André Muller/iStock Editorial via Getty Images

In conjunction with our recent publication on Enagás (OTCPK:ENGGF; OTCPK:ENGGY) and Mare Evidence Lab’s view on the European energy crisis, today we also provide a comment about Uniper (OTCPK:UNPRF). The European energy company engages its activities through three business segments: Russian Power Generation, European Generation, and Global Commodities. In 2016, Uniper was spun off from E.ON (OTCPK:EONGY).

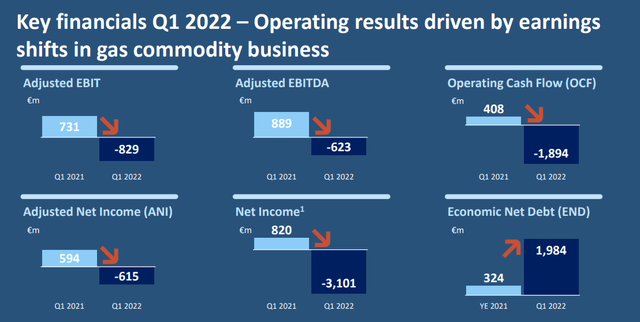

Looking at our European utilities universe coverage, Uniper is one of the most exposed companies toward Russia. The German energy giant owns various power plant facilities, but it is also engaged as a reseller of gas for B2B and B2C customers. After a turbulent Q1, a few days ago, the company cut its 2022 guidance.

Germany towards Uniper’s rescue

As a recap, we should say that the gas flows to Europe have been interrupted due to Gazprom’s force majeure. Indeed, on the 14th of July, the Russian company announced to its European customers, including Eni (E), Uniper, Omv, and RWE the closure of Nord Stream 1. Since mid-June, Uniper has received only 40% of the gas volumes stipulated in the contract from Russia and has been forced to turn to other markets, providing gas supplies at much higher prices. However, this attempt has drastically reduced the company’s liquidity and increased Uniper’s losses.

Germany has strengthened its national emergency plans, warning of the possibility of energy rationing in the coming winter if it fails to adequately fill the storage areas. In the meantime, the German government is studying measures similar to those that allowed it to support Deutsche Lufthansa (OTCQX:DLAKF) during the COVID-19 pandemic, ensuring the company a €9 billion aid package.

The CEO of Uniper, Klaus-Dieter Maubach, had anticipated in recent days that he had started discussions with the German government, taking into consideration various hypotheses from the increase of credit lines to public shareholding. After the nationalization of EDF in France, which was announced on the 6th of June, a new draft law is under study in Germany: this could reach the Bundestag in the next few days that also provides an equity purchase. An alternative mechanism is also envisaged to equally share the costs of rising gas prices among all consumers. Thus, the German government will be able to activate a general price adjustment clause in the event of even greater fluctuations in gas imports. According to the latest rumors (just released today), it seems that a limited gas pass-through will be passed to German customers, providing some relief to Uniper’s cash burn.

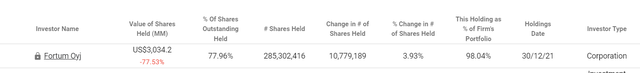

Fortum

Here there is an ongoing dispute between Uniper’s main shareholder and the German government. Reporting the news from Reuters, the latter says that “(Uniper) belongs to someone, someone who is solvent and can provide support. So it’s right to consider models where the owners also bear an obligation“. Whereas, at this stage, the Finnish Fortum has decided to not capital increase the German energy giant adding also that “The German security of supply businesses need to be owned by the federal state that has the required strong creditworthiness“.

Conclusion and Valuation

Looking at the latest words of the Berlin Minister of Economy Robert Habeck that affirms that “we will not allow a company of this magnitude to become insolvent and cause turbulence on global energy markets“, our internal team believes that a solution will be found. The sharp reduction in supplies by Gazprom has already led Uniper to reduce guidance for the whole of 2022, warning German consumers of significant increases in their bills. In numbers, Uniper could lose almost €10 billion by the year-end if this situation is not solved. To be more specific, based on a gas price of €130 per MWh, the company is losing almost €1.45 billion per month versus an average yearly operating profit of 1 billion forecasted in the latest plan presented (before the Russian invasion of Ukraine). At this stage, providing future estimates is quite complicated. Uniper should receive almost 200 TWh of gas until 2035/36 and it might be impacted by currency fluctuation after the force to accept the double euro-rubles payment model imposed by Russia. We currently provide a hold rating with a target price of €10 per share reflecting the very wide range of outcomes for the company.

Be the first to comment