Ryan Fletcher

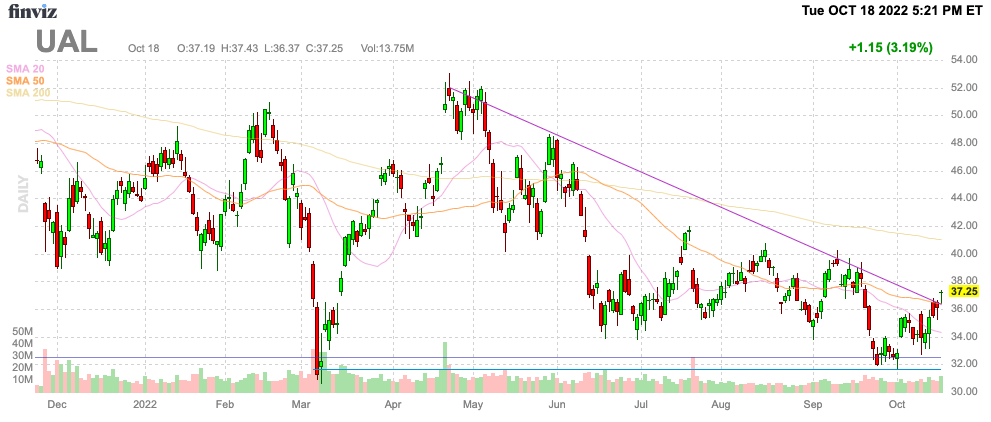

The market hasn’t liked the airlines for years, if not decades. United Airlines Holdings (NASDAQ:UAL) just reported a quarter with blowout margins, yet the airline trades like the sector is still being hit by covid lockdowns. My investment thesis remains ultra-Bullish on the airline sector, especially the turnaround occurring with United Airlines while the stock trades near the lows.

Source: FINVIZ

Booming Business With Constraints

United Airlines just reported a quarter with all-time record revenues despite capacity down nearly 10% from 2019 levels. The airline reported revenues grew 13% above 2019 levels of $11.4 billion to reach $12.9 billion.

The company left for dead is now entering a debate on how much upside exists, even without the stock rallying this year. In what was supposed to be a horrible operating environment, United Airlines reported a $927 million adjusted net profit during Q3’22.

United Airlines even reported a pre-tax margin of 8.9% despite the large headwind of higher interest expenses and gas prices. In total, the airline reported a Q3’22 EPS of $2.81 compared to $4.07 earned back in Q3’19.

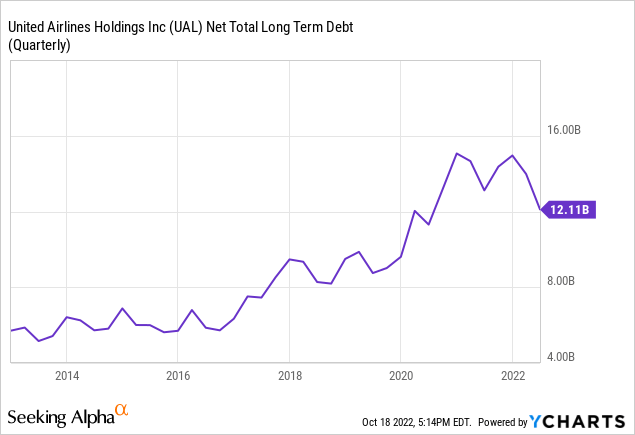

Investors writing off the airlines due to higher interest expenses and share counts will now face the reality of an industry surviving and thriving, even with gas prices at unusually higher levels. The market appeared to assume an airline like United Airlines would never overcome higher interest expenses and debt levels up at $12 billion. The net debt levels have already fallen due to net income and higher advanced ticket sales pushing cash flows up.

United Airlines saw interest expenses jump to $455 million in Q3’22, up from only $191 million in Q3’19. The airline did see higher interest income, due to shifting some cash into short-term investments as interest rates rose.

Fuel costs were 5.55 cents per ASM compared to 3.05 cents back in Q3’19. The airline paid nearly $1.5 billion in additional fuel expenses last quarter despite capacity being down 10%.

United Airlines offset these higher fuel expenses with increased fares and additional revenues. The market should have far more confidence in the airlines being able to thrive in any environment where business isn’t shut down.

EPS Surge

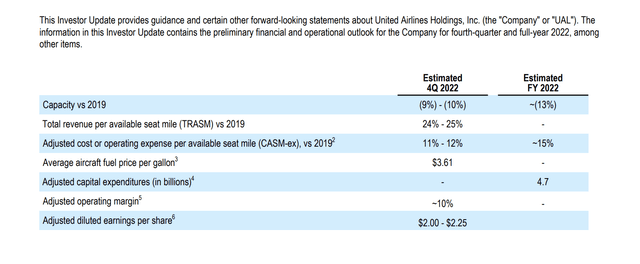

No matter how one calculates a forecast for profits going forward, United Airlines is set to produce massive profits in the years ahead. The airline forecast a Q4’22 adjusted operating margin of ~10% leading to a $2+ EPS followed by a 2023 pre-tax margin of ~9%.

Source: United Airlines Q3’22 earnings release

Analysts forecast United Airlines earning $5 per share in 2023 leading to $8 in 2024 and $11 in 2025. The big Q3 beat and strong guidance suggests all of these analyst estimates aren’t even in the right ballpark.

If the company hits long-term targets for a 9% pre-tax margin in 2023 and a goal to reach a 14% pre-tax margin long term, United Airlines was already predicted to produce a $17 EPS. The 9% pre-tax margin on revenues of $53 billion would produce ~$3.8 billion in profits assuming a 20% effective tax rate. With 330 million shares outstanding, the airline produces an EPS of $11.50.

Note, analysts are only forecasting a $5 EPS next year. United Airlines was trading at only $37 heading into earnings due to this huge disconnect with the strong operating models of the airlines now. Also remember, airlines aren’t even close to 2019 capacity and the amount should’ve grown up to 10% in the period from 2019 to 2023 suggesting capacity needs to reach 110% of 2019 levels.

The market should no longer have any doubts whether an airline such as United Airlines can produce strong pre-tax margins again. One might question whether the airline can turn the current 9% to 10% pre-tax margin into a 14% pre-tax margin in a few years, but the airline clearly has the ability to produce strong income and profits to help pay down debt and buy new airplanes.

Takeaway

The key investor takeaway is that United Airlines is ridiculously priced at $40 in initial after-hours trading. The company has this clear path to a $11+ EPS next year where any stock price not in the triple digits appears disconnected from the actual operations of the business.

Be the first to comment