ipopba

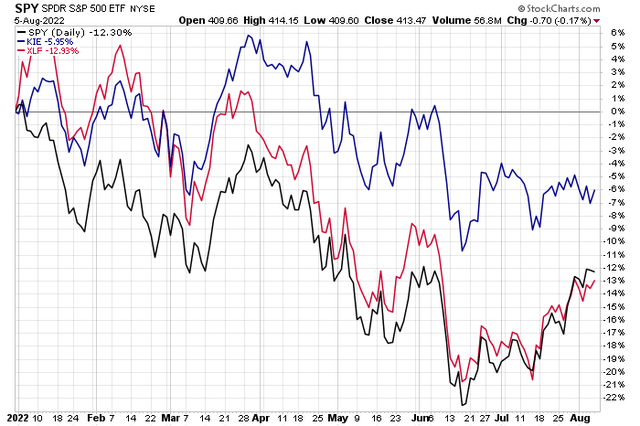

Amid a year of above-average volatility, one industry few investors discuss has been outperforming with low week-to-week swings. The SPDR S&P Insurance ETF (KIE) is down less than 6% total return in 2022. Contrast that to the S&P 500’s (SPY) year-to-date drop of 12.3% and the Financials sector SPDR fund’s (XLF) 12.9% fall.

Insurance stocks tend to have more stable earnings even though their cost of goods sold is only known in the years after writing policies. One U.S.-based insurance company with international exposure reported excellent earnings last week and its share price exhibits impressive relative strength.

YTD: S&P 500, Financials Sector, Insurance Industry

According to Bank of America Global Research, Unum is a leading provider of disability income insurance and ranks among the world’s leading special risk insurers. Unum has a strong market share in the U.S. and U.K. Unum has a large legacy book of long-term care (LTC) and individual disability but has put these businesses in runoff. The company distributes via captive sales representatives, brokers, and sales consultants.

The Tennessee-based $7.1 billion market cap Financials sector company pays a hefty 3.7% dividend yield, according to the Wall Street Journal. Last Tuesday, the stock crushed earnings estimates, and its share price rallied big.

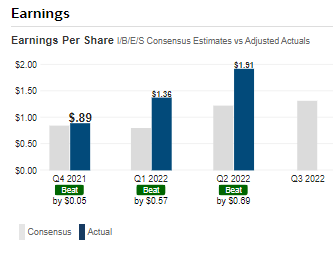

Unum’s Earnings History: A String of Beats

Fidelity Investments

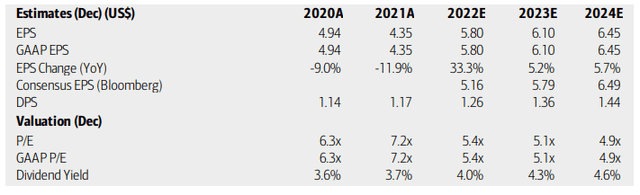

BofA analysts expect Unum’s EPS to rise sharply this year and at a steady rate through 2024. That growth would yield an even more attractive P/E ratio should the stock stay at the same level (while paying out a high yield). I like the valuation and payout with UNM.

A key risk, though, is what happens with interest rates as the company is very sensitive to rate changes given its long-term care policy exposure. So, it is not as defensive as many other insurance firms.

Unum Earnings, Valuation, Dividend Forecasts

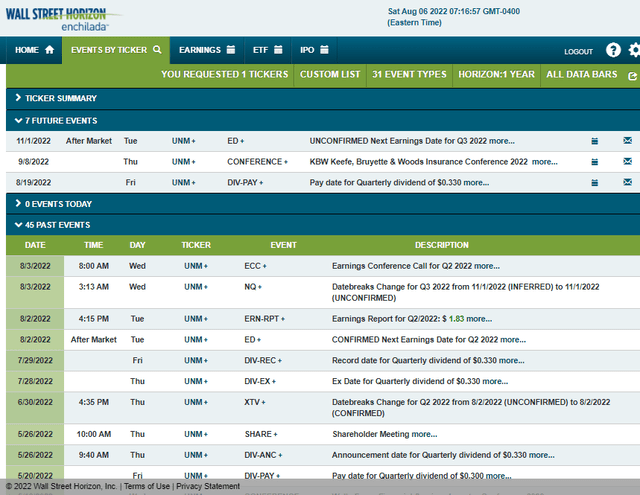

Looking ahead for volatility catalysts, beyond a dividend pay date on the 19th, there is an insurance industry conference at which Unum’s management team is expected to speak on September 8th. Then on the first of November, Q3 results hit the tape, according to Wall Street Horizon.

Unum Corporate Event Calendar

The Technical Take

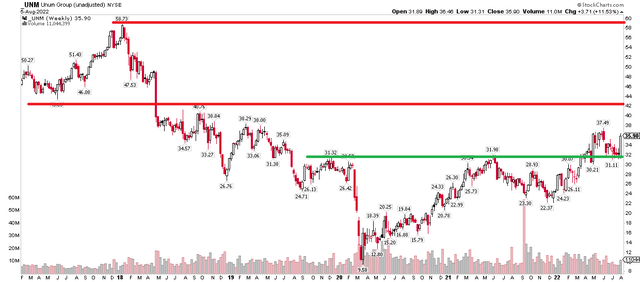

Unum shares are doing the right things. The stock crossed above key resistance near $31 in the second quarter and it held that level on a few retests recently. I see resistance in the low $40s. Given the “buy the dip” price action of 2022, I think the stock can get there by year-end. The $59 high notched in early 2019 could eventually be in play, but that is a long way off.

UNM: Breaking Above Resistance, Eyes the Low $40s

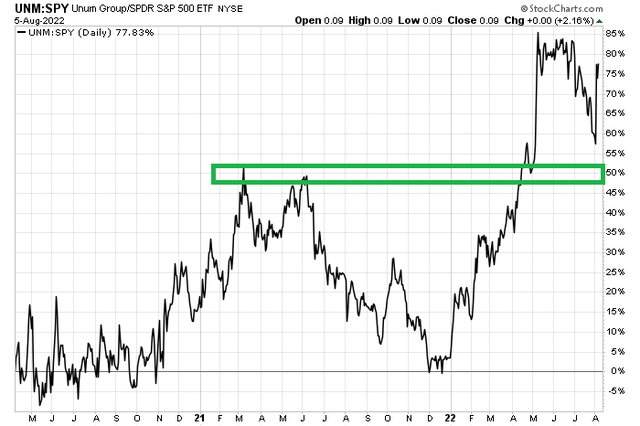

Here’s a bonus chart: It’s a relative strength look at UNM vs SPY over the last two-plus years. Notice how this ‘boring old insurance company’ is trending higher vs the broad market. Technicians like to see this relative momentum. It is another bullish factor.

UNM’s Relative Strength, Handily Holding Support From Early-Mid 2021

The Bottom Line

Unum’s low valuation, decent growth prospects, and positive technical features make me bullish on the stock. I see the low-$40s area as a first target and the low $30s as support. Meanwhile, holders can collect its high dividend along the way.

Be the first to comment