jetcityimage

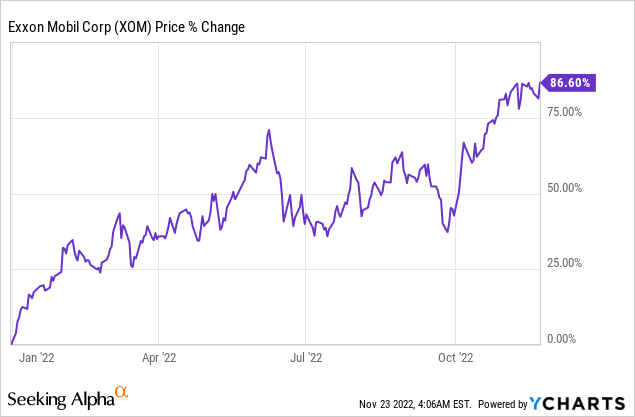

Exxon Mobil (NYSE:XOM) reported record profits for the third-quarter due to strong product pricing and energy supply fears that are related to the war in Eastern Europe that broke out between Russia and the Ukraine in February. Shares of Exxon Mobil have soared 87% year to date and the company recently delivered a 3.4% dividend increase to shareholders as well. Given the high stock price and very favorable market environment, I have decided to take profits and sell all my shares of XOM into the current strength!

Soaring natural gas prices leading to record profits for Exxon Mobil

Exxon Mobil has been a big winner this year due to a repricing of petroleum and natural gas products in the energy markets. The key event that drove an upwards revaluation of Exxon Mobil’s shares was the start of the war in Eastern Europe which is dragging on to this day.

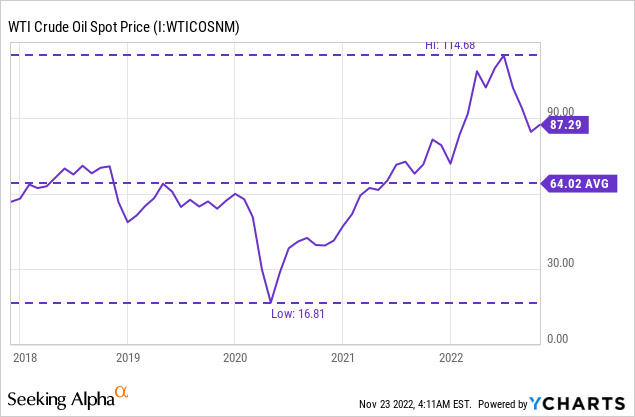

The war seriously stoked fears over adequate energy supplies in Europe and Western countries were quick to impose sanctions on the Russian energy sector as a result. All of this, and the attack on the Nord Stream 1 pipeline in the Baltic Sea in October, resulted in a major upwards surge in pricing for petroleum and natural gas. The price for crude oil is currently $87 a barrel and is significantly above its longer term 5-year average of $64 a barrel.

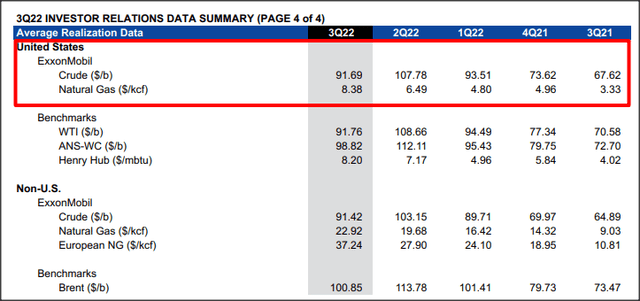

Exxon Mobil benefited greatly from escalating supply fears in FY 2022 and the firm’s realized prices and production profits surged as a result. In the third-quarter, Exxon Mobil’s realized natural gas price soared to $8.38/kcf, showing an increase of 152% compared to the year-earlier period. Petroleum pricing also remained strong with Exxon Mobil’s realized crude oil price improving 36% year over year to $91.69 a barrel in Q3’22. While petroleum prices were still higher than normal, they declined 15% from a high of $107.78 a barrel in the second-quarter.

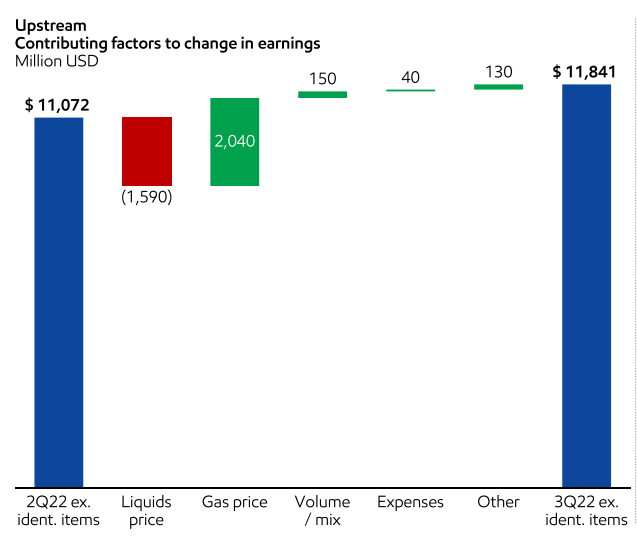

Because of the improved pricing situation, especially regarding natural gas, Exxon Mobil reported record profits in the third-quarter. Higher gas prices alone boosted Exxon Mobil’s third-quarter results by $2.0B and the energy firm reported a total of $11.8B in adjusted production profits. Although Exxon Mobil’s realized petroleum prices dropped off quarter over quarter in Q3’22, the surge in natural gas pricing more than compensated for the decline.

Source: Exxon Mobil

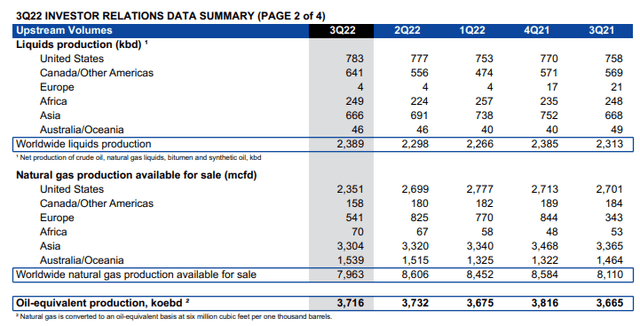

The surge in Exxon Mobil’s profits, however, is almost entirely driving by price, not by volume gains. Both liquids and natural gas production has barely changed year over year which means Exxon Mobil is entirely dependent on strong market pricing for its energy products. Liquids production increased only 3% year over year in Q3’22 while Exxon Mobil’s natural gas output actually decreased 2%, in part because it is harder for energy companies to secure the necessary permits required for an expansion of their production bases.

Outlook and valuation

The short-term outlook for Exxon Mobil remains positive: supply fears continue to dominate the energy markets before winter. I continue to expect Exxon Mobil generate between $60-62B in free cash flow in FY 2022 and $45-50B in FY 2023.

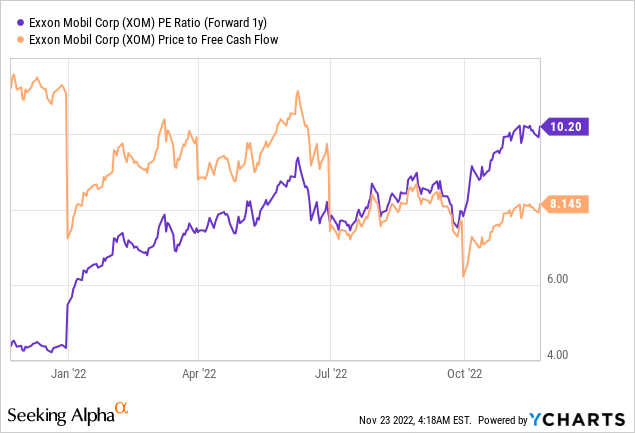

However, I believe there is nothing wrong with securing profits if an investment has done well and out-performed expectations. Given the growing risk of a global economic contraction in FY 2023 — and with it the possibility of declining energy demand — Exxon Mobil’s shares may now appear cheaper than they really are. Currently, shares of XOM have a P/E ratio of 10 X and a P/FCF ratio of 8 X, but if energy prices normalize again (which they eventually will), Exxon Mobil could be looking at a serious down-ward reset of EPS estimates… and with it a higher P/E ratio.

Risks with Exxon Mobil

The biggest risk for Exxon Mobil, as I mentioned previously, is weaker product pricing, especially in natural gas which could result in a major down-ward revaluation of Exxon Mobil’s shares. The company is also confronted with a hostile regulatory framework that disincentivizes investments in the fossil fuel industry. If the US government continues to hamstring the production sector, Exxon Mobil’s growth prospects may be negatively affected going forward. A slowing economy, which the market now seems to expect for FY 2023, is also a major risk factor for Exxon Mobil as demand for energy may be set for a steep decline next year.

Final thoughts

I nearly doubled my investment in Exxon Mobil and although I like Exxon Mobil’s short-term prospects, I believe this is a great time to sell into the strength. The production company has strong earnings prospects as long as commodity prices remain high, especially in natural gas, but weaker product pricing will immediately have a negative impact on Exxon Mobil’s earnings and free cash flow. Since I have become more cautious about a potential recession next year (and its impact on asset prices), I am closing out a successful and profitable investment!

Be the first to comment