PeopleImages/iStock via Getty Images

Upstart (NASDAQ:UPST) delivered a disappointing and confusing second quarter earnings report. The company had already pre-announced second quarter results, but in addition to issuing disappointing guidance, the company also flip-flopped yet again on whether to use its balance sheet to fund loan originations. While it is not necessarily a surprise for the business to be experiencing volatility amidst a rapidly rising interest rate environment, the pace of unwinding took many investors by surprise, nonetheless. The stock is still very cheap here, and if the company can return to even some semblance of stable growth, then this stock could still provide strong forward returns.

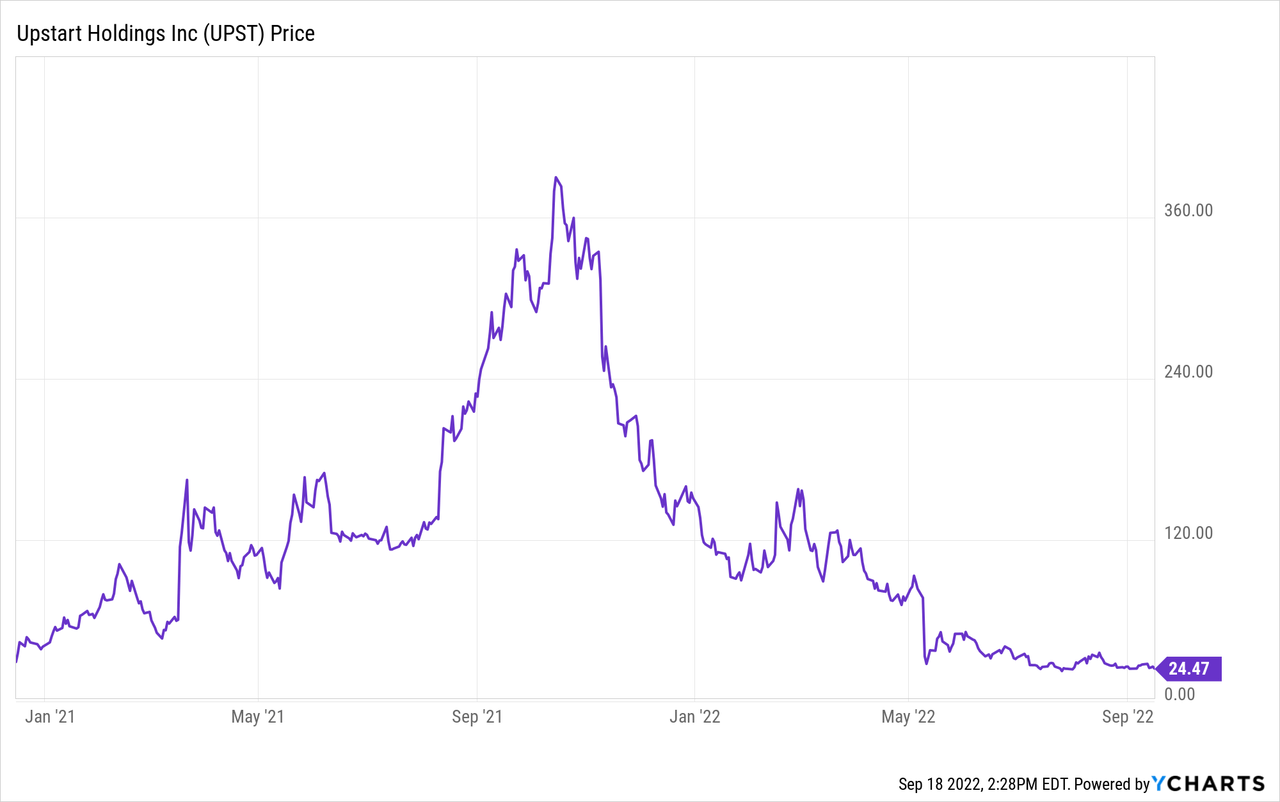

UPST Stock Price

After peaking just above $400 per share in late 2021 right before the tech bubble burst, UPST has since fallen over 90%.

I last covered UPST in May, where I discussed the attractiveness of the stock after the second quarter earnings crash. That crash was largely attributed due to the company straying from the tech model in holding some loans on its balance sheet. The company has since stated intentions to avoid doing that in the future, but in this latest earnings release once again has become comfortable using its balance sheet to fund loan originations.

What is Upstart?

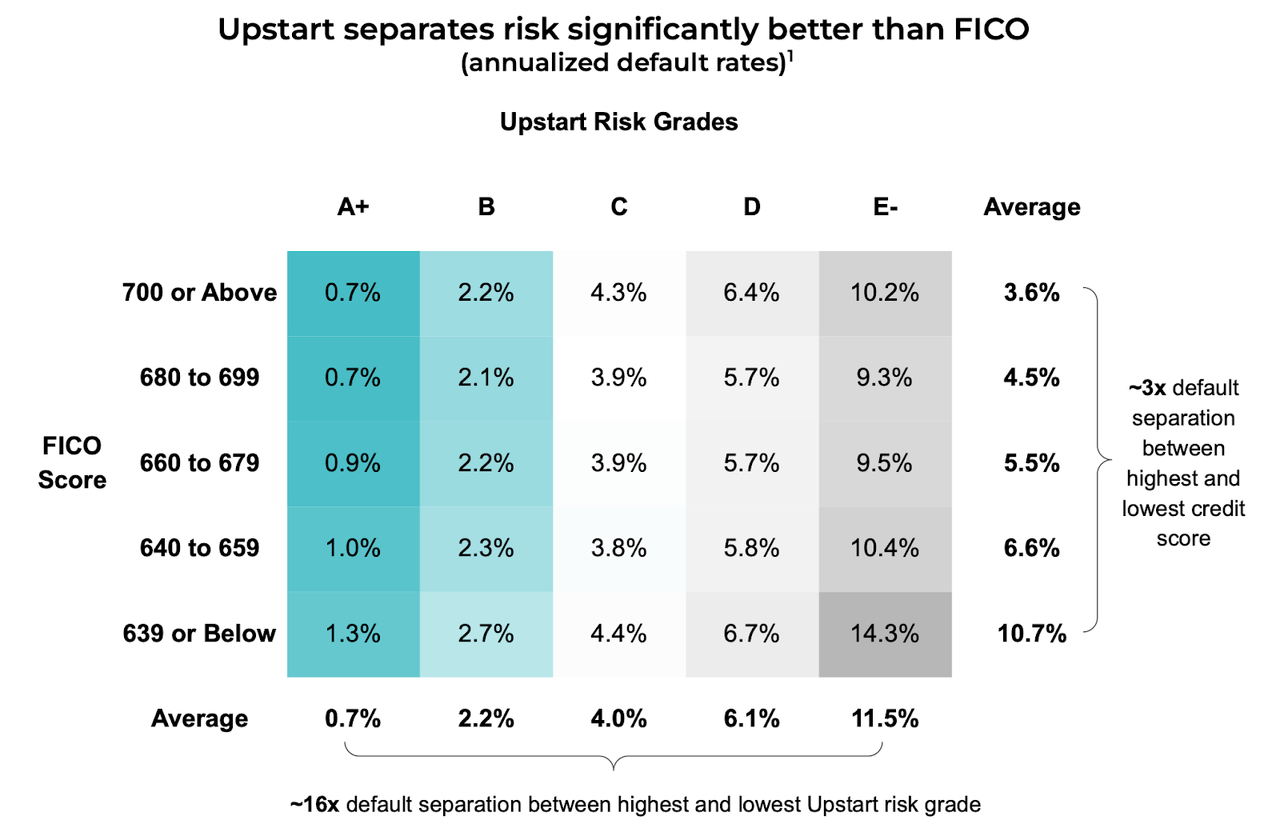

In short, UPST uses its artificial intelligence algorithm to determine creditworthiness in a way that it believes is superior to that of FICO.

We can see below that UPST’s models have done a superior job relative to FICO based on comparing the default rates for their respective grades.

2022 Q2 Supplement

The way to interpret the above chart is to focus on how UPST’s “A+ and B” ratings have generated very low default rates while its “E-” rating has been very comparable to FICO’s “629 or Below” rating.

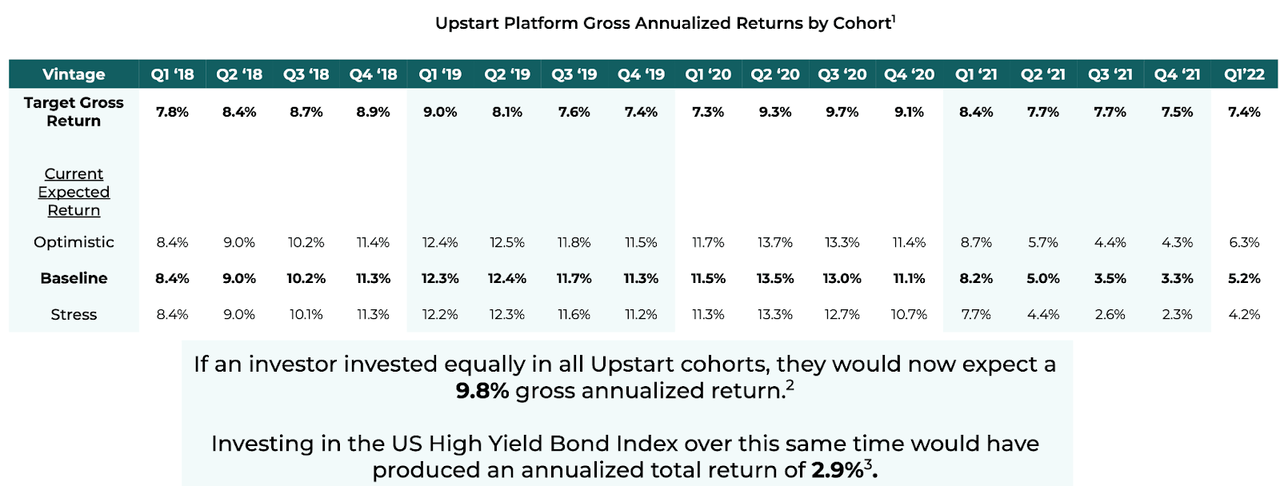

UPST monetizes their algorithm by helping originate loans, typically earning a fee on each loan processed. Prospective investors (those buying the loans) are presented with projected return profiles for the loans. We can see below that UPST has typically materially outperformed the target gross return.

2022 Q2 Supplement

Recent quarters have seen the baseline expected return dip below the initial target gross return rates, which is understandable on account of the rapidly rising interest rate environment.

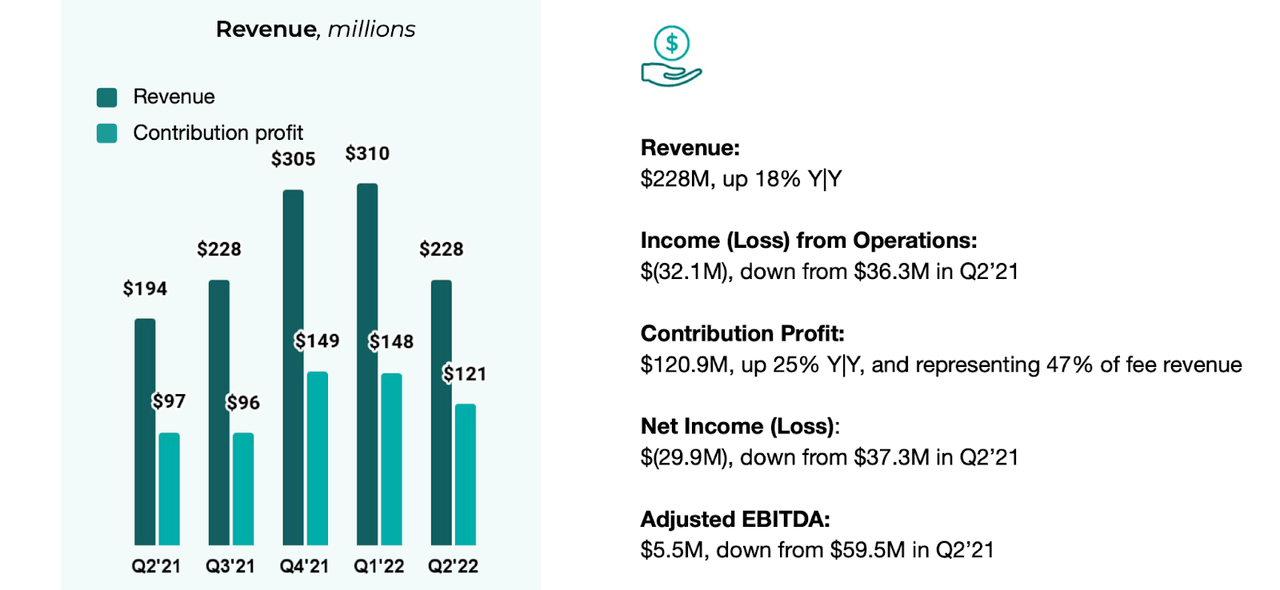

UPST Stock Key Metrics

The latest quarter saw revenues grow by only 18% year over year, with net income swinging slightly negative.

2022 Q2 Presentation

UPST was able to offset weakness in loan volumes with pricing power, as contribution margins rose to 47%.

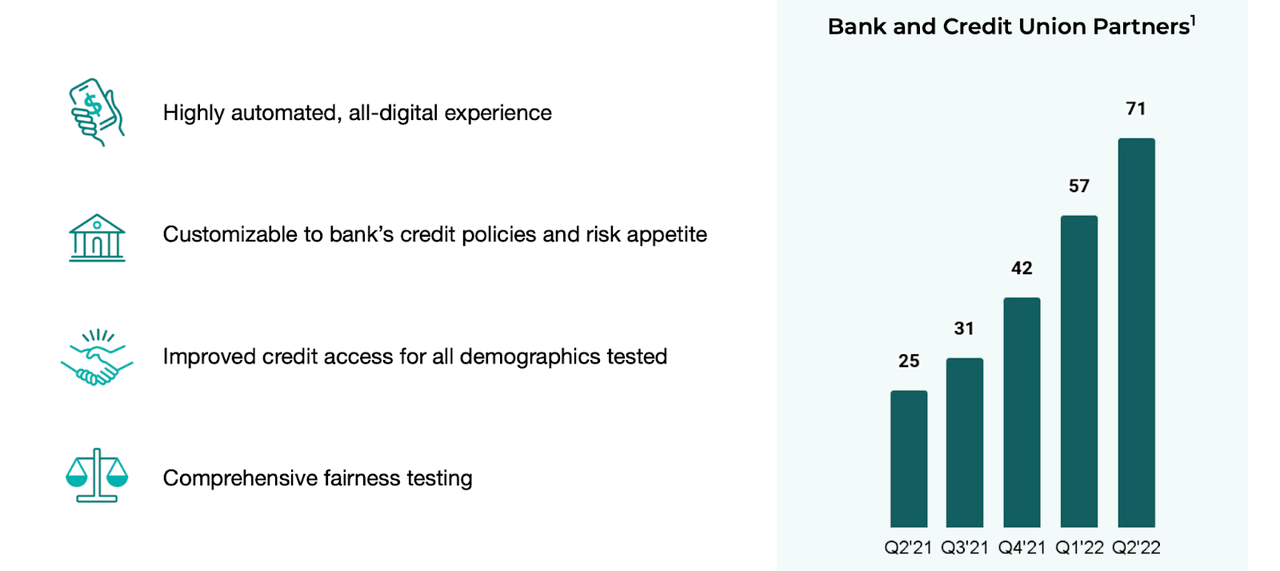

UPST continued to increase the number of bank and credit union partners on its platform.

2022 Q2 Presentation

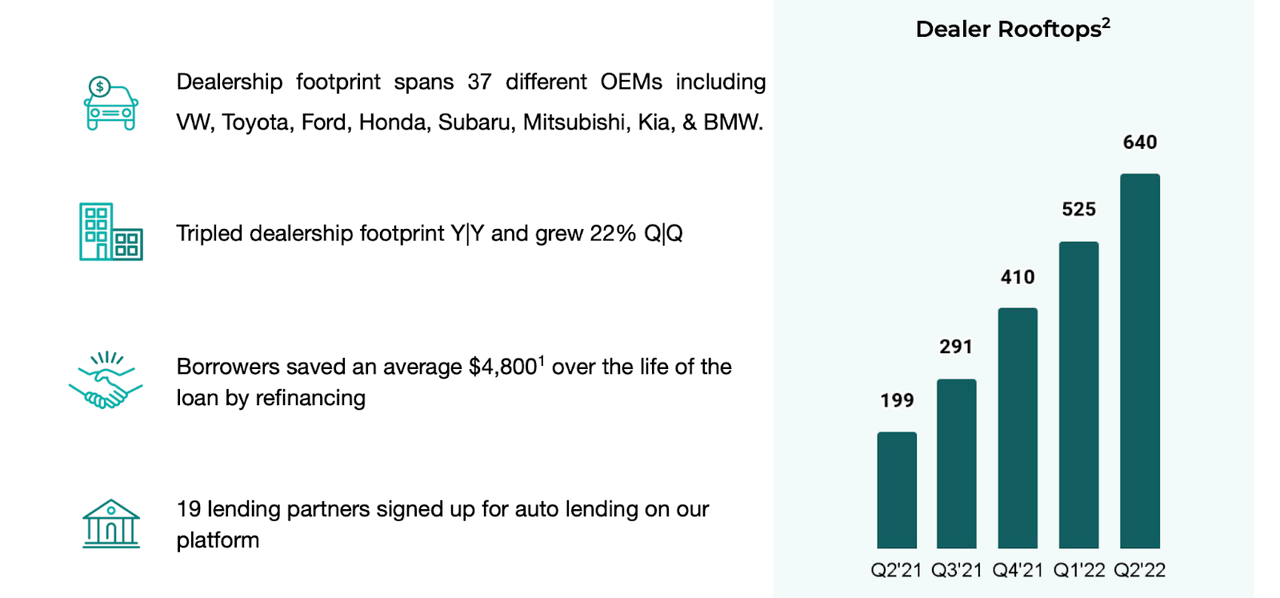

Most of its loans continue to be originated by two “power customers,” who accounted for 78% of revenues in the quarter. UPST also continued to increase the number of dealerships using its auto lending platform.

2022 Q2 Presentation

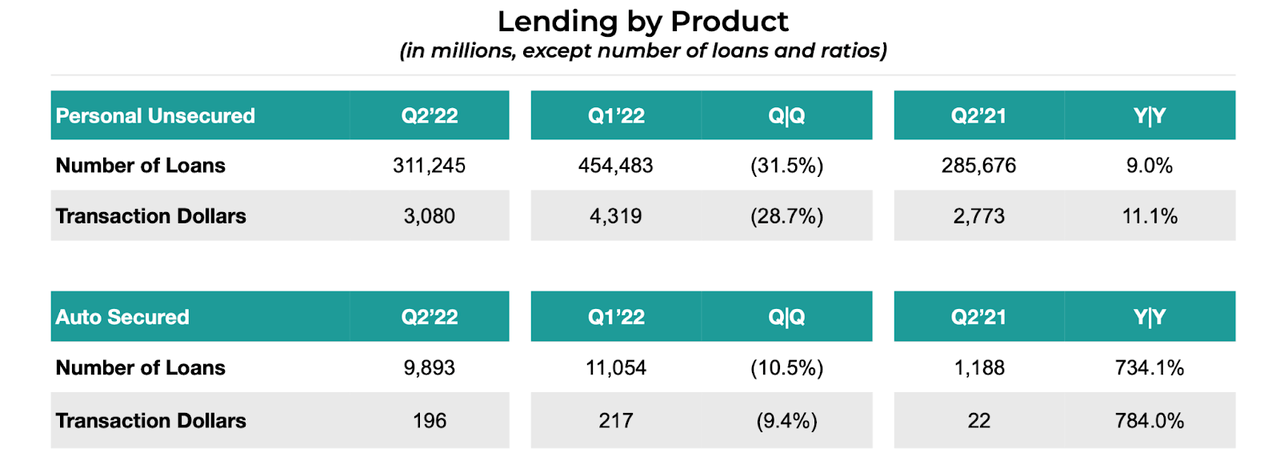

Auto lending remains a small part of its overall business as seen below. We can also see below the dramatic 31.5% decline in number of loans processed in its core personal unsecured product.

2022 Q2 Presentation

In a surprising detail, Upstart repurchased 3.5 million shares totaling approximately $125 million. The company ended the quarter with $914.4 million of cash on its balance sheet.

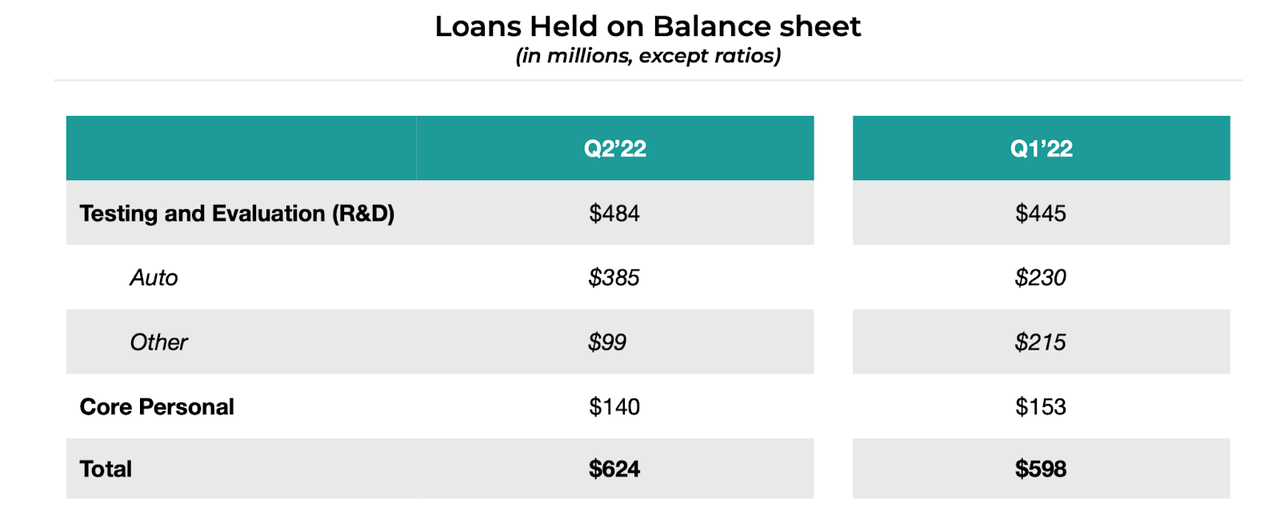

At an investor conference subsequent to the last earnings release, UPST stated that it would no longer use its balance sheet to fund loans, as the market made it clear that it did not appreciate the ambiguity in the business model. Yet the company was still holding $140 million of non-R&D loans on its balance sheet as of the end of the quarter.

2022 Q2 Presentation

Then in yet another stunning flip-flop, management has stated that it intends to use its balance sheet once again to fund loans. This is what they stated on the conference call:

Why do this? We understand better than anybody how our model is performing today. We believe that it’s well calibrated for the current economic environment and that the opportunity to generate outsized profits on our platform is significant right now. So we’re comfortable putting our balance sheet to work as necessary to navigate this transition.

We acknowledge that this is a significant shift relative to what we planned and communicated earlier this year. Yet, if my co-founders and I have learned anything after working together for more than 10 years, it’s that a volatile environment requires thoughtful and nimble execution. We believe betting on our own marketplace will provide stability for the business as we move toward long-term committed capital, demonstrate confidence in our model, and take advantage of some of the economic opportunities we see available on our platform until lenders increase their originations again.

In summary, it appears that the company is having issues funding the loans due to its typical funding partners being unwilling to extend credit in the current market. This decision to use its balance sheet seems necessary to not only sustain ongoing operations of its business but perhaps even also to prove the effectiveness of its algorithms during this tumultuous period.

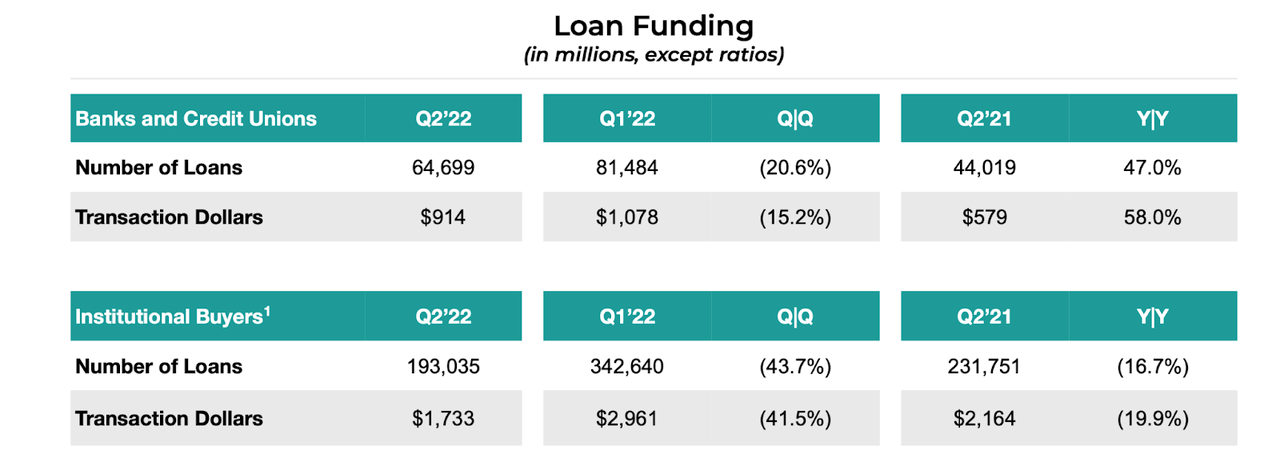

We can see below the main culprit of funding shortfalls. Loan funding from institutional buyers dropped off a cliff in the quarter, more than offsetting the strength seen from its bank and credit union funding sources.

2022 Q2 Presentation

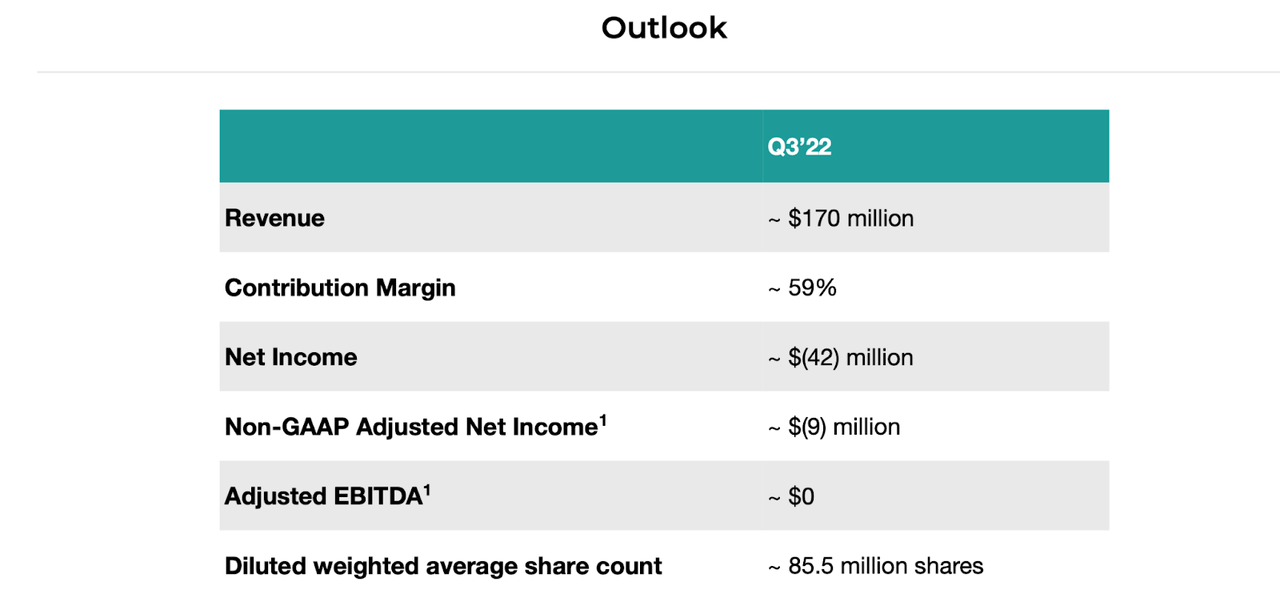

Management stated a desire to find more committed long-term funding partners in the future, but acknowledged that this would take time. Looking forward, UPST has guided for around $170 million of revenue, a 25% decline from the same quarter last year.

2022 Q2 Presentation

The guidance for breakeven adjusted EBITDA was the lone positive, as the company continues to operate with an impressive expense structure in spite of the decelerating growth.

Is UPST Stock A Buy, Sell, Or Hold?

This earnings report in conjunction with the past several months has greatly changed my view of the strength of the business. While I expected some volatility on account of rising interest rates, I did not expect the funding sources to evaporate so rapidly. I previously thought of UPST as being a pre-IPO type company having a breakthrough in terms of revenue and income growth. But it is clear that this is still a pre-IPO type company still in search of a sustainable breakthrough.

The tech crash has led to a punishing re-rating of the stock. At recent prices, UPST is trading at less than 3x annualized sales. This company is operating near breakeven even amidst the volatility. I could see multi-year growth returning to the 30% to 50% annual rates in a recovery, but when will that recovery take place? Applying a 30% long-term net margin assumption and 1.5x price-to-earnings growth ratio (‘PEG ratio’), the stock might trade at 15x to 18x sales in a recovery, implying immense upside.

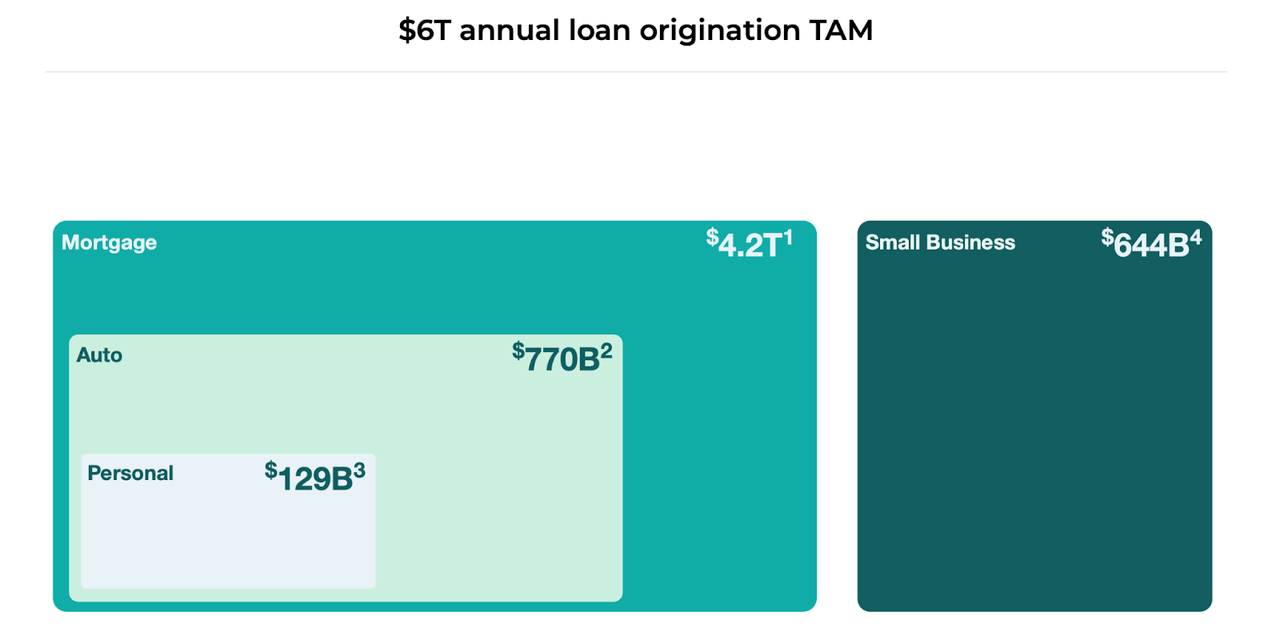

One mustn’t forget that UPST is still tackling a huge opportunity and has been adding new product lines to its arsenal. The company announced that it had quietly launched its small business loan product at the end of June ahead of schedule. UPST is also working on a mortgage loan product – these product roll-outs could theoretically sustain rapid growth for many years.

2022 Q2 Presentation

Unfortunately, with the deep undervaluation comes great risks. One needs to question UPST’s ability to find consistent funding sources moving forward – the fact that management appears ready and set to use its balance sheet to fund loans does not increase confidence. There is also the risk that this tumultuous period exposes flaws in the AI model – that would pose existential risk to the company. The stock is likely to remain highly volatile in the near term, and I wouldn’t be surprised if the stock rallied hard on any indication of an end to the rising interest rates. But it also seems like its true upside will be held back until the company makes it clear that its funding sources are back and here to stay. Even after the recent rally in tech stocks, tech stocks all around still trade at compelling valuations, leading to plenty of alternatives to own other than UPST. I rate UPST a buy on account of the solid financial footing and strong upside in a recovery.

Be the first to comment