We Are

Introduction

Income investors looking for exposure to the oil and gas industry will find Permianville Royalty Trust (NYSE:PVL) an attractive option. PVL has royalty interests in the Permian Basin, one of the largest oil-producing regions in North America that has been in production since the 1920s. The trust also has interests in East Texas and North Louisiana wells.

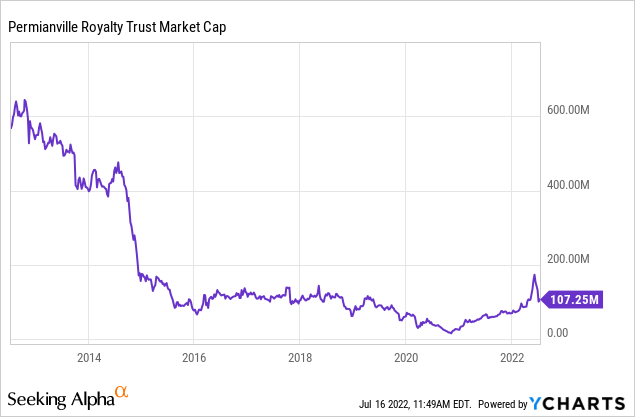

PVL has always been a small capitalization stock as the market capitalization has not exceeded $160MM since 2014 and currently trades at 33% below its highs earlier in the year. PVL is well-positioned to take advantage of the high energy prices and inflation.

2021 gives an idea of how the trust works:

Permianville Royalty Trust, previously known as Enduro Royalty Trust, is a Delaware statutory trust formed in May 2011. The Trust was created to acquire and hold for the benefit of the Trust unitholders a net profits interest representing the right to receive 80% of the net profits from the sale of oil and natural gas production. The Trust has no employees. Administrative functions are performed by the Trustee pursuant to the Trust Agreement. The Trustee has no authority over or responsibility for, and no involvement with, any aspect of the oil and gas operations or other activities on the underlying properties. Each month, the Trustee determines the amount of funds available for distribution to the Trust unitholders. Available funds are the excess cash, if any, received by the Trust from the net profits interest and other sources (such as interest earned on any amounts reserved by the Trustee) that month, over the Trust’s liabilities for that month. Available funds are reduced by any cash the Trustee decides to hold as a reserve against future liabilities.

In essence, PVL is a servicing intermediary that collects monthly payments from issuers. After deducting a fee, it remits or passes them through to the unit holders. PVL does not employ any contracts to hedge against commodity prices but instead employs very little debt to reduce their downside when commodity prices decline and have very little in the way of operating expenses as they do not operate the wells themselves. PVL instead has reputable clients such as ConocoPhillips (COP), Occidental Petroleum (OXY), and Holly Frontier who combined represent 61% of income from net profits which pay dividends.

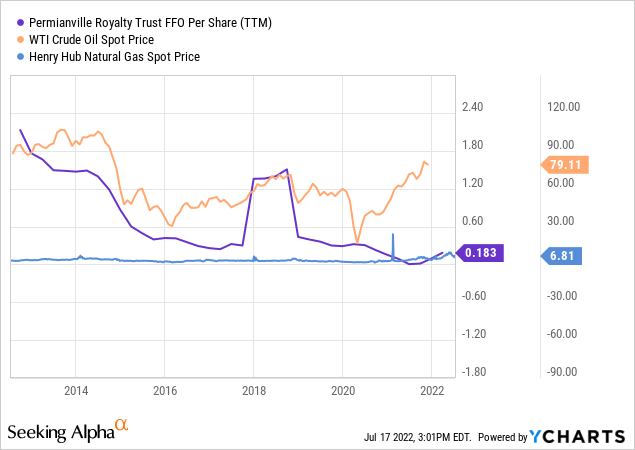

PVL’s business model allows them to be FFO positive in even low commodity pricing environments.

The Dividend

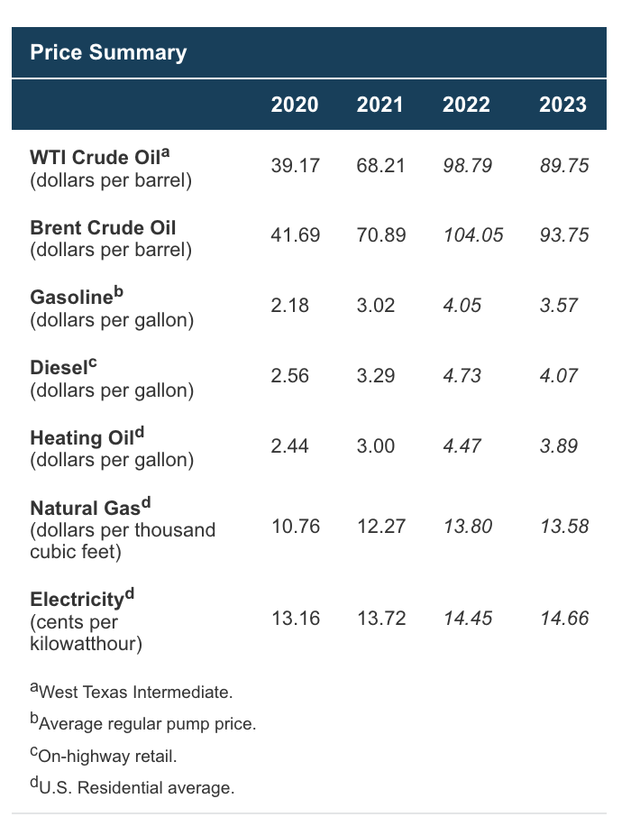

Key points from the EIA’s July 2022 forecast:

- The Brent price will average $104/b in 2022 and $94/b in 2023.

- The Henry Hub spot price will average $5.97/MMBtu in 2022 and average $4.76/MMBtu in 2023.

- Global oil inventories in the forecast rise by 0.8 million barrels per day (b/d) in 2022 and remain unchanged in 2023. Inventory builds in 2022 reflect rising production of liquid fuels in the United States and OPEC, paired with slowing liquid fuels consumption growth.

- OPEC crude oil production will rise by 2.4 million b/d to average 28.7 million b/d in 2022 and will further increase to 29.3 million b/d in 2023. Crude oil production from OPEC members averaged 26.3 million b/d in 2021.

- U.S. crude oil production averages 11.9 million b/d in 2022 and 12.8 million b/d in 2023, which would set a record for most U.S. crude oil production in a year.

- U.S. dry natural gas production in the forecast averages 96.2 Bcf/d in 2022, up 2.7 Bcf/d (3%) from 2021. Average production will increase to almost 100.0 Bcf/d in 2023.

- Compared with 2021, U.S. natural gas consumption in the forecast will increase by 2.9 Bcf/d (3%) to average 85.9 Bcf/d in 2022 and then fall to 85.4 Bcf/d in 2023.

- U.S. natural gas inventories will end October 2022, the end of the 2022 storage injection season, at almost 3.5 trillion cubic feet, which would be 6% below the 2017-21 average for the end of October and down 5% from October 2021.

- The forecast is subject to heightened uncertainty resulting from a variety of factors, including Russia’s full-scale invasion of Ukraine.

Short-Term Energy Outlook (U.S. Energy Information Administration)

In essence, the EIA expects rising oil and gas prices to begin tapering off before the end of 2022, and even decline into 2023 as a result of demand leveling off and rising inventory levels. The final point about the conflict in Ukraine, however, is key in that it represents a major variable in the forecasts.

We will discuss in the next sections how even if there’s a pullback in commodity prices, this stock would still have downside protection.

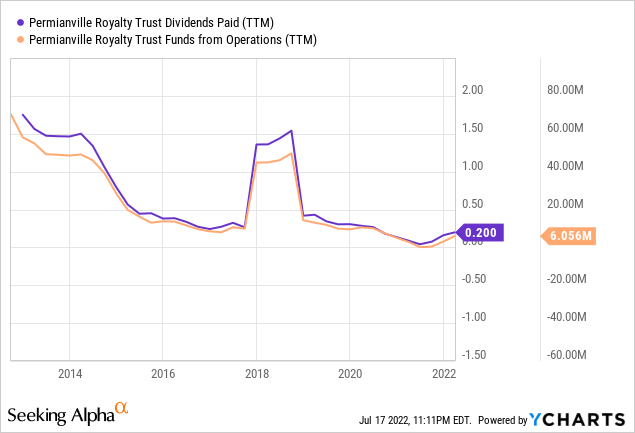

Dividend

Over the years the dividend has been extremely volatile but always covered by FFO. The dividend is based on excess cash received by the trust from net profits over liabilities and can be reduced if the trust deems it prudent to withhold cash as a reserve against future liabilities. For the most part, the trust pays out 100% of net profit interest. The trust did however suspend the dividend in July 2020-July 2021 as a result of low commodity prices being realized during the pandemic and to conserve cash to meet future liabilities. Commencing with the distribution to Trust unitholders paid in February 2022, the Trust is withholding, and in the future intends to withhold, $37,833 from the funds otherwise available for distribution each month to gradually build a cash reserve of approximately $2.3 million. This cash is reserved for the payment of future known, anticipated or contingent expenses or liabilities of the Trust.

Even if commodity prices decline as the EIA suggests they will with natural gas prices, Q1 2022 provides guidance on distributable cash flow that investors can expect. Average realized prices in Q4 2021 and Q1 2022 for oil were 74.60 $/bbl and $62.82 $/bbl, respectively, and for natural gas were 3.52 $/Mcf and 4.52 $/Mcf, respectively. Distributable income for the quarter was still $0.089/unit and paid out $0.08/unit for a payout ratio of 90%. Even if the average monthly dividend was $0.02/unit which was the average in Q1 2022 that would still be a respectable forward dividend yield of ~9.8% which is much higher than the yield on most market index funds and will be well covered.

Valuation

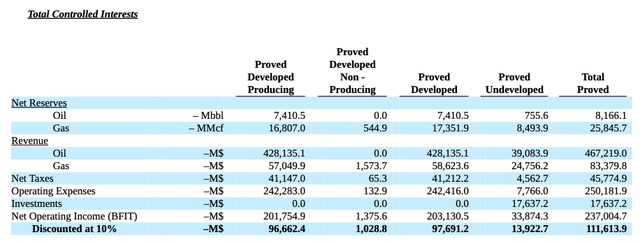

Unlike many royalty trusts, PVL is kind enough to provide the PV10 of their reserves which allows us to estimate the NAV.

The assumptions are as follows and are very reasonable:

- The net profits interests entitle the Trust to receive 80% of the net proceeds attributable to the company interest from the sale of production from the underlying properties.

- The base SEC oil and gas prices calculated for December 31, 2021 were $66.56/bbl and $3.598/MMBTU.

- The future net cash flow has been discounted at an annual rate of ten percent

2021 Annual Report (Permianville Royalty Trust)

PVL estimates it has $112MM in reserves which means a NAV/share of $3.39/share relative to the market price of $3.25/share. This is only a 4% discount, however, the pricing assumptions are very conservative and 11%-21% below those already realized in Q1 2022.

Conclusion

PVL has maintained good dividend yields and has the potential for strong income generation as it currently trades at 9.8%%. I expect the annual cash distributions for 2022 to exceed payments made in 2021 due to the commodity price increases witnessed in 2022. Price fluctuations of these commodities continue to pose a risk to the stock’s upside but may be good for long-term income generation. Those looking for capital appreciation may want to wait for a better entry point, but this stock should provide consistent double-digit returns anyway for the foreseeable future.

Be the first to comment