ElsvanderGun/E+ via Getty Images

Since I wrote my “avoid Union Pacific Corporation stock” piece in late March, Union Pacific (NYSE:UNP) shares are down about 21.5% against a loss of about 16.7% for the S&P 500. This is obviously gratifying, but the price change means that I need to review the name again. I should also state that the company came back on my radar because it seems that investors are starting to pay attention to traffic data. I’m reminded that someone else (i.e., “me”) was paying attention to that sort of thing six months ago. And it’s that sort of “welcome to the party, I was following this long before you” attitude that is partially responsible for the current state of my social life. Anyway, Union Pacific came back on my radar recently, so I thought I’d revisit the name. After all, what was a bad investment at $270 might be quite compelling at $208. Additionally, the company has released financials again, so I want to review those. I’ll also write about the stock to see if there’s value at current prices. Finally, I wrote options on this name previously, and I need to remind investors about that trade.

Welcome to the “thesis statement” portion of the article, where I give you the highlights of my thinking, just in case you missed the title and the three bullet points above. Given the financial performance, and the unassailable moat, and the reasonable valuation, I think Union Pacific is now a “buy.” I would recommend buying at current prices for people who are just joining us. I should disclose that I can’t (yet) buy because I remain short what is probably an irresponsibly large number of puts. When the first crop of these expire in August, and holding all else constant, I’ll certainly buy. If you’re just joining this party, though, I would recommend buying shares. Also, if you’re comfortable, I think the options market is offering some very decent premia at the moment.

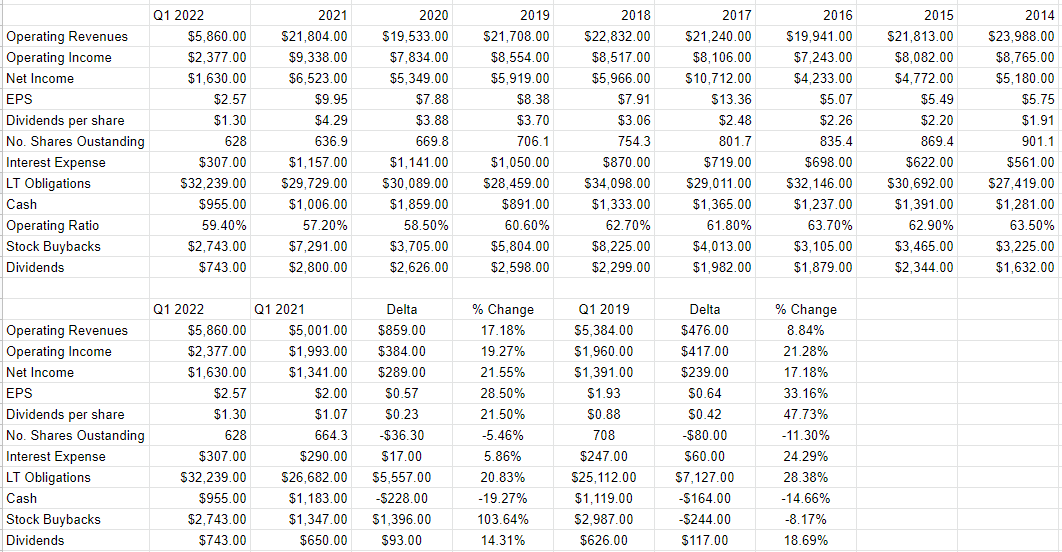

Financial Snapshot

In my previous missive on this name, I got a little salty because Union Pacific did better financially during the current period than it did in 2020. I then reminded readers that a global pandemic swept across the globe in 2020, massively impacting economic output and thus any comparisons to that period should be taken with a boulder of salt. My tune has changed from then to now. When we compare the most recent quarter to the per pandemic era, it’s obvious that Union Pacific had a very decent quarter. In particular, when compared to Q1 2019, revenue and net income during the most recent quarter were higher by 8.8%, and 17% respectively. At the same time, management has rewarded shareholders with a massive increase in dividends. Specifically, the dividend in 2022 was 21.5% higher than it was in 2021, and fully 47.7% higher than it was in 2019. In my view, this is important because a dividend obviously supports the price.

It’s not all smiles and sunshine at Union Pacific, though, as evidenced by the relative deterioration of the capital structure. Total debt increased just over $5.5 billion from last year to this, and cash declined about $227 million. As might be expected, interest expenses increased $17 million, or 5.86% over the year.

The Buyback

Finally, I want to write about the buyback activity here, so I’ll write about the buyback activity here. On April 1st, the Board authorized the repurchase of another 100 million of the company’s shares by March 31, 2025. It seems that the company remains intent on buying back its stock. This may be good, this may be bad because, as the saying goes, the devil is very much in the details. With that as background, let’s review the most recent buyback activity, shall we?

According to note 15 of the latest 10-Q, during the quarter, the company repurchased 11,014,201 shares for an average price of $249.95. They spent $2.753 billion of shareholder wealth to do that. I think it’s also relevant to note that during the quarter, long-term debt increased by $2.51 billion, up 8.4% from the end of 2021 to Q1 2022. So, the company could have cleaned the balance sheet up slightly, but instead, they chose to buy stock back. The fact that the Board has authorised them to buy 100 million more suggests this will remain a priority for the firm.

Some suggest that a buyback is “good” if it happens at a price below the current market price, and “bad” if it happens above the current market price. This isn’t a sound way to view it in my opinion, because it assumes that the current market price is somehow correct. If that were so, we wouldn’t be here, writing about and reading about stocks. An assumption undergirding this whole enterprise is that stock prices are very often wrong. Thus, I’m not going to judge the company too harshly for this buyback price. Yes, it happens to be above the current market price, but that’s not too important in my view. What’s much more important is the valuation at which the buyback happened. If they bought shares back at valuations that are unreasonable, then we’re gonna have a problem. So, for the moment, please just put a pin in that $249.95 price.

Union Pacific Financials (Union Pacific investor relations)

The Stock

I’ve made the point that a stock is quite distinct from the underlying business to the point of tedium. If you think that fear of being tedious will prevent me from repeating myself, think again! I’m very comfortable leaning into tedium, so here goes. A business and a stock are different things. A business buys a number of inputs, including locomotives, railroad ties, labour, performs value-adding activities to those, and sells transportation services at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company. The crowd changes its views about the company relatively frequently which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. This is troublesome in some ways, but it also represents opportunity for us. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. This is why Warren Buffett once famously quipped that “bad news is an investor’s best friend.”

If you thought I was going to make this point theoretically and leave it at that, you’ve got another thing coming, I’m afraid. If I see an opportunity to belabour a point, I always take it. I’ll push the above point further by using Union Pacific stock to demonstrate. The company reported its latest quarterly results on April 21. If you bought that day, you’re down about 14.75% as of last night’s close. If you waited exactly one month, you’re down only 2.6%. Not enough changed at the firm over such a short time to justify a 12%+ variance in returns. So, the stock is a very volatile thing, and the person who buys cheaper does better or “less badly.”

Anyway, as my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins.

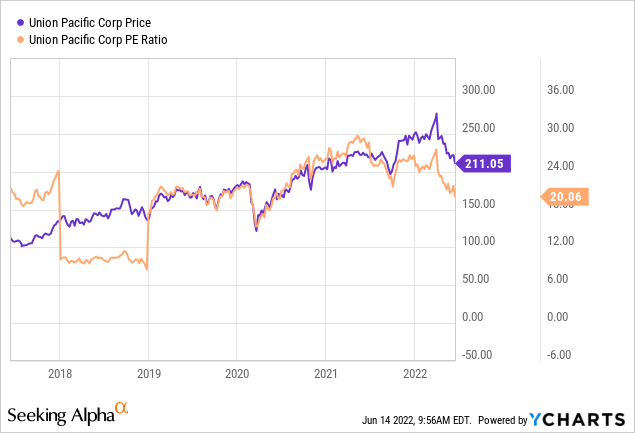

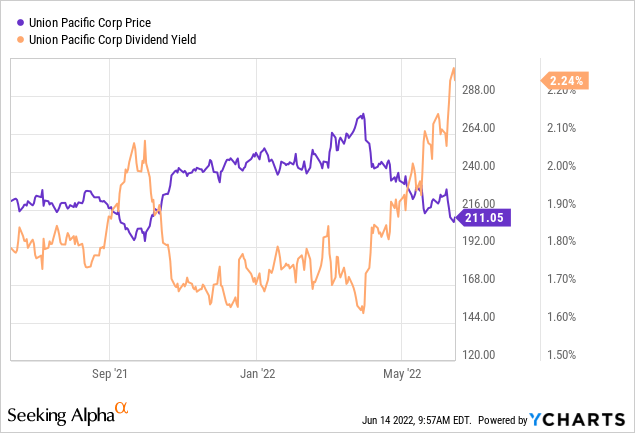

In the previous article on this name, I was unimpressed by the fact that the PE was floating around 26 times, and that the dividend yield was just under 1.7%. Today, the shares are ~23% cheaper on a PE basis, and the yield is very near a 2-year high, per the following:

In addition to looking at simple ratios, I also want to try to understand what the market is currently “thinking” about a given company’s long-term future. This involves taking a finance formula and isolating the “g” (growth) variable to work out long-term growth expectations embedded in the current price. When I last reviewed this name, the market was assuming a perpetual growth rate of ~6% for this company, which I considered to be too rich. At the moment, it’s assuming a growth rate of ~4.9%. This might be a bit optimistic, but it’s not as egregiously expensive as it was previously. In my experience, investors like to learn about how to spot current growth assumptions. If you have an interest in this approach, I’d check out “Accounting for Value” by Penman and “Expectations Investing” by Mauboussin and Rappaport.

Given the above, I’d normally be comfortable buying these shares at current prices. The issue for me is that I’m short 10 puts with a strike of $175, so I can’t initiate a long position here until my August puts expire (more on those below). If I were just coming to this story, though, I’d be comfortable buying.

Buyback Assessment

To refresh your memory, earlier in the article I pointed out that the company bought back shares at about $250 each. That price lines up with a dividend yield of ~1.89% and a PE of about 23.7. That’s too rich a valuation, in my view, and I think the company would have done better to either pay down some debt or hand out a special dividend to owners. I’m of the view that a company should buy back stock when the valuation is compelling, and it wasn’t compelling in this case. I’d give the latest buyback a “C” grade.

Options Update

In case you don’t happen to have your “Almanac of Doyle’s Trades” handy, I’ll refresh your memories and remind you that I’m short the August puts with a strike of $175, and the January 2023 puts with the same strike. I sold the former for $0.87, and the latter for $5.85. As of now, the former is asked at $2.60, and the latter is asked at $7.90, so each of these trades is very much “under water.” I’m comfortable with that because I still consider this to be a “win-win” trade. If the shares continue to fall, and I have the option to buy at $175, I’ll call that a win, and I’ll call the $6.72 per share in premiums received to be “gravy.”

It’s not all animated bluebirds and rock candy for me, though. Because I’ve got a rather large amount of capital committed to this trade, I’m not willing to buy more at current prices. So an added risk for me, in this case, is that the shares spike in price between now, when they’re reasonably cheap, and the third Friday of August, when my first crop of $175 puts expire. This is a risk in this case because of the high price of the strike price. If I were short puts with a strike of, say, $40, I’d probably be willing to bite the risk bullet and buy the stock before the options expired. That’s not possible in this case, though. The phrase “too rich for my blood” keeps flashing before my eyes as my mouse hovers over the “buy” button. This is because I’m potentially on the hook to come up with $175,000 if I’m exercised. That’s a spicy meatball.

My whining aside, if you’re just joining us, I would recommend taking advantage of the current market to sell some of the August puts with a strike of $175. These are currently bid at $2.20, which I consider to be a “win-win” trade. If the shares drop below $175 as I hope they do, you’ll be obliged to buy, but will do so at a price that lines up with a dividend yield of about 2.7%, and a PE of about 16.4 times. That is a win in my view. If the shares remain above $175, you’ll pocket a reasonably decent premia for two months of what could only very loosely be called “work.”

I should also point out some more of the risks associated with this strategy, other than the one enunciated above. Broadly speaking there at two types of risk associated with this strategy in my view, the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices, I’d be willing to pay. So, I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So my first bit of advice is to only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay. Take my word on this one, as it’s informed by painful history. For example, I could have made about $15 in premia by selling August at the money puts. It would have been disastrous to give in to temptation and sell these back then.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that Union Pacific stock price goes parabolic and hits $300 per share between now and the third Friday of August. The puts will expire worthless, which is a great outcome in some ways, but the investor won’t catch any of the upside from the stock. This can be emotionally painful and it’s one reason why I’m hoping that the market doesn’t rally between now and the end of August.

Secondly, it can be emotionally painful when the shares crash below your strike price. So far whenever this has happened to me, things have worked out well over the long term, because I insist on only ever writing puts at “screaming buy” strike prices. That said, it has been emotionally stressful in the short term on occasion. If you’re going to sell puts, please be aware of this phenomenon.

If you understand these risks and can tolerate them, I would recommend that you sell puts. I think they enhance the return on the stock and lower the overall risk of the investment. It may seem strange to write about the risk-reducing, yield-enhancing potential of these in a section about risk. I can be strange. Get past it.

Conclusion

I think this stock now represents a reasonably good investment, and so would recommend buying some at current prices. The underlying business is doing well, and management has (mostly) done a good job of treating owners well. I wish they had paid down debt rather than buy stock at elevated valuations, but complaining about expensive buybacks in the current environment is like handing out speeding tickets at the Indy 500 in my estimation. Thus, I can be frustrated by it, but we work with what we’ve got. Union Pacific has an unassailable “moat”, and the valuation is now attractive. For that reason, I would recommend people buy. In addition, I think it’s possible to earn some decent premia by selling puts that have relatively little time value left.

Be the first to comment