Pekic

United Insurance Holdings Corp. (NASDAQ:UIHC) is one of the popular P&C insurance providers in Florida. Over the years, it has been through several economic downturns and rebounded. Yet, external pressures are tougher – inflation, roofing scams, and insurance exodus, to name a few. The rising costs, matched with lower policy renewals, are more evidence that it had to make an important decision. Thankfully, it maintains a stellar financial positioning to suffice its operations and cope with the upcoming changes. Its plan may not pay off, given its gloomy growth prospects, but it appears to be a wise move. It may also take a long time to regain its footing and bounce back. Patience, prudence, efficiency, and prudence are some attributes it has to improve to meet its target. Likewise, the stock price remains adherent to its fundamental trend as it continues to drop.

Company Performance

The state of Florida may not be a conducive place for many companies in the financial sector. The market volatility and the increased frequency of natural calamities are some problems. Yet, there appears to be more than meets the eye. It is more evident in the insurance industry, particularly P&C insurance providers. In recent years, there have been six insurance companies withdrawing from the state. Earlier this year, another three companies started liquidating. The pandemic disruptions, higher claims, and tighter competition are the primary drivers. UIHC is not exempt. It must be noted that many of its peers are also experiencing massive setbacks. That is why it is reasonable to say that Florida must prepare for a potential P&C insurance exodus. Policyholders and contractors hurt many companies amidst the rampant roofing scams.

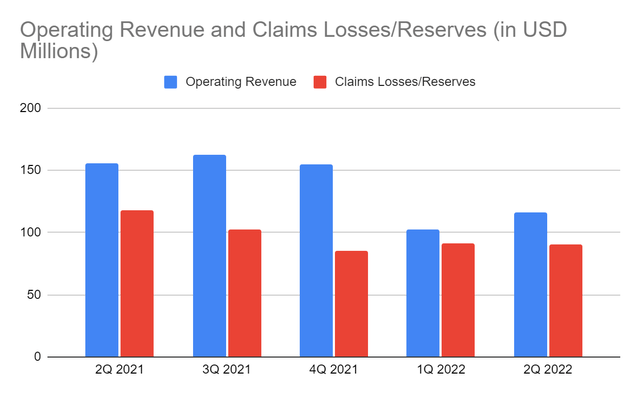

Despite this, it appears that UIHC is trying its best to strategize and stay afloat amidst market pressures. In Q2 quarter, operating revenue amounted to $115.79 million, a 26% year-over-year decrease. Yet, it is a slight rebound from 1Q 2022 at $102.37 million, giving it a 13% increase. The massive change in the last year has been driven by policy additions and renewals. We can see the downtrend in the policy renewals in personal lines, leading to a 25% reduction. Thankfully, UIHC is determined to offset it by its strategic pricing that continues to increase. It moves in line with the increase in additional premiums as the demand for P&C insurance increases. Only, the overall impact of lower policy renewals is much greater than higher premium rates and policy additions.

Operating Revenue and Losses/Claims (MarketWatch)

Meanwhile, commercial lines are stable and still show promise. Policy rates, additions, and renewals are in an uptrend, offsetting the decrease in personal lines. So, commercial lines now appear to be the stronger segment with a steady increase in demand. The operating revenue of this segment is $50.5 million, a 14% increase from the comparative quarter. The prudent management of its investment portfolio is also part of its core competencies. Investment yields are also stable in a high-inflation environment. UIHC may still make a comeback. But, these promising prospects may not materialize soon. Patience and prudence must work hand in hand before their strategies and efforts pay off. It will still take a long time as economic uncertainties remain evident in the U.S. Plus, the hurricane season is not done yet.

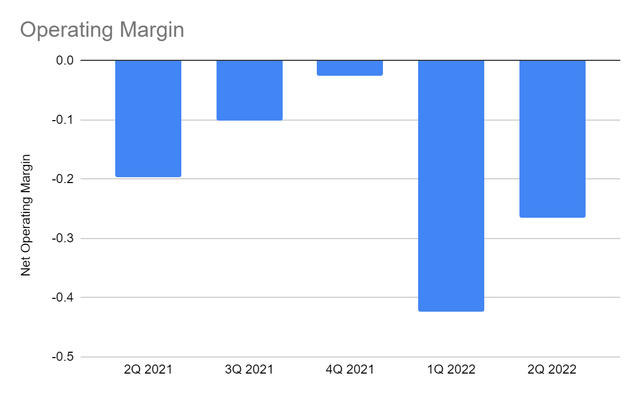

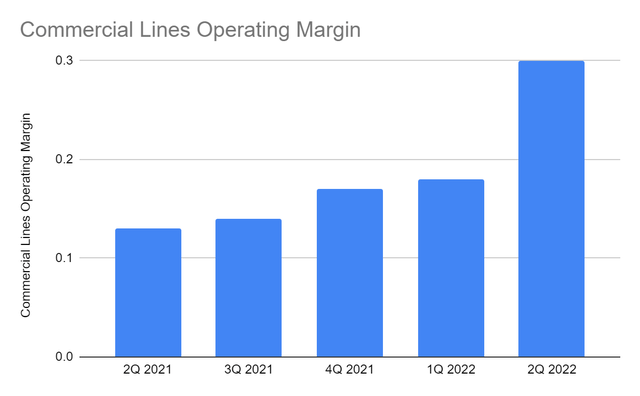

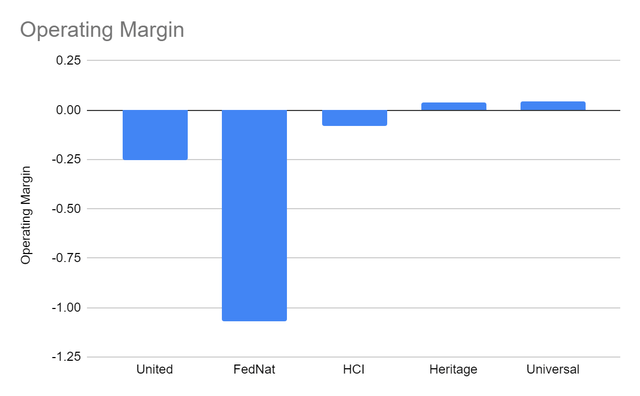

The figures show that focusing on commercial lines may be a wise move to stabilize its operations. Aside from sustained policy additions and renewals, this segment appears to be more efficient. Operating costs and expenses are lower. Underlying losses are more manageable in commercial lines than personal lines. The operating costs and expenses of personal lines of $114 million (page 5) are more than thrice as much as that of commercial lines at only $32 million. It can be attributed to the higher amount and frequency of claims. Also, roofing scams are more evident in personal lines. The operating margin is -26% vs -20% in 2Q 2021. But, it is better than in 1Q 2022 at -42%. The operating margin of commercial lines is 30% vs 13% in 2Q 2021, proving the enhanced demand and efficiency in the commercial lines segment.

Operating Margin (MarketWatch)

Commercial Lines Operating Margin (MarketWatch)

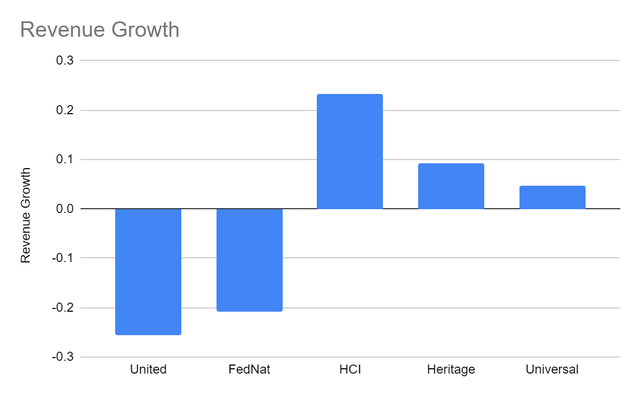

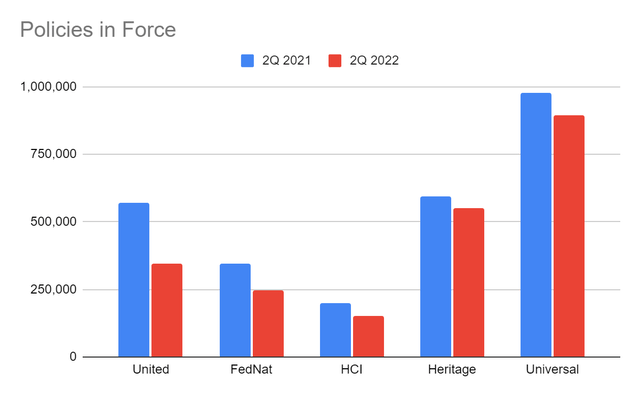

If we compare it to its close peers, UIHC is lagging behind them. Its revenue growth and operating margin are negative and second to the lowest. It also has the highest drop in policies in force, primarily due to the decrease in personal lines. It appears to have a hard time sustaining the demand in both segments while keeping costs and expenses low. It must work better and wiser to bounce back, and its decision to withdraw personal lines may be an ideal move.

Revenue Growth (MarketWatch)

Policies in Force (2Q 2022 Financial Report)

Operating Margin (MarketWatch)

Potential Risks

United Insurance Holdings Corp. has been hammered in the last year. It was one of those unperturbed insurance providers in Florida amidst the pandemic. Yet, the widespread roofing scams and increased natural calamities are almost unbearable. To address the problem, the company is working on its transition after its reorganization. Also, it plans to withdraw its personal lines segment in Florida and other states. It can be challenging since personal lines are one of the primary revenue components. But doing so may help it manage its costs and manage policy retention better. It may also lead to an orderly run-off that may materialize in the long-run. We have to weigh the impact though to know how much it will improve or further aggravate the situation.

The P&C insurance industry in Florida is plagued with roofing scams. The state only comprises 9% of the total P&C insurance claims in the US. Yet, almost 80% of lawsuits are fraudulent. Numerous reports point to the possible connivance of roofers, public adjusters, and salespeople. They even connive with the homeowners. For instance, scams begin under the pretense of free roof inspection by roofing contractors after the storm. They come knocking at the door of random households, claiming to have seen roof damage and offering a free inspection. After a while, they come back to the owners confirming the roof damage and come back with proof damage. They convince the homeowner to have the insurance company cover roof damages. It has been problematic and rampant for many P&C insurance provider, especially in Florida, given its exposure to storms and hurricanes.

To combat the connivance between policyholders and contractors, the government exerts more effort. It allows P&C insurance companies to be stricter with claims approval. But, companies are still in a disadvantaged position. They can’t deny claims whether due to natural disasters or deliberate actions if the roof age is below fifteen years. On average, roof age is twenty years. So, problems are still visible. Insurers are faced with choices between adhering to these restrictions or leaving the state.

UIHC is a popular insurance provider and one of the most active in targeting more individuals. Perhaps it is a wise move to implement more stringent underwriting policies. But, it led to a 25% year-over-year decrease in policy retention. The increase in policy rates and additional policies could not offset the impact.

Another risk is the vulnerability of Florida to natural disasters. Research on the OCHA Services shows that over 400 catastrophic events happened worldwide. The number is 20% higher than the average in 2001-2020. In the U.S. alone, there were 97 natural disasters in 2021, accounting for 22% of the global data. Since 2017, a total of 101 severe storms and hurricanes have been recorded. The uptrend is evident, showing the increased frequency and intensity of natural disasters. The risk is higher in Florida with 41% of hurricanes hitting Florida since 1850. In 2021, it was one of the ten hard-hit states, leading to billion-dollar damages. As global warming becomes more evident, experts expect more frequent and severe disasters. The US had $742 billion in damages brought about by natural calamities in the last five years. This value is way higher than the 1980-2021 average. With the above-normal intensity of natural disasters, more risks and costs may be incurred. As such, P&C insurance becomes at the forefront of climate resilience.

Indeed, it is challenging to have this industry in the state. The roofing scams and higher exposure to hurricanes may bring more risks to the business. It may have higher claims due to the combination of these two factors. Now that it has fewer revenue streams, it must be more strategic with the pricing. It must be more careful with policy approval to lower the risk of scams and manage expenses better.

Potential Opportunities

United Insurance Holdings Corp. is the fourth Florida-based P&C insurance provider I have covered. I can say that it appears to be the weakest so far. My observation is based on the current results, especially its massive decline in policies and margins. Even so, I can see its potential to rebound as it tries to match its operating capacity and viability with the current market conditions. It may not be easy, so stakeholders must be wiser and more patient.

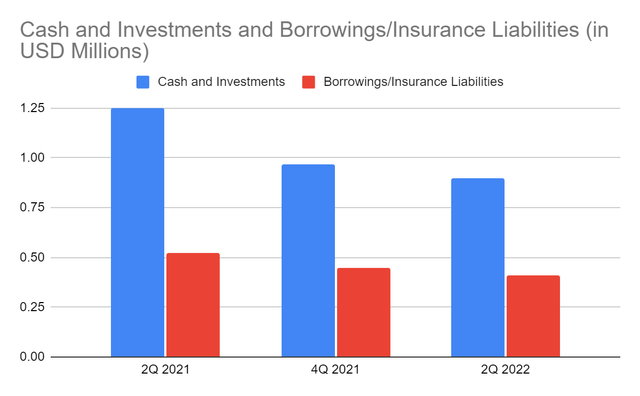

There are opportunities that can help UIHC speed up its recovery. Right now, it still appears weaker than usual, but its fundamentals remain sound. This aspect may tell that UIHC is still capable of maneuvering in a stormy market landscape. UIHC has a solid liquidity position, allowing it to cover its main liabilities. Cash levels are stable, comprising 26% of the total assets. Also, its percentage is higher than in 2Q 2021 at 20%. Investments are way lower than in 2021, which can be attributed to the operational contraction. Also, interest rate hikes affect investment valuation and yields. If we combine cash and investments, their value will be 74% of the total assets. They can also cover borrowings and insurance liabilities even in a single payment. Borrowings are also stable, showing that it still can sustain its operations without increasing its financial leverage. It has adequate capacity to cover its present requirements, which is vital amidst its reorganization.

Cash and Investments and Insurance Liabilities/Borrowings (MarketWatch)

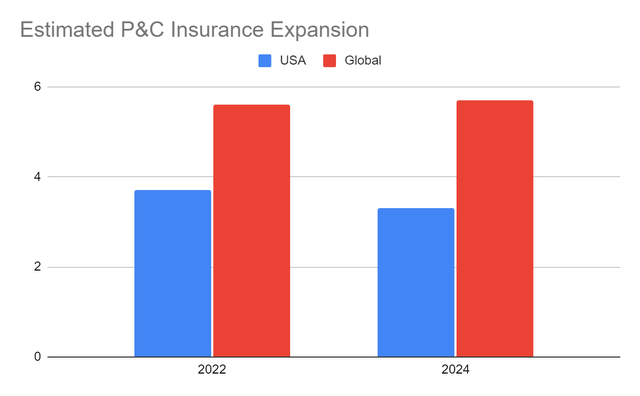

Another opportunity is the potential expansion in the P&C insurance industry. It means more demand and revenues for P&C insurance companies. Recent estimates of the Insurance Journal show that it the U.S. expansion may reach 3.7% this year and 3.3% in 2024. Likewise, the global P&C insurance industry may expand by more than 5% in the next 12 months. Given this, its plan to pull out personal lines in Florida and other states appears to be a double-edged sword. It already lost many policyholders, as shown by the decrease in policies in force. But, it may be a wise move amidst roofing scams and more frequent natural disasters.

As discussed, Florida has more exposure to hurricanes, given its location. So, it may avert more claims from homeowners and other individuals. It may also be more relaxed, knowing that it is a fresh start to eradicate false roof damage claims. Personal lines account for more costs and expenses due to higher claims. The net income of commercial lines of $18.8 million or $0.44 per share is higher than $5.5 million or $0.13 per share in 2Q 2021. It conveys that focusing on commercial lines segment can be more lucrative.

“Due to significant uncertainty around the future availability of reinsurance for our personal lines business, I believe placing United P&C into an orderly run-off is prudent and necessary to protect the Company and its policyholders. The Company is actively pursuing opportunities to leverage our people, technology, and other capabilities. Our commercial business continues to perform well and provides the Company a stable platform to build new engines of growth and profitability,” said Dan Peed, Chairman & CEO.

Estimated P&C Insurance Expansion (Insurance Journal)

Even better, withdrawing from personal lines means it can focus on commercial lines better. Note that there is tighter competition in P&C insurance, especially in Florida. It may be confusing at first, given the P&C insurance exodus in Florida. But, the increasing preference of many P&C insurance companies to commercial lines rather than the problematic personal lines may start competition in the segment. Thankfully, UIHC currently focuses on commercial lines, providing it more advantage to improve this segment. Moreover, it has better pricing flexibility. Many reviews show that its policies are 7% cheaper than its peers. On average, its P&C insurance is way lower than the state and national average. It has a more flexible pricing system, which can adjust to market changes. It is evident in how its premium rate continues to increase in response to inflation. With regard to inflation, it appears to be in an autumn lull. It continues to decrease at 8.3% although it is still way higher than pre-pandemic levels. Despite this, the demand for P&C insurance is still higher as shown by its policy additions. It may become better once the economy stabilizes. It has to focus on how it can expand its commercial lines.

Moreover, Florida and Texas have a solid and active business sectors. They continue to bounce back as restrictions continue to ease. According to Policygenius, cities in Florida and Texas are part of the 25 best cities to put up a business in the U.S. and Canada. In fact, Florida has five cities on the list. The U.S. Census Bureau shows that Florida has the highest business formations in the US. It accounts for 12% of total business formations nationwide. In 2021, it had 5.8 million business applications. As of the first half of this year, almost 700,000 have already been approved. So, it has about four million pending applications. More applications and openings may be expected once the economy becomes stable. It provides more opportunities for UIHC to capture more businesses. It may have an advantage in commercial lines due to its increased focus and better price flexibility.

Stock Price Assessment

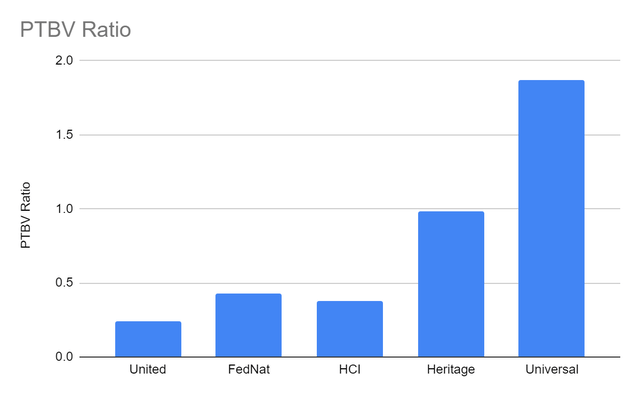

The stock price of United Insurance Holdings Corp. is in a steep downtrend. It has been hammered for more than a year but is in line with the fundamentals. At a recent share price of $0.7147, the stock price has already been cut by 84%. The decrease is also consistent with its continued contraction. It may be unenticing, but the stock price appears to be very cheap. The PTBV Ratio of 0.24x and the P/S Ratio of 0.26x suggest potential undervaluation. At 1x ratio for each, the stock price would be in the $2.74-2.98 range. It may also be an opportunity for optimistic investors to take a risk and realize potential gains. But, UIHC stopped paying dividends, another factor that drove the price decrease. It is reasonable due to consistent net losses in the last two years. Although it had positive FCF, which could sustain dividends this quarter, UIHC had to focus on reorganization. To assess the stock price better, we will use the DCF Model.

PTBV Ratio (Yahoo Finance)

FCFF $9,850,000

Cash $317,000,000

Borrowings $155,000,000

Perpetual Growth Rate 3.6%

WACC 9%

Common Shares Outstanding 43,313,000

Stock Price $0.7147

Derived Value $2.05

The derived value of $2.05 using the DCF Model proves the undervaluation of the stock price at only $0.7147. It agrees with the PTBV Ratio although it is lower by 24-31%. So, there may be a 200% increase in the next 12-18 months. But, investors must not rely on the fundamentals alone. The inflationary pressures and the success of its transition to commercial lines may influence the outcome.

Bottom Line

United Insurance Holdings Corp. faces a challenge and a new beginning. It has been hammered in the last two years, but it remains durable and flexible. Its complete transition to commercial lines and the potential expansion in the P&C insurance industry appears to be promising. Also, the stock price is cheap although dividend payments have stopped. This may still be a bold thing to say, but the recommendation is that United Insurance Holdings Corp. is a buy.

Be the first to comment