hapabapa/iStock via Getty Images

Berkshire Hathaway’s Wind Generation

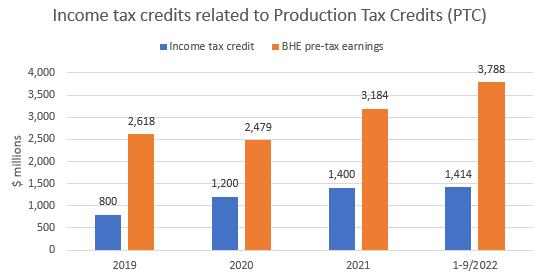

Berkshire Hathaway (NYSE:BRK.A; NYSE:BRK.B) owns several infrastructure assets that produce energy by different inputs. These are, to name a few, natural gas, coal, and wind. Of these, I view wind as the most interesting and the one with the brightest future ahead of it for a couple of reasons. First, it’s a renewable resource, i.e., you can never run out of wind. Second, the electricity production from wind doesn’t release any carbon dioxide into the atmosphere. That’s all fine and dandy, the capitalists would declare, but what about the economics of a wind turbine? Well, due to the renewable nature of wind, the U.S. government grants a tax credit on electricity generated from wind, which makes it quite profitable. See below the income tax credits BRK’s subsidiary Berkshire Hathaway Energy (‘BHE’) received during the period 2019 to Sep-2022. I have included BHE’s pre-tax earnings here as well to get the point over how significant the income tax credits are for BHE. For the astute reader, I took BHE’s pre-tax earnings from BRK’s financial statements, which means that BHE’s equity investments (e.g., OTCPK:BYDDF) are not included in these pre-tax earnings figures.

Income tax credits (Berkshire Hathaway Energy financial statements)

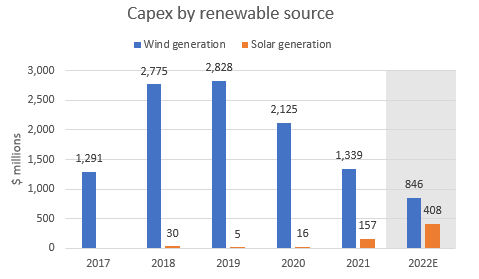

BRK benefits significantly from the income tax credits, which is likely why the company has spent a huge amount of capex to expand their wind generation facilities. In the graph below, I’ve included capex for solar power as well (I’ll explain why in a later section). The capex has however decreased during 2020-2022 which, in my opinion, reflects the fact that the income tax credits were set to expire already at the end of 2019 but has been extended for two 1-year periods (the income tax credit was first extended for the year 2020 and later for the year 2021). I believe the uncertainty regarding the extensions has dampened BRK’s willingness to invest heavily in wind generation during this period.

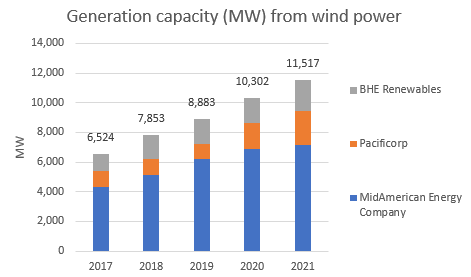

Capex spend in renewables (Berkshire Hathaway Energy financial statements) BHE wind power generation capacity by business (Berkshire Hathaway Energy financial statements)

So what does the Inflation Reduction Act got to do with all of this? First, we need to look at the “old” tax credit law to gain a holistic view of the situation.

The “Old” Tax Credit (Section 45 Production Tax Credit)

The production tax credit (‘PTC’) has already been in place since 1992. When a wind generation facility is functional, it will be eligible for the tax credit for the next 10-year period. The amount of the tax credit is 1.5 cents per kilowatt-hour (kW/h) using 1992 as the base year. The tax credit has an inflation adjustment component to it, which means that the current year’s (2022) tax credit is 2.6 cents per kW/h. The tax credit also has a phase-out period. For example, wind generation construction beginning in 2017 only receive 80% of the full tax credit (1.2 cents per kW/h) for the next 10 years. In the table below, you can see how the production tax credit phase-out has evolved. The plan was for the tax credit to expire completely after 2021.

| Year construction began | % of tax credit received |

| On or before year 2016 | 100% (1.5 cents per kW/h) |

| 2017 | 80% (1.2 cents per kW/h) |

| 2018 | 60% (0.9 cents per kW/h) |

| 2019 | 40% (0.6 cents per kW/h) |

| 2020 | 60% (0.9 cents per kW/h) |

| 2021 | 60% (0.9 cents per kW/h) |

| After 2021 | Not available |

Source: U.S. Energy Information Administration

The “New” Tax Credit (Inflation Reduction Act)

Most of the text below is sourced from McGuireWoods, although I have fact-checked it against several other sites including the original legislation.

Among other things, the Inflation Reduction Act (IRA) extended and modified the old production tax credit legislation in a couple of meaningful ways. I go through the main items below.

The IRA reintroduced the 10-year tax credit for wind projects starting construction after 2021. The new base rate tax credit is only 0.3 cents per kW/h (or 20% of the old 1.5 cents per kW/h tax credit) using again 1992 as the base year. However, a wind generation facility is able to receive a 5x multiplier on that 0.3 cents if certain requirements are met (more on these below). If achieved, the 5x multiplier would of course increase the tax credit to 1.5 cents per kW/h which equals 100% of the old tax credit. New wind generation that satisfies the modified requirements will thus receive a remarkable tax credit increase versus the wind facilities that started construction during 2017 to 2021 which earned between 40% to 80% of the tax credit.

The IRA will also reinstate the PTC for solar generation. This is why I wanted to show BHE’s increased capex in solar generation as they will also be able to capture the PTC from this source going forward.

I mentioned a few requirements that must be met to be eligible for the 5x multiplier. The requirements are “wage and apprenticeship requirements”.

- Wage requirement: all employees need to be paid the prevailing wages at the local rates for the construction and maintenance of the facility during the whole 10-year tax credit period

- Apprenticeship requirement: qualified apprentices have to perform a certain percentage of total labor hours. That percentage is 10% for projects beginning construction in 2022, 12.5% in 2023, and 15% in 2024 and later

The tax credit will be phased out at the beginning of the 2030s. Thus, wind generation that is starting production at the beginning of the 2030s will still be able to reap the full benefit of the tax credit into the early 2040s (assuming no further extensions). The takeaway is that wind (and other forms of renewables) will have a significant tailwind behind them for at least a couple of decades ahead.

Another interesting fact is that in 2025 and later, the tax credit will become technology-neutral, which means that all renewable energy generation will be eligible for the tax credit.

Furthermore, the IRA lists two separate requirements that can make a renewable producer eligible for two 10% additional tax credits (“PTC adder”).

- Domestic-content requirement: Construction material that is made primarily out of steel and iron must be 100% produced in the U.S. In addition, a certain percentage of the total cost of manufactured products must be allocable to the U.S. This percentage varies from 20% to 55% depending on if it’s onshore or offshore wind generation. This “adder” will be available after 2022.

- Located in energy community requirement: A wind generation facility that is located in an “energy community” will be eligible for the “adder” after 2022. On a high level, an energy community is defined to have had some sort of fossil fuel energy generation in the past. The details can be found here, for example.

Lastly, another modification of the PTC and an interesting option for a company receiving the PTC is to transfer it to a third party in exchange for cash. Older wind generation facilities can also take advantage of this rule.

How This Affects Berkshire Hathaway

So, what does this all mean for Berkshire Hathaway? I believe it’s a foregone conclusion that Berkshire Hathaway will be eligible for the 5x multiplier. When you give it some thought, it’s rational to conclude that the tax credit advantage for paying prevailing wages and satisfying the apprenticeship requirement are so significant that it wouldn’t make sense for BRK or anybody else not to satisfy it. It means that BRK’s greenfield/repowering projects most likely become significantly more profitable than before. To provide some evidence of my claims, I present this from BHE’s third quarter report (under the heading “Future Uses of Cash”):

As a result of the Inflation Reduction Act of 2022, all of the 310 MWs of current repowering projects not in-service as of September 30, 2022, are currently expected to qualify for 100% of the PTCs available for 10 years following each facility’s return to service.

I also tried to do some digging regarding the “PTC adders” but your guess is as good as mine whether BRK will be able to satisfy these additional requirements. I suppose the “located in energy community” requirement could be easier to satisfy as you only have to pick certain locations that qualify for the “adder”. I hope we will get some additional commentary on this in either BRK’s or BHE’s annual reports in a couple of months. If BRK would qualify for both adders, the PTC would increase to 1.8 cents per kW/h.

It will also be interesting to hear BRK’s or BHE’s thoughts on the option to sell the tax credits for cash to a third party. I’m not sure whether this would make sense in BRK’s case but some color on this in the annual reports would also be welcome.

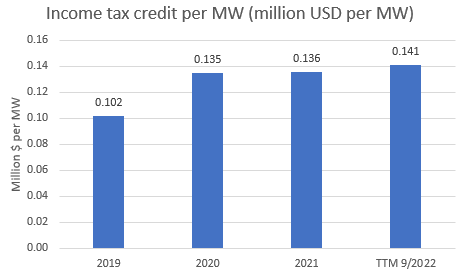

It’s a fairly imprecise exercise to try to quantify the effect that this will have on Berkshire Hathaway’s financials and ultimately on its value. I expect that the capex for both wind and solar will increase significantly in the coming years as it becomes more profitable to generate electricity from both sources due to the increased tax credits. The income tax credits should therefore increase meaningfully. But by how much? As I said, it’s an imprecise exercise, but I’ll amuse you with some simplistic calculations and assumptions. Taking the total income tax benefit for a particular year and dividing that by the previous year’s wind capacity (at the end of the year) in MW, we get a sort of income tax credit (in dollars) per MW metric. Below, you can see the result for 2019 to 9/2022 (trailing twelve months).

Income tax credit per MW in million USD (Author’s calculations)

I think it’s reasonable to assume that the metric would increase somewhat due to the increased PTC. Let’s assume it would increase to $0.145 million per MW (or $145 thousand per MW). Assuming BRK would add 1,250 MW per year from wind and solar generation (during 2017 to 2021 BRK has increased wind generation on average by 1,250 MW) they would increase the income tax benefit by $181.25 million p.a. That’s a nice sum, even for a huge conglomerate such as BRK. Give it 10 years and that has grown to $1.81 billion, which is already a significant sum for BRK. Some may view my assumptions as too conservative and therefore there could be some upside to this (I wouldn’t bet on it, however).

To conclude, although my calculations may be way off, I think it is clear that the Inflation Reduction Act is a net positive for Berkshire Hathaway and, ultimately, net positive for us shareholders.

Be the first to comment