Poulssen/iStock Editorial via Getty Images

I see an investment in Unilever (NYSE:UL, OTCPK:UNLYF) as a potentially attractive defensive play amidst macroeconomic challenges such as inflation, rising real yields, and risk-averse investor sentiment. The company’s stock, however, is not necessarily cheap, as I calculate a fair implied share price of $52.41, indicating less than 20% upside. I assign a HOLD recommendation.

About Unilever

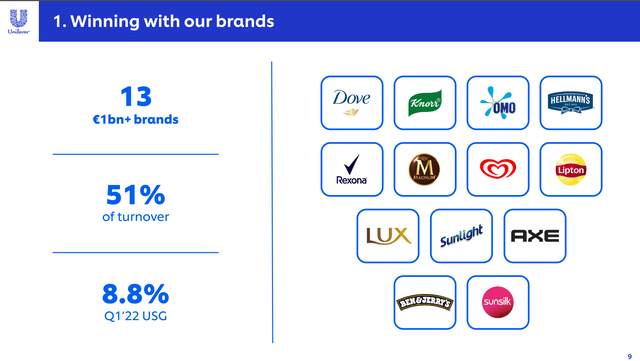

Unilever is one of the world’s biggest conglomerates in the consumer goods industry. The company owns a portfolio of more than 400 brands and develops, manufactures and markets products in three main categories, including Food, Home Care and Personal Care. Many of Unilever’s assets enjoy high brand equity and strong consumer demand, as the company owns names such as Dove (soaps), Axe (deodorant), Ben & Jerry’s (ice cream), Knorr (soups) and Lipton (tea). Unilever operates worldwide and sells in more than 190 countries.

Unilever Investor Presentation

Diversified revenue exposure

Investors might appreciate Unilever for the company’s defensive profile, with strong resilience in challenging/recessionary market environments. Reflecting on the current downturn, I believe two pillars will support Unilever’s fundamentals-and thus stock price.

Firstly, consumer goods in the food and personal care vertical are inherently relatively resilient in an economic downturn. Moreover, many of Unilever’s products are supported by brand equity, which further supports volume and margins.

Secondly, Unilever’s business operations are well diversified, both from a product and from a geographical perspective. As of 2022, the Beauty & Personal Care is approximately 40% of sales, the Food & Refreshment accounts for another 40% and Home Care is about 20%. With regards to geographical exposure: the U.S. being the company’s largest single country only accounts for about 20% of total sales. Notably, more than 50% of the company’s revenues are generated in emerging markets.

Financials

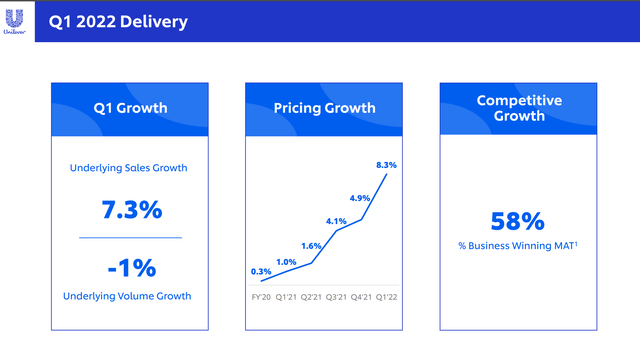

In Q1 2022, Unilever managed to perform well, despite the inflationary environment and the slowing economy. In fact, the company managed to record a sales growth of 7.3% YOY, which was driven by 8.3% from pricing and a negative 1% from lost volume. For the full year 2022, management guided for 4% – 6% sales growth and a 16% – 17% EBITDA margin. This would imply approximately a five-percentage point decrease in EBITDA margin as compared to the 2021 (EBITDA margin was 1.7%).

Unilever’s business model is relatively resilient to inflation as the company enjoys strong pricing power vis-à-vis customers. This is due to two reasons: First, consumption of consumer goods–especially low involvement categories in the food and consumer staples vertical–is generally not a function of price. Secondly, many of Unilever’s products are supported by strong brand equity, which is arguably the best antidote to price-sensitivity.

Unilever Earnings Presentation

Unilever closed the year 2021 with a slightly stretched balance sheet. The company recorded $5.1 billion of cash and cash equivalents and $34 billion of total debt. Furthermore, the company also has $3 billion of preferred equity debt. But given the company’s strong cashflow from operations, which was $9.07 billion in 2021, the company’s debt position should arguably not concern investors at this point.

How analysts see Unilever

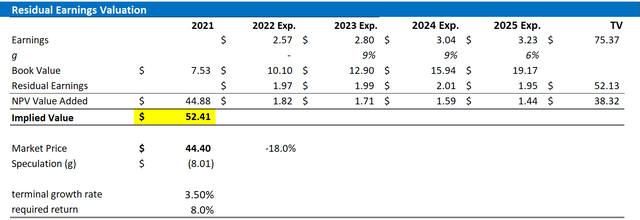

Analysts expect Unilever’s revenue and earnings to grow attractively for the next few years. Consensus estimates as available on the Bloomberg Terminal indicate revenues for 2022, 2023 and 2024 of $61.81 billion, $64.12 billion and 66.36 billion, representing a 3-year CAGR approximately in line with nominal GDP growth. Respectively, EPS is estimated at $2.57, $2.8 and $3.04. Investors may appreciate that there is not much volatility in revenue or earnings.

Residual earnings valuation

If analysts are correct, what would be a fair valuation for Unilever? To answer that question and value the company, I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS till 2024, a WACC of 8% and a TV growth rate equal to expected nominal GDP growth at 3.5%. I feel these estimates are very reasonable to anchor a valuation, but not necessarily conservative.

Based on the above assumptions, my valuation estimates a fair share price of $52.41/share, implying an approximate 18% upside potential based on accounting fundamentals.

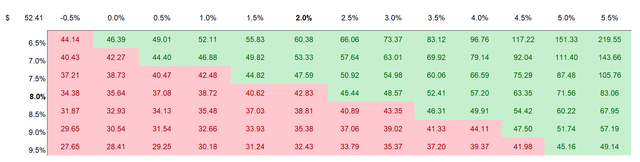

Investors might have different assumptions with regards to Unilever’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus; Author’s Calculation Analyst Consensus; Author’s Calculation

Risks

Unilever is arguably quite low risk given the company’s relatively non-cyclical exposure and consumer awareness based on strong brand equity. Moreover, the company has proven earnings resiliency even in challenging macro-environments. I argue that the company’s strong global presence, scale and brand portfolio provide a solid competitive moat. But investors should note the low/average business growth of Unilever. Short term downside risks could be currency exposure and compressing profit margins. As potentially long-term risks I have identified non-strategic/non-economic M&A activity and structurally changing market trends–such as changing demographics and consumer preferences.

Conclusion

Unilever could be a solid investment given the current market environment, as UNLYF investors are very likely to outperform both inflation and the broad market. I feel this is the maximum that investors can hope for, as the stock market, real estate, fixed income, alternative assets such as bitcoin and venture capital, et al. are losing value.

I value Unilever with a $52.41/share target price. That said, my target price is relatively close to the current market price of $44.4/share and a BUY recommendation would not really be justified. HOLD.

Be the first to comment