courtneyk

Introduction

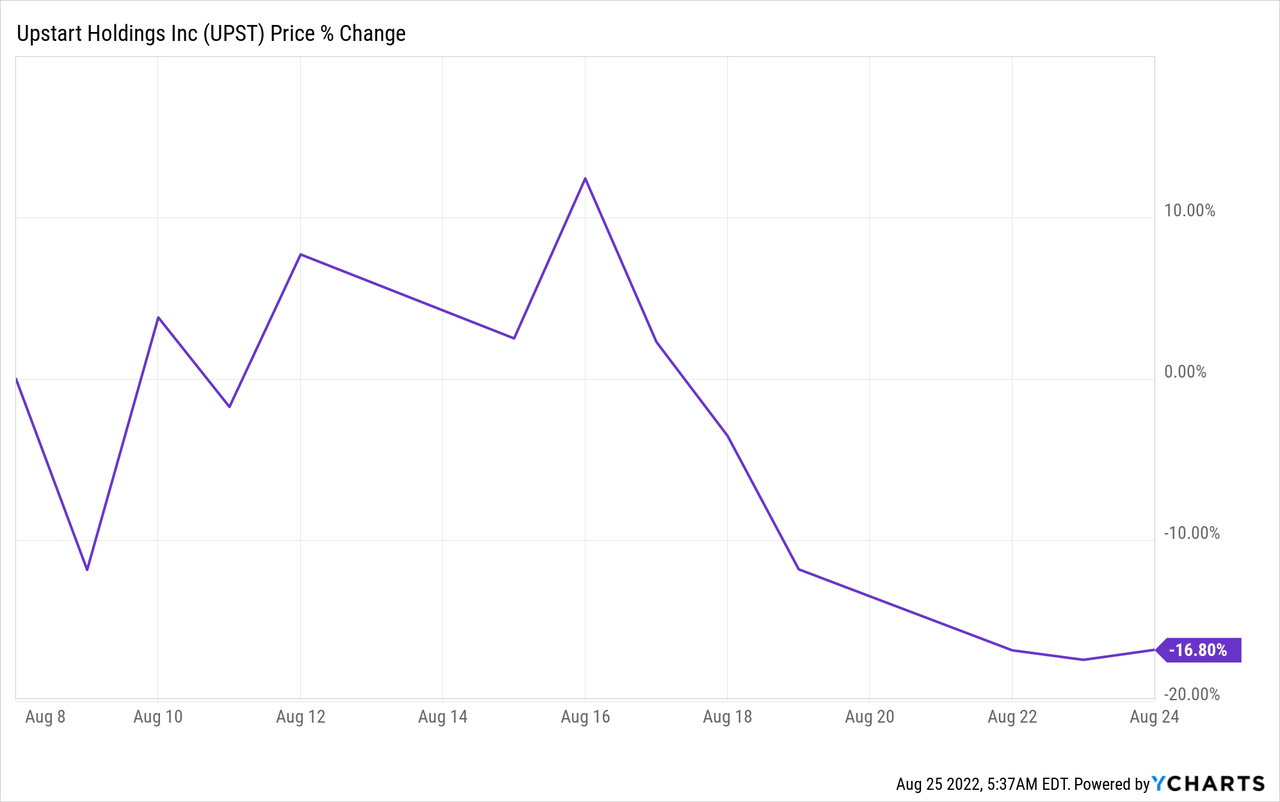

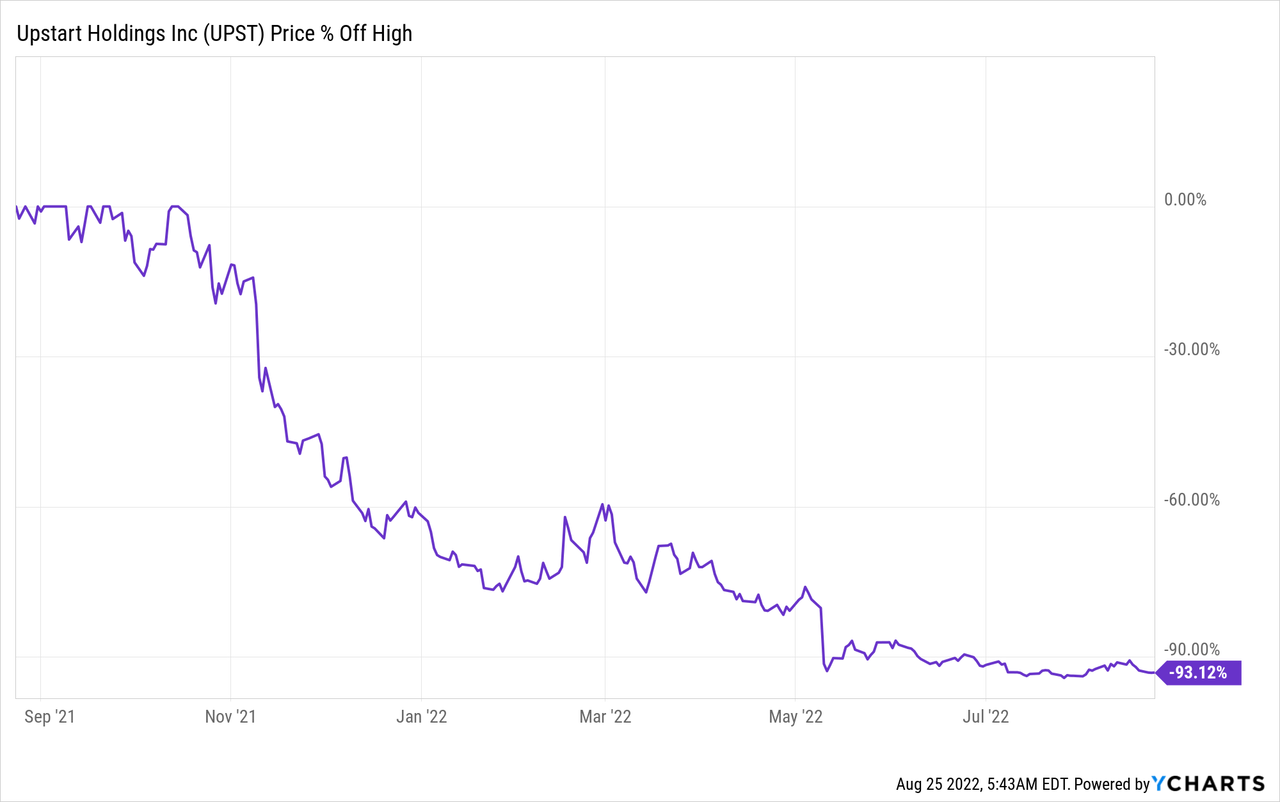

I have held many volatile stocks over the years, but Upstart is in a category of its own. The stock is down a whopping 93% from its highs.

The question is then: is this a broken company or a broken stock? Or, in other words, is this a good long-term opportunity or should you stay away from the stock? As often with the most interesting questions, the answer is “it depends”. I know that is an unsatisfying start for a lot of you, but just as in real life, in investing it’s not as simple as black and white. If you are interested to know the details, then I think this article could help you.

My initial reaction to the results

On the evening of the results, I shared my initial thoughts on a chat with the subscribers of my marketplace, Potential Multibaggers. This is what I wrote there:

The earnings are out for Upstart, not good but that’s not a total surprise, of course. The stock was halted at -15% after hours for pending news, but there was not that much news, just that Upstart would take every necessary measure to find funding. The stock now trades down about 9%, so it’s more or less flat compared to this morning.

I have listened to the earnings call. Management said that the results were bad, but that they will do everything to return to the great company they really are. They sounded like an injured sports person who is frustrated because they want to prove they are good, but can’t because of the circumstances (for Upstart, the injury is the macroeconomic environment).

They will also cautiously take loans on their balance sheet again. They first did that, then turned back that decision because the market didn’t like it and now just say something like: “Look, we have extreme confidence in our model, it has been adapted to macroeconomic circumstances for months now and we have the balance sheet to do this, so we are very confident about this.”

I think it makes sense. The problem is often not debt, but bad debt and from what we have seen, the results of Upstart are much better when it comes to predictability than those of the FICO score.

Bottom line: not a great quarter, for sure, but the company grows on a YoY basis (by 18%) although QoQ revenue is down 26%. It will be a very volatile ride, with extreme ups and downs, but I’m not selling my UPST position on this. I’ll probably not add much too, so just holding for now.

If you have read up to here, you already know more of what I mean with that “it depends” from the introduction. The rest of the article explains the why of my conclusion.

The Numbers

Before we dive into the numbers, this is how Dave Girouard, Upstart’s founder and CEO, opened the call:

Today, we reported a decline in revenues, which is obviously disappointing and unacceptable to us. (…) there’s no getting around the fact that a decline in revenues is a business problem that we need to address.

And this is how he concluded the earnings call:

Thanks all for being with us today. Sanjay and I just want to make clear we’re not happy with our results. We’re not a company that likes to have a declining revenue from one quarter to the next. But we are – we feel, doing the right things to make the company as strong and as powerful as it can be in the future.

I actually like that. It’s straightforward. Overall, I found management much more determined and confidence-inspiring than in the previous two quarters. Frustrated, yes, but in a way that makes them want to prove that they are down, but definitely not out.

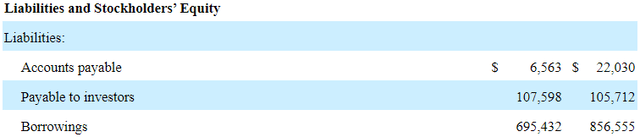

On July 7th, Upstart reduced its Q2 2022 guidance from $300 million to $228 million. As most, but not all analysts had adapted their projections, the consensus anticipated Q2 revenues of $235.3M and predictably, Upstart missed that consensus. It reported revenues of $228.2 million, slightly exceeding its revised target but falling 3.1% short of analyst average expectations. Revenue was down 26% QoQ, a big drop.

Also on July 7th, Upstart had reduced net income from about breakeven to a net loss of $31M to $27M. It lost $29.9M.

Guidance was the worst part of the earnings. The company withdrew its full-year guidance, which didn’t come unexpectedly. They maybe even should have done that earlier. They now see $170M for revenue, 30% lower than the consensus and down 25% QoQ. This has to do with adjustments in the fair value of the loans on their balance sheet. CFO Sanjay Datta on the earnings call:

Net interest income was a negative component of net revenue this quarter, as we entered into multiple loan sale transactions, some of which incurred a negative fair value impact. And as the valuation marks of our remaining loans continue to be negatively impacted by the rising interest rate environment.

So, they have sold loans worth less than previously accounted for and the same goes for the remaining loans on the balance sheet. This will remain a headwind in the next few quarters. Simply put: if you have a loan of 5% and you know there are loans available at 8%, which one would you want to buy as an institutional investor? That’s why the 5% loans must be sold at a discount to their fair value.

The company also guided for breakeven EBITDA, while the consensus stood at $22.1M. For EPS, guidance is a loss of $0.10 per share, $0.30 below the consensus of $0.20.

Before we go any deeper, I first want to address some misconceptions I have heard about Upstart.

Misconceptions

1. Upstart can only do well in a low-interest rate environment

Cheap money provided by the Fed, that’s what Upstart needs. Now that there is tightening, it will crumble. Something like that is buzzing around comments from individual investors.

Let me be clear: Upstart doesn’t need low-interest rates to thrive, it needs stable interest rates, just like all loan providers. If institutional investors think that interest rates will continue to go up, they will wait and that’s what is happening here. They think they will be able to buy more interesting loans later and wait to buy. Once rates have stabilized more or less, you’ll see demand return.

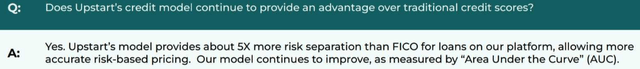

2. Banks already use AI, Upstart is unnecessary

I keep hearing that banks use AI already but why do they still use the old FICO (FICO) score then? The answer is that this AI is not good enough. Upstart is only focused on this and that could make its AI much better than what banks have. It’s like saying that a Lamborghini is useless, as there are already Hondas. One is clearly superior to the other.

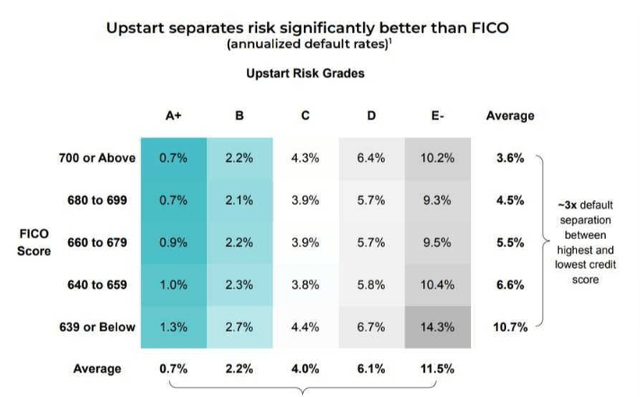

For those who would still have their doubts that the AI works, Upstart also directly answered that question in the earnings slide deck:

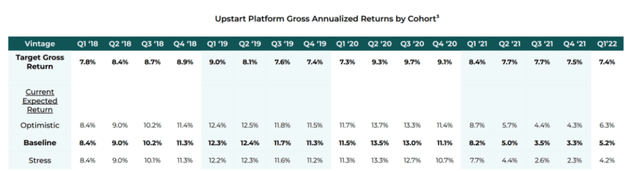

Upstart’s Q2 2022 earnings call slides

And this stat clearly shows that Upstart seems to be working much better than FICO.

Q2 2022 earnings call slides

I’m not saying some big banks will never have AI that is as good as Upstart’s. But if so, there will be one or two leaders and maybe the rest would be forced to turn to Upstart to not be left behind. But suppose all big-5 banks could do it sufficiently enough to drop FICO at a certain moment, even that is not a bear case for Upstart, as they are not the customers Upstart wants to partner with. It’s all the rest of the banks and credit unions. Look at it this way: some big companies have made their internal software, but many more find it much easier to apply that of another company.

More Insight

In the previous quarter, the company had taken loans on its balance sheet, to smoothen things out. The market reaction was very negative and Upstart said it would no longer use the balance sheet for ‘core loans’, meaning their personal loans. They clearly said they would keep auto loans on the balance sheet, as they are there for R&D purposes. I have heard people calling this scammy or a stupid explanation, but it makes total sense. A bank cannot take loans from an unproven system on its balance sheet, so Upstart must prove that it works with loans on its balance sheet. They also did that with personal loans in the past. They sold them off when the system had clearly proven its superiority. With those numbers, they could convince institutional investors, banks and credit unions.

Management now turned back the decision not to take core loans on the balance sheet. You could call that constantly changing your mind and that would be truthful, of course, but I think it’s a good decision. When the circumstances change, you have to be able to adapt.

Upstart is the lender for just a very small percentage of the loans, to smooth things out. The reason is that there is enough demand from consumers, but not enough from banks and institutional investors to sell the loans to. Dave Girouard on the conference call.

Today, we’re in a funding-constrained environment, which is the primary cause of our revenue shortfall.

In other words, Upstart has to turn down people who want a loan and who can’t be served because there is not enough demand in the market to buy those loans. Taking some of these on your balance sheet if the risk-reward looks good doesn’t sound like a bad idea at all in that context.

Management repeated several times that they will not become bank-like and will not use leverage to be a lender. This was very, very, very important to me. Why do credit companies have a bad reputation? For a big part that is because of leverage. They need the cash flow from people paying back their loans; if too many people stop paying, there may be a problem. But that problem comes from leveraging.

What Upstart does is different. Suppose 10% of people could not pay their loans back. That would already be very high. With $600M in loans on the balance sheet, let’s take very conservative profits of 5%, even in that pessimistic scenario, Upstart would not lose much money. 10% of $600M could be $60M. And that is if nothing would be reclaimed, which is already very pessimistic too. Suppose the other loans bring in 5% on average. 5% of $500M means $25M in profits. In other words, in this very pessimistic scenario, the company would lose $35M, while it still has $790M in cash and equivalents. If you are leveraged, the losses mount, just as for investing and that’s why it’s so important to me that Upstart does not want to leverage its balance sheet.

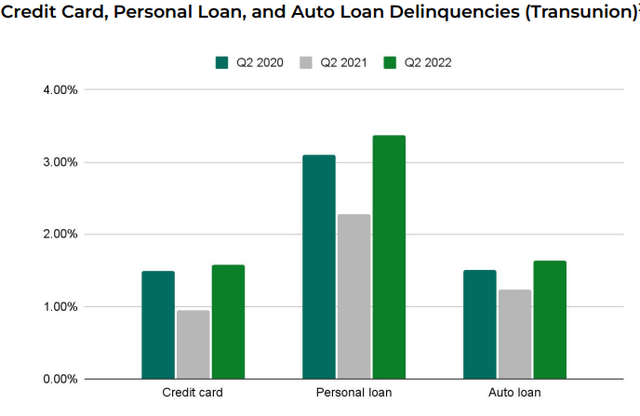

Right now, these are the delinquency rates

Upstart’s Q2 2022 investor presentation

As you can see, they are above the levels of Q2 2020 (which I often call the pandemic quarter) but still just a bit above 3% for personal loans, the worst-performing category. That’s normal and it’s the reason why auto loans are actually a better business. There is collateral there (the car), unlike personal loans. That’s why Upstart’s venture into auto loans is promising.

Dave Girouard gave three reasons for taking loans on the balance sheet.

We’re taking this step for a few reasons. First, there’s an obvious information asymmetry where we understand better than anybody, how our model is performing today and how well it’s calibrated for the current economic environment.

Secondly, we believe the opportunity to generate outsized profits on our platform is unusually high right now. And third, we can bring a level of stability to our business. That’s important to our longer-term goals while we work to put these committed capital structures in place.

I think these are understandable reasons.

But let me be very clear here: if the company would take on leverage for loans, I’m out, immediately, no matter at what price.

A funding plan

The company announced a plan to get the funding side of its platform back on track. Dave Girouard:

As a result, we’ve concluded that we need to upgrade and improve the funding side of our marketplace bringing a significant amount of committed capital on board from partners who will invest consistently through cycles. We’re currently evaluating a variety of opportunities to do just that. So we expect this will take some time to bring to fruition.

I think this is a part of Upstart which shows that the founders are not traditional bankers. Girouard is the former head of what used to be Google Apps, then Gsuite and now Workspace. He’s great at software and tweaking it to get better and better results. That’s also why I don’t have big doubts about the superiority of the software, especially if you add a top computer genius like co-founder and CTO Paul Gu, who was in the Thiel Fellowship program.

The funding was a problem in the last quarters as well, albeit to a lesser extent. Maybe they already started working on a solution for that earlier, but they have not made progress in that case and they didn’t communicate about it.

What Upstart is basically looking for is funding that can take over the function of their balance sheet, through longer-term commitments. It’s like permanent capital. That won’t be easy, especially not in this environment where the capital supply is much tighter but it’s not impossible either.

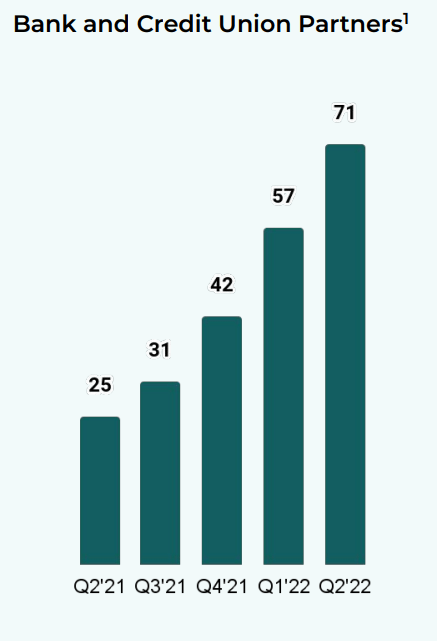

How is this possible with more and more banks and credit union partners that funding is still difficult?

Upstart’s Q2 2022 earnings slides

I can’t think of any other explanation than the macroeconomic environment. Loans are priced according to their risk. In other words, the higher the likelihood of a successful repayment (with interest) the less they cost. When the likelihood of a bad payment goes up, the APR (annual percentage rates) also goes up.

But when you expect the economy to perform badly over the next year or years, you distrust the pricing, as risk has increased. For Upstart, I think there is an extra obstacle and that it is that banks and credit unions, very conservative in nature, stick to what has proven itself over decades, no matter if the results of the new application seem superior. Or you stick to the highest score only if you use Upstart’s platform. Those people are not very often the ones taking personal loans, as they don’t need them as often, so the volume goes down.

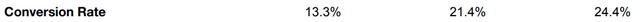

The fact that Upstart’s partners hit the brakes can also be seen in the conversion rate. That’s the number of rate inquiries that eventually lead to a loan. While that was 24.4% last year, and 21.4% in Q1 of 2022, right now, it’s only 13.3%.

Upstart Q2 2022 Earnings Slides

This big drop means that Upstart’s partners are not comfortable taking the loans. This is the reason why:

Upstart blog post, written by CEO Dave Girouard

As you can see, the expected returns were 7.4% for the Q1 2022 cohort, but now just 5.2% for the base case. That’s why hedge funds, other institutional buyers and even bank and credit union partners hold off. Not because they think Upstart’s model is bad, but because they want to see the drop in expectations stop before they feel comfortable buying again. If unemployment would suddenly shoot up or there is a deep recession, the returns would drop even more. At the same time, you can see that the expected returns have gone up again and if this continues, it makes Upstart’s job easier. But we don’t know yet if that will happen.

To me, it also says that Upstart could rocket once the sentiment in the market changes and we all know how fast that can go. Especially if you combine that with the very high short ratio.

Seeking Alpha

Even though Upstart is not a lender itself (or just very limited, I should say now), it’s still dependent on the credit cycle. That’s now apparent. The bad thing about credit cycles is that they are cyclical, but for Upstart, that’s a good thing right now. If there is more supply, the revenue will shoot up again. Don’t forget that in Q2 2021, the company saw its revenue skyrocket by a jaw-dropping 1,000%. Not a typo, no, 1,000%. That was after Q2 2020, the pandemic quarter, of course, but it shows how volatile these cycles can be. If you look at it from that perspective, Upstart’s 17% revenue growth on top of that 1,041% of last year is not even bad at all.

Is Upstart in danger of bankruptcy?

I know that investors are always afraid that their investments could go to zero, which is totally understandable. When a stock drops more than 93% from its all-time highs, I think many assume that this is quite possible.

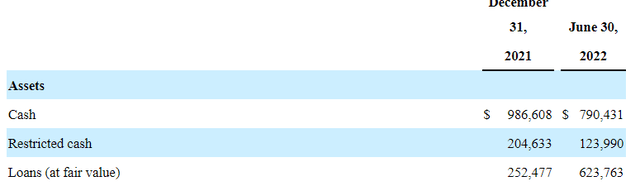

I see no reason to believe that Upstart could be in any form of financial trouble right now or in the near future. This is part of their balance sheet.

Upstart’s 10Q

As you can see, the company has $790.431M in cash and $623.763M in loans. We have already seen that even in a very negative scenario, that $623M would still be around $600M. In other words, the company actually has $1.4B available if it needs it. Upstart could sell the loans if it needs the cash and they will also mature, so be repaid. Of course, this is less liquid than pure cash.

On the other hand, there is this in the liabilities column (both for assets and liabilities, I only list the most significant numbers)

Upstart’s Q2 2022 Q10

Borrowings is the same as long-term debt. We get to a bit less than $1B with the other items. That’s above pure cash but much below loans+cash, which was $1.4B.

Now, of course, we also have to look at the cash burn rate.

Upstart’s 10Q Q2 2022

As you can see, the company lost $32M, but for 2022 as a whole, it’s still $2.7M positive. In other words, you shouldn’t expect huge losses. Also going forward, the risk for big losses is very limited.

As Dave Girouard said on the conference call:

Our fixed costs are low and our gross margins are strong. So we can continue to invest in our roadmap and in our future through a variety of macro environments.

That’s totally true. So, no worries about bankruptcy here. Unless Upstart would do really crazy things like leveraging the balance sheet, it should not be in trouble at all.

What I’m doing with my Upstart position

So, what to do with my position in Upstart, which has an average cost of about $100 and of course deeply in the red? It was a 3% position, but now only a 1% position of my portfolio.

On the one hand, it’s clear that Upstart had bad results and the worst may not be over yet. If there is a severe recession, there could be more bleeding. At the same time, I don’t think you can entirely blame the company for this. What has become much clearer over the last quarters is that the company is much more dependent on macroeconomic circumstances than initially thought.

The company itself hadn’t factored that into this extent. It thought banks and credit unions would be rational and see the better risk rewards now compared to a while ago. But just like investors, they go away when things go down and they are afraid they could go down further, even if the return potential looks better than before. The company is more fragile than it rationally should be, so to speak.

On the other hand, the fundamental thesis is not broken. That fundamental thesis says that Upstart has a better credit rating score than FICO. I’m pretty sure that Upstart’s stock and financial results will keep underperforming as long as there are doubts about the economy and rates keep rising. But things can change very quickly. There are indications we could have passed peak inflation already (although that is always only 100% certain in hindsight). That means we could return to more confidence and more demand for loans from institutional buyers.

When you don’t know what to do in investing, very often doing nothing is the best course of action. That’s exactly what I’m going to do here. I will not sell my position, I will not add. I’ll simply hold. I still think there is value in the long-term counterposition of Upstart but of course, it will also depend on management. With Paul Gu and Dave Girouard, I feel pretty comfortable.

This could be dead money for a while, so I’m not blaming anyone if they don’t feel comfortable holding their position. That is a personal decision. While I’m down a lot on this position, I can still see the long-term potential. But Upstart will have to prove itself in the coming quarters.

If this works out, it will be because the company can solve the funding problem. I will watch the conversion rate number more closely in the future, as that indicates how demand is.

Conclusion

This was a bad quarter and guidance for Q3 was even worse. But the reasons are mostly outside of the company’s control. Once the macroeconomic sentiment changes, credit might change fast too, and Upstart could turn around quickly. That may be the case for the stock and the company’s results. The stock is shorted heavily with 37% of the float sold short, and if there are any signs of better outlooks, we could see a big short squeeze. To me, that’s not really a reason to invest, but I know some look at short-term possibilities here.

Every single company goes through tough times and how they come out of that period is very telling for their long-term story. We will gradually learn how Upstart does in the upcoming quarters but we will only fully see when the tide turns.

In the meantime, keep growing!

Be the first to comment