumer spending, the positive activity could come as a surprise.

Negative Renewal Spreads Are A Concern

But current signings aren’t exactly being completed on the most favorable terms to the company. Cash spreads on renewals, for example, were down 2.8% during the quarter. This compares to a double-digit increase in the prior quarter. This was partially offset by positive cash spreads on new signings of 4.3%. But on a blended basis, spreads were still negative.

Driving the decline, according to management commentary, was the renewal of a strong anchor tenant at lower rents in exchange for other offsetting considerations. While that is one response, it still shouldn’t provide comfort to investors.

As a smaller REIT with a tenant base that includes Fortune 50 companies, one would expect UE to be at a disadvantage from a negotiating standpoint due to the sheer power of many of these larger corporations to extract favorable concessions. With many of them under significant pressure to reduce costs, flexing their financial prowess on low hanging fruit appears to be an easy first step.

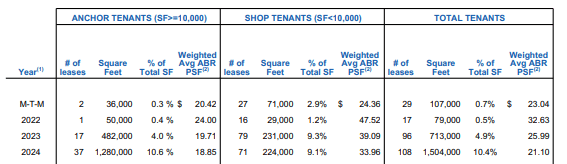

If the economic environment continues to deteriorate, spreads could come under even further pressure. An accommodative expiration schedule, however, does provide some protection against renewal risk. Through the end of 2024, for example, about 16% of their total square footage is set to expire. While that does sound high, most of it will occur in 2024. So UE does have some time on their side.

Q3FY22 Investor Supplement – Snapshot Of Upcoming Lease Expirations

Upcoming Debt Maturity Could Constrain Liquidity

UE ended Q3 with total liquidity of nearly +$1.0B, comprised primarily of their +$800M undrawn credit facility. They do, however, have one large debt maturity in 2023 of about +$352M. At present, there has been no movement on rolling that obligation. But management does expect to ultimately settle the obligation via a new mortgage, their line of credit, or through a term loan.

In ordinary conditions, this maturity wouldn’t be of elevated concern. But with rates up and lenders hesitant to engage with commercial borrowers, rolling this maturity could be more challenging than expected. Their debt load as it is already elevated, at 7.4x adjusted EBITDAre. As such, any refinancing efforts would likely be done at unfavorable rates that would further compound their current interest burden.

The company does generate stable cash from operations and does have about +$150M in cash on hand. So a liquidity event is unlikely. The current dividend payout appears safe for now as well, representing just over 50% of FFO. Still, investors should closely follow the status of the company’s efforts to address to upcoming maturity in 2023.

The Upside Is Not Attractive Enough

At the end of 2021, shares closed at $19/share with full year reported unadjusted FFO of $1.48/share or $1.09/share on an adjusted basis. This translates to an unadjusted and adjusted multiple of 12.8x and 17.4x, respectively.

At its current multiple of 12.1x of management’s expected full year adjusted FFO range, shares appear undervalued by over 40% from its trading levels at the end of 2021. The outlook, however, is substantially changed. For one, rates are obviously higher, which is affecting external markets and resulting in increased projections of interest expense on an elevated debt load.

In addition, the company still has one large upcoming maturity in 2023 that has yet to be resolved. While the company does have sufficient liquidity via the funds available on their revolver, it would come with variable rates that may prove challenging to term out in the current environment.

Spreads on renewals were also negative during the current period, as opposed to up in the mid-single digits last year. In addition, the company has exposure to several weakened tenants, such as Bed Bath & Beyond (BBBY) and Regal Theaters.

With these several considerations in mind, it’s prudent to leave current multiples unchanged, especially when comparing against a related peer, Acadia Realty Trust (AKR), one with a larger portfolio, but whose current multiple is a step down at just 11.8x. While existing shareholders would be better off holding onto their existing positions, others may find it more appropriate to deploy available capital elsewhere.

Be the first to comment