shotbydave/E+ via Getty Images

In a global economy, transportation is a vital resource that cannot be done without. And given how large the economy is, it stands to reason that there would be many companies, some large and others small, dedicated to providing said transportation of goods. An example of one of the smaller players in this space is Universal Logistics Holdings (NASDAQ:ULH). With operations spread throughout North America and Colombia, the company has a significant geographical reach. In recent years, the overall trajectory for the company’s revenue has been positive. However, profitability and cash flows have been somewhat volatile. On an absolute basis, shares of the business are trading at cheap levels. But given how the company is priced relative to similar firms, I do think that there are probably better prospects on the market that can be had. While I am generally bullish about this space and I believe that most of the players in it offer some upside, I am a bit more cautious on this particular play. Given how it’s priced compared to similar firms, I have decided to rate it a ‘hold’ for now.

A small transportation player

According to the management team at Universal Logistics, the company operates as an asset-light provider of customized transportation and logistics solutions. At present, the company offers its services throughout the US, Mexico, Canada, and Colombia. As of the end of its latest completed fiscal year, the company had 51 managed terminals, and it serviced 63 value-added programs at locations throughout the countries in which it operates. In terms of specific services the company provides, things can really be broken down into five separate categories. First and foremost, the company focuses on what it calls truckload services. These include dry van, flatbed, heavy haul, and refrigerated operations through which the company transports a variety of goods ranging from commodities to automotive parts to machinery and more. According to management, this segment was responsible for 14.2% of the firm’s revenue last year.

Under its brokerage services category, the company provides customers with a full range of domestic and international freight forwarding and customs brokerage options. This particular set of operations accounted for 22.9% of the company’s revenue in 2021. Next, we have the company’s intermodal operations. These include steamship to truck, rail to truck, and various support services. For the most part, these services fall under short to medium distance delivery for both international and domestic containers between the port in which they operate or leave from to their desired destination. This unit was responsible for 27% of the company’s revenue last year. Next, we have its dedicated services. These largely consist of support for automotive customers utilizing various van equipment. Last year, these operations accounted for 11.7% of the company’s revenue. And finally, we have the value-added services category. Under this, the company provides material handling, consolidation, sequencing, subassembly, cross dock, kitting, repackaging, and other related services. These activities are typically dedicated to individual customer requirements. Last year, this set of operations accounted for 24.2% of the firm’s revenue.

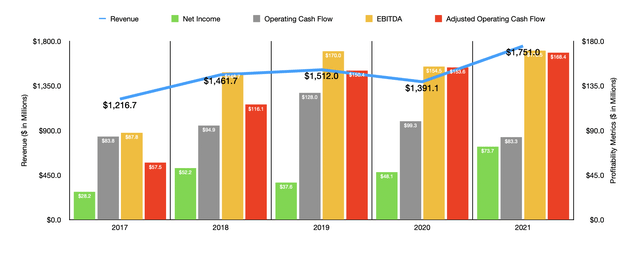

Over the past few years, business for the company, from a topline perspective, has been quite positive. Revenue rose from $1.22 billion in 2017 to $1.51 billion in 2019. As a result of the COVID-19 pandemic, sales dropped in 2020, falling to $1.39 billion. The good news is that that decline was short-lived. This can be seen by looking at the 2021 fiscal year, which saw revenue spike to $1.75 billion. What’s interesting about the change from 2020 to 2021 is that it came about in spite of mixed load counts for the company. Under its intermodal segment, the total number of loads transported dropped by 7.6% year over year. The trucking segment reported an increase of 12%, while the contract logistics segment increased load count by 20.5%. Meanwhile, the company-managed brokerage segment saw loads decline by 16.3%. Although the number of loads transported was mixed, pricing for the company remained strong. Under the intermodal segment, for instance, average revenue per load for the company rose by 13.2% from $461 to $522. Meanwhile, the trucking segment saw average revenue per load jump by 11.3%, and the company-managed brokerage segment reported a rise of 31.5%.

While the trend for revenue is pretty clear, the trend for profitability has been slightly less so. After seeing net income jump from $28.2 million in 2017 to $52.2 million in 2018, it then dropped to $37.6 million in 2019. Since then, net income has been on a consistent rise, hitting $48.1 million in 2020 before jumping to $73.7 million in 2021. Although this increase may seem odd from 2020 to 2021, It really represents a margin improvement of just 0.75%. For low-margin, capital-intensive businesses, small improvements in margin can have a big impact on the bottom line. And small changes in either asset utilization or pricing, or both, can easily facilitate such a change. It’s also worth looking at other profitability metrics. Consider, for instance, operating cash flow. Between 2017 and 2019, this metric rose year after year, climbing from $83.8 million to $128 million. It then dropped in the two years that followed, eventually bottoming out at $83.3 million. If, however, we were to look at it through the lens of adjusted operating cash flow, where we remove the impact of working capital adjustments, then the metric would have risen consistently over the past five years, climbing from $57.5 million to $168.4 million. The trend when it comes to EBITDA has been similar, with only one year showing a worsening compared to the year prior. But ultimately, the metric increased from $87.8 million in 2017 to $170.5 million last year.

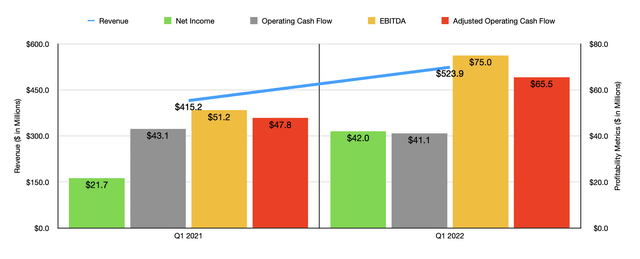

Growth for the company has continued into the current fiscal year. Revenue in the first quarter of the year, for instance, came in at $523.9 million. This represents an increase of 26.2% over the $415.2 million generated the same time one year earlier. With the exception of the company’s contract logistics segment, which saw total loads increase by 1.2%, loads across the company’s other operations actually fell. For intermodal, the decline was 14.3%, while for the trucking segment we saw a decline of 30.1%. In the middle of those two was the decline in the company-managed brokerage segment, totaling 25.2% year over year. The key driver in revenue growth, then, was a strong uptick in pricing. Under the intermodal segment, average operating revenue per load shot up 51.2% from $461 to $697. That increase under the trucking segment was 41.4%, taking it from $1,246 per load to $1,762. And under the company-managed brokerage segment, the increase was 25.3%, taking it from $1,737 per load to $2,176.

This rise in revenue caused net income to skyrocket, nearly doubling from $21.7 million to $42 million. Operating cash flow did worsen year over year, dropping from $43.1 million to $41.1 million. But if we adjust for changes in working capital, it would have risen from $47.8 million to $65.5 million. Meanwhile, EBITDA shot up, jumping from $51.2 million to $75 million. Given this significant improvement in profitability, management has been active in buying back stock. Most recently, the company completed a tender offer for 164,189 shares, or roughly 0.62% of all shares outstanding, paying a price of $28 apiece for the units. And in the first quarter of the year, management bought back 257,261 shares at $20.42 apiece, costing shareholders $5.25 million.

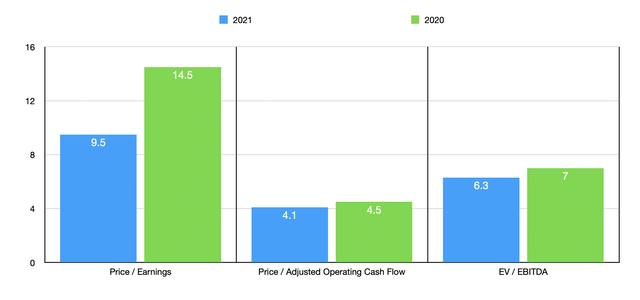

We don’t really know what the rest of the current fiscal year will look like. So instead, it’s best to rely on 2021 results. Using that data, the firm is trading at a price-to-earnings multiple of 9.5. That’s down nicely from the 14.5 reported for the 2020 fiscal year. The price to operating cash flow multiple should be 4.1. That’s down from the 4.5 reading that we get using 2020 results. And the EV to EBITDA multiple should decline from 7 using 2020 results to 6.3 using 2021 results. To put this in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 5.7 to a high of 13.6. In this case, four of the five companies were cheaper than Universal Logistics. Using the EV to EBITDA approach, the range was from 2.9 to 4.4. In this scenario, our prospect was the most expensive of the group. The only way in which the company looked cheap was when using the price to adjusted operating cash flow approach. In this scenario, the range was from 2.8 to 8.9. Our target was cheaper than all but one of the five firms.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Universal Logistics Holdings | 9.5 | 4.1 | 6.3 |

| P.A.M. Transportation Services (PTSI) | 7.1 | 5.3 | 4.3 |

| Covenant Logistics Group (CVLG) | 6.1 | 4.2 | 2.9 |

| Daseke (DSKE) | 5.7 | 2.8 | 4.0 |

| Heartland Express (HTLD) | 13.6 | 8.9 | 4.4 |

| USA Truck (USAK) | 8.2 | 7.2 | 4.1 |

Takeaway

Operationally speaking, Universal Logistics seems to be doing fine right now. This year looks set to be a great one for the company absent some major downturn in the broader economic situation. I am concerned that substantially all of its improvements in the past two years now have been because of increased pricing and not because of higher volume. While that has proven to be a huge benefit for investors in the near term, we could see a significant reversal of fortunes should the economy worsen. Even if results revert back to what we saw in 2020, I would argue that shares would still be somewhat on the cheap side on an absolute basis. But relative to similar firms, the company is a bit lofty right now. Because of this, I have decided to rate the business a ‘hold’ for the moment.

Be the first to comment