Marje

At a glance, UMH Properties (NYSE:UMH) appears to be appropriately valued. It is trading at 22X current year FFO which places it right in line with peer manufactured housing REITs. However, a large portion of its assets are not currently generating earnings which makes the FFO/share artificially low. These are valuable assets that will soon generate earnings, thereby unlocking substantially higher FFO/share. When that happens, I believe it will become clear that UMH is undervalued and I anticipate upward movement to its market price.

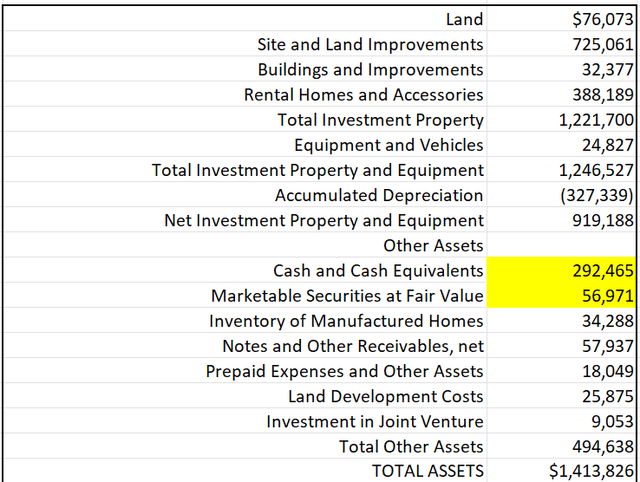

For clarity I am not referring to a pipeline of accretive developments or acquisitions. These are assets that UMH already owns. They come in three forms:

- Cash hoard

- Transitioning assets

- Land bank

In this article I will detail the process by which each of these will swiftly become FFO generating assets and tally the incremental FFO production from assets already on the balance sheet.

How UMH became undervalued

UMH is down 25.5% year to date. Some of this is the general market downdraft, but a lot of it is related to first quarter earnings which got badly misinterpreted. UMH reported earnings on May 4th and as you can see on the chart below, that is when most of the selloff began.

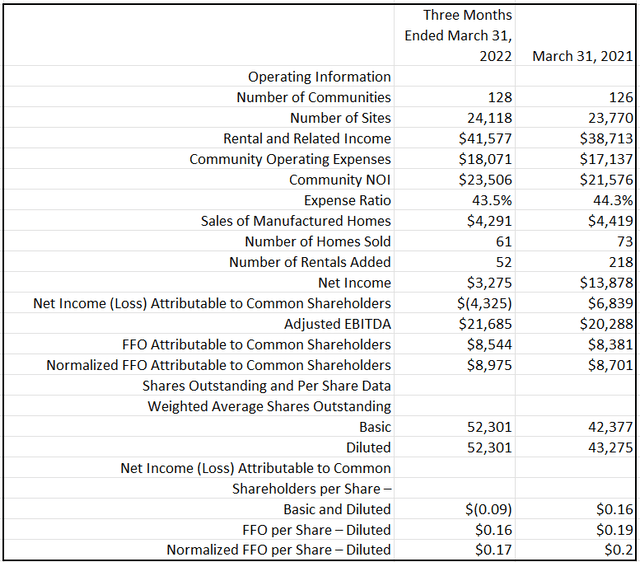

The pessimism came from headline FFO/share which came in at $0.16 with normalized FFO at $0.17.

That is a success rate of about 98%.

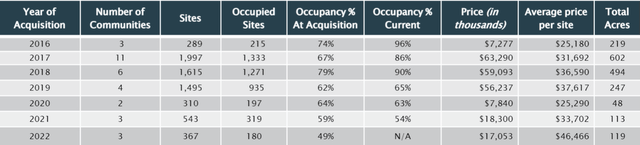

Estimating the incremental FFO as these communities stabilize – $0.04 per share

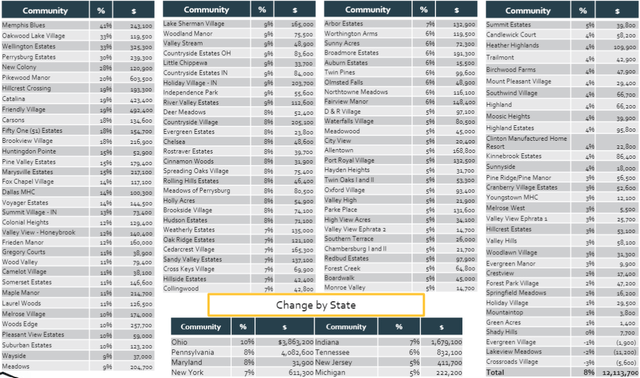

In the past couple of years, 1,220 sites were acquired and are not yet stabilized. Average occupancy is about 60% with fully stabilized occupancy likely to hit about 88%. That is an additional 341 occupied units which on average pay rent of $840. Average operating expense ratio on stabilized assets is 44% resulting in an NOI margin of 56%.

That would be $3.437 million of incremental revenue and $1.924 million of incremental FFO as these communities stabilize – roughly $0.04 per share.

Land Bank – embedded growth potential – ~$0.40 FFO/share accretion (over multiple years)

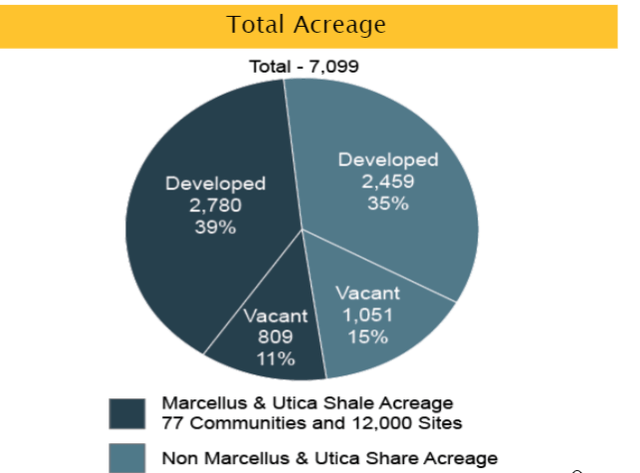

Out of 7099 total acres, 1860 are vacant land.

Each acre can usually be turned into four sites which portends 7,440 potential sites for development at some point down the road.

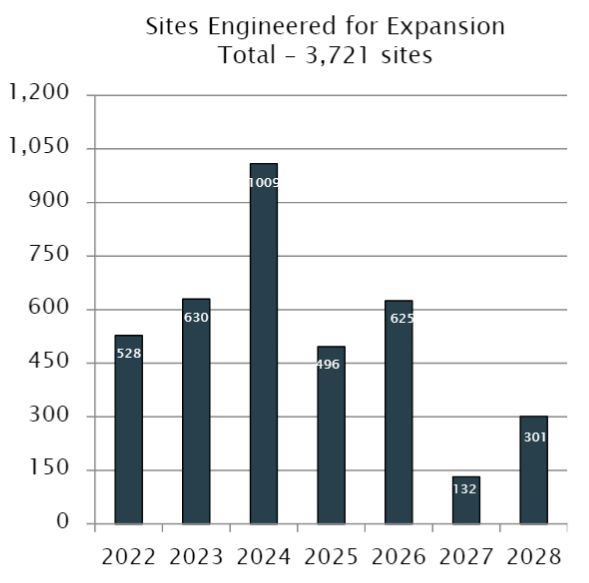

Among these, UMH has identified and scheduled 3,721 sites for expansion.

UMH

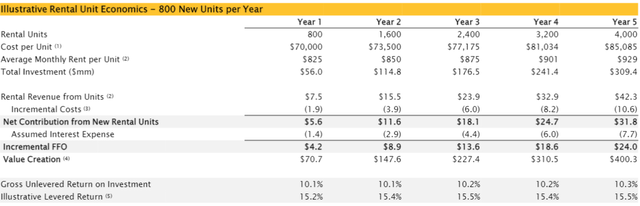

Land is a large portion of the cost, so having the land already in place makes the unit economics quite accretive. Shown below is the return on adding a unit to existing land.

If UMH can successfully place 3200 units on the 3721 identified sites, that would result in incremental FFO of about $21 million or about $0.40 per share. The timing of this will depend on demand and availability of units from the home manufacturers.

UMH’s typical pace of expansion would be around 800 rental units per year, but in recent quarters supply chain issues have prevented suppliers from actually being able to deliver that many units. Demand growth, however, looks to be well north of 800 units per year. Thus, the pace will depend on how well demand holds up and how quickly suppliers can get their manufacturing bottleneck sorted out.

Overall embedded FFO that is not in the quarterly numbers

The $0.31 of FFO/share accretion will not be realized in the 2Q22 report which I expect will also come in weak due to the cash mountain, but it will immediately accrue to FFO/share run-rate beginning in late July as the preferred is redeemed.

$0.04 from stabilization of recent acquisitions will accrete to run rate FFO/share over the course of the next few years

$0.40 from filling the vacant land should accrete to run rate FFO/share over the course of the next 3-7 years

In total that is $0.75 of embedded growth from assets already on the balance sheet. So while the first quarter of 2022 showed an FFO/share run rate of $0.72, the actual run rate upon full stabilization is closer to $1.47

That is basically double the FFO the market is seeing and the true FFO would spot UMH at an FFO multiple of 13.46X. That is obviously too cheap for a growth manufactured housing REIT. I see fair value as about 20X long term stabilized FFO which would be a market price of $29 or roughly 50% upside from today’s price.

Caveat on the timing of realization of FFO growth

The above run rate of FFO is what I believe would happen if UMH were to stabilize its existing holdings and not do anything else.

In reality, they will likely continue to grow with acquisitions and each time they acquire new assets it extends the timeline for full realization of stabilized FFO. The current assets will stabilize, but there will be a new round of assets that are in that transitionary period. As such, there will continuously be assets on the balance sheet that are a drag on current earnings.

This process is net beneficial to shareholders in the long run as UMH is generating double digit IRRs as they go full cycle, it just creates a repeated lag to earnings realizations. It is an extension of the growth runway and a raising of the level of FFO/share at which UMH will eventually stabilize at the cost of delaying the timing of realization.

Risks to investment in UMH

UMH, unlike its peer manufactured housing REITs, is focused on affordable workforce housing. As such, its demand is more cyclical with the economy. So far, job growth has been fantastic, but some are anticipating a recession in 2023. This would likely slow UMH’s growth considerably as people are less likely to form new households when the job market is tough.

There are a couple factors which reduce UMH’s cyclical risk:

- Current rents are about 20% below market, making tenants unlikely to leave.

- UMH is currently operating at very low debt

Thus, I do not see a recession as causing serious harm, but rather as something that would slow growth.

Be the first to comment