Just_Super/E+ via Getty Images

Belgian specialty chemical company Umicore (OTCPK:UMICF) has finalized the creation of a battery materials production joint venture with PowerCo, Volkswagen’s (OTCPK:VWAGY) battery unit, for its unified cell program. The terms of the agreement were surprisingly favorable, with Volkswagen offering a guaranteed return on investment for Umicore’s long-term production targets. This not only significantly de-risks the earnings growth outlook but also underlines the company’s competitive position in the EV space. With expectations for at least one other major announcement in H2 2022 as well (guided at this year’s Capital Markets Day event), Umicore’s growing leadership in cathode materials is compelling.

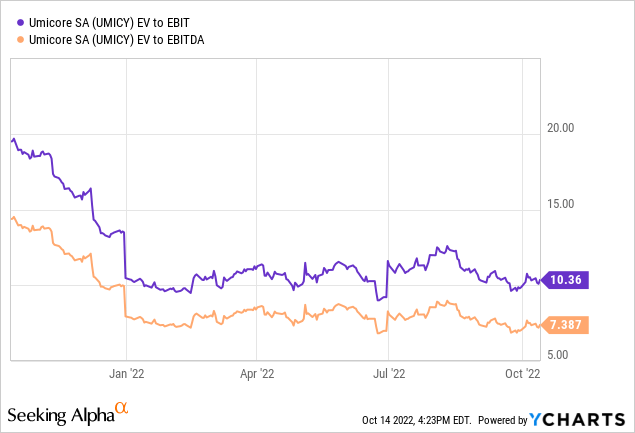

That said, this year’s commodity price upswing across platinum group metals and nickel looks set to turn in the coming months, posing more risk than reward to the outlook. With balance sheet risks also elevated from the upcoming capital-intensive production plans, the ~10x EV/EBIT (or ~7x EV/EBITDA) valuation seems a tad pricey.

Completing the Umicore/Volkswagen JV

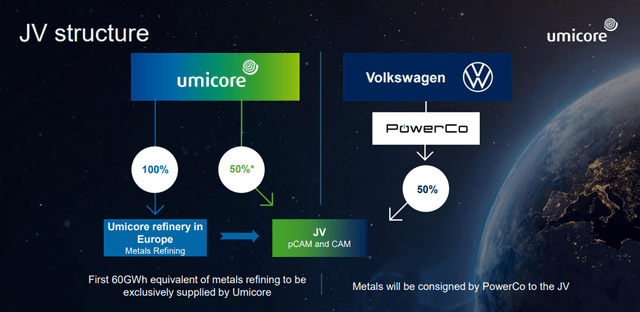

Umicore has disclosed the creation of a JV with PowerCo for battery materials production in Europe for the Volkswagen unified cell program (a ‘prismatic’ EV battery cell design projected to reduce battery costs by up to 50%). Per the deal terms, the venture will be set up as a joint 50/50 partnership, although Umicore will have de-facto control via a one-share advantage over Volkswagen/PowerCo, as well as operational control and the ability to appoint the CEO.

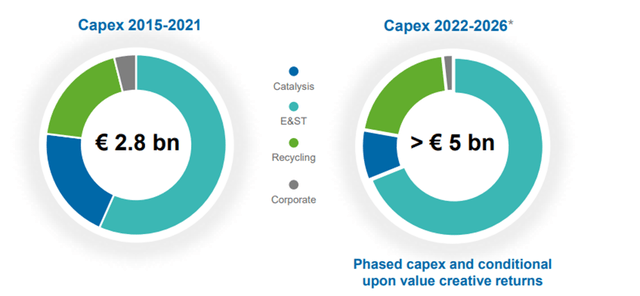

Another positive surprise from the announcement was that the JV spans pre-cursor cathode active materials (pCAM) and refining as well. Finally, Umicore will be granted exclusive supply of the first 60GWh of refined materials for pCAM production. The capex outlay is massive, though, at ~EU3bn (of which ~EUR2.5bn will be spent by 2026) – a sizable amount relative to the ~EUR5bn capex program announced at this year’s CMD. While the full program will be jointly funded by Umicore and PowerCo, the significant capex burden likely entails new debt issuances or equity raises ahead.

A Key Milestone in the Long-Term Cathode Materials Strategy

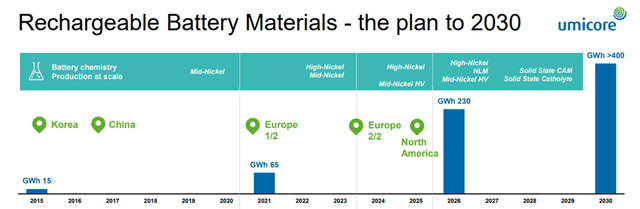

Having first announced its intention to form the JV in December 2021, this marks an important step in Umicore’s long-term cathode material strategy, headlined by a 400GWh production target through 2030.

JV production is slated to begin in 2025, with nameplate capacity scheduled for 40GWh in 2026 before total capacity ramps up to 160GWh in 2030 (a schedule consistent with prior announcements). From a strategic standpoint, the willingness of a major manufacturer like Volkswagen to commit two-thirds of its European battery material demand to Umicore validates the company’s strong competitive positioning. The JV economics are attractive as well – Umicore gets a guaranteed minimum value-accretive return, supported by take or pay contracts, on a 160GWh/year investment. This translates into a compelling 12.5% pre-tax return on capital employed (or ~EUR150m/year by 2030), significantly de-risking the company’s cash flow profile and boosting the case for a valuation re-rating. With another major announcement (likely another partnership) guided for the back half of the year as well, all signs point to Umicore emerging as a serious contender in the cathode materials space.

Elevated Near-Term Financial Risks

On the back of the rally in commodities, Umicore looks set for another bumper year – recall that the company guided for above consensus FY22 profits of EUR828m, building off a strong H1 2022 performance. The near-term hinges on continued strength in metal prices, though, and it seems unlikely that the >400% YoY growth rate in H1 2022 lithium prices is sustainable. Given lithium drove the bulk of the guidance upgrade, despite weakness in battery volumes and a double-digit % decline in platinum group metal prices since its April update, there remains an elevated risk of downward revisions ahead. Current guidance numbers also don’t contemplate a material worsening of the macro environment or disruptions to Umicore’s operations, adding to the downside risk.

Beyond the P&L, Umicore’s recent CMD announcement of EUR5bn of growth capex through 2025 to fund its batteries footprint expansion poses a risk to the FCF generation and balance sheet. Even in a base case macro scenario (i.e., a shallow recession/slowdown), the elevated run rate likely entails negative free cash flow from the next year, with positive generation only likely once the investment cycle ends in 2025. The balance sheet could come under significant pressure as well – without additional funding, leverage levels (net debt to EBITDA) would rise significantly. Best case, Umicore extends the runway via government grants or lower rechargeable battery material-related working capital requirements. The more likely scenario, though, with debt funding costs rising amid the higher interest rate backdrop, is a dilutive equity raise at the expense of shareholders.

Growing Materials Leadership Outweighed by Pricey Valuation

Building on this year’s price rally across key commodities (e.g., platinum group metals and nickel), Umicore looks set for a strong full-year earnings report. Having gained a stamp of approval from Volkswagen (via its PowerCo battery unit) for its JV on favorable terms as well, the company’s competitiveness in cathode materials is compelling. That said, the mid to long-term investment case looks tough, particularly with signs of a cyclical downswing in commodities already emerging and a global recession likely in the coming months. Given the low earnings visibility and the potential balance sheet stress from a challenging EV transition ahead, the current ~10x EV/EBIT (~7x EV/EBITDA) valuation offers investors a limited margin of safety.

Be the first to comment