Melpomenem/iStock via Getty Images

Investment Thesis

Unibail-Rodamco-Westfield (OTCPK:UNBLF), which I will refer to as URW hereafter, is in a peculiar position. On the one hand, rising rates create a difficult environment against which it has to deleverage its US operations. On the other hand, the company has locked in interest rates for some of its debt at very low levels and can now buy them back at a steep discount, sometimes above 50%.

Investors have shunned the shares this year as most peers have resumed dividend payments and URW shareholders have to wait another year. However, true to the maxima when life gives you lemons you make lemonade, URW may combine its need to retain earnings and the discount on its bonds to achieve excellent results.

I think the company will regain its footing as the premium European REIT and should outperform Klepierre (OTCPK:KLPEF) given the unique debt buyback opportunity, the small exposure to offices and the traditional premium for its prime locations. Should central banks pivot on their hiking plans in 2023, URW will stand to benefit the most thanks to its very high net debt to market capitalization (3.6 times).

Company Overview

As per the Q3 2022 earnings release:

The Group operates 80 shopping centres in 12 countries, including 45 which carry the iconic Westfield brand. These centres attract over 800 million visits annually and provide a unique platform for retailers and brands to connect with consumers. URW also has a portfolio of high-quality offices, 10 convention and exhibition venues in Paris, and a €3 Bn development pipeline of mainly mixed-use assets. Currently, its €55 Bn portfolio is 87% in retail, 6% in offices, 5% in convention and exhibition venues, and 2% in services (as at June 30, 2022).

Operational Overview

While occupancy remained flat Q/Q at 93.1%, the company boosted its Adjusted recurring earnings per share (AREPS) target to at least 9.1 EUR/share, driven by strong operating momentum, a weaker euro and a higher ECB rate at which it can park its 3B EUR of cash. Indeed, if the rate on the ECB deposit facility reaches 2% by the end of 2022, its cash which was bringing in nothing at the start of 2022 may now raise AREPS by some 0.4 EUR/share in 2023. I think this will offset the effect of disposals to an extent.

Post Q3 2022, URW refinanced an extra 0.55B EUR of debt, boosting its cash position to 3.4B EUR, already above the 3.2B EUR of debt maturing by December 2024.

Let’s now dive deeper into the unique debt situation faced by the company.

The Debt Buyback Opportunity

Given the continued rise in interest rates (which admittedly should be peaking in the near future) and after the bird’s eye overview of the total impact of refinancing (4.5 EUR/share in AREPS pre-indexation) in my previous article, I decided to dive deeper and see what is the potential to repurchase debt at a discount.

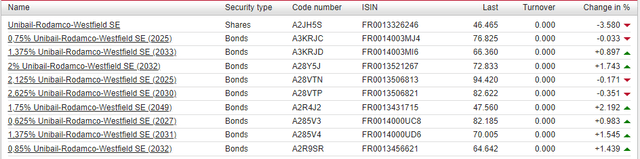

As things stand, all of URW’s bonds trade below par, some significantly so:

Since URW is a significant issuer of debt, it has a whole section on its website dedicated to debt investors. Given the current interest rate environment and the fixed interest rate nature of its debt, URW has two main options:

1. Focus on higher AREPS. This will entail paying back near-term debt at par and allowing the below-market interest rates on its long-term bonds to boost AREPS. This option also results in a better interest rate coverage ratio but a higher loan-to-value ratio.

2. Focus on lower loan-to-value. This will entail drawing down on current liquidity and/or refinancing near-term maturing debt at higher market interest rates, while using current earnings and/or disposal proceeds to retire long-term debt below par. This option will result is an inferior interest rate coverage ratio as compared to option one, but a better lower loan-to-value ratio.

For example, its XS0942388462 2.5% bond maturing next year trades at 99.5% of par:

Figure 1: Debt maturing in 2023 and trading close to par

Boerse Frankfurt

Retiring the bond outright rather than refinancing it still lowers the loan-to-value ratio, but not as much as buying back some of its FR0013431715 1.75% bond maturing in 2049 at 47% of par:

Figure 2: Debt maturing in 2049 and trading >50% below par

Boerse Frankfurt

In essence, option one above entails retiring the short-dated bond at par, lowering the loan-to-value ratio one to one for each euro spent on debt reduction. In contrast, option two would be to focus on buying back its long-date bond, lowering the loan-to-value ratio two to one (since the current price is below 50% of par) for each euro spent on debt reduction.

Higher AREPS or a lower Loan-to-Value

At the end of the day, given its capital structure of 23.3B EUR proportionate net debt (taking into account actual building ownership percentages rather than the IFRS approach of consolidating properties of above 50% ownership) and a market capitalization of 6.5B EUR, URW will likely have to discuss the exact approach to lowering debt with its creditors.

That said, the company has an interest to take advantage of current market developments and optimize lifetime cashflows to shareholders. Thus, I think favoring a high AREPS approach is the way to go since it will allow the company to maximize the effect of fixed low interest expenses, at the same time utilizing inflation-indexation of rents, before it has to repay creditors at par. Of course, some buyback of long-dated debt to reduce the loan-to-value quickly could play a role as well.

Market-implied Net Initial Yield Valuation

To calculate the market-implied net initial yield I will use the EPRA Net Disposal Value (NDV) which I estimate stood at around 120 EUR at the end of Q3 2022, after adjusting it downwards by 35.83 EUR/share for the fair value of interest rate debt as per the H1 2022 earnings release (no NDV figure was released with the Q3 2022 results):

Market-implied net initial yield = Valuation net initial yield / Division factor where:

Division factor = Price/NDV Ratio * ( 1 – Loan-to-value ratio) + Loan-to-value ratio

Substituting with my estimates for Q3 2022, namely:

1. EPRA NDV = 120 EUR

2. Loan-to-value = 41.5%

3. Valuation net initial yield = 4.3%

4. Closing price at the time of writing = 46.79 EUR

You get a Price/NDV Ratio of 46.79 /120 = 0.39, a division factor of 0.71 (0.39 * (1-0.415) + 0.415 ) and a market implied net initial yield of roughly 6.7%. Accidentally, I estimate largest peer Klepierre currently trades around a market implied yield of circa 6.7% as well, with the URW premium I observed over the last year in terms of market-implied rate gone. Remember though that URW has a 6% office exposure, unlike Klepierre which is more pure-play retail.

Santa Anita Disposal

During the quarter the company closed on the sale of its Santa Anita, CA property at a sub-6% net initial yield and a 10.7% discount to the December 2021 valuation.

While the sub-6% yield is much higher than the 4.9% net initial yield achieved for European disposals, it is still lower than the market implied yield of around 6.7%. It is also not too far above my pessimistic 5.75% net initial yield scenario for US disposals in my 2021 article. At the time interest rates were still lower and the loan-to-value reduction achievable today is greater, given the above-mentioned discount on long-dated bonds.

Investor Takeaway

The biggest risk I see to the investment case is that interest rates rise even further, dragging down US disposal proceeds, potentially delaying the 2024 dividend and in a very adverse scenario, resulting in a dilutive capital raise to fix the capital structure.

However, I think the situation with rates is stabilizing and URW will benefit the most of all European REITs once the market comes to terms with the new interest rate curve. The company is in a unique position, having to retain earnings, but also able to deploy them against its distressed debt, to the maximum effect.

Personally, I will continue to monitor the shares and may open a position after the December options expiration.

Thank you for reading.

Be the first to comment