AmnajKhetsamtip/iStock via Getty Images

Investment Thesis

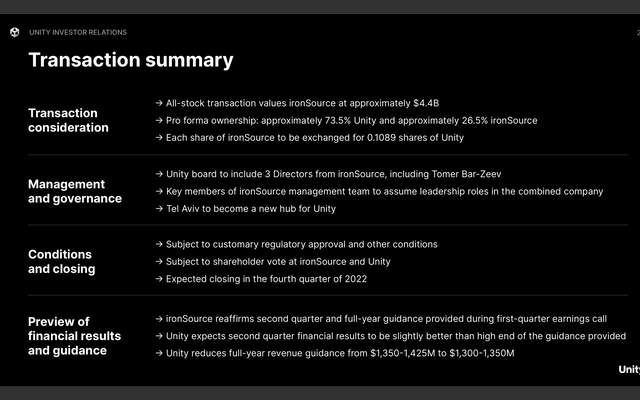

Unity Software (NYSE:U) recently announced a merger with Israeli app monetization company ironSource through an all-stock transaction valuing the company at $4.4 billion. This comes as a surprise as Unity shares are down over 80% from its all-time high last year and the company reported disastrous earnings in Q1 as faulty data from a large customer caused its advertising tool to place wrong ads in front of the wrong users. I don’t think the deal will help Unity in the long term and may, in fact, harm them. This is due to the shift in their business mix, which now focuses a lot more on the ad business. This is not good for the company as the ad business is a lot more cyclical, volatile, and has a much lower valuation. I believe Unity is a sell after the merger.

A Step In The Wrong Direction

I originally thought the merger between the two companies made sense, as ironSource is profitable and undervalued in my opinion. It also allows Unity to strengthen its gaming monetization business. But after a while, I start to feel like Unity’s acquisition of ironSource might be a step in the wrong direction. What makes Unity special is its real-time 3D development platform and solutions, which allows professionals to create and operate applications and immersive experiences. This is used across multiple industries like gaming, film, architecture, automotive, and more. Currently, over 50% of the world’s video games are created from Unity. It would make total sense if the management team decides to invest more in this side of the business as it has a ton of opportunities with the latest trends in AR/VR.

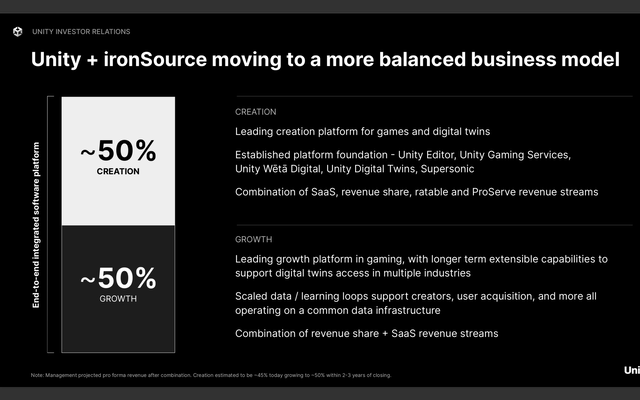

However, the merger with ironSource seems to indicate that the company wants to increase its emphasis on its ad business instead. It is trying to become an end-to-end platform for creators to build, run, manage, grow, and monetize games. During the merger presentation, the company mentioned that they are now aiming for 50% in the creation business and 50% in the growth (AD) business. This is problematic, in my opinion, as the ad business should’ve never been the main focus. It may also mean that Unity is losing the battle to Epic Games in the gaming engine area, so they are now changing battlefields. I would have been more glad if the company acquired let’s say Matterport (MTTR), at least it aligns with their initial focus on 3D creation and visualization.

John Riccitiello, CEO, on ironSource merger

“We believe the world is a better place with more successful creators in it. The combination of Unity and ironSource better supports creators of all sizes by giving them all the tools they need to create and grow successful apps in gaming and other consumer-facing verticals like e-commerce,”

Why I Don’t Like The Ad Business

I don’t like Unity focusing on the ad business as the landscape is very competitive, the business is highly cyclical, doesn’t operate with a SaaS (subscription as a service) model, and the valuation for the industry is generally very low. Unity has been enjoying the duopoly treatment in the gaming engine space alongside Epic Games, but this will be a whole different story in the ad space. The app monetization space is quite concentrated with notable competitors like Google’s AdMob (GOOG) (GOOGL), AppLovin (APP) and Digital Turbine (APPS). AdMob has a dominant position given Google’s reach while Digital Turbine has unique features like Single Tap. It will be very hard for the combined company to create a unique competitive advantage that outruns these companies.

The ad business is also very cyclical and highly exposed to the macro environment. During economic downturns, it is very natural for brands to cut ad budgets as demand falls, and vice versa in economic expansion, which increases the volatility of the company. The problem worsens as the combined company won’t operate with a SaaS model. This vastly reduces their revenue visibility for upcoming quarters as ad revenue isn’t pre-booked. The combined company may also face impacts from Apple’s IDFA change, which has been affecting ad companies’ targeting significantly. In turn, the company’s valuation should be revised down as it is no longer a SaaS play. Most companies in the ad industry are rewarded with a low valuation, even Meta (META) is no exception. From the chart below, we can see that the valuation gap between ad companies and SaaS companies is huge, not to mention that these ad companies are actually seeing decent growth over the past few quarters.

Financials Synergies

The most and only important thing ironSource is able to bring to the table is profitability. Despite being around for such a long time, Unity is still unprofitable. Although CEO John Riccitiello said the company is expected to be profitable by Q4, skepticism still remains. ironSource is able to help out a lot as it has a much stronger bottom line with an adjusted EBITDA margin of 34% for the last twelve months. Unity expects an adjusted EBITDA run rate of $1 billion by the end of 2024 for the combined company, with $300M+ anticipated annual EBITDA synergies by year 3.

Luis Visoso, CFO, on merger synergies

“Beyond our platform, we expect the combination of our business with ironSource to transform Unity’s financial profile to that of a highly profitable and free cash flow positive company,”

Questionable Deal Structure

I also do not like the structure of the deal. It doesn’t make any sense to do an all-equity deal while using another $2.5 billion to buy back stocks on the other hand, especially when the company is not even profitable yet. Why doesn’t the company just simply use that $2.5 billion to do a cash/equity deal instead? Doing an all-stock acquisition after the stock price dropped by over 80% is very dilutive and detrimental to shareholders. Unity’s share count has already been increasing over the past few quarters, currently at 294,341,000 weighted-average shares, up 6.6% year over year. I am also questionable on whether Unity has to pay a whopping 74% premium for the acquisition at a time when M&A sentiment is so bad.

Conclusion

Overall, I do not think this is a good deal. It might look good on paper with the launch of its end-to-end platform combined with improving profitability, but I think this is weakening the company’s prospect by shifting the focus away from creation to ads. In the long run, the company will face more volatility due to the nature of its new business. The company will also now face much stronger competition in the condensed ad space. Valuation is also poised to get revised lower due to the shift in the business model. The structure of the deal is also very questionable in my opinion. Therefore, I believe the company is a sell after the merger as fundamentals weaken and valuation is poised to get revised down.

Be the first to comment