GoodLifeStudio/iStock Unreleased via Getty Images

About 3 weeks ago, I covered one of my favorite stocks that is a direct beneficiary of the gig economy, Fiverr (FVRR). Today, I will discuss another smaller holding in my portfolio that is leading the space within the gig economy in a slightly different fashion. Upwork’s (NASDAQ:UPWK) mission is to “create economic opportunities so everyone has better lives”. Trading near its 52-week lows, I believe UPWK provides significant long-term upside to investors today at current levels.

Overview

Similar to Fiverr, Upwork manages a marketplace connecting businesses to independent talent. Similar to many middlemen and marketplace businesses such as DoorDash (DASH), Uber (UBER), Lyft (LYFT), Fiverr, and Airbnb (ABNB), Upwork operates a fee-based model in which it charges clients and freelancers money for utilizing its platform. Sporting over 10,000 skills across 50+ categories, Upwork’s global community of talent has whatever you need, from graphic design to ghostwriting to consulting.

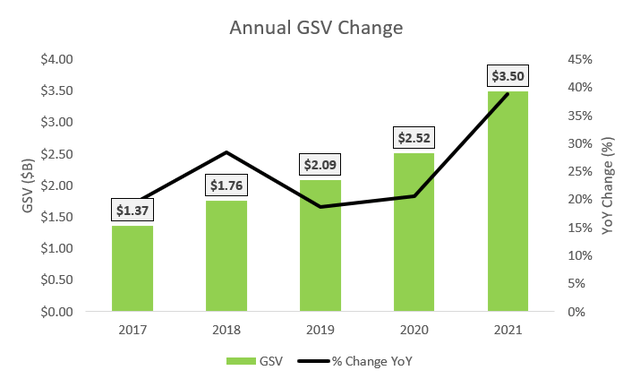

As of FY’2021, Upwork’s GSV (gross service volume) was a whopping $3.5 billion, making it the world’s largest marketplace by this metric.

Author Created (Annual Reports)

Most recently in F’21, UPWK increased its GSV by 38%. Upwork derives revenue from two different sources.

- Marketplace Revenue

- Managed Services Revenue

Upwork’s marketplace revenue accounts for 92% of all sales, with the remaining focused on managed services. The company’s marketplace revenue is derived into four different segments, as described in its 10-K.

Upwork Basic: The simplest of the four offerings, Upwork Basic provides clients with access to independent talent with a verified work history in the marketplace.

Upwork Plus: In addition to Upwork’s Basic offering, Upwork Plus clients can access personalized assistance, whether strategic or job-specific. They also receive perks such as a verified client badge and highlighted job posts, which stand out to top talent and help clients achieve results.

Upwork Enterprise: Designed to serve larger clients with 250+ employees, Upwork enterprise includes consolidated billing and monthly invoicing, a dedicated team of advisors, detailed reporting with company insights and trends to enable clients to hire faster and more successfully, and the opportunity for clients to onboard pre-existing independent talent onto our work marketplace

Upwork Payroll: Upwork payroll is a service available to clients when they choose to work with talent they engage through Upwork as employees. With Upwork Payroll, clients have access to third-party staffing providers to employ their workers so that they can meet their talent needs through our work marketplace.

Within the Managed Services segment, accounting for 8% of total revenue, Upwork engages workers directly on behalf of its clients, claiming responsibility for invoicing and quality of work.

Hybrid Model Provides an Advantage

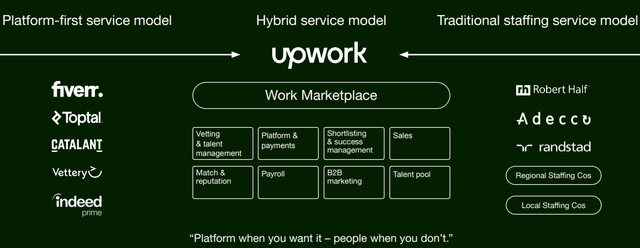

One of the great aspects of UPWK’s business model is that it considers itself a hybrid between a gig company and a traditional staffing agency. By tackling both ends of the spectrum, the business caters both to enterprises, SMBs, and individuals looking for freelancers.

Investor Presentation

Data from Intuit (INTU) owned Mint shows that half of the freelancers work 30-50 hours a week, similar to a full-time role. Once a simple gateway for smaller companies to hire temporary workers, Upwork now works with Fortune 100 businesses within its enterprise segment. According to data from Fortune itself, 30% of Fortune 500 companies hire through various freelancing platforms like Upwork.

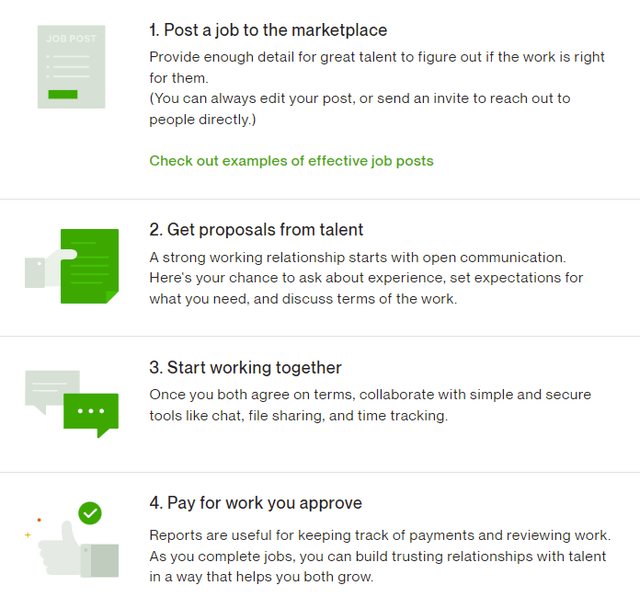

Contrary to competitor Fiverr, which is focused on one-time jobs, Upwork clients actually post jobs on the platform and “recruit” or “invite” qualified talent.

Upwork Website

As remote and flexible working arrangement culture continues to prevail in a post-pandemic environment, corporations continue to increase the use of freelancers within their organizations. Thus, Upwork’s hybrid model better poises the company to benefit from robust growth within the enterprise segment. The business model allows Upwork to be more agile in serving customers across all its segments. As stated in UPWK’s investor presentation and in the image above “a platform when you want it – people when you don’t”.

In the first quarter of 2022, Upwork brought on Honeywell (HON) as a client.

Honeywell competes with other top companies for tech talent, and its current resources do not allow for flexibility in contract duration—it currently can hire only for six months or more. The leaders envision utilizing Upwork to start with what they call microtasks: to be able to have a bench of flexible talent focused on product innovation. We are excited to continue to grow our partnership with Honeywell and support its access to the on-demand, specialized experts it needs to scale product innovation.

UPWK onboarded 32 new enterprise clients in the first quarter alone, including Reddit and Global Payments (GPN).

Unit Economics & Capital-Light Business Model

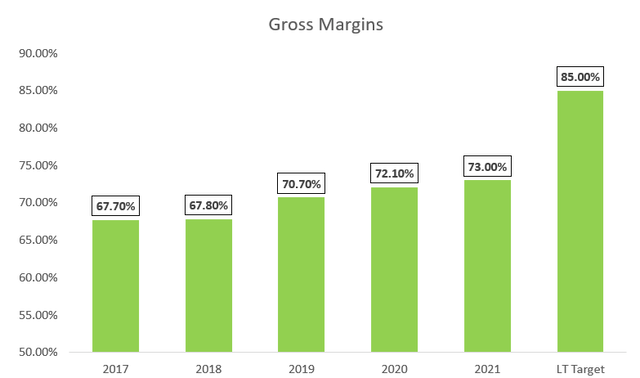

As previously mentioned, UPWK is the market leader in terms of GSV, or gross service volume. Its capital-light business model is another attractive business quality of UPWK. As a marketplace business with extremely low COGS, Upwork’s exceptional unit economics drive high-margin revenue as exemplified by the chart below.

Company Filings

With a long-term gross profit target of 85% and Adjusted EBITDA margin of 35%, the long-term profitability and cash-generating potential of Upwork can significantly reward shareholders over the long term.

Stickiness Driving Network Effects

Defined as a customer’s propensity to use a product or service more frequently, stickiness is a key trait that demonstrates strength in marketplace and social media business models. In December of 2005, Meta Platforms (META) boasted a whopping 6 million DAUs (daily active users). In its most recent fiscal year, the company boasted a whopping 1.93 billion DAUs, a 300-fold increase in 17 years. The logic behind this was simple: people loved using Facebook because the platform was sticky and it kept customers coming back. Once a simple Harvard internal site to connect students is now a multi-billion social media giant that many could argue they cannot live without. To clarify, I am not arguing that UPWK will ever recognize the size and scale of Meta, but rather the importance of having a sticky product or service.

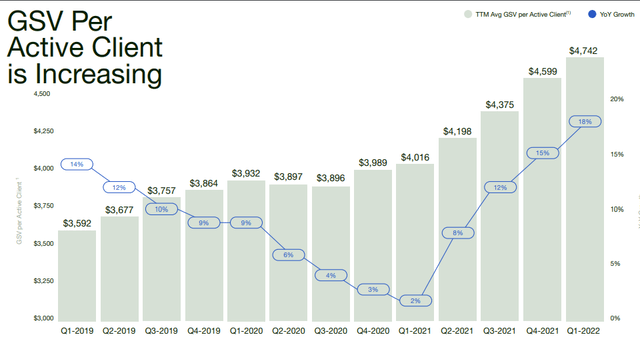

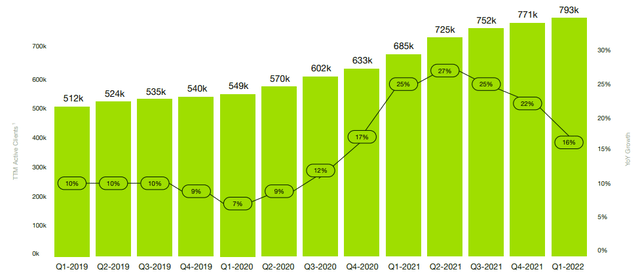

Upwork’s stickiness has been proven over the last 10 quarters. The twin engines driving UPWK’s growth are the number of clients and total GSV per client.

Investor Presentation

Over the past 13 quarters, UPWK GSV per active client has grown at a very healthy 32% despite the consecutive quarterly declines during the beginning of COVID in 2020. Furthermore, Upwork continues to see robust growth in total active clients, up 55% from 2019. With spend per client and total client growth supercharging Upwork’s top line, it is evident that the company is the direct beneficiary of network effects as clients and talent find value in its platform.

Investor Presentation

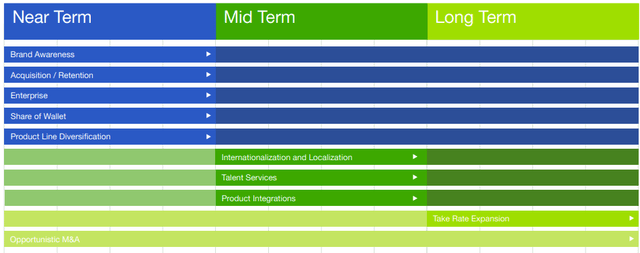

Upwork’s stickiness results in a moat derived through a network effect, in that the more users it has, the more value is recognized from the product. As Upwork continues to add value across all business channels, both clients and freelancers will become reliant on the platform as either a source of income or the best place to find global talent. While it may take time for this to translate into exceptional financials and economics, UPWK’s long-term target is to expand its take rate. As a company in the early stages of benefiting from the gig economy, the near-term focus continues to revolve around strong product integration, growing its client base, and increasing its industry share of wallet.

Upwork Investor Presentation

Financials

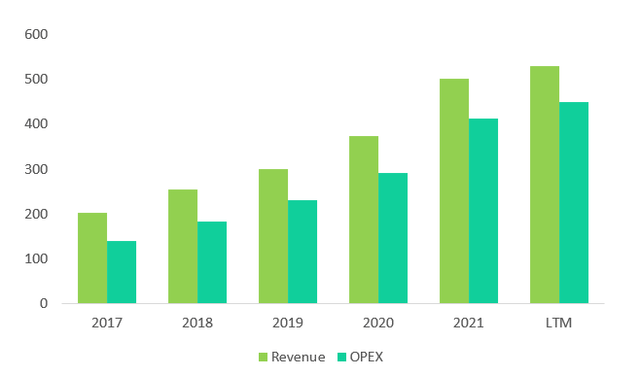

Over the years, Upwork has exemplified robust top-line growth as a business and across all of its channels. Despite top-line growth, Upwork is yet to achieve favorable economics as OPEX continues to grow with revenue, negatively impacting profitability.

Author Created (Upwork Financials)

The table below depicts OPEX as a percentage of revenue.

| 2017 | 2018 | 2019 | 2020 | 2021 |

| 69% | 72% | 77% | 82% | 85% |

While net income for the previous fiscal year came in at -$56.24 million, UPWK did generate $10 million in operating cash flow. Nevertheless, the company does depend on funding, and per its 10-K, issued $575 million in unsecured senior notes payable in August 2026.

Furthermore, it is prudent for investors to recognize the increasing share count that will likely dilute shareholders. While this is normal for companies constantly reinvesting into growth initiatives and having to raise capital, investors shouldn’t expect share buybacks any time soon.

Competition

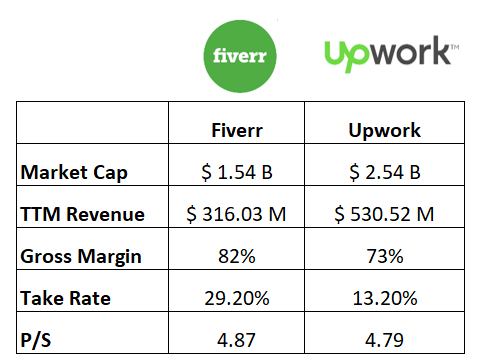

Upwork’s pure-play public competitor is Fiverr, another company taking advantage of the gig economy market tailwinds. However, as mentioned above, Fiverr’s focus is more on one-time jobs whereas Upwork has a foot in both camps. The table below depicts some key metrics comparing the two businesses.

Author Created (Company Filings)

With similar valuations, Fiverr’s take rate is more than double UPWK’s. However, Upwork’s rationale for the lower take is due to higher volumes from Enterprise clients, resulting in lower take rates. While this may pose a cause for concern, 13.2% is still a healthy take rate that can be increased in the future as UPWK strengthens its moat and grows its market share.

Naturally, as UPWK clients and talent recognize more value from the platform, it will have the leverage to increase its fees and take rate. Companies such as Amazon (AMZN) and ETSY (ETSY) are key examples of platform-focused companies that continuously increase fees as users become reliant on the platform. In a recent article of mine on Etsy, I talk about its most recent fee increase and how it resulted in zero churn.

Additionally, there are threats from new entrants in the private markets including Toptal, Jooble, Freelancer.com, and Guru. While Upwork’s dominance remains intact, it must not rest on its laurels if it wants to uphold its strong competitive position.

Final Thoughts

All in all, Upwork is a phenomenal business benefiting from network effects and secular tailwinds driven by growth in the gig economy. Its stickiness proves that it is truly providing an excellent solution for its customers, exhibiting robust growth in both GSV and spend per client.

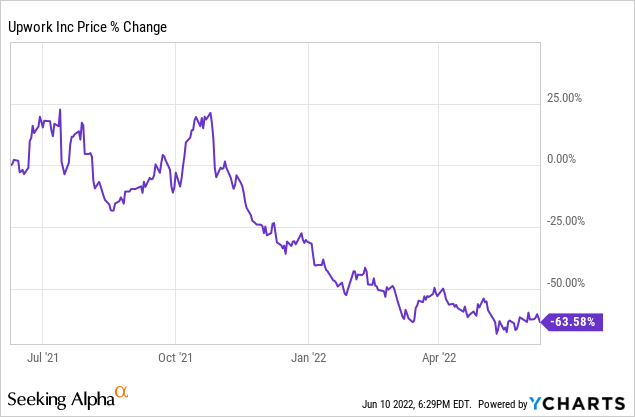

Down 64% over a 1-year period with a reasonable 4x P/S multiple, Upwork’s sticky business model and attractive economics make it an excellent addition to one’s portfolio. With the valuation significantly compressing following the tech sector sell-off, I believe Upwork provides significant upside for shareholders at today’s prices.

Be the first to comment