HT Ganzo/iStock via Getty Images

United States Antimony Corporation (NYSE:UAMY) is a nano-cap company based in Thompson Falls, Montana, that owns the only antimony refining and processing facility in the United States. Antimony, known since ancient times, has historically found its greatest application as an alloy to harden lead and tin. Among other uses, antimony is used in the production of ammunition, and for this reason, it is and has been considered a critical defense material since WWII.

Additionally, UAMY mines and processes antimony in Mexico, produces zeolite through the wholly-owned Bear River Zeolite Company and produces a limited quantity of precious metals as a by-product of its antimony production.

The premise of this article is that several developments and catalysts coalesce to position UAMY to achieve substantial growth in production volumes into an antimony price environment that is stronger – and likely to remain so – than the company has experienced in recent decades.

At the same time, the current share price is underpinned by a strong balance sheet, reasonable valuation and what I believe is a break-out first quarter that together warrant opening a small speculative position in UAMY.

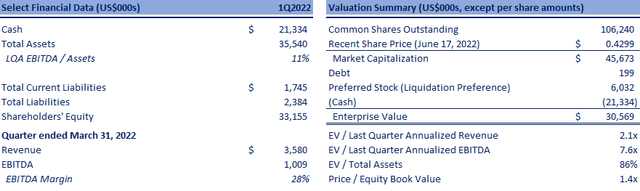

Data per Company filings; calculations per author.

Background

UAMY was founded in 1970, which certainly must have seemed like a great time to get into the antimony mining and processing business. The Chinese, which had dominated world market share since the early 20th century, had seen market share drop into the mid-twenty percent range by the mid-1970s.

However, the growing importance of antimony in the global economy compelled China to step up its investment making upgrades to mining and processing facilities and embracing new technologies. According to “A brief history of antimony in China”:

The overall effect of these improvements has been to return China to the level of dominance it enjoyed at the beginning of the last century and to give Chinese high grade antimony trioxide the reputation of being among the best in the world.

The relentless price pressure in the following decade compelled UAMY to suspend mining operations in 1983, and UAMY diversified into producing zeolite starting in 2000. While a minor part of the share price thesis, the zeolite business (a group of microporous, aluminosilicate minerals used as commercial absorbents and catalysts) has provided consistent cash flow since its founding – allowing UAMY to weather the difficult antimony price environment created by what many observers characterize as monopolistic mining practices by the Chinese.

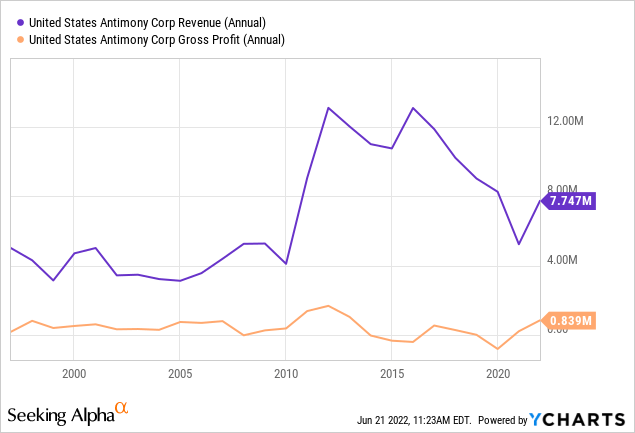

As a result of these difficult market conditions, UAMY struggled to keep itself financially above water for several decades:

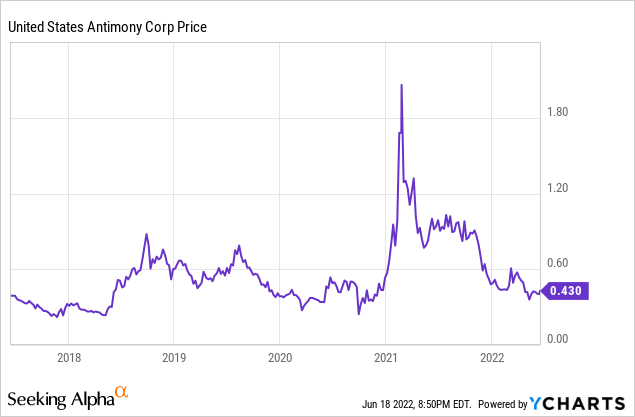

Unsurprisingly, UAMY’s share price has been listless during most of its literal 40+ years in the stock market wilderness:

UAMY shares showed signs of life in early 2021 due to speculation and developments with Ambri and Perpetua Resources Corporation (PPTA) regarding potential participation in the supply chain for Ambri’s liquid metal battery technology. The Board of Directors wisely took advantage of this interest to recapitalize the company, selling approximately 15 million shares at US$0.70 and then, weeks later, an additional almost 11 million shares at US$1.30. The company also issued warrants along with the sale of common stock. Total warrants outstanding as of March 31, 2022 are approximately 12.5 million, of which 9.2 million have an exercise price of US$0.85.

The Antimony Business

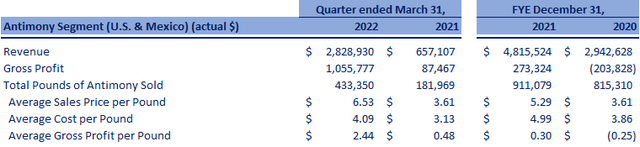

UAMY set a company record for first quarter gross profit and net income of US$1.14 million and US$786,252, respectively. This performance was fueled by significant improvement in antimony pricing but also increased volume and renegotiation of certain contracts which contributed to improved margins.

Data per Company filings; table per author.

Expectations for continued strong near-term antimony prices were affirmed in the press release announcing first quarter results, stating that the company expects high antimony prices to continue in the immediate term.

While UAMY ultimately does not control antimony prices, it is well-positioned to drive a key variable it does control – sales volumes.

- UAMY estimates that it has only a 4% market share of domestic antimony sales suggesting significant room to grow.

- The company recently made a key hire to focus on antimony sales initiatives.

- UAMY is operating significantly below capacity at its Mexican smelters permitting for a 50-70% increase in capacity.

- Because of its strong cash position, the company has the resources to increase sales volumes through a combination of capital spending and marketing initiatives.

Increasing Demand for US Sourced Antimony

Two demand side developments support the thesis that medium and long-term trends in domestically sourced antimony have reached an inflection point with highly favorable implications for UAMY. In the medium term, the replenishing of the National Defense Stockpile and in the long-term demand related to Ambri’s game-changing liquid metal battery technology will both lift demand for domestically produced antimony.

National Defense Stockpile

The dependence of the U.S. military on Chinese and Russian antimony for its ammunition supply has recently been the focus of the House Armed Services Committee with Massachusetts Democratic Rep. Seth Moulton, a member of Committee, stating:

China clearly has a comprehensive global strategy to corner the market on these materials and we’re behind and we’re playing catch-up.

On June 21, 2022, Perpetua Resources released a press release applauding steps being taken by the House Armed Services Committee to address antimony supply chain issues that threaten national security.

Green Energy Transition

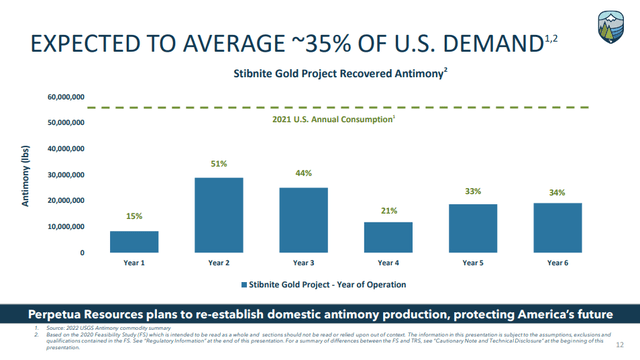

While a longer-term driver, Perpetua Resources is about five years away from initiating production on its Stibnite Gold Project in Idaho. On initiation of production, it is expected to provide domestically mined antimony equal to about 35% of U.S. 2021 consumption (which do not reflect future demand associated with green energy). In May of 2021, Perpetua Resources and UAMY signed a collaboration agreement to explore processing antimony produced at the Stibnite Gold Project at UAMY’s processing facilities. UAMY estimates it has about a 4% share of the domestic antimony market. This deal alone suggests the potential for UAMY volumes to increase approximately 9x when the Stibnite Gold Project initiates operations in approximately 5 years.

Recommendation and Key Risks

I believe the company has the potential to increase sales volumes by up to 4x without requiring significant capital investment. I look for continued improvement in sales volumes with strong antimony pricing (although perhaps somewhat lower than recent levels) and continued cost reduction from ongoing process improvements being implemented by UAMY. As the company continues to post solid results, I would expect the shares to trade at a premium to the multiple range of 9x to 10x EBITDA (more consistent with levels seen by other mining, chemical and refining companies).

Putting these together, I believe US$1.00+ per share to be achievable by year-end based on entering 2023 with a still strong balance sheet, run-rate sales volumes on track to achieve 2 million+ pounds of antimony sales and 2023 EBITDA of US$6+ million with further upside as the company continues to increase sales volumes in coming years.

The primary risks are continued monopolistic practices by Chinese miners and the impact this could have on global antimony pricing. This risk is mitigated, in my view, by the strong balance sheet, modest premium to book value and heightened awareness of industrial and government users of antimony to both ongoing supply chain issues and risks of geopolitical disruption of supply.

At 1.4x book value, I believe long UAMY is a favorable risk/reward trade with little downside and a lot of upside driven by two highly favorable drivers of demand for domestically sourced antimony.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment