Nikada/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ:AAPL) analyst Jim Suva has come out stating that, with Apple’s second quarter earnings, the company could boost dividends by 5 to 10% and buybacks by ~$80-90 billion. Unfortunately, as we’ll see throughout this article, even if that happens, Apple is still overvalued without the ability to provide continued shareholder rewards.

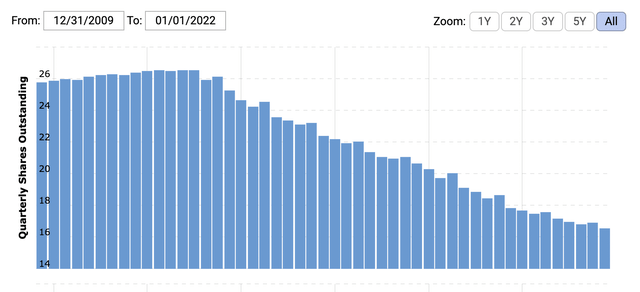

Apple Buyback History

Apple has a long history of buybacks that have been incredibly comfortable for the company.

Apple has become the poster child for share buybacks. Since the program started in 2012, the company has spent a substantial $467 billion, making it the largest spender on share buybacks out of any company. Through that, the company has managed to reduce its outstanding shares from 26 billion to roughly 16 billion on top of managing employee costs (dilution from RSUs).

That means the company’s cost per share for the entire program so far has been roughly $47/share, or roughly 25% of current share prices of $167 / share. Given that the company used 16% of the market capitalization to repurchase shares at these prices, the buyback program has had a substantial effect on the company’s current value.

However, to continue the effects going forward, it’ll be hard. Since 2012, the company has repurchased roughly 40% of its outstanding shares at the time or 4% annually. To continue, the company would have to spend more than $100 billion annually on buybacks, or more than double the rate it’s spent on buybacks so far.

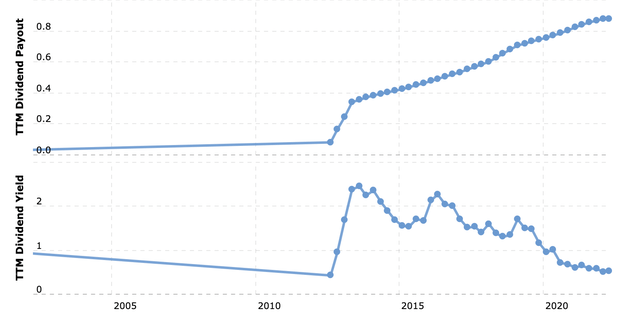

Apple Dividend

Apple has had a modest but steadily increasing dividend.

Apple’s initial dividend was impressive at more than 2%. Unfortunately for the company, multiple expansion has caused that dividend to decrease substantially despite increasing dividend payouts. That’s now at roughly 0.5% yield, and given the company’s FCF yield, we don’t see that increasing significantly in the future.

Specifically, a 2.5% dividend yield would now cost the company more than $70 billion annualized, a significant part of its FCF.

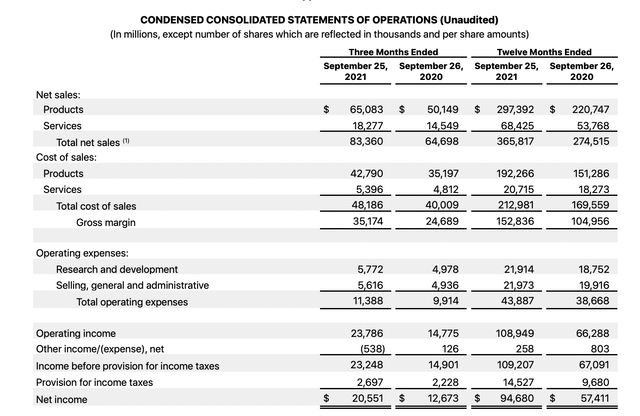

Apple FCF Yield

Apple’s issue versus its current valuation is its FCF yield.

Apple has dramatically increased its net income YOY on the back of much slower revenue growth. Part of that has been accelerated by COVID-19 related growth but the company has earned almost $95 billion in net income, or an FCF yield of roughly 3%. The company’s operating expenses have increased by 10% but it’s been supported by a 30% growth in net sales.

However, despite this substantial earnings growth, the company’s low FCF yield still hurts its shareholder returns. A 10% dividend growth, as stated potentially, would take dividends to a mere 0.6%, and similarly $80 billion in annual buybacks would utilize most of the company’s cash flow and take total shareholder returns to roughly 3.5%.

Among the company’s issues is stock-based compensation expense approaching $8 billion annually. That’s a very real part of the company’s operating costs, and it’s not expected to go down anytime soon. It costs the company roughly 10% of its allocated buybacks or roughly 0.3% of its market capitalization.

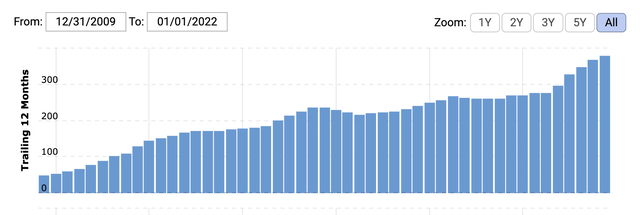

Apple Growth

Apple has achieved consistent revenue growth, however, the revenue has gone through cycles of boom and bust.

Specifically, especially for iPad and Mac sales, Covid-19 related trends have consistently helped the company’s revenue, which has grown substantially over the past year. However, we expect that growth to peter out from a combination of return to the office and the impacts of inflation on budgets for replacing higher-end items.

With a 3% FCF yield, Apple needs to achieve significant continued growth to justify its valuation. Profits and cash flow need to expand significantly from current incredibly high levels because of the pandemic, which would hurt the company’s ability to provide continued shareholder returns.

Thesis Risk

The largest risk to our thesis is Apple’s brand. Apple has the most valuable brand in the world and has built up substantial loyalty from impressive products. The company, versus a decade ago, now has the AirPods and Apple Watch as products that most iPhone users purchase and consider essential as part of the “ecosystem.”

There’s no guarantee the company won’t be able to launch more products like that, increasing earnings growth and minimizing its valuation.

Conclusion

Expectations are that with Apple’s next earnings, the company could expand its buyback program and dividends significantly. Unfortunately for investors, when you’re approaching a $3 trillion market capitalization, you need a massive capital program in order to move the needle. The company has spent ~$500 billion on buybacks, which only moved the needle at below current prices.

The company’s FCF yield means that with dividends plus share buybacks, the company will be able to move share prices substantially. The company will be spending $10s of billions if not $100s of billions in cash, but struggle with its current valuation to generate continued shareholder returns. In our view, that makes the company a less valuable investment.

Be the first to comment