Delmaine Donson

In the face of macro environment pressures, Upwork, Inc. (NASDAQ:UPWK) remains durable. It has endured numerous disruptions – pandemic, inflation, and geopolitical tension in Europe, to name a few. Although it narrowed its Q4 and full-year guidance, market opportunities remain evident. Its solid and intact fundamentals will help it capitalize on these levers while sustaining its operations. Its liquidity position is impressive with well-covered borrowings. Meanwhile, the stock price remains divorced from the fundamentals. But potential returns are more enticing.

Company Performance

As Upwork, Inc. approaches the year-end, it proves that its business model and value proposition remain crucial to clients during economic volatility. The pandemic has led to paradigm shifts in work setups and workforces. Hybrid and remote work setups were inevitable as digital transformation peaked. But it was the pandemic that fastened the pace, forcing many workplaces to adapt to changes. Businesses also went online as online transactions became more convenient for customers and employees. Amidst the Great Resignation, the new reality of work has also transformed. It has intensified as restrictions eased ahead of the impending RTOs across industries. Amidst the fundamental changes, going back to pre-pandemic setups could be almost impossible. It is no wonder that 71% of businesses plan to include remote work in their SOP. This trend opens more ways for Upwork to expand and reintroduce its market presence to more companies, hiring managers, and professionals.

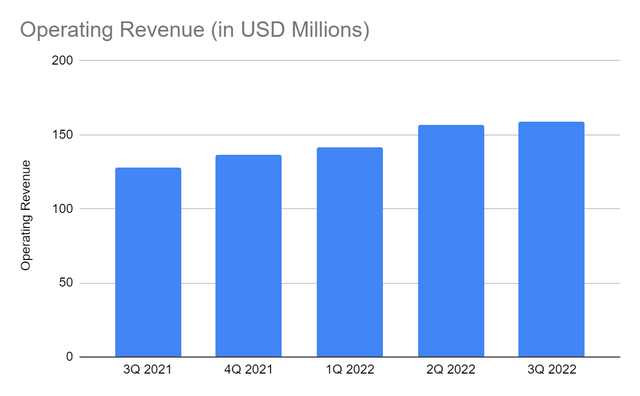

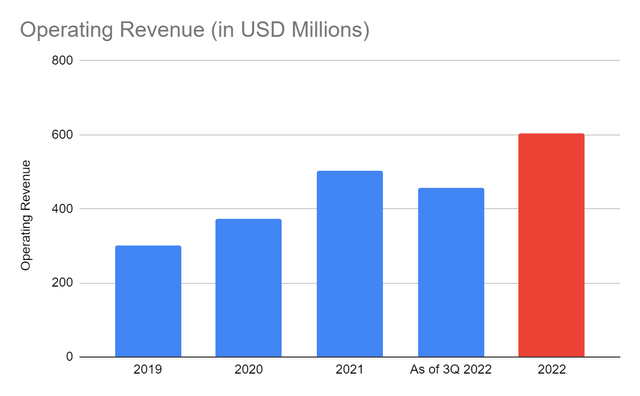

The operating revenue this quarter amounts to $158.64, a 24% year-over-year growth. Even better, the quarterly revenue had a consistent increase in the last year. The annual revenue growth also remains steady after speeding up in 2021. It may be attributed to more clients and professionals entering the marketplace. Indeed, it has benefited from the drastic labor market changes in the last two years. As of 3Q, the accumulated revenue is $455 million, which is already 90% of the full-year revenue in 2021. It shows that Upwork has been performing better this year. Its marketplace and managed service revenues are in an uptrend, showing sustained strength in both segments. We also have to consider the more volatile economy as inflation ensues. Upwork remains stable, making it a reliable business in the industry.

Operating Revenue (MarketWatch) Operating Revenue (MarketWatch)

Upwork remains well-positioned with a clear value proposition. Its market presence becomes more evident, as shown by its active brand campaign and increased client engagement. Thanks to its enticing business model that maintains hiring process and talent acquisition flexibility, cost-reduction feature, and operational agility. It appears more essential today as inflation drives the increase in costs and expenses. Its instant and affordable delivery of talent in over 180 countries help improve margins and stimulate growth amidst economic uncertainties.

However, it must not be complacent. Despite its recent milestones, it has to improve further to sustain its growth and manage costs and expenses better. Its active clients, for instance, continue to increase, but the comparative growth appears to be cooling down. The same goes for its GSV per active client. I find this trend logical since the marketplace growth may be approaching its peak. Also, it has been two years since the pandemic started so many clients have already adjusted to it. It is no wonder Upwork narrowed its Q4 guidance to match its recent financial trends. Upwork must do its best to retain its clients while expanding its market. There are still a lot of untapped potentials that may stimulate its performance.

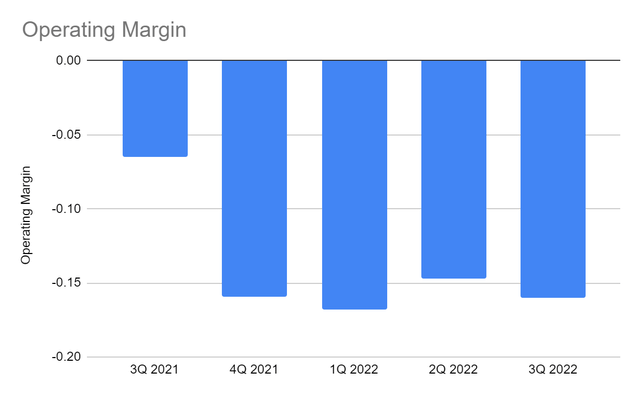

It has to remain prudent to reduce cash burn. Its operating income remains a negative value as its spending remains elevated. Research and marketing expenses are the primary drivers. Fortunately, they remain well-managed and consistent with the operating size and capacity, showing consistent asset management. It must maintain or even improve its strategies, given the seasonal and softening macroeconomic conditions. It must also review its pricing structure to balance marketplace take rate and client spending.

Operating Margin (MarketWatch)

Labor Market And Business Landscape Changes And Untapped Potentials

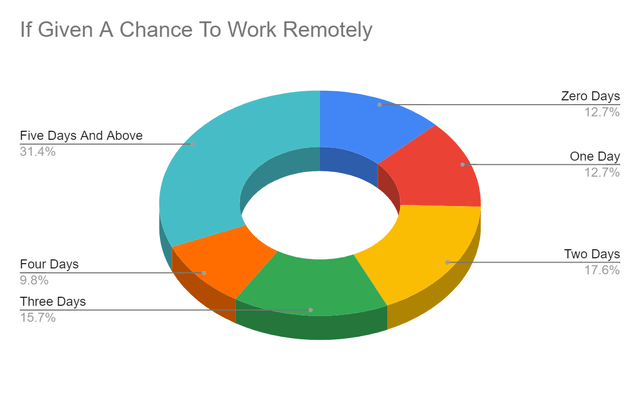

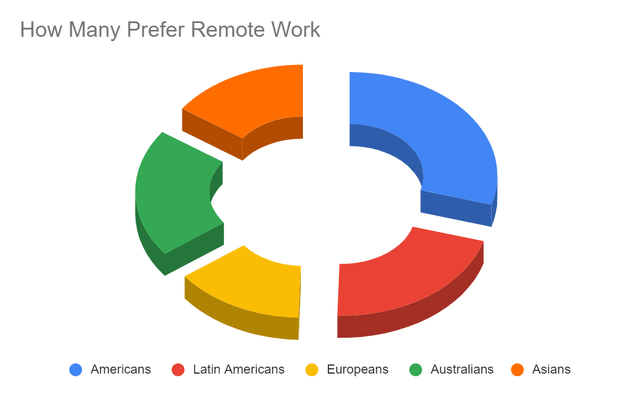

The unprecedented events in the last two years have transformed the labor market. Remote and hybrid work setups have become the new reality of work. As the Great Resignation remains evident, workplaces have to meet the new standard in the market. In a study that compared the pre-pandemic and 2022 trends, we can see the integral changes in the last two years. Recent surveys show that 32% prefer to do remote work for five days every week or 100% remote work. This is regardless of the fact that hybrid or flexible work setups will be implemented. Globally, Americans are more geared to it. Latin Americans and Australians are also open to this possibility with 22% and 21%, respectively.

Remote Work (McKinsey And Company) Global Remote Work (Velocity Global)

Aside from convenience and lower costs, the preferred setup also saves time and energy. It allows many workers to have side hustles. In 2020, 48% of freelancers were working part-time while 36% are full-time freelancers. The remaining 14% were full-time employees who decided to have a freelance job for extra income. Competition may be a concern, but Upwork remains the top provider. With an increased preference for remote setups, the freelance marketplace will most likely keep expanding. It will be one of the primary growth drivers of the demand and supply of freelancers.

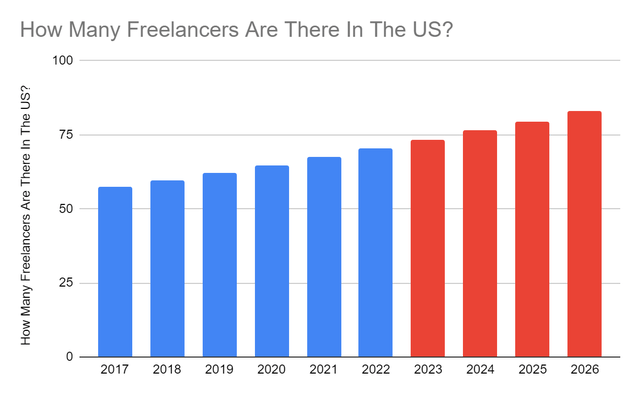

In the US alone, there are over 70 million freelancers. Projections show that the number may exceed 80 million in 2026. The outlook is possible, given that most businesses plan to include remote or hybrid work setups in their standard business. Also, Upwork has a strong customer base and brand loyalty. It caters to large companies, such as Marriott International (MAR) and iCIMS (TLNT). It can leverage the popularity of these companies to maintain its competitive advantage and capture more customers.

Number Of Freelancers (Statista)

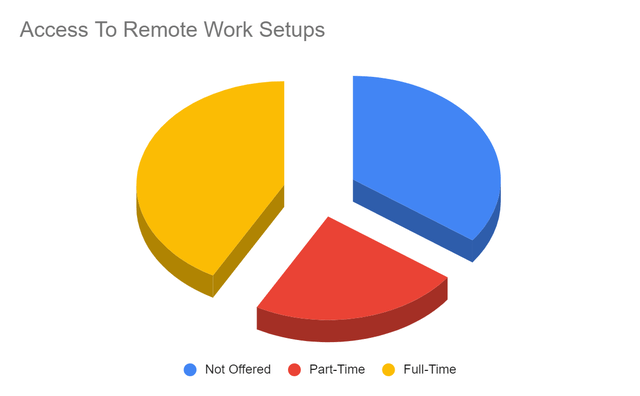

Moreover, there is still a lot of untapped potential in the freelance marketplace. Upwork may expand its presence in emerging economies. Why? They have a higher labor intensity. Wages can work better for companies and clients, allowing them to maximize their capacity. Even so, it may unleash its potential in the US if it wants to. Although the labor market is evolving, there are opportunities it can capitalize on to expand and capture companies and freelancers. As of 2022, at least 35% of employees still have no access to remote work setups. The percentage is lower than pre-pandemic levels, showing that businesses became open to it. Yet, it remained high, which may lead to massive changes in the marketplace once they enter. Indeed, Americans are embracing remote and flexible work setups, and they want more of these.

Access To Remote Work Setups (McKinsey And Company)

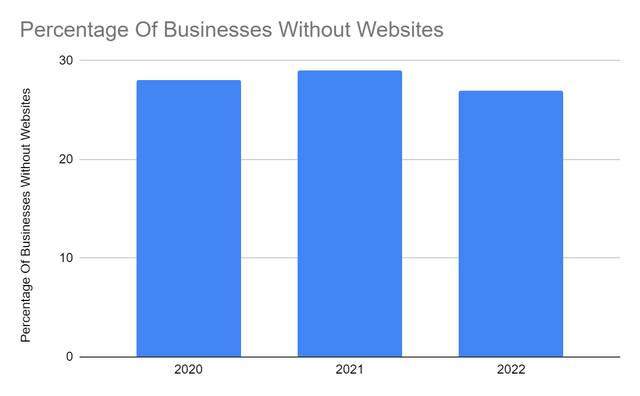

On the business side, business reopenings can become a growth driver for Upwork. Many small businesses have a limited capacity to create, design, and develop their websites. They may have to spend at least $1,000-1,500 to do so. But the average cost amounts to $2,400, which may not be convenient, especially for startups. Social media websites are common tools for marketing and promotion, but most of the recruitment process takes place on Upwork. As early as 2018, 50% of small businesses have embraced agile workforces. Upwork was at the forefront of this transformation. Now, more small businesses are opening with a net increase of 700,000 as of this year. Even better, 27% of small businesses still do not have a website, which may open more doors for Upwork to help them in recruiting talent. The e-commerce expansion will also have positive spillovers on the freelance marketplace, leading to more demand for remote staff and assistants.

Percentage Of Business Without Websites (McKinsey And Company)

Maintaining Solid Fundamentals

With these market risks and opportunities, Upwork must be capable of sustaining its operations. The economic volatility may continue to hit it as the costs of operations remain elevated. Although revenues and income assess their performance, liquidity shows its capacity to sustain it. Upwork has an excellent liquidity position with a current ratio of 3.5x.

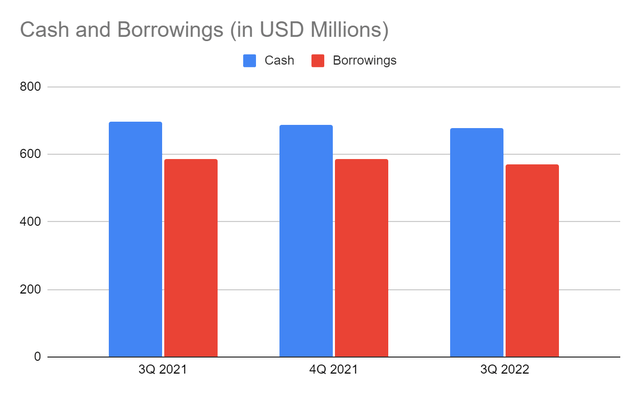

Moreover, its cash and cash equivalents alone can cover all its current liabilities. It can also cover its borrowings should it decide to make a single payment. It is also a vital aspect as interest rate hikes make the cost of borrowings higher. Cash and cash equivalents comprise 86% of the total assets, making it liquid. It can also use the excess cash to increase its investment in the flourishing freelance marketplace.

Cash And Borrowings (MarketWatch)

Nevertheless, it must take note of its spending on brand marketing. This quarter, it plans to spend $19 million, bringing to a total of almost $80 million. It is in line with its expansion, but a reasonable reduction may have a substantial impact on its viability, allowing it to reach its target value.

Stock Price Assessment

The stock price of Upwork, Inc. remains hammered. It is higher than its 2020 lows but lower than pre-pandemic and 2021 averages. At $12-14, it is 59% lower than the starting price. It may decrease further as Q4 guidance is lowered. But it appears to be an opportunity for potential gains. Growth prospects are promising amidst economic volatility. It is still too cheap, trading at less than 3x of revenues. With a plan to raise its revenue and EBITDA, the stock price appears to be a good entry point. With its current cash levels and overall liquidity, it may achieve its projections that may lead to a price rebound.

Bottomline

Upwork, Inc. remains well-positioned in an evolving market landscape. Its revenue growth remains stable although it must do more to sustain it. It has excellent liquidity allowing it to cover its borrowings and expand its operating capacity, making growth prospects enticing. Meanwhile, the stock price is still in a downtrend, making it ideal. The recommendation is that Upwork, Inc. is a buy.

Be the first to comment