400tmax/iStock Unreleased via Getty Images

Introduction

As a dividend growth investor, I constantly look for additional opportunities in different sectors. As the stock market is volatile, investors tend to look at different sectors at different times. Right now, for example, the energy sector is booming as the price of oil and gas is skyrocketing. In this article, I will focus on an industrial company.

In the industrial sector, companies are suffering from a challenging supply chain situation. Supply chains have become much more fragile since the pandemic, and there is great value in companies that can help and assist clients in their maneuvers. United Parcel Service, Inc. (NYSE:UPS) is one of these companies, and it has returned to my radar as the company announced a 49% dividend increase in February.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same methodology to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, United Parcel Service provides letter and package delivery, transportation, logistics, and related services. It operates worldwide. The U.S. Domestic Package segment offers time-definite delivery of letters, documents, small packages, and palletized freight through air and ground services in the United States. The International Package segment provides guaranteed day and time-definite international shipping services in Europe, the Asia Pacific, Canada, and Latin America, the Indian sub-continent, the Middle East, and Africa.

Wikipedia

Fundamentals

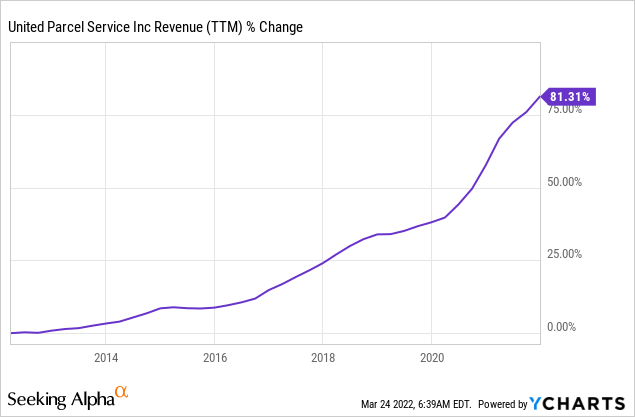

Revenues have shown decent mid-single digits annual growth over the last decade. It amounted to an 81% increase in sales over the last ten years. The company’s growth rate is mainly organically and is derived by a higher volume of shipments and the addition of value-added services to clients. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects UPS to keep growing sales at an annual rate of ~4% in the medium term.

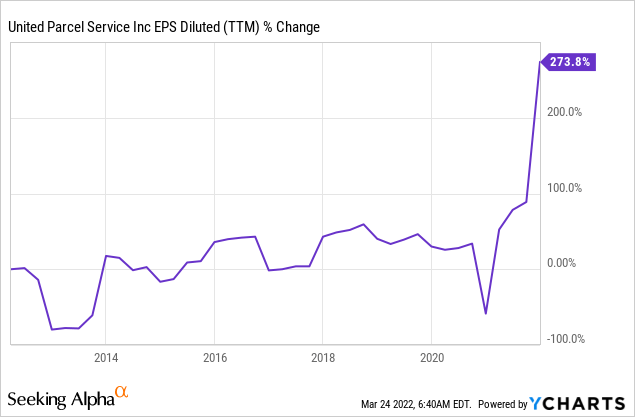

The EPS (earnings per share) has increased at a much faster rate than the company’s sales. The company’s EPS has almost quadrupled, with a significant almost 50% EPS increase in 2021. The reason for such a fast growth rate was the margin expansion over the past decade and particularly in 2021. It has happened due to the company’s additional services, and the price increases we see across the board in logistics. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects UPS to keep growing EPS at an annual rate of ~5% in the medium term.

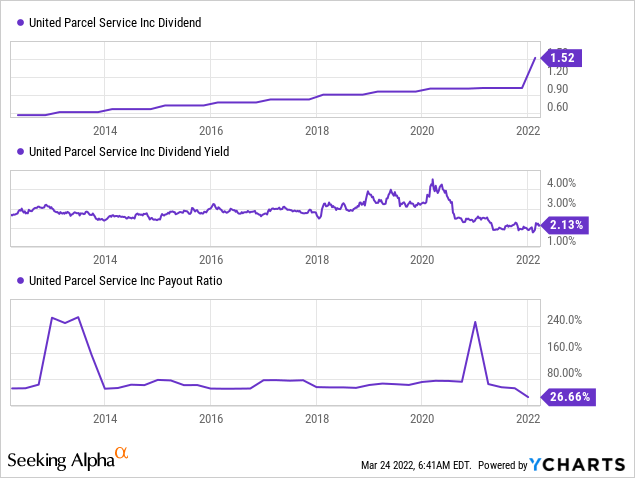

The dividend is another bright point for UPS investors. The company has been increasing dividends for twelve years, and the reason the streak isn’t longer is that it froze its dividend for one year during the financial crisis. The company hasn’t reduced the dividend for over twenty years. In 2021, the dividend was raised by 49% in line with the EPS growth to maintain a 50% payout in the coming twelve months. Investors should expect mid-single digits dividend growth rate in line with the company’s EPS growth.

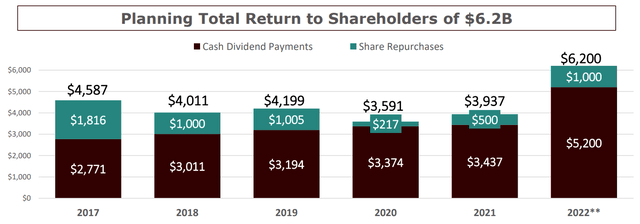

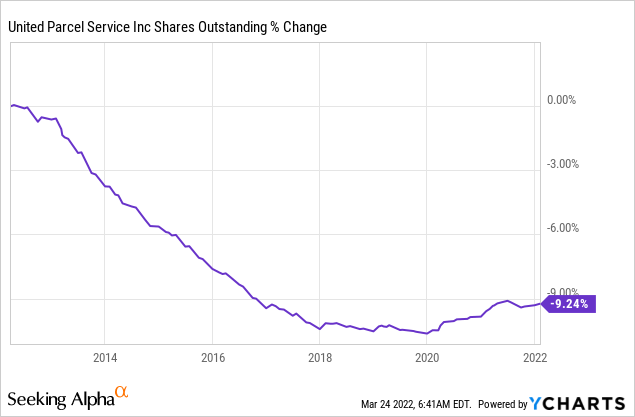

The number of shares outstanding has been declining over the last decade. During the last 10 years, UPS has bought close to 10% of its shares, yet the buybacks have slowed down over the past four years, and more significantly since the pandemic. The company bought back shares worth $500M in 2021, and it intends to double that amount to $1B in 2022.

UPS Q4 Results

Valuation

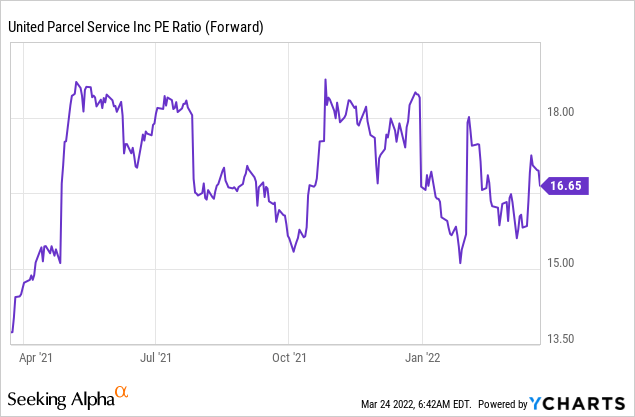

The company’s current forward P/E (price to earnings) ratio stands at 16.65. This is in line with the company’s valuation over the past twelve months. I believe that this is a fair valuation for a company that is growing earnings at a mid-single-digit rate, and has a long track record of strong execution in a business that requires significant CAPEX to enter in terms of airplanes and trucks.

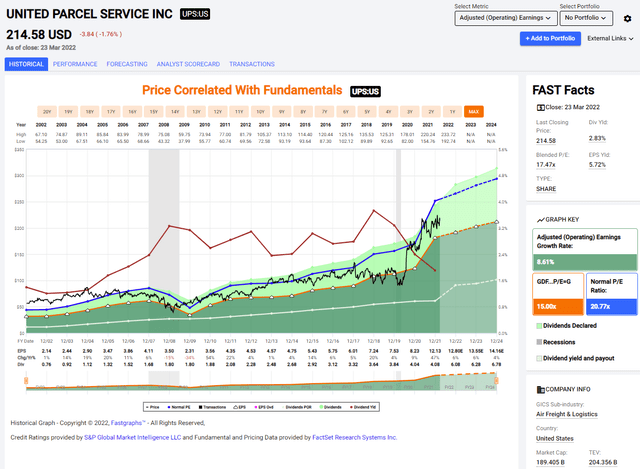

The graph below from Fastgraphs also implies that at the moment UPS is trading for a fair valuation. The company’s average P/E over the last 20 years was 20.7, compared to the current 17. The company’s average growth rate was 8.6% compared to the current forecast for 6% in the medium term. Therefore, I believe that the discount in the valuation suits the slightly lower growth rate that investors expect in the coming three years.

To conclude, UPS is a great company. The company is enjoying the growth in demand for logistics services to grow revenues and EPS. The growth is translated into meaningful dividend growth and additional buybacks. These great fundamentals now come with what I believe to be a fair valuation for a company that is as solid as UPS.

Opportunities

The first opportunity is the company’s scale. UPS is operating worldwide, and delivers goods between countries, states and even delivers the last mile. The company delivers millions of items and controls the entire logistics value chain. Therefore, the company can expand easily, as the initial investment in logistics operation is massive. The company already reaches every home in the United States, and offering additional services will increase margins.

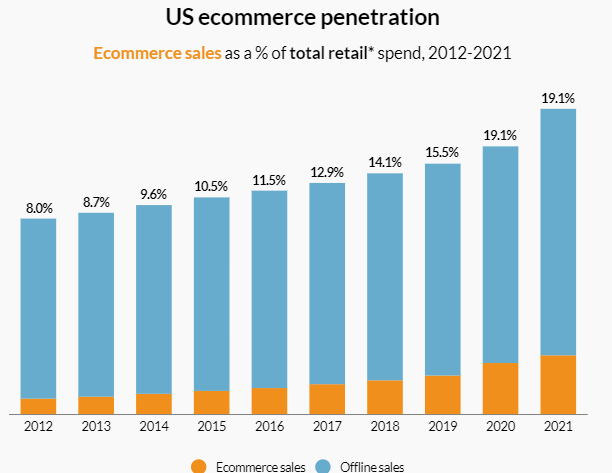

E-commerce is another growth opportunity for UPS. As consumers buy more products online, there is a growing need for logistics services. According to Digital Commerce 360, the penetration of e-commerce stands just below 20%. It has more than doubled within one decade, and there is still more room for growth. As more vendors offer online purchases, they will also need a company like UPS that can handle the delivery and understand the unique challenges in the supply chains.

Digital Commerce 360 analysis of U.S. Department of Commerce data; February 2022

The supply chain solutions segment is a growth opportunity as well. As the supply chains around the world have become more fragile, there is an increased demand for additional services besides delivery. Companies outsource their logistics to companies like UPS who take care of the entire process, from clearance to special logistics. An example of that is the logistics required by healthcare companies that need to move delicate products in extreme temperatures.

And amid the bottlenecks and uncertainty, our Supply Chain Solutions group is providing customer supply chain flexibility and resiliency through alternative routings and solutions. Demand for forwarding products continued to be strong in the fourth quarter. In fact, ocean shipments were up double digits and container rates remain elevated in the market.

(Carol Tomé – Chief Executive Officer, Q4 Earnings Call)

Risks

Competition is the largest risk for UPS. While the barriers to entering this market are very high, other incumbent companies offer similar services and products. The company is competing both with other logistics companies like FedEx, large retailers who can operate their delivery operation, and competitors who compete with UPS on the last mile like Uber (UBER) and DoorDash (DASH).

Another risk is the inflationary risk. When the margins are as high as they’re right now, with operating margins around 17%, the inflation is likely to hurt profitability. The company and its competitors will have to deal with higher prices mainly of fuel, and with such high profitability, they may fight for market share. It may result in the inability to increase prices significantly, and hurt the profitability in the process.

Geopolitical tensions are another risk for UPS. They already have a toll on UPS as the company is paying more for oil, and has longer flying routes as it cannot fly over Russia. Moreover, the war and its effects may turn into an economic recession first in Europe and then in the United States. A recession will decrease spending and purchases and may lower the demand for logistics. and recession.

Conclusions

UPS is a great company across the board. The company shows strong fundamentals, that lead to an ever-growing ability to return capital to shareholders in the form of buybacks and dividends. In addition, it has several significant growth opportunities and high barriers to entry. Therefore, I believe that due to the limited risks, UPS is poised to keep performing.

The valuation at the moment is fair, and it makes UPS a decent addition to dividend growth portfolios. I believe investors can feel comfortable adding shares at the current price. However, they have to take into account that this is a rather conservative investment that may not outperform the S&P 500 in the long term despite the current tailwinds.

Be the first to comment