kasezo/iStock via Getty Images

Introduction

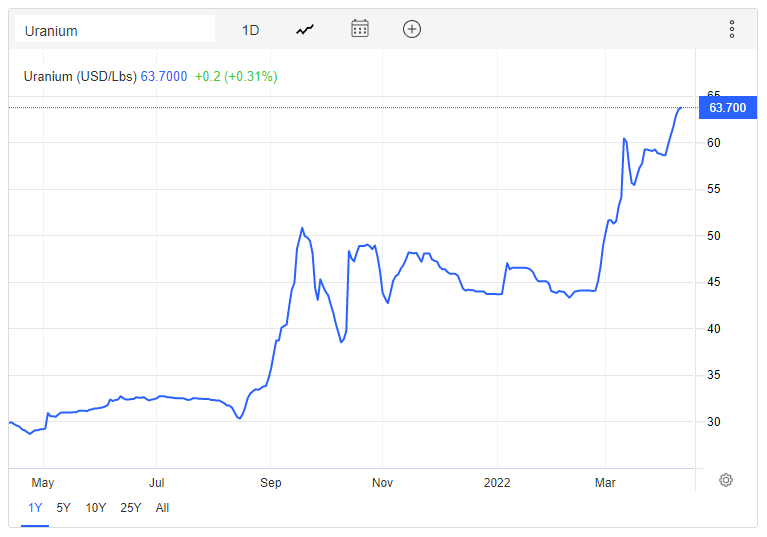

It’s been a wild year for uranium prices as the world is in the midst of an energy shortage and prices have more than doubled since August.

Trading Economics

In view of this, I think this is a good time to take a look at what’s happening at Ur-Energy (NYSE:URG). The company says on its website that it’s the lowest-cost producer of uranium in North America and the last time I covered it on SA was in May 2021.

Over the past year, Ur-Energy has strengthened its balance sheet and has taken steps to prepare its Lost Creek project for a rapid restart. The NPV of the property has improved significantly thanks to high uranium prices, but Ur-Energy looks expensive at the moment. Let’s review.

Overview of the recent developments

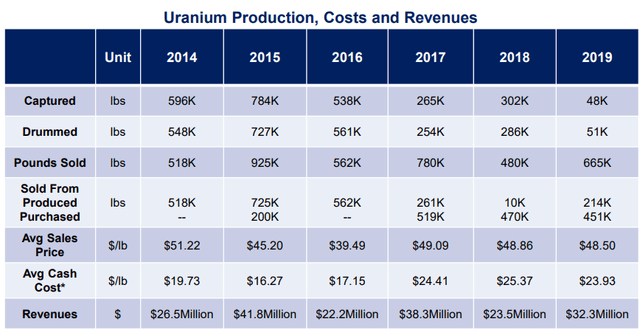

In case you haven’t read my previous article on Ur-Energy, the company’s main project is the Lost Creek in-situ recovery (ISR) uranium facility in the state of Wyoming which has two mining units and measured and indicated resources of 11.9 million pounds at an average grade of 0.046%. Yes, the grades are very low but this is ok for an ISR project as those usually have low production costs. Between 2013 and 2020, Ur-Energy sold a total of 2.4 million pounds of uranium from Lost Creek as well as 1.8 million pounds of the purchased product. As you can see from the table below, average cash costs ranged between $16.27 per pound and $25.37 when Lost Creek was in operation.

Ur-Energy

Looking at the other assets of Ur-Energy, the company owns the Shirley Basin ISR uranium project in Wyoming which has so far produced more than 28 million pounds. The property currently has measured and indicated resources of 8.8 million pounds at an average grade of 0.23% and the company claims that production costs are estimated at $15.86 per pound. Ur-Energy also holds an inventory of about 284,000 pounds of uranium that is valued at $18.09 million at current spot prices. As of March 3, the company’s cash position was $44.7 million.

So, what has Ur-Energy been up to lately? Well, the company raised $55.2 million through capital increases in 2021, and in October 2021 it initiated a development program at Lost Creek that includes a drilling and construction program for the development of the fourth header house at the second mining unit at the project. This is expected to be completed in the second quarter of 2022, at which point the second mining unit will be ready for production. Ur-Energy then plans to initiate a delineation drill program, which will enable the development and construction of the next four header houses in the second mining unit. These initiatives are aimed at shortening the time it takes to restart production and Ur-Energy estimates that operations can increase to full production rates in as little as nine months once it makes a decision to return to the market. Unfortunately, Ur-Energy hasn’t specified at what levels of uranium prices it’s willing to restart production. Optimistically, the company can be running at full capacity by early 2023 but the issue is that it has no long-term contracts for the sale of its uranium, which is usually a prerequisite for a mine starting operations in this space.

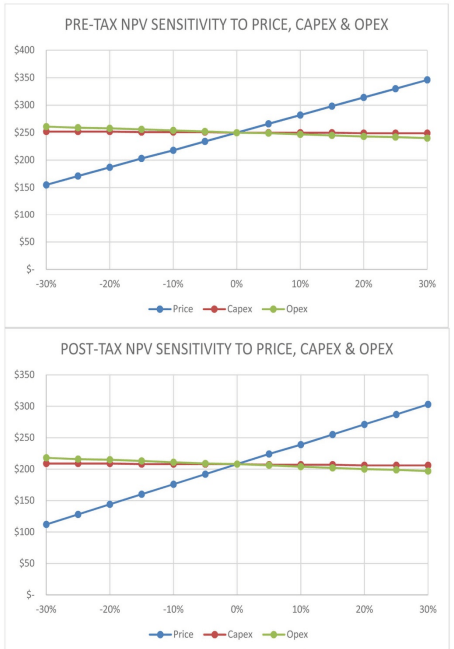

Overall, I view Lost Creek as a relatively small uranium project as it currently has a licensed annual plant production of 2.2 million pounds of uranium, which includes wellfield production of up to 1.2 million pounds and uranium and toll processing of up to 1 million pounds of uranium. If you exclude toll processing, the project can generate revenues of just $76.4 million per year at today’s spot prices and the mine life is about 8 years. However, the net present value (NPV) is starting to look compelling at today’s spot uranium prices as production costs are low. The latest preliminary economic assessment (PEA) for Lost Creek was completed in 2016 and was based on uranium prices of $66.03 over the life of mine. The post-tax NPV was just above $200 million.

Ur-Energy

According to a PEA from 2015, Shirley Basin has an NPV of $146 million at $65.29 per pound of uranium over the life of mine. However, this mine isn’t close to resuming production and Ur-Energy has a market valuation of $384.4 million as of the time of writing. Excluding the $62.8 million that the company holds in cash and uranium inventory, we’re left with $321.6 million which is about 60% above the current after-tax NPV of Lost Creek. In order for Ur-Energy to be trading at around 1x NPV, uranium prices would need to increase to above $85 per pound.

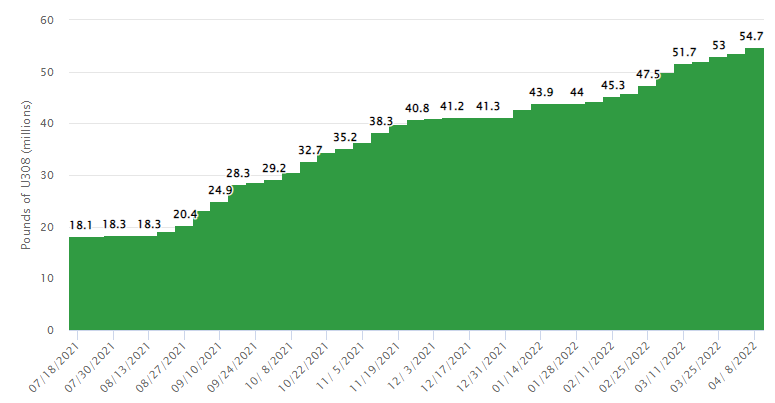

Overall, I think that the economics of the projects of Ur-Energy look much better today than a year ago thanks to high uranium prices. However, the company is priced for perfection at the moment and this is why I’m bearish. That being said, opening a short position looks dangerous at the moment as I think uranium prices are likely to continue to increase in the near future. In my view, the market is being squeezed by Sprott Physical Uranium Trust (OTCPK:SRUUF), which I’ve covered here. The current annual global consumption of uranium stands at about 190 million pounds and this trust alone has bought 36.4 million pounds since the middle of August 2021.

Sprott Physical Uranium Trust

Considering the trust has a $3.5 billion at-the-market equity program, it could take a long time before uranium prices stop rising.

Investor takeaway

Uranium prices have increased significantly over the past several months and this has improved the NPV of Lost Creek. I think that the announcement of a restart of production is likely to provide a significant boost to the share price of Ur-Energy.

However, this project is worth about $200 million at today’s uranium spot prices, which is much lower than Ur-Energy’s market valuation. Yet, I think that investors should avoid short selling this stock as uranium prices could continue to increase for some time as a result of the pressure Sprott Physical Uranium Trust is putting on the market at the moment. In case you are thinking of using a strange options strategy to gain from share price volatility, there are no options currently available for Ur-Energy. I think it’s best to avoid this stock for now.

Be the first to comment