Frazer Harrison

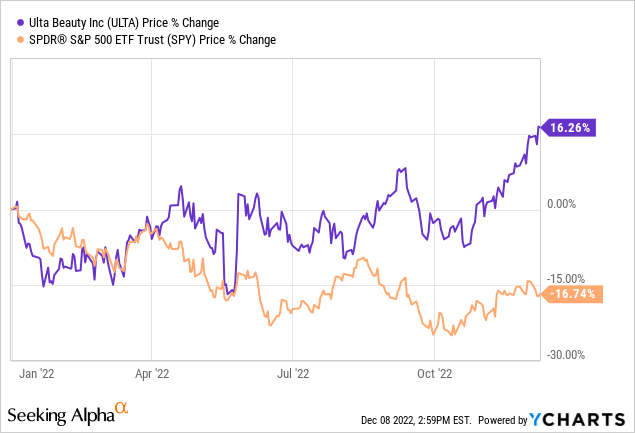

Ulta Beauty, Inc. (NASDAQ:ULTA) operates as a retailer of beauty products in the United States. Compared to the broader market, ULTA’s stock price has been performing exceptionally well, gaining more than 16% year-to-date, and with that significantly outperforming the S&P 500.

In today’s article we are going to take a look at ULTA’s Q3 results and try to gauge whether this outperformance is likely to last in the coming quarters. We will be focusing three areas that we like the most.

Sales

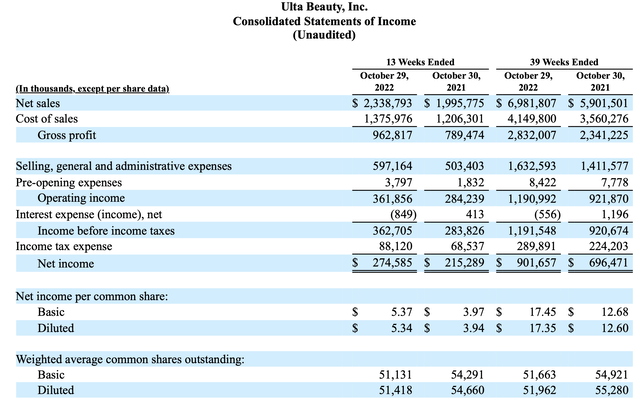

ULTA has managed to increase its sales by more than 17%, compared to the year ago period, reaching as much as $2.3 billion. The key drivers of this growth were: favorable impact from the continued strong demand for beauty products, retail price increases, and the impact of new brands and product innovation. While comparable sales growth has slowed from last year, it has reached 14.6% in the third quarter, fuelled by a 10.7% increase in transactions and a 3.5% increase in average ticket.

In our opinion, these figures prove that despite the price increases and the challenging macroeconomic environment, customers still want ULTA’s products and are loyal to the firm.

Many firms have actually achieved sales growth in the third quarter, so one might ask, what is so special about ULTA?

First, ULTA has achieved this sales growth with lower marketing spending. Many firms had to spend substantial amount on marketing to keep the demand high, which has substantially hurt their margins. To mention an example, we have published an article on Lovesac (LOVE), titled: “Lovesac: Key Takeaways From The Q3 Results“, where we also touch upon the negative impact of the increased marketing expenses to maintain the high demand.

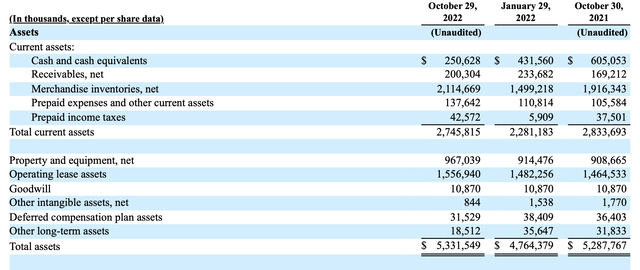

Second, firms may also achieve revenue growth by changing their credit/collection policies, resulting in more sales on credit, potentially longer collection periods and eventually an increase in receivables. This is normally a concerning sign. However, ULTA does not fall into this category. The firm has even managed to reduce their receivables compared to Q3 2021. For these reasons, we believe that their revenue growth is of high quality.

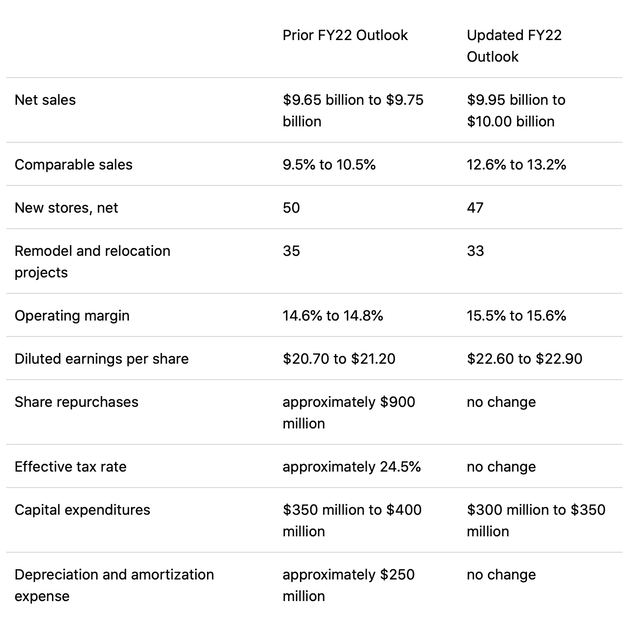

Further proof of the high quality of the growth the firm has revised its full year 2022 guidance upwards. They are expecting to achieve higher sales and comparable sales growth, with higher margins and with less stores than previously thought. These improvements eventually also lead to a positive change in the EPS figures.

Margins

Both gross and operating margins have been expanding year-over-year.

The gross margin has reached 41.2%, compared to the 39.6% in the prior year. This expansion has been primarily driven by the leverage in fixed costs, strong growth in other revenue, and higher merchandise margin, partially offset by higher inventory shrink.

While the SG&A expenses have increased as well, mainly due to the deleverage in store payroll and benefits and corporate overhead due to strategic investments, the lower marketing expenses have partially offset the negative impacts. The operating margin in the Q3 came in eventually at 15.5%, compared to the 14.2% in the prior year.

Returning value to shareholders

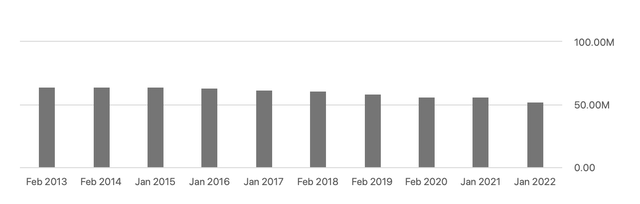

While ULTA does not pay dividends, over the decade they have stayed committed to returning value to their shareholders through share repurchases. They have reduced their number of shares outstanding by about 20%.

Shares outstanding (Seeking Alpha)

This year, so far, the firm has repurchased 1.5 million shares of its common stock at a cost of $571.9 million. They have still as much as $1.4 billion available under the $2.0 billion share buyback program, which has been announced in March 2022. To put these figures into perspective, ULTA’s current market cap is around $24 billion.

We believe that the firm’s capital allocation strategy and its way of returning value to investors is attractive. If a firm pays dividend, normally the pressure is high to keep paying the dividends and even increase them, regardless of how challenging the macroeconomic environment may be. In contrast, share repurchase programs are much more flexible and there is no fixed schedule that the firm should follow, leading to more financial flexibility, when the times are challenging. Further, share repurchases may also provide tax benefits in certain cases.

To sum up

Double digit sales growth fuelled by an increase in transactions and an increase in the average ticket. At the same time, receivables on the balance sheet have declined, indicating that the firm has not been making excessive sales on credit, which is a good sign.

The firm has also not spent an excessive amount on advertising to keep the demand high for their products. Their marketing expenses have even fallen year-over-year.

Both gross and operating margins have expanded year-over-year.

The firm’s commitment to returning value to shareholders through share repurchase programs can also be appealing for many investors.

For these reasons, we rate ULTA’s stock as “buy” now.

Be the first to comment