MEDITERRANEAN

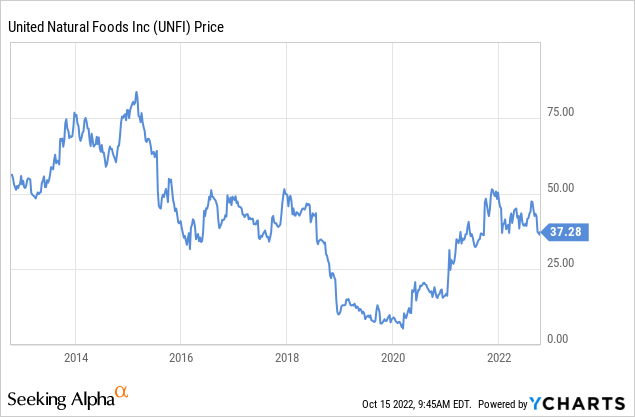

United Natural Foods (NYSE:UNFI) almost went bankrupt from the massive debt it added from its acquisition of Supervalu. In some ways, it got saved by Covid and people eating at home more often. After seeing the share price reach single digits, it has now deleveraged and recovered for the most part. We covered the impact of the Supervalu acquisition in more detail, including the indigestion it gave the company, in a previous article. Here, we will discuss the recent performance and the current valuation. In particular, we are surprised at how cheap shares remain despite the company proving itself resilient in the current tough industry environment.

Analyzing the most recent financial results we see improving operational performance, with the company driving share gains and delivering solid financial results. This is despite the very challenging industry backdrop. Food at home inflation remains in the double digits, driving consumers to buy fewer items, and the labor market tightness persists.

Proving Resilient

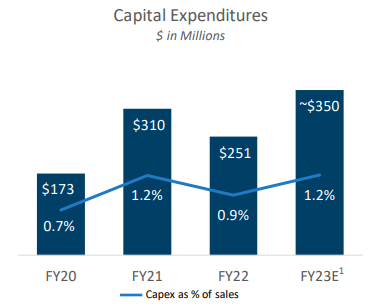

We believe the company’s scale remains a significant competitive advantage. The company has become the largest grocery wholesaler in North America, distributing approximately 260,000 unique SKUs, from around 12,000 suppliers, to over 30,000 customer locations. It also has 56 distribution centers across the United States and Canada. The company is further increasing the strength of its network, with a large part of the planned capital expenditures focused on initiatives to increase distribution center automation and efficiency.

Sales for the fourth quarter of fiscal 2022 grew 8% and totaled $7.3 billion setting a new fourth quarter record. This increase was composed of inflation, of about 8.8% and a volume decline of less than 1%. The modest volume loss was significantly better than that of the broader industry, for which Nielsen reported units declined by close to 3% for the same period. Operating cash flow before changes in working capital increased to nearly $700 million in fiscal 2022.

The company has improved the balance sheet so much that the Board has now approved a new $200 million share repurchase authorization that can be utilized over the next four years. Guidance for the coming fiscal year was pretty decent, with adjusted EPS growth for fiscal 2023 expected at ~$5 per share.

Private Brands

One big positive we see with United Natural Foods is that its private brands growth is accelerating. During the last earnings call management mentioned that the private brands business grew double-digits in the fourth quarter, and continued to accelerate through the start of fiscal 2023. In particular the company sees a strong trend towards its value brands. The company has over 18 brands in its portfolio, with the Essential Everyday brand doing over $1 billion at retail, and that is despite it being a value brand.

Financials

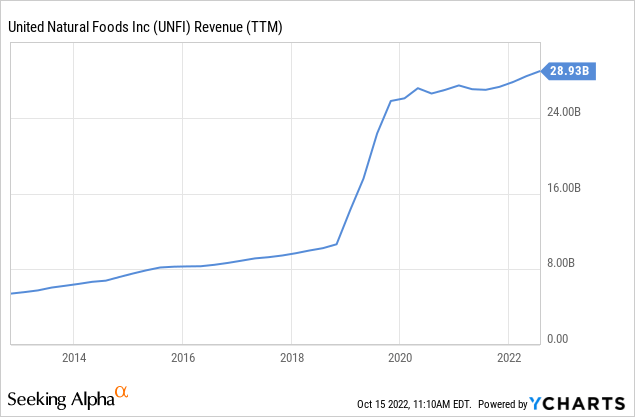

Revenues continue growing at a nice rate, although as we saw previously, much of it is the result of inflation, with volumes modestly lower in the most recent quarter.

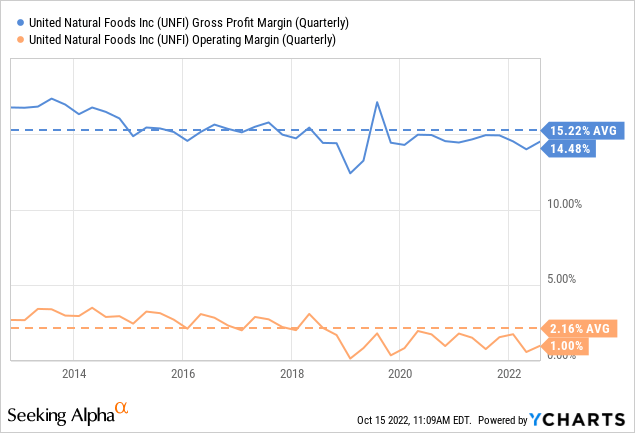

Operating margins appear to have stabilized at a lower average compared to where they were before the Supervalu acquisition. It remains to be seen if the automation and efficiency initiatives the company is implementing are able to bring back margins to where they were before.

UNFI is certainly increasing its capex spend, with management saying they have many attractive projects with good rates of returns. For fiscal year 2023 the expected capex spend comes to ~$350 million.

United Natural Foods Investor Presentation

Balance Sheet

UNFI ended the fiscal year with an improved balance sheet and ample liquidity to fund growth initiatives. Net leverage fell to under 2.6x, and the company ended the year with approximately $1.7 billion of liquidity. The company’s target leverage remains 2x to 2.5x, so it is very close to finally reaching its target.

Valuation

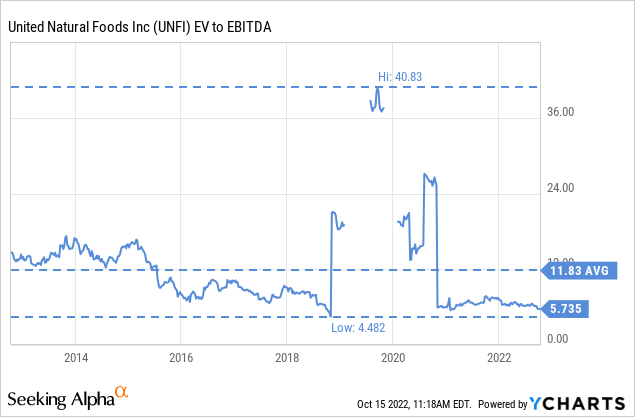

Despite the good financial results the company has delivered the last few quarters, we believe it continues to be punished for its near-death experience after the Supervalu acquisition. EV/EBITDA is about half its ten-year average, and extremely low on an absolute basis.

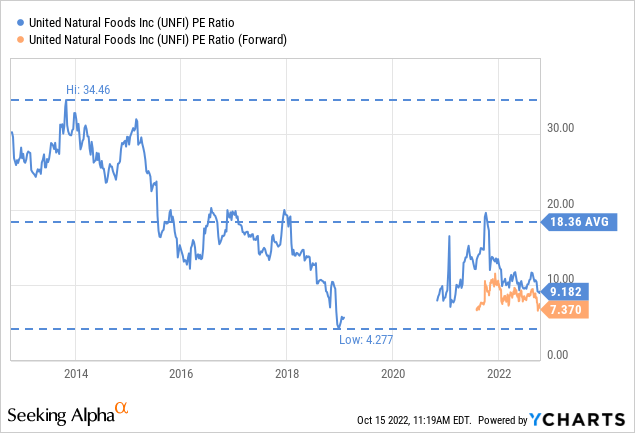

The price/earnings is also about half its historical average, with the forward p/e particularly cheap at only ~7.3x.

Risks

We believe the market continues to punish UNFI for having taken so much leverage for the Supervalu acquisition, and how close it came to being a complete disaster. Hopefully now that the company has proven resilient, the market will start re-rating the company to a more reasonable valuation. Still, there are other concerns beyond a repeat of the Supervalu situation. Probably the biggest risk is the potential loss of Whole Foods Market as a customer. UNFI and Whole Foods Market extended the current distribution agreement until September 27, 2027.

Conclusion

United Natural Foods had a near death experienced after taking too much debt for the Supervalu acquisition, but it seems the market cannot forgive the company despite coming a long way to repairing its balance sheet, and proving incredibly resilient despite the current tough economic conditions. We believe shares present an attractive opportunity trading at very low valuation multiples, and with the company almost done repairing the balance sheet and even authorizing a significant share repurchase program. We believe the company deserves a higher multiple, and that shares are looking quite attractive at these levels.

Be the first to comment