annatodica

UnitedHealth (NYSE:UNH) and Centene (NYSE:CNC) are both part of the Managed Health Care industry, an important segment of the health care sector with only nine publicly traded companies. UNH is the giant in managed health care. It has a market cap of almost $500 billion. Its nearest rivals are Elevance Health (ELV) with a market cap of about $111 billion followed by Humana (HUM) with a market cap of $62 billion. Centene comes in fourth in the managed health care industry with a $53 billion market cap. All three together are less than half the market cap of UnitedHealth.

Though it is very much in the same business as the other three, CNC is an outlier because its specialty is serving the uninsured and under-insured. Its business depends upon working with Medicare, Medicaid, and Marketplace. Under the late Michael Neidorff, CNC was shaped by a commitment to provide affordable, high quality health care to the most vulnerable people. It began as a non-profit in 1986 but in 2001 went public as a profit-making company. Since then it has grown rapidly, helped in recent years by acquisitions. A comparison of UNH and CNC thus needs to involve a careful exploration of the differences of two companies which operate in the same industry.

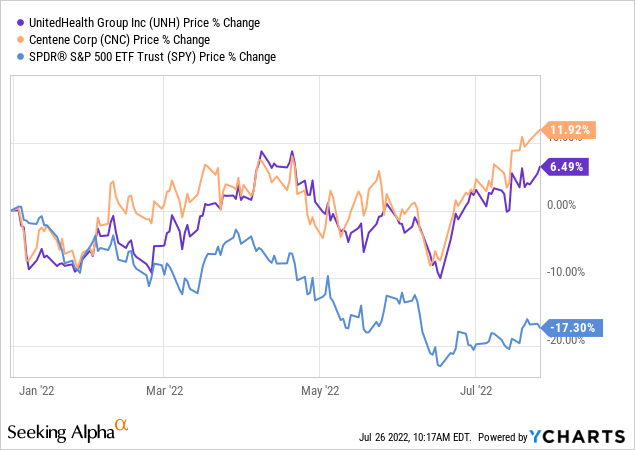

Both UNH and CNC have outperformed the S&P 500 so far in 2022, with Centene leading as evidenced by the chart below:

Investors should bear in mind that this is a point in the economic cycle when stocks in the health care sector tend to outperform the market.

UnitedHealth Group Is A Juggernaut With Many Good Years Ahead Of It

A comparison of UnitedHealth and Centene must start with the fact that UnitedHealth is a well established bluechip company with almost ten times the market cap of CNC. It is ranked third in the Vanguard Value ETF (VTV). In this recent article I made the argument that UnitedHealth really belongs in the hazily defined category often referred to as Growth At a Reasonable Price (GARP). I also pointed out the fact that except for absolute size it has growth characteristics closely matching those of Apple (AAPL). Apple is the number one stock in the Vanguard Growth ETF (VUG) as well as the full S&P 500 (SPY). UnitedHealth can thus be described as a mature growth company with revenues which have grown over more than a decade at a dependable annual rate of a bit over 9%. That’s not just a long term average. It’s pretty much every year. Year over year revenue growth has been remarkably steady and predictable at 9% with little deviation.

While revenue has grown about 242% from 2012 through mid-year 2022, UNH has maintained tight control of expenses enabling Net Income to increase 322%. Regular but small buybacks have reduced the shares outstanding by about 8% over that period so that Earnings Per Share have increased by 362%. Its dividend yield is only 1.15% but its rate of dividend growth (750% over the 2012-2022 period) has more than doubled the growth in earnings per share. To do this, UNH has doubled its payout ratio from 15% to 30%. This is still fine for a maturing growth company. Its free cash flow has increased by essentially the same amount as earnings (363% from 2012 through Q2 2022). Its long term debt is up 327% over the period, in line with other metrics. That’s only about 10% of enterprise value, making UnitedHealth a very conservative company. Only superlative management produces results so stellar and consistent.

UnitedHealth checks all the boxes for an investor looking for a well-run company with moderate growth. It is extraordinarily consistent in every measure of business performance and should continue to grow at more or less the same rate in the future. Its SA Factor Grades are as follows:

One might reasonably ask why a company with exceptionally consistent 9% growth in revenue and both earnings and free cash flow around 13% has a D- ranking for Growth. This has to do with the fact that the Factor Grades are measured against the Health Care Sector. Most investors would probably be satisfied with those numbers for top line and bottom line growth in a company with the consistency and conservatism of UNH. The Quant Rankings below show that SA Authors rank UNH a Hold while Wall Street Analysts rank it a Buy. Quant Rankings rank it a Hold.

The key factor for the Quant Ranking of Hold is, most likely, the D grade for Valuation, starting with its P/E ratio of a bit over 24. That’s hardly stratospheric as a valuation for safe defensive stocks, but I agree that it’s a little high. At their highly probable earnings growth rate of 13%, however, that P/E ratio drops to 21% for 2024 and 18.3% for 2025. With its resistance to inflation and recession, those numbers are enticing but Hold is nevertheless the right ranking.

Centene Has Faster Growth But A Bit More Risk

An analysis should begin with a congratulatory note to CNC and its leadership on earnings out this morning (July 26) before the market open. The Q2 non-GAAP EPS of $1.77 beat by $0.18 and revenue of $35.95B (+15.9% Y/Y) beat by $390B. The press release further noted that the improved health benefits ratio (HBR) of 86.7% was largely driven by Marketplace (exchange). FY 2022 revenue guidance was $141.6B-$143.6B vs consensus of $142.66B and non-GAAP EPS guidance was $5.60-$5.75, with a most likely increase up $0.05 from the $5.61 consensus shown next to the stock chart on Seeking Alpha. These numbers might raise its SA Quant Ranking when Valuation, Growth, and Revisions are updated.

Yesterday (July 25) CNC announced that it was selling its continental European holdings to Vivalto Sante, stating that it intended to use the majority of proceeds from the sale to repurchase shares and the rest to reduce debt. This news should be seen in context of two recent acquisitions. In a deal closing in January 2021 Centene acquired WellCare paying for $17.3B consisting of 3.38 Centene common shares and $102B in cash. Then in a deal closing in January of this year it acquired Magellan for $2.2B in cash. In 2018, in a joint cash and stock deal, CNC bought MHM, including MHM’s 49% stake in the correctional health care venture jointly owned by Centene and MHM. The three deals ripple revealingly through Centene’s numbers for net debt and shares outstanding:

| Year | 2017 | 2018 | 2019 | 2020 | 2021 | 2022Q2 |

| Total Share End of Period (Millions) | 347 | 413 | 587 | 582 | 583 | 585 |

| Net Debt (Millions) | 4771 | 6781 | 14520 | 18317 | 22661 | 22669 |

Those two lines provide a picture of what Centene paid for its past three acquisitions and the breakdown by shares issued and debt added. What an investor has to bear in mind is that the latest two acquisitions (the price for the MHM acquisition not being available) added close to 70% in market cap assuming that they their return was about the same as that of Centene before the acquisitions. Centene expected the larger WellCare acquisition to be accretive within 18 months.

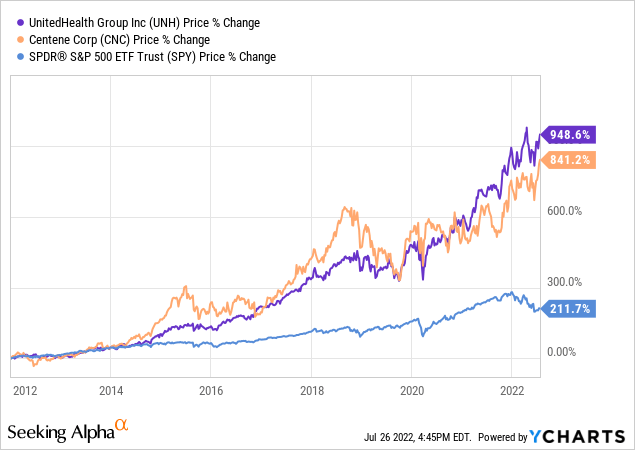

Because of acquisitions which were very large compared to the acquirer it is hard at this point to get a linear picture of organic growth. For the 10.5 year period covered in Financials at SA the revenue line rose 1500% and the net income line 1600%. That’s including several acquisitions, of course. This chart covering the period from 2012 to the present compares Centene to both UnitedHealth and the S&P 500:

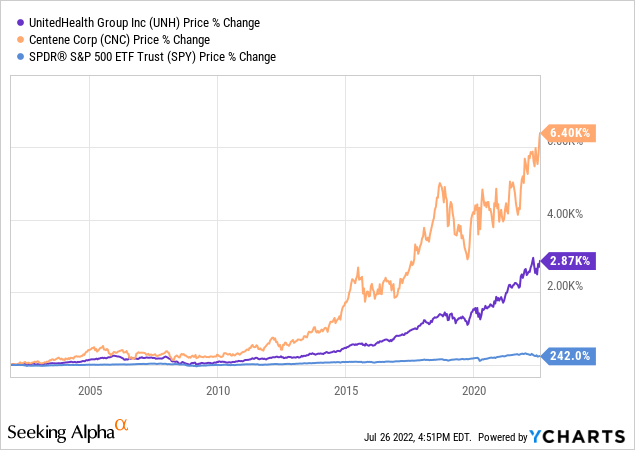

Centene trailed UNH slightly while both trounced the S&P 500. Centene was much more volatile, as shown in the run-ups in 2015 and 2018. The 2022 outperformance in the first chart above may suggest that it is about to take the lead again. Over the longer period going back to its IPO in 2001 CNC has outperformed decisively as shown in the chart below:

CNC And UNH Are Neck And Neck For Quant Rankings And Factor Grades

CNC’s Factor Graders are as follows:

The only real difference is CNC’s higher grade for Valuation. Its Profitability grade, like the D- of UNH, may stem from being in context of the Health Care Sector. Both SA Authors and Wall Street Analysts rate Centene a Buy while its Quant Ranking is Hold. My quant friends tell me never to second guess the algorithm, but it’s not exactly second-guessing to suggest that the Quant Ranking may be revised upward as a result of upgrades in Revisions and Profitability after the earnings report. Most interesting is the fact that Centene and UnitedHealth, which are ranked #3 and #4 in the Managed Health Care industry, are separated by the most slender of margins, 3.49 to 3.48.

Current Valuation Tips The Scale Toward Centene

UnitedHealth and Centene are very different companies with different virtues. UnitedHealth is the blue chip of blue chips and also happens to have very good growth working out to a very regular 13% annually compounded per share earnings over the past 10.5 years. Its only downside is that its 24+ P/E ratio makes is slightly overpriced as its Valuation Factor Grade confirms. A 13% drop in stock price, equaling its annual 13% growth in earnings, would produce a forward P/E ratio of 21 which would serve as a good enough buy point.

Centene has faster growth driven in part organically and in part by a series of successful acquisitions. Those acquisitions have increased the number of shares outstanding as well as the level of debt, which is high enough to add a modest amount of risk. The proclivity to make acquisitions is also a risk factor, as not all acquisitions work out well. Investors in Centene must be willing to accept the added risk and the volatility shown on long term charts in exchange for a better rate of growth in revenues, per share earnings, and share price. For those willing to accept the risks Centene should be an excellent investment right now in both the short and long term.

Be the first to comment