MicroStockHub

I’ve often been asked by readers whether to invest in Ultra Clean Holdings (NASDAQ:UCTT), a major supplier of parts to Applied Materials (AMAT) and Lam Research (LRCX) or to invest in these companies, which assemble parts from various suppliers into a finished system and sell them to semiconductor manufacturers.

In the past year, these equipment companies, particularly LRCX and ASML (ASML) have been stymied by lack of components from the supply chain. I’ve written several articles about these problems from LRCX in my SA article “Lam Research: Expect More Supply Chain Woes In Upcoming Earnings Call,” and ASML “ASML: Fire And Supply Chain Woes Plague Shipments And Revenues.”

The inter-relationship between supplier and customer also serves as a “sanity check” in evaluating the participants, because problems impacting one will ultimately impact the other. This is exactly the situation in my analysis of UCTT, because their guidance for the impact of China sanctions didn’t corroborate with guidance from customers AMAT or LRCX, nor from two other subassembly supplier to both companies MKS Instruments (MKSI) and Ichor Holdings (ICHR).

Guidance on Impact of China Sanctions

UCTT

Its two customers, AMAT and LRCX, “accounted for 64.0%, 67.1% and 66.9% of the Company’s revenues for fiscal years 2021, 2020 and 2019, respectively.”

UCTT CEO Jim Scholhamer, in the company’s 3Q earnings call, reported:

“While some customers continue to prioritize and reconfigure their delivery schedules, we have seen only limited cancellations relating to the new export regulation for U.S. semiconductor technology sold in China.”

Sheri Savage, CFO noted:

“Nothing has affected us in the third quarter, but we anticipate around a $15 million impact in the fourth quarter for the new export legislation.”

ICHR

For 2021, its two largest customers were Lam Research and Applied Materials, which accounted for 53% and 32% of sales. ICHR CEO Jeff Andreson reported in the company’s earnings call:

“We have incorporated the impact of the export restrictions in our outlook and build plants. We estimate that the total impact of these changes to be approximately $20 million this quarter. And as such, the midpoint of our Q4 revenue guidance represents a 6% decline from our record third quarter.”

MKSI

Lam Research Corporation and Applied Materials were its top two customers in 2021 and together accounted for approximately 27% of net revenues. MKSI CEO John Lee reported in the company’s 3Q earnings call:

“U.S. export restrictions on advanced semiconductor equipment sales to China are immediately impacting our direct customers who rely on our subsystems. In addition, as I mentioned earlier, we continue to see shortages of components needed for certain high value products.”

Seth Bagshaw, CFO noted:

“Based upon our preliminary assessment of sales through our direct sales channel and through our OEMs, we estimate the overall annualized impact could be in the range of $250 million to $350 million.”

What Did AMAT and LRCX Guide?

Applied Materials reported on Oct. 12 export restrictions to China would result in a $250 million-$550 million loss in net sales in the quarter ending Oct. 30, with a similar impact expected in the following three months.

Lam Research on Oct 19 warned of a $2 billion to $2.5 billion revenue hit in 2023 from U.S. curbs on exports of high-end technology shipments to China.

Guidance Summary

UCTT estimates the impact of China sanctions in Q4 guidance at just 2.5% of revenues, as shown in Table 1. MKS Instruments, another major supplier to Applied Materials and Lam Research guided an impact up to 18.8% of revenues from China sanctions, significantly higher than UCTT. ICHR guided a China sanction impact of 5.6% of revenues.

Investor Takeaway

The impact guidance from UCTT for Q4 of just 2.5% of revenues is significantly lower than other suppliers and from both customers, which doesn’t make sense.

CFO Savage’s comment of “Nothing has affected us in the third quarter, but we anticipate around a $15 million impact in the fourth quarter for the new export legislation” also doesn’t make sense because AMAT is noting an impact in the coming quarter (ending January 2023) unless AMAT’s orders for the coming quarter have already been delivered and paid for and purchase orders for CY 2023 have not been made from either AMAT or LRCX.

UCTT, ICHR and AMAT provided Q4 guidance of 2.4%, 5.6%, and 5.3%-11.6%, respectively. MKS and MRCX provided CY 2023 guidance.

Why is this important? Shares of UCTT increased strongly following its earnings call on October 26 was largely a result of guidance, since top line revenues beat by just 14.7% albeit exceeding analyst estimates by 3.3%, but bottom line earnings were in-line with consensus. In addition, CITT’s Net Income was just $9.74m, down 70% from 3Q 2021, and Profit margin was 2.4%, down from 5.8% in 3Q 2021.

Incidentally on the 1st of November, Sheri Savage sold around 15k shares on-market at roughly US$31.92 per share. This transaction amounted to 32% of their direct individual holding at the time of the trade. And on October 10, 2022, Amir Widmann, President, Fluid Solutions of Ultra Clean Holdings, Inc., resigned from the Company effective December 31, 2022.

UCTT Metrics

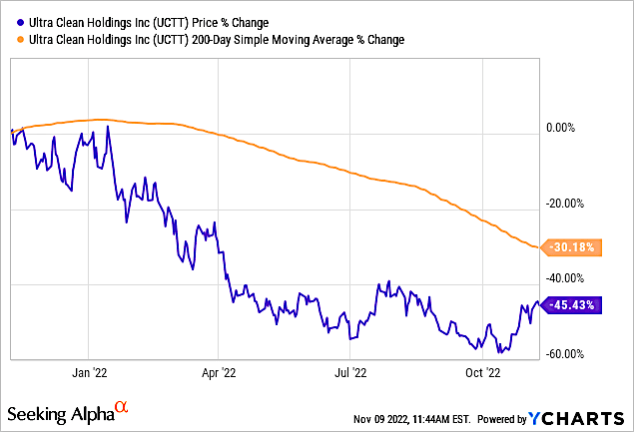

Chart 1 shows share price of UCTT for the past 1-year period, which has been below its 200 day moving average since December 2021. Share price is down 45.4% for the 1-year period but up 12.3% since the earnings call.

YCharts

Chart 1

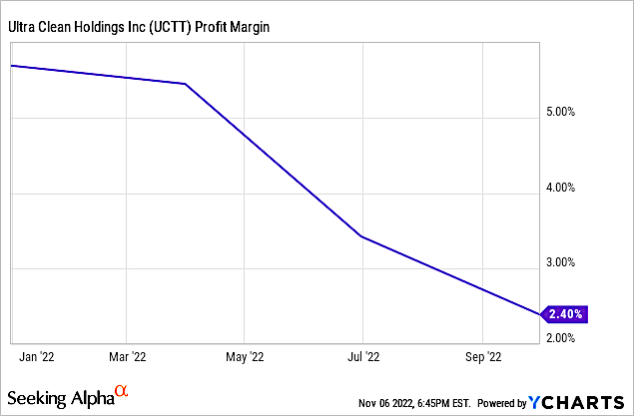

EPS fell from $2.7 to 1.26 over the past 1-year period, Chart 2 shows that profit margin decreased from 5.7% to 2.4%.

YCharts

Chart 2

Comparison of UCTT with Competitors and Customers

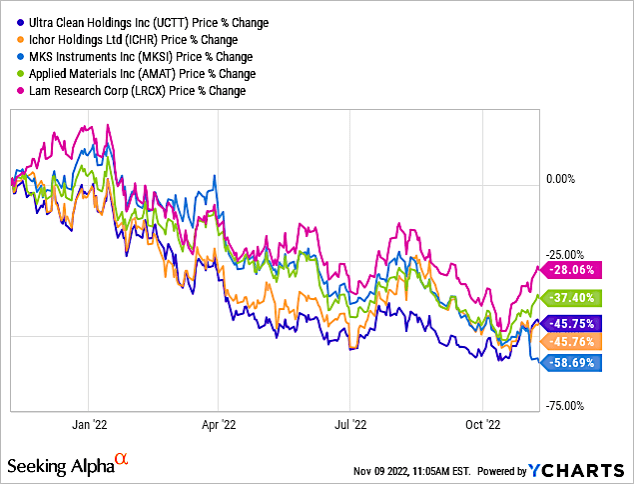

Earlier I raised the question whether UCTT was a better investment than the customers it supplies, primarily AMAT and LRCX. Chart 3 shows share price % change for these companies as well as other major suppliers ICHR and MKSI for a 1-year period.

For UCTT, shares are down 45.45% (purple), and lower than LRCX (magenta) at -28.10% and AMAT (lime green) at -37.79%. In fact, all three subassembly companies underperformed their major customers.

YCharts

Chart 3

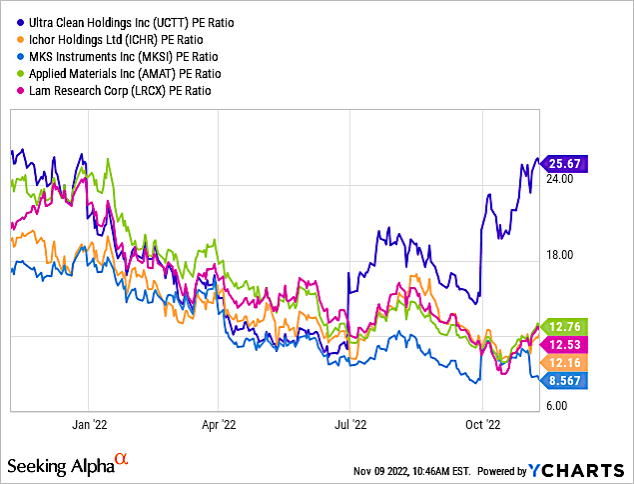

Chart 4 shows that recent drops in earnings have moved UCTT into the stratosphere with a PE ratio of 25.05x, more than twice that of the other four companies.

YCharts

Chart 4

UCTT’s guidance on China sanctions raises a big question mark. The semiconductor equipment market is facing several headwinds at one time:

- Capex cutbacks by Micron (MU)(and SK Hynix (OTC:HXSCL) in the memory sector

- China sanctions and the most recent that have been specific to U.S. equipment suppliers

- Significant drop in semiconductor equipment in 2023 from capex overspend in 2021, as detailed in the Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.”

As a major supplier to AMAT, UCTT is significantly overpriced, and the higher revenue guidance (lower impact on China) is a warning sign for me. Simply Wall Street has a Fair Value of $9.46 compared to current price of $32.29, translating to an Overvalue of 247.7%.

I presented a thesis in mid-2021 that the extraordinary amount of capex spend for equipment will lead to a severe downturn in 2023 for equipment companies because of an oversupply of capacity and chips. That market will be down 20+%.

The current macro factors have clouded the issue – less demand for consumer products resulting in capex cuts by Micron and SK Hynix, and the China sanctions. What would have been a severe hit in 2023 has been moved forward into 2022, lessening the shock in 2023. But my thesis calls for a continued slowdown in 2024.

President Widmann’s resignation, CFO Savage selling 32% of owned shares, and sky high PE are earmarks of problems with Ultra Clean. This to me is another headwind, and I rate the company a Sell.

Be the first to comment