Ryan Fletcher/iStock Editorial via Getty Images

After strong results from legacy airline peer Delta Air Lines (DAL), the market appears surprised United Airlines (NASDAQ:UAL) would post equally bullish guidance. The airlines are shocking the market by easily generating strong profits despite oil trading above $100 per barrel. My investment thesis remains ultra Bullish on the airline stock heading to multi-year highs above $60 on these strong numbers.

Amazingly Strong Guidance

After the close, United Airlines reported guidance that is near unbelievable. The airline missed the Q1’22 revenue estimates by $110 million and lost $4.24 per share. The losses are a depressing $1.4 billion for the quarter, but this is where the depressing covid saga ends and the promising future begins.

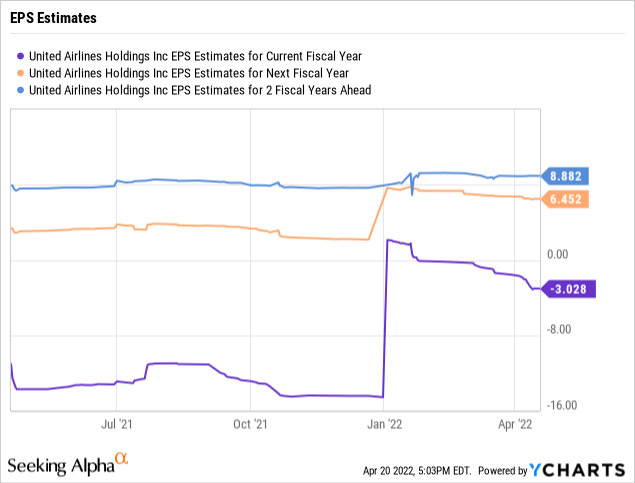

Not only were the losses depressing, but the market expected United Airlines to report tepid profits for the rest of year still leaving the airline with a $3+ per share loss for the year. The airline shocked the market with guidance for a goal to now be profitable for all of 2022 starting with impressive 10% operating margins in Q2’22.

While the market was stuck focusing on surging oil prices impacting the cost structure of airlines, the sector has made drastic improvements in the last decade to tie air fares with fuel costs. In no surprise to those paying attention, the airline forecast a robust operating revenue outlook, including total revenue per available seat mile (TRASM) in the June quarter of approximately 17% over 2019 levels. In essence, fares are rising enough to fully capture the higher fuel costs.

In order for United Airlines to be profitable for the year, the airline must generate over $4.25 per share in profits for the last 9 months of the year. Analyst estimates were forecasting a small loss in Q2’22 followed by ~$1.29 per share in profits for the 2H of the year. Instead, the airline will generate operating profits topping $1 billion in the current quarter alone.

The airline went even further to guide towards 2023 pre-tax margins of 9% and 2026 pre-tax margins reaching 14%. With revenues topping $50 billion by 2026, United Airlines is on a path to pre-tax income reaching an impressive $7 billion.

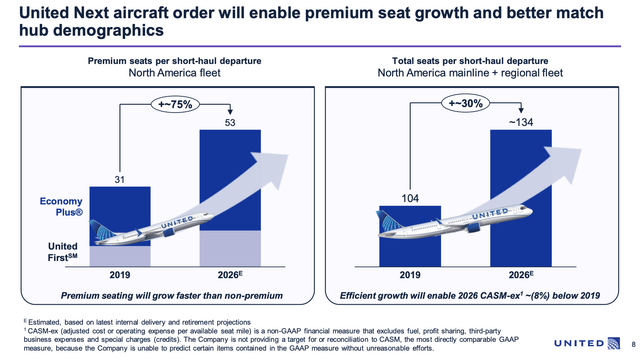

United Airlines is busy upgrading the fleet with premium seats in order to provide higher quality options in comparison to ULCC flights. The airline has targeted a 75% increase in the premium seats in a short-haul departure by 2026 with the seats growing from just 31 per departure to 53. With the addition of more seats per flight, United Airlines won’t actually lose any non-premium seats in the upgrade process.

Source: United Airlines presentation

Deep Stock Value

While this isn’t a new story, the deep value of the stock is becoming far more obvious now. The stock only has a $15 billion market cap suggesting the stock only trades at 2x targeted operating profits in 2026.

United Airlines does have 325 million shares outstanding now versus 268 million back in 2019. These share counts and the impact of higher debt was already factored into the prior EPS estimates for the airline reaching $6.45 in 2023 and $8.88 in 2024. The airline just guided 2022 EPS targets to beat current analyst targets by over $3 per share suggesting these numbers need to be hiked.

The stock if far too cheap here, if United Airlines were to just make these EPS targets. At $50 in early after-hours trading, the stock only trades at 5x the current 2024 targets. These numbers are likely to jump here.

At $7.0 billion in pre-tax profits in 2026, United would generate up to $20 per share in profits before taxes. The massive losses for the last couple of years will provide operating losses to offset taxable income for the foreseeable future. At an effective income tax rate of 20%, United Airlines would generate income of $5.6 billion and an EPS in the $17 range.

While the numbers seem far too good to be true, United Airlines was on a path to a strong EPS approaching $15 pre-covid. Of course, the biggest risk is that another virus shutdown hits the sector while the airline still has over $32 billion in total debt and some $14 billion in net debt. The airline and sector still hasn’t recovered from financial impacts of covid despite the strong signals for robust travel rebound, so any sudden hit to passenger demand again would devastate airlines before rebuilding the balance sheet.

Takeaway

The key investor takeaway is that United Airlines is far too cheap at $50 with the potential for pre-tax profits to reach $4 billion next year. The stock trades at least than 4x this profit picture and the recovery is just in the early phases.

Be the first to comment