ipuwadol

A Quick Take On Unisys

Unisys Corporation (NYSE:UIS) reported its Q3 2022 financial results on November 8, 2022, missing expected revenue and EPS estimates.

The company provides a variety of enterprise software, computing and cloud infrastructure services to enterprises worldwide.

Until management makes progress on the company’s transition to high value solutions, reignites top line revenue growth, and reduces its cost structure to achieve operating breakeven, I’m on Hold for UIS.

Unisys Overview

Blue Bell, Pennsylvania-based Unisys was founded in 1986 and provides a range of information technology solutions to organizations worldwide.

The firm is headed by Chairman and CEO Peter Altabef, who was previously president and CEO of MICROS Systems, president of Dell Services, and president and CEO of Perot Systems.

The company’s primary offerings include:

-

Digital Workplace Solutions

-

Cloud Applications and Infrastructure

-

Enterprise Computing Solutions.

The firm acquires customers through its direct sales and marketing efforts as well as through partner referrals and channels.

Unisys’ Market & Competition

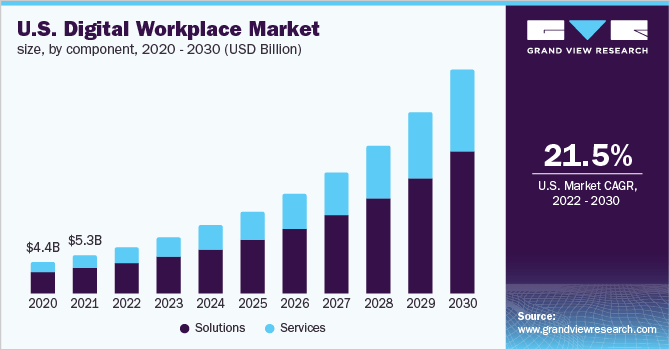

According to a 2021 market research report by Grand View Research, the market for digital workplace solutions and software was an estimated $27.3 billion in 2021 and is forecast to reach $167 billion by 2030.

This represents a very strong forecast CAGR of 22.3% from 2022 to 2030.

The main drivers for this expected growth are increased demand for hybrid workplaces as the outbreak of the global pandemic forced many organizations to adopt more flexible working arrangements.

Also, the chart below shows the historical and projected future growth of the digital workplace market in the U.S.:

U.S. Digital Workplace Solutions Market (Grand View Research)

Major competitive or other industry participants include a wide variety of firms serving various market segments. An abbreviated list is shown here:

-

IBM

-

Accenture plc

-

Atos SE

-

Trianz

-

Capgemini

-

HCL Technologies

-

Infosys

-

Tata Consultancy Services

-

Mphasis

Unisys’ Recent Financial Performance

-

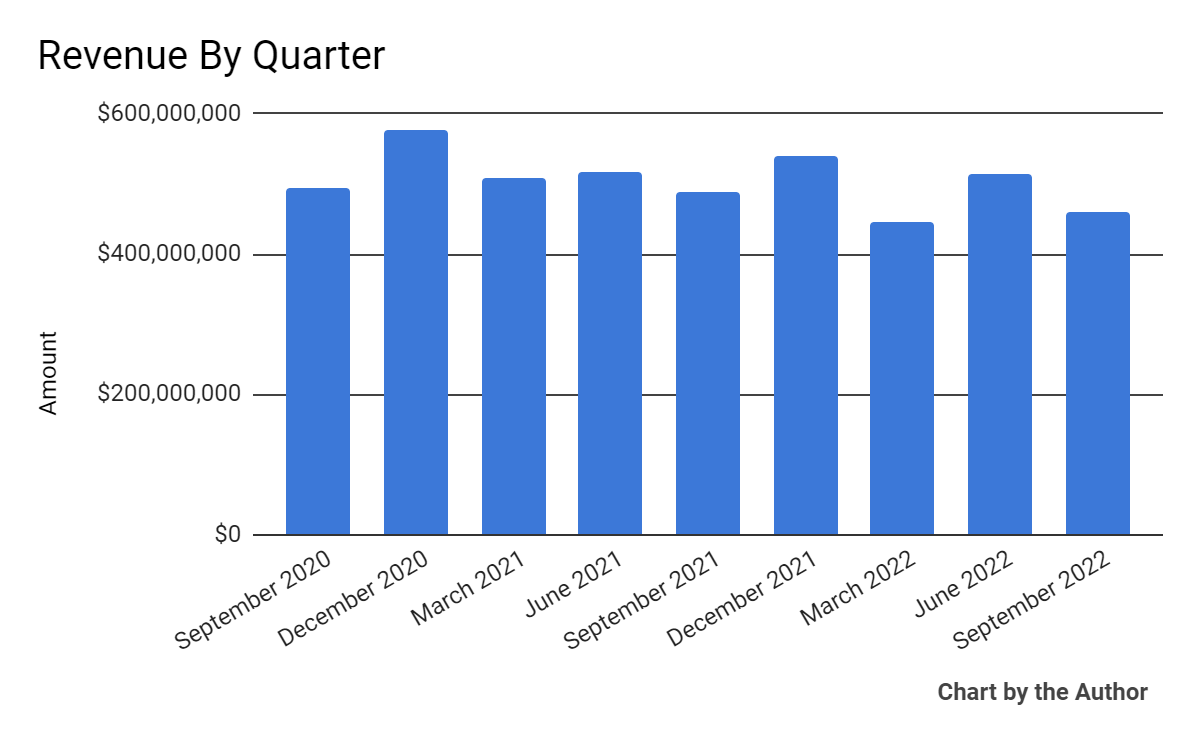

Total revenue by quarter has dropped per the chart below:

9 Quarter Total Revenue (Seeking Alpha)

-

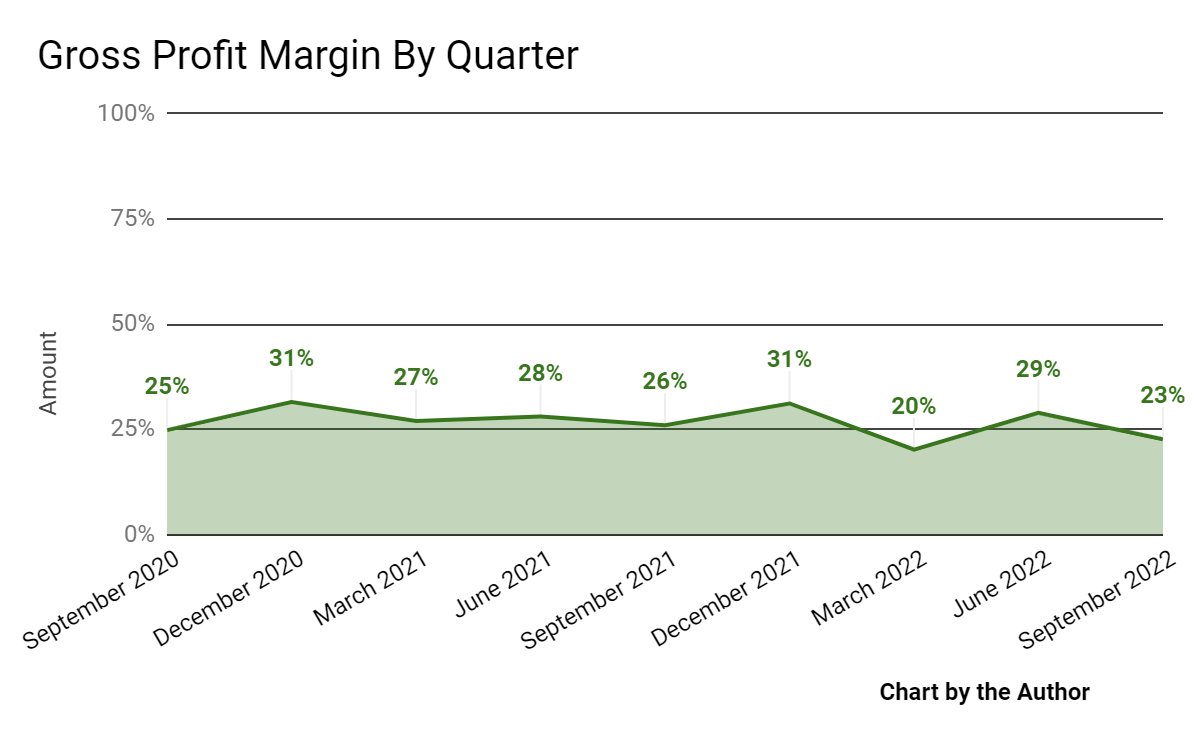

Gross profit margin by quarter has trended lower in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

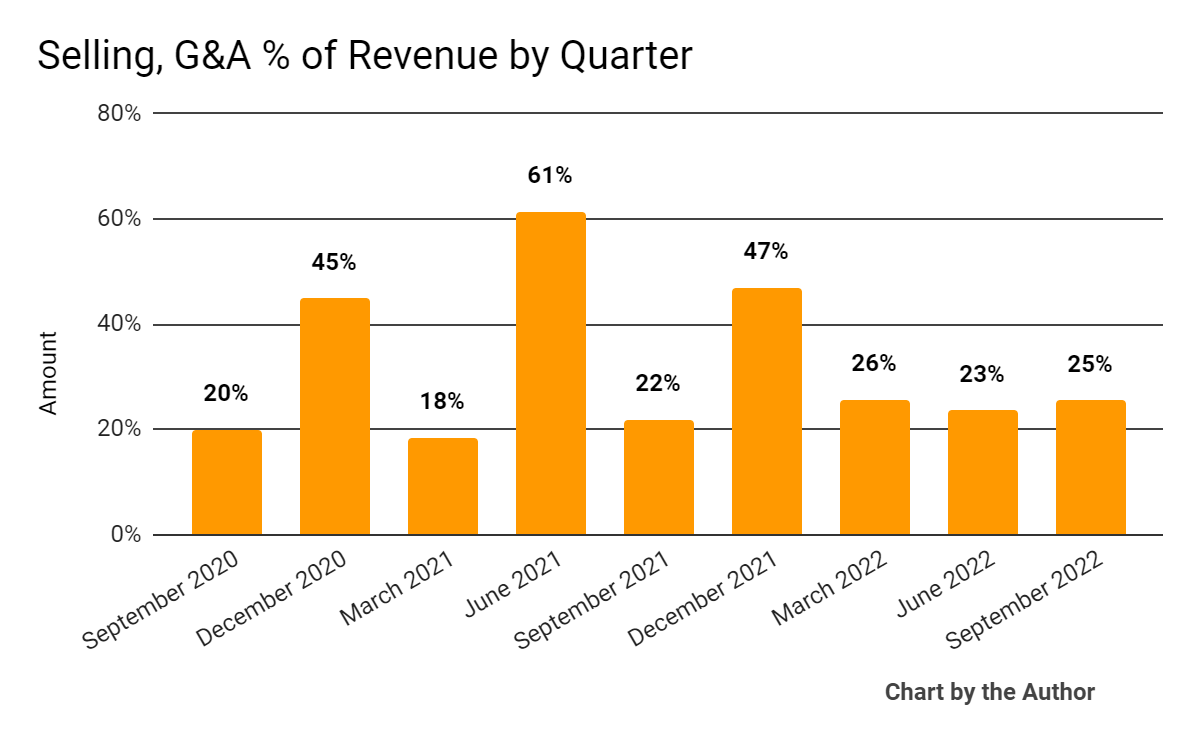

Selling, G&A expenses as a percentage of total revenue by quarter have produced the following results:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

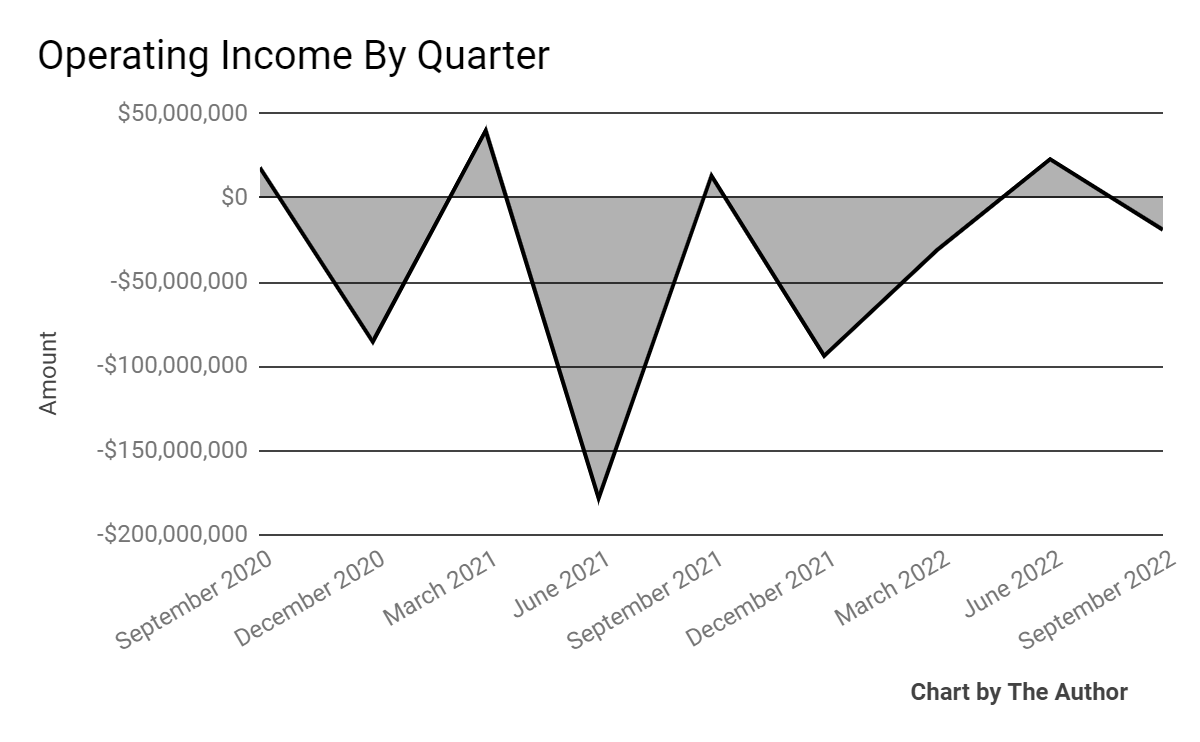

Operating income by quarter has been mostly negative in the last 9 quarters:

9 Quarter Operating Income (Seeking Alpha)

-

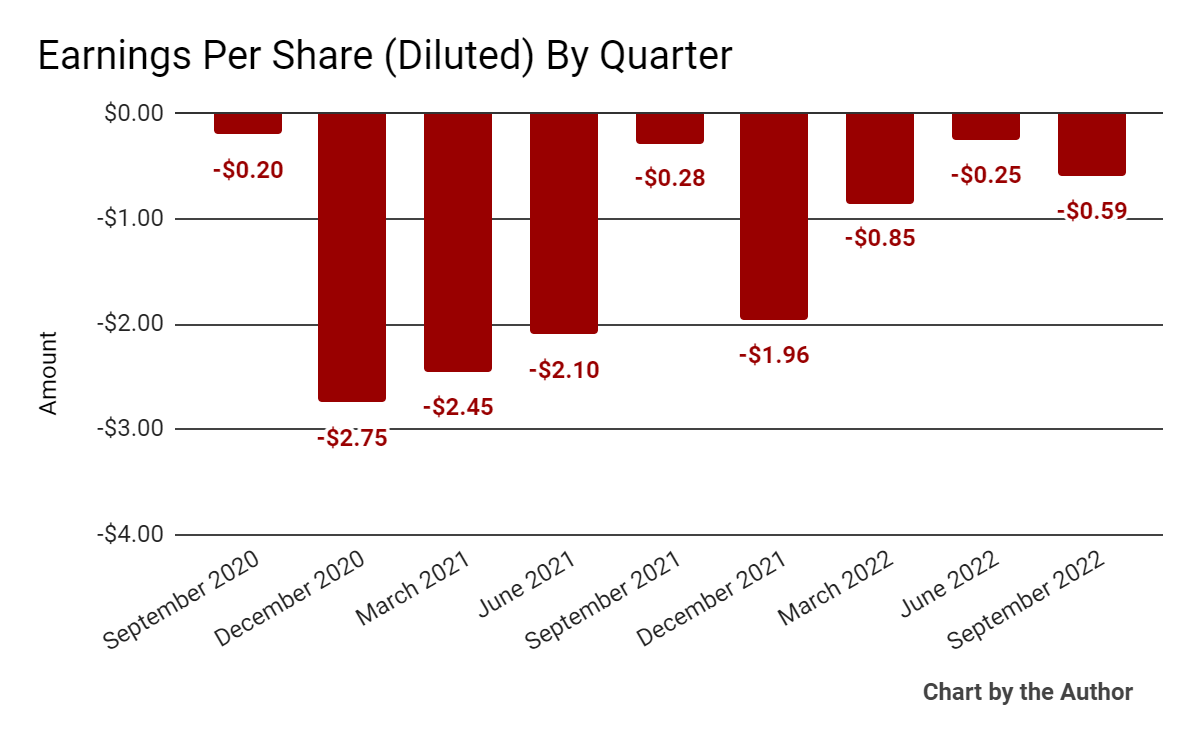

Earnings per share (diluted) have remained negative in the past 9 quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP.)

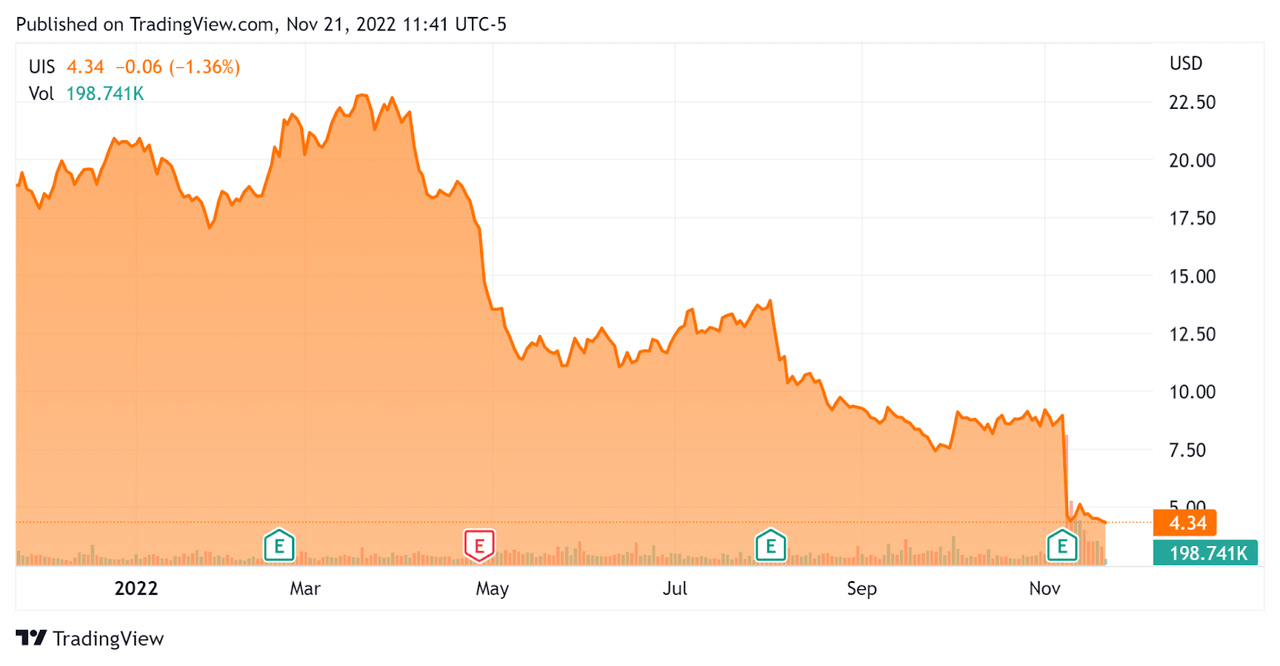

In the past 12 months, UIS’ stock price has fallen 76.7% vs. the U.S. S&P 500 index’ drop of around 15.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Unisys

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.3 |

|

Revenue Growth Rate |

-6.2% |

|

Net Income Margin |

-12.5% |

|

GAAP EBITDA % |

-3.3% |

|

Market Capitalization |

$298,260,000 |

|

Enterprise Value |

$545,560,000 |

|

Operating Cash Flow |

$45,800,000 |

|

Earnings Per Share (Fully Diluted) |

-$3.65 |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rates equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

UIS’ most recent GAAP Rule of 40 calculation was negative (9.5%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

-6.2% |

|

GAAP EBITDA % |

-3.3% |

|

Total |

-9.5% |

(Source – Seeking Alpha.)

Commentary On Unisys

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the firm’s continued transition toward higher value solutions such as its digital workplace solutions.

Leadership believes the digital workplace represents a $40 billion market, and the company is growing its digital workplace segment 50% year-over-year, much faster than the industry growth expectation.

The company is also shifting its cloud applications & infrastructure focus toward hybrid and multi-cloud management as clients continue their multi-decade transition from on-premises systems to the cloud or hybrid environments.

As to its financial results, revenue dropped 5.5% year-over-year by up to 0.3% in constant currency, with a 5.8% foreign exchange headwind due to the strong U.S. dollar.

Management did not disclose any company retention rate metrics and its Rule of 40 results have been poor.

Gross margin dropped 3.4% due to lower margin license renewals, while earnings per share worsened sequentially and year-over-year to negative ($0.59).

For the balance sheet, the company finished the quarter with cash and equivalents of $351.4 million and $515.9 million in debt.

Over the trailing twelve months, free cash flow was $16.7 million, of which capital expenditures totaled $29.1 million.

Looking ahead, management reduced its revenue guidance for 2022 to a negative 4.5% at the midpoint of the range on an as-reported basis.

The company is seeing delays in signing new customers, likely as a result of the current macroeconomic downturn and customer hesitation in taking on new contracts.

Management plans to:

“implement a cost reduction program to further improve our cost structure, continue to right size our real estate footprint to accommodate our hybrid working environment, and write off certain assets.”

Regarding valuation, the market is valuing UIS at an Enterprise Value / Sales multiple of just 0.3x.

The primary risk to the company’s outlook is the slowing economy, which in turn slows down sales cycles and the company’s transition toward generating revenue growth from its new cloud focus.

Until UIS management makes progress on the company’s transition to high value solutions, reignites topline revenue growth, and reduces its cost structure to achieve operating breakeven, I’m on Hold for Unisys Corporation.

Be the first to comment