Ladislav Kubeš/iStock via Getty Images

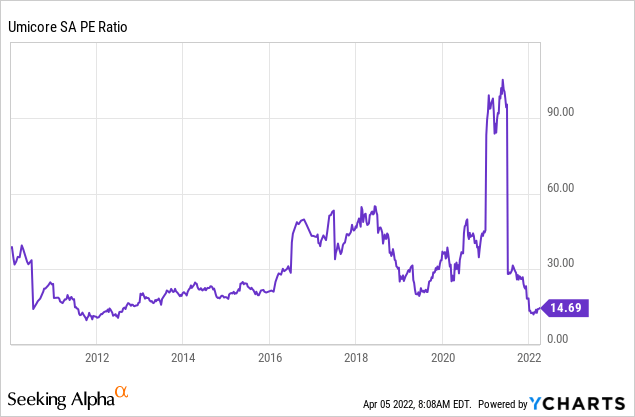

Umicore SA (OTCPK:UMICF) (OTCPK:UMICY) posted record results in 2021 on the back of an exceptional precious metal price environment. As a result the P/E ratio currently stands at 15, a value not seen for nearly a decade.

The stock price has been lagging as the company did not meet expectations regarding the growth of the “Rechargeable Battery Materials” division. It seems, however, the forest is missed for the trees as the significance of this division is limited when earnings are considered. The metal recycling business will remain the earnings driver in the short term, while the Battery Materials division (E&ST) is the earnings driver for the mid to long term. Umicore is, therefore, a buy at current price levels.

Results

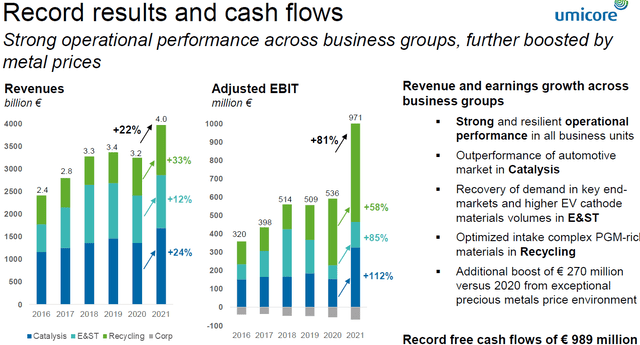

Umicore recently updated shareholders on 2021 performance and presented record earnings. Adjusted EBIT, for example, rose by 81% compared to 2020, and basic earnings per share (diluted) rose to €2.56 (2020: €0.54). The opening slide of the results presentation neatly sums it up, see figure 1.

Figure 1: Record earnings (www.umicore.com)

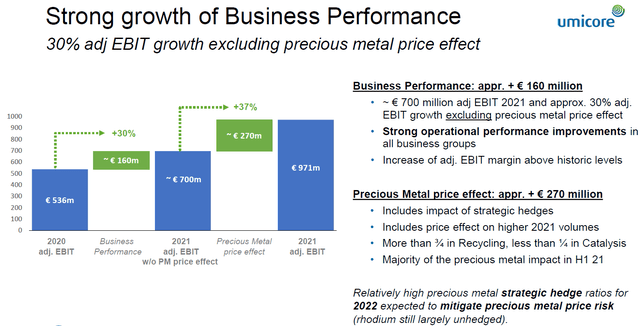

The performance of the company has been driven by the exceptional precious metals price environment. The effect thereof on earnings was visualized by the company as well, see figure 2. The metal prices boosted the adjusted EBIT by €270 million to a level of €971 million, but even excluding this effect, the adjusted EBIT showed 30% growth.

Figure 2: Precious metal price effect (www.umicore.com)

For two years in a row, the company has pointed to the exceptional precious metal price environment as the driver for earnings. It’s interesting to know which part of the earnings per share was generated by the exceptional metal prices. After all, the company seems to expect this part of the earnings may not be sustainable as they report it separately.

The €971 million EBIT translated into €619 million of net profit according to the income statement. Considering the company had over 241 million shares outstanding at December 31st, the earnings per share came in at the aforementioned €2.56. A quick calculation, based on the ratio between adjusted EBIT and net profit, shows an estimated €0.71 per share resulted from the precious metal (PM) price effect. Note the adjusted EBIT excludes €75 million of (non-recurring) adjustments.

With the EPS contribution of the PM price effect known, it follows earnings per share would be approximately €1.85 without this “metal tailwind.” At the current price of approximately €41, and excluding the potentially non-sustainable PM effect, this translates into a P/E ratio of 22. The only time in the last five years the P/E ratio for Umicore hit such a low number was in 2019.

However, assuming the PM effect will be completely absent in 2022 is too conservative as management shared the expectation results “would still include a significant precious metal price uplift versus 2020, albeit below the €270 million uplift of 2021” when it gave the outlook for this year. If the PM effect is not excluded, the P/E ratio is even lower at a value below 15, a number not seen for nearly a decade, see the next chart.

Even though the company expects the PM effect to subside, the earnings per share for 2022 will be supported by a €454 million debt reduction and the delivery of a new battery materials factory in Nysa which has been the main driver of capital expenditures.

Bottom line, the company performed well even when the precious metal price tailwinds are excluded. This made management decide to increase the dividend payment to €0.80 per share for 2021 (2020: €0.75), leaving ample room for another increase this year. The stock price, however, didn’t show good performance after hitting a high in August 2021. In the remainder of this article, I will explain why I believe this stock is currently undervalued.

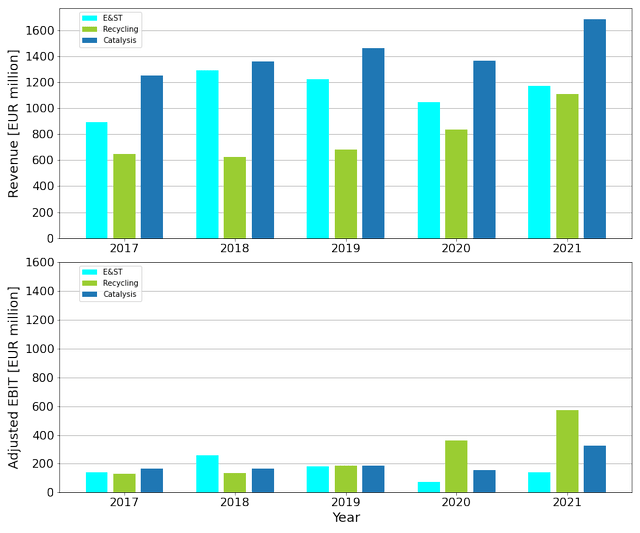

Recycling is the earnings driver

With the company posting record earnings, it is interesting to see how the Recycling segment has performed. Figure 4 shows the development of revenue and (adjusted) EBIT for each division over a time span of five years. The total adjusted EBIT amounted to €971 million in 2021 of which €573 million, or 59%, was generated by the Recycling segment.

Figure 4: Revenue and EBIT per segment over the past 5 years (www.umicore.com, chart by author)

While the company gave a careful outlook during the results presentation on the 11th of February it should also be realized the situation in Europe has changed significantly ever since. This resulted in futures of rhodium (XRH:COM), palladium (XPDUSD:CUR) and gold (XAUUSD:CUR) to trade higher than the company anticipated in February.

Reference is made to these metals as they were highlighted by the company to explain the exceptional precious metal environment driving earnings. For this reason, they appear to be a good proxy to assess the performance of the Recycling segment. Although futures for these metals are currently not at H1 2021 levels, the outlook of the company seems careful considering recent price developments. Moreover, price appreciation may further be enforced by a policy shift that is currently taking place in Europe.

Europe upping the ante

The war in Ukraine has forced European politicians to take a stance. The well-known laissez-faire attitude of European Union (EU) politicians on virtually every matter other than climate (defense spending, drug policy, inter-state quarrels to name a few) overnight turned into a proactive one. This became clear from the press release which was shared following the EU-China summit. The presser was remarkably uncompromising and straightforward, to wit:

There must be respect for international law, as well as for Ukraine’s sovereignty and territorial integrity. And therefore, China, as a permanent member of the UN Security Council, has a very special responsibility. (…)

Together with our international partners, (…) we have adopted massive sanctions that are effective. (…) we also made very clear that China should, if not support, at least not interfere with our sanctions. (…) it would lead to a major reputational damage for China here in Europe.

The reputational risks are also driving forces in the exodus of international companies from Russia. (…) Let me remind you that every day, China and the European Union trade almost EUR 2 billion worth of goods and services. In comparison, trade between China and Russia is only some EUR 330 million per day. So a prolongation of the war, and the disruptions it brings to the world economy, is therefore in no-one’s interest, certainly not in China’s.

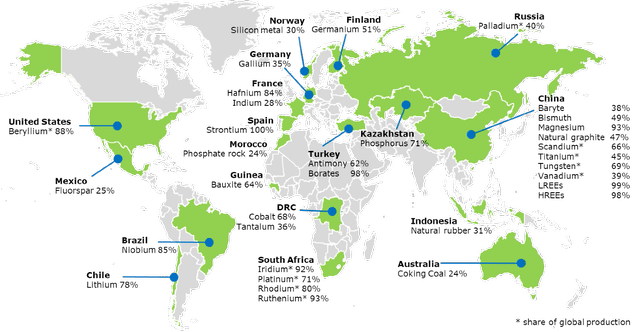

The Russia-Ukraine war is now a starting point for the EU to start applying pressure on China. Since this is the case, the bloc must consider how China will reciprocate. One of the most obvious ways is to leverage the bloc’s dependency on rare earth metals, which China produces almost exclusively. Literally, every metal produced by China, see figure 5, appears on the Critical Raw Material list of the European Union.

Figure 5: European imports of Critical Raw Materials (European Commission)

Another interesting observation is that Russia supplies significant amounts of palladium to the European Union. So far, the export of metals has not been restricted, but it is likely the EU will want to reduce dependency on Russia and look for alternative sources of palladium. European policy was already aimed at greening of the energy supply, thereby driving up demand for rare earth metals, but now it risks choking of the supply of these metals as well. Instead of regarding elevated precious metal prices as an exception, it is likely here to stay, thereby supporting the bottom line of Umicore.

Alternatives to recycling

With metal prices skyrocketing, it is hardly surprising other companies are trying to enter the metal business, which may put pressure on margins. For example, in addition to Umicore, another company trading on the Brussels Stock Exchange is Ackermans & Van Haaren (OTCPK:AVHNY), or AvH. AVHNY is a holding company and the majority shareholder of DEME, a marine contractor. The step from a material technology and recycling group to a marine contractor may seem odd, until one realizes the oceans hold vast deposits of polymetallic nodules. For this reason, DEME has been exploring the harvesting of these nodules in an offshore trial last year.

The story has similarities to the endeavors of TMC the metals company (TMC). This company also focuses on nodule collection and recently partnered with Swiss-based marine contractor Allseas to prepare for offshore tests in mid-2022. Although the headquarter of Allseas resides in land-locked Switzerland, it appears the company runs operations from the Netherlands. With Belgium and the Netherlands being neighbors and both boasting a lively maritime sector, it can hardly be coincidence that TMC has found a partner in Europe to develop their technology.

As offshore exploration is a costly undertaking, I would not be surprised to learn the polymetallic nodule collection is part of a concerted effort driven by a European desire for self-sufficiency regarding rare earth metals. Yet, with Europe upping the ante towards China while simultaneously accelerating efforts to limit the dependency on Russian commodities, time may not be available to wait for technology to mature. For this reason, I prefer onshore miners and recyclers with a proven business model.

Batteries need more time

The Energy & Surface Technology (E&ST) division, containing the Rechargeable Battery Materials segment, has been a drag on the stock price performance of Umicore. With the focus on climate change and consequently the attention for electric vehicles, general consensus is that the Catalyst segment will go into decline while the E&ST segment must grow to make up for lost earnings. For this reason, many analysts lowered their estimates last year when the company issued a profit warning resulting from “lower than anticipated sales volumes in Rechargeable Battery Materials.”

Admittedly, it was a disappointment to learn the production start at the new cathode materials production plant in Nysa, Poland was delayed by a full year. Moreover, the latest update stated the plant will start up in Q2 2022 with “initial commercial production volumes” only. This careful phrasing indicates the plant is nowhere near utilizing its capacity.

On top of this, the relatively expensive NMC cathode technology developed by Umicore showed modest demand while the cheaper short-range LFP-technology turned out to be the preferred choice in China. One could say the company has been betting on the wrong technology, one of the risks highlighted in previous coverage of this company.

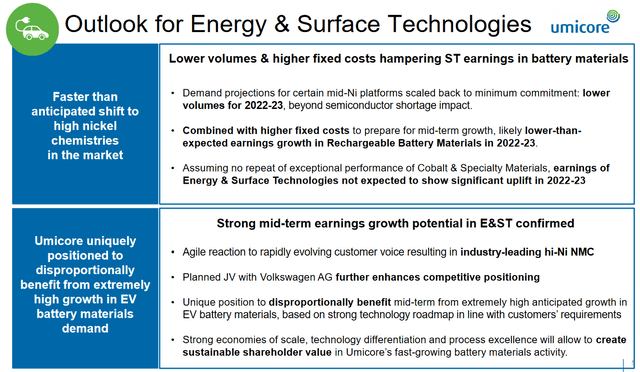

Two months after the profit warning, Umicore unveiled an EV battery materials joint venture with Volkswagen AG (OTCPK:VWAGY). This news prompted another blow to the stock as the company delivered a sobering outlook for the E&ST segment, see figure 6.

Figure 6: E&ST outlook (www.umicore.com)

Basically, the performance of the E&ST division is expected to remain subdued until at least 2023 as costs are higher and earnings are lower than expected. The potential for the mid-term, however, is confirmed, which seems reasonable as demand for NMC batteries with a larger range may be expected to be stronger in Europe than for example China. This assumes European customers are willing to spend more on the range. After all, EVs still can’t compete with combustion engines when it comes to range.

On the upside, the desire for mobility will not change. If the transition from conventional internal combustion engines to electric vehicles takes longer, the consequence is that demand for the Catalysis business will remain in place for an extended period of time. After all, it doesn’t seem likely emission requirements for vehicles will be relaxed.

Conclusion

Umicore posted record results in 2021 on the back of an exceptional precious metal price environment. Even excluding the PM effect, the company performed well. As a consequence, the P/E ratio dropped well below 20, a value only seen once over the last 5 years. Including the precious metal price effect, the P/E ratio currently stands at 15, a value not seen for nearly a decade.

The reason the stock price has not yet caught up is the fact that expectations for the E&ST division, which produces rechargeable battery materials, were not met. Moreover, the division performance is expected to remain subdued until at least 2023.

It seems, however, the forest is missed for the trees, as the significance of the E&ST unit is limited when earnings are considered. Umicore has a solid Recycling business which will remain the earnings driver in the short term, especially with Europe upping the ante towards Russia and China. Given continued attention for electrification of society and transportation, the E&ST unit is the kicker for the mid to long term. Umicore is therefore a buy at current price levels.

Be the first to comment