Olemedia

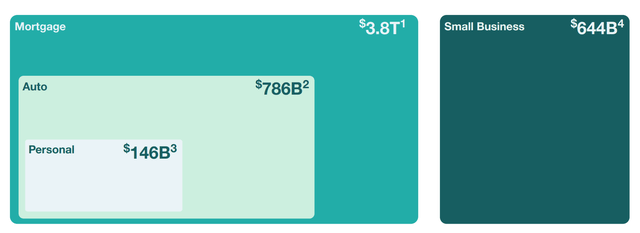

Upstart Holdings, Inc. (NASDAQ:UPST) is a financial technology company that specializes in providing a marketplace for “AI-powered” loans. Approximately $5 trillion in loans are originated each year, which consists of Mortgages ($3.8 trillion), Auto finance ($786 billion), Small Business Loans ($644 billion), and Personal Loans ($146 billion). Upstart is poised to attack this market as it builds out its vast marketplace. In this post I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Upstart Loan Market (Q3,22 report)

Fintech Business Model

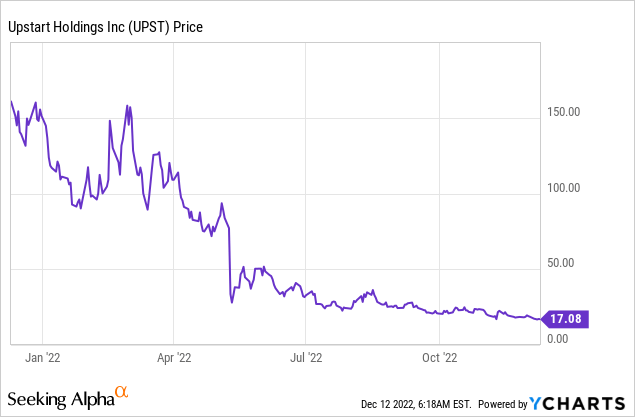

Upstart is an Artificial Intelligence [AI] powered lending platform for personal loans, auto financing, and even credit card consolidation. Traditional banks can be slow to borrow, offer high rates, and can be restrictive to users with poor credit. Upstart flips this model on its head with its automated loan service, which provides higher approval rates and lower loss rates than traditional methods. For example, below you can see the company’s personal loan product offers 43.2% lower rates when compared to a credit score-only model. While its small business loan offers between $5,000 and $200,000 in as little as one business day. An incredible 75% of its loans are instantly approved and fully automated.

Upstart products (Q3,22 report)

The company can accomplish this rapid and reliable lending through its marketplace model. Upstart has partnerships with over 150 institutional investors and 83 banks.

According to data for the full year of 2021, 80% of its loans were purchased by institutional investors via multiples methods from whole loan purchases to securitizations. In addition, 16% of its loans were funded through the platform and held by the originating bank. This is a brilliant business model as it means Upstart can spend less time worrying about individual loans and more time as a middleman facilitator. Its AI model takes a variety of factors into account from Employment History to Application interaction, Bank Transactions, Cost of Living, Education, Credit Experience, and much more.

Upstart AI model (Q3,22 report)

Mixed Third Quarter Financials

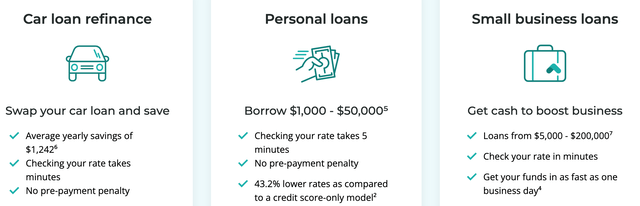

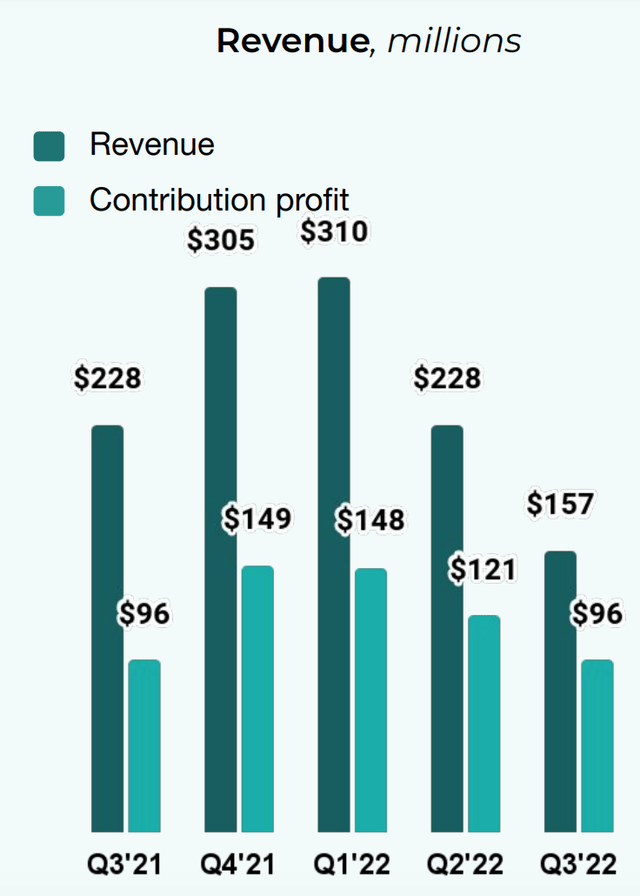

Upstart reported mixed financial results for the third quarter of 2022. Revenue was $157 million which declined by an eye-watering 31% year over year. The decline was driven by 48% decline in loan transactions to 188,000 loans. This was further driven by the rising interest rate environment and macroeconomic environment. As a result, Upstart is approving 40% fewer loan applications than last year. In addition, many of its lending partners have also reduced their originations and/or raised their rates. Management believes its banking partners are just showing an “abundance of caution” as their Upstart-powered loan portfolios have met or exceeded expectations on average since 2018.

A positive was the company reported 125,000 new borrowers and its average loan size increased by 14% year-over-year. This means as the macroeconomic environment improves in future years, the company will have a larger base of customers ready to upsell more loans.

Upstart’s “contribution profit” was $96 million which was the same as the equivalent quarter last year, despite the decline in revenue. Contribution profit is defined as revenue minus variable costs, borrower acquisition, verification, and servicing. Its Contribution margin has expanded from 47% in Q2,22 to 54% in Q3,22 as a result of higher take rates and more efficient marketing spend.

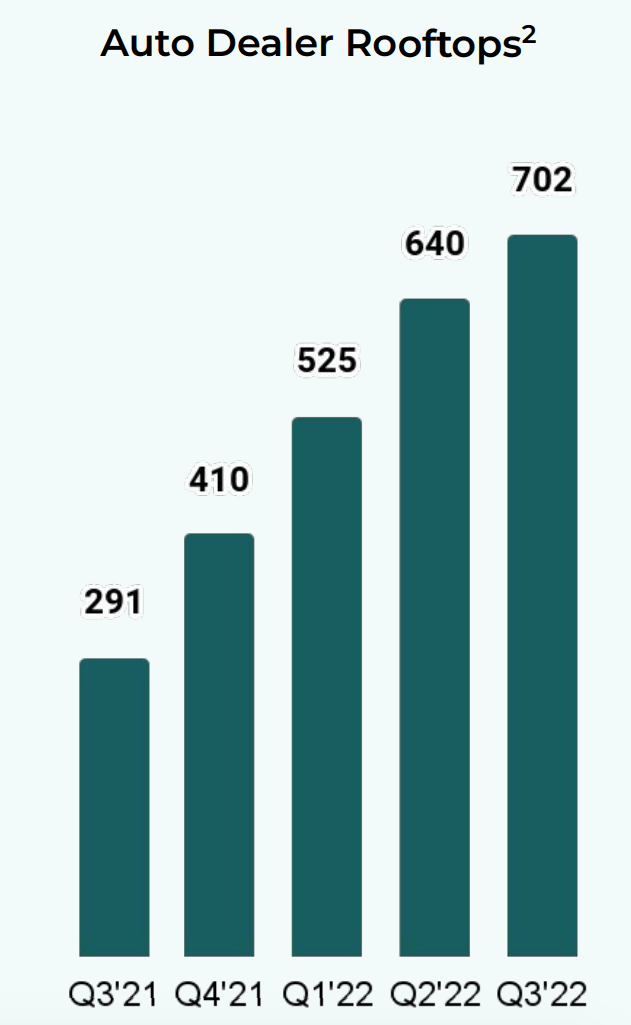

The company has also continued to expand its Auto Dealer business to cover 702 deal locations or “rooftops,” up an outstanding 141% year-over-year. This business unit is now live in three dealer groups across four states and represents 25% of the U.S population.

Autodealer Locations (Q3,22 report)

The company has also increased its number of banks and credit union partners by Its number of bank and credit union partners by a staggering 168% year over year to 83. This means its marketplace is now much larger and poised to drive results when economic conditions improve.

Upstart also rolled out an innovative software update for its Auto retail software which enables buyers to price autos before they arrive at dealer locations. According to Upstart data, borrowers saved an average of $5,835 over the life of the loan, with Upstart Auto refinancing. In addition, the company grew its small business loan volume by an incredible 10X, from $1 million in the prior quarter to $10 million.

Moving forward management plans to improve “operational efficiency” while also continuing to invest into its AI technology. So far the company has gotten of to a strong start with Operating expenses of $215 million which declined by 17% sequentially. This was driven by a 46% reduction in sales and marketing spend, due to the weaker conversion funnel. However, the business continued to invest into product development increased investments by 16% quarter over quarter.

Overall, the company reported non-GAAP earnings per share of $0.69, which missed analyst expectations by $0.21.

The company has a strong balance sheet with $830 million in “total cash” and $431 million in net loan equity. Its Gross balance of loan assets increased by $76 million since the last quarter to $700 million.

Advanced Valuation

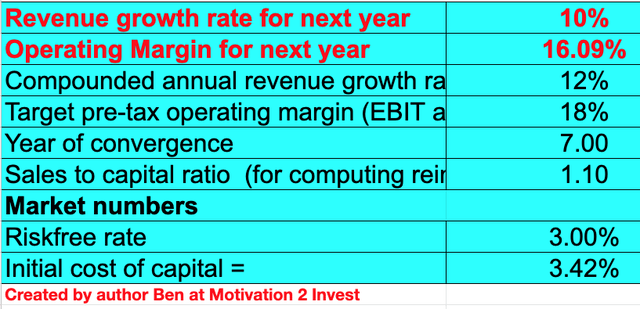

In order to value Upstart, I have plugged the latest financials into my discounted cash flow model. I have forecasted 10% revenue growth for next year and 12% revenue growth over the next 2 to 5 years. This is fairly conservative and based on a slow but steady economic rebound. For example, analyst estimates by Yahoo Finance forecast 30% revenue growth per year over the next 5 years.

Upstart stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses which have lifted the operating margin slightly. In addition, I have forecasted an 18% pre-tax operating margin over the next 7 years, which is also fairly conservative given the product innovation and upsell potential.

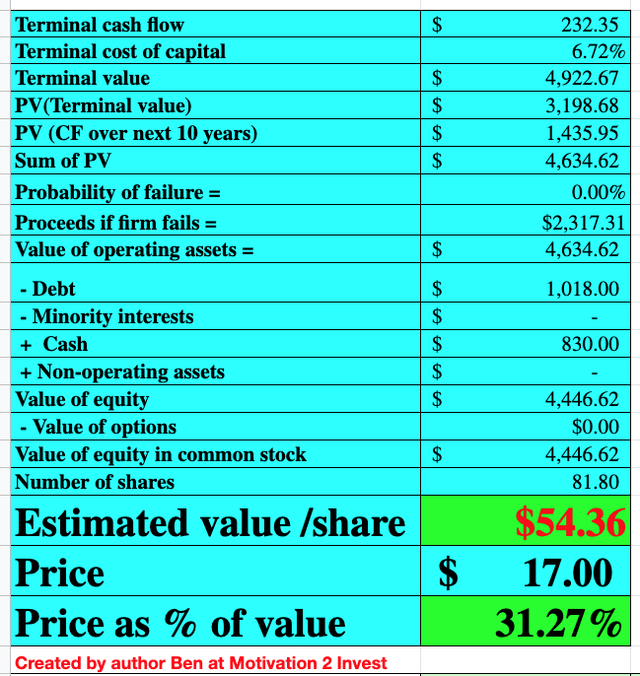

Upstart stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $54 per share, Upstart Holdings, Inc. stock is trading at $17 per share and thus is ~69% undervalued.

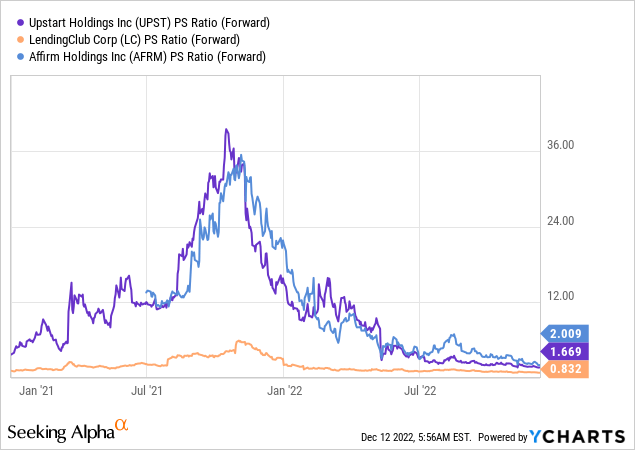

As an extra datapoint, Upstart trades at a Price to Sales ratio = 1.669, which is substantially cheaper than historic levels. In addition, the stock trades at a mid range valuation relative to industry peers such as Affirm (AFRM) and LendingClub (LC).

Risks

Recession/Loan Defaults

The high inflation and rising interest rate environment has already started to impact the revenue of Upstart. Lenders are becoming more cautious and borrowers are getting stung by higher interest rates. This is an unfavorable dynamic, but a positive is the economy tends to be cyclical, and thus as it recovers so should the business.

Final Thoughts

Upstart has an innovative business model and is poised to disrupt the trillion dollar loan market. The company is facing a series of short-term macroeconomic headwinds, but it has continued to grow its marketplace, increasing both new borrowers and banks. Upstart’s stock is undervalued intrinsically at the time of writing and thus could be a great long-term investment.

Be the first to comment