gorodenkoff/iStock via Getty Images

Investment Thesis

UiPath Inc. (NYSE:PATH) is a stock that has been on my watchlist for a very long time. However, I was never compelled, until recently, to invest given its very high valuation, even when taking its high growth rate into account.

However, with the stock dropping to new all-time lows after its recent report, the value proposition for a long-term investment becomes a lot stronger.

In summary, this is a company with a 145% net retention rate that should have a large long-term runway for growth. It is unlikely that UiPath is really facing a structural slowdown as is now being priced into the stock. Contrary to other contributors, I am not convinced the bull thesis is broken.

Q4 and FY 2021 results

UiPath reported revenue of $290M, up 39%. Nevertheless, investors should note that UiPath is managing the business for ARR growth (annual recurring revenue). On the ARR side, the results were even more impressive with 59% growth to $925M. UiPath added a record $107M in net new ARR during the quarter, an increase of 72% YOY. As mentioned, net retention was 145%. RPO increased 65% to $683 million.

For the full year, revenue of $892M grew 47% while ARR as mentioned grew 59%. A total of $345M of net new ARR was added, an increase of 51%. UiPath further reported $140M ARR coming from its cloud products. Customer count grew by about 29% to over 10k.

UiPath further announced two leadership transitions:

A former Microsoft executive with more than 25 years of enterprise software experience, Weber will be responsible for leading global go-to-market strategy and execution at UiPath, and will guide worldwide sales, services, and other go-to-market operations including its partner organization. UiPath also announced that Chief Revenue Officer Thomas Hansen is leaving the Company to pursue other opportunities. Hansen will remain with UiPath through the end of the first quarter fiscal 2023 to assist with the transition.

Guidance

The most important metric, ARR, has been guided to $1210M for the next year. While this is a solid increase of 31%, it is nevertheless a steep slowdown compared to the current 59% growth rate. UiPath expects that 65% of its net new ARR will be added in the second half.

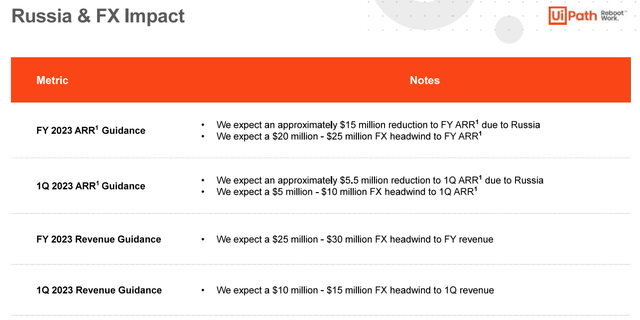

During the earnings call, it was remarked that UiPath is guiding for a 20% decrease in net new ARR that will be added during the year. UiPath’s response was that when incorporating the FX and Russian impacts, the guidance calls for “just” a 8% decrease in net new ARR. UiPath is also maintaining – or even further increasing – its “historically” conservative approach to guidance:

When you actually factor in the impact of Russia and FX when you normalize for that, that really is talking about an 8% decline, which in the current environment that we talked about, we believe just kind of stays in line with our — with the guidance philosophy that we — the prudent guidance philosophy that we have had from the very beginning of our journey here.

As mentioned, the two other factors for UiPath’s conservative guidance are general macro concerns, as UiPath gets 30% of its revenue from Europe, and the leadership transition.

We have a meaningful business in Europe that has been growing well over the last several years. This includes both employees and customers in Ukraine and in Russia, where we have paused business. I can tell you firsthand, this war is having a profound impact on the sense of physical and economic security across the continent and in the UK. We are also starting to hear customers in the US express reservations about both political uncertainty and rising interest rates. As we start the fiscal year, we believe it is prudent to guide assuming the uncertainty we are seeing in the first quarter will continue. (…) We have also made prudent assumptions around the profile of large deals in our pipeline, given the current environment and factored in the risks that exist with any sales leadership transition. (…) We do not see pauses, we just see uncertainty, given the environment.

Nevertheless, note that the last part was immediately followed by:

Our 2023 pipeline is strong and growing broadly. We hear from customers their continued desire to expand their automation programs and the strategic importance of the UiPath platform to their digital transformation efforts and our differentiation from our competitors. (…) The remaining balance that we see there is we look at our pipeline, and we have a very strong pipeline, as Daniel mentioned. There’s a number of large deals, which we’re excited about. We’ve won those deals in the sense of they’re not being backed off by competition. But given the macro climate, there’s just uncertainty around that.

Overall, management reiterated that it remained very bullish about the long-term to grow at scale:

And I want to give you some data points that convinced me that our growth profile is going to stay in high numbers for many years to come. If we look at customers over 1 million, we have improved this number by 78% this year, up to 158 customers. If you look at customers over $100,000, we have increased that number by 50% to almost 1,500 customers. They represent a great pipeline for us to grow the business for many years to come. This year, we added 2,000 new customers to our total base of customers.

Valuation

At a $22 price, UiPath becomes valued at a $12.5B market cap. This brings the forward ARR multiple to about 10x. Given that this is a business well above 80% gross margin and given the historical growth trends, this starts to become a favorable valuation.

For example, after two to three more years, assuming that UiPath indeed does not further slow down, the forward multiple would decline by 50% (since ARR will double to ~$2.5B) to just 5x. Perhaps more realistically, though, by that time the share price might have grown to maintain a ~10x multiple, which means the share price will have doubled just like ARR.

In the bullish case of multiple expansion, the stock might grow even further. In any case, UiPath’s long-term growth prospects arguably shield investors from further significant downside at the current price.

Risks

UiPath’s stock has been in a downward trend for some time. Although in the long-term this trend should reverse given the company’s strong growth (prospects), it is obviously not possible to time or predict when or how low the bottom will be.

Additionally, the thesis in this article is that since the slowdown is not structural, UiPath’s current guidance for ~30% growth represents the worst-case scenario, and should improve (reaccelerate*) again over time.

To recap, as backwards-looking evidence for this thesis is the 145% net retention rate combined with solid new customer growth, while the forward-looking evidence consists of the strong deal pipeline with some visibility into 2023 already. In addition, management said that it was prudent about its assumptions about the timing of large new deals given the current macro environment.

*Note that “reaccelerate” is a bit fuzzy here since the slowdown has obviously yet to happen in the first place given the currently reported 59% ARR growth. In the bullish case, UiPath raises guidance through the year and never actually slows down that much. In the bearish case, the stock sinks further through the year as the growth rate declines (as expected, though).

Investor Takeaway

The combination of uncertainty and a slowdown in growth is causing a sell-off. However, aside from the leadership transition, all three other factors that UiPath cited are not even fundamental to the business. The leadership transition itself also should not have a structurally downside effect. In other words, this does not seem like a structural slowdown, but is reminiscent to how many companies, a slowdown in growth in the wake of COVID-19. Many of those eventually recovered.

While clearly the guidance should lead investors to expect a slowdown, at least in the near-term, investors should nevertheless appreciate that in the last quarter UiPath delivered a strong combination of both best-in-class net retention rates (145%) and customer growth (29%), and net new ARR increased by 72%.

Overall, understandably the market is repricing the stock lower due to near-term uncertainty given that this is high-growth stock. On the other hand, investors with a longer-term horizon who see automation as a strong growth category, with UiPath as a segment leader, may use the dip to accumulate some shares. Perhaps for the very first time since IPO has this stock become reasonably valued.

Be the first to comment