Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Micron Technology, Inc. (NASDAQ:MU) stock’s post-FQ2 earnings momentum has almost been fully digested at writing. Nevertheless, the company reported a solid earnings card that outperformed Street estimates and proffered robust guidance.

MU is one of the leading DRAM players with South Korean memory giants SK Hynix and Samsung (OTC:SSNLF). Therefore, the company has also tremendously benefited from the secular underlying drivers undergirding 5G, high-performance computing, data center, enterprise, and EV. As such, Micron investors can continue to rely on the company’s leadership position and robust fundamentals moving forward.

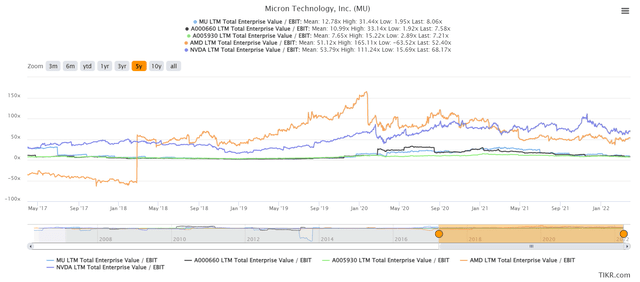

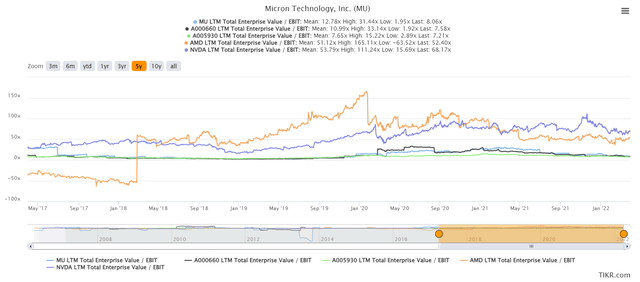

Nonetheless, we would like to highlight a caveat when attempting to value MU stock. As a memory play, it’s critical to benchmark MU’s valuation against its leading memory peers. Trying to value it against the leading pure-play logic foundry Taiwan Semiconductor Manufacturing Co. (TSM) may not be appropriate. In addition, investors should also be circumspect about valuing it against its CPU/GPU chip design peers such as Advanced Micro Devices (AMD) or Nvidia (NVDA). Notably, the market has often accorded much lower valuations to memory makers, and we don’t think that’s likely to change moving forward.

Micron’s Earnings Card Underscored Strong Underlying Drivers

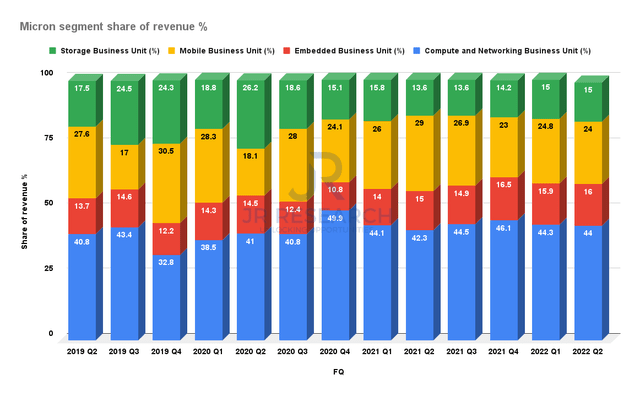

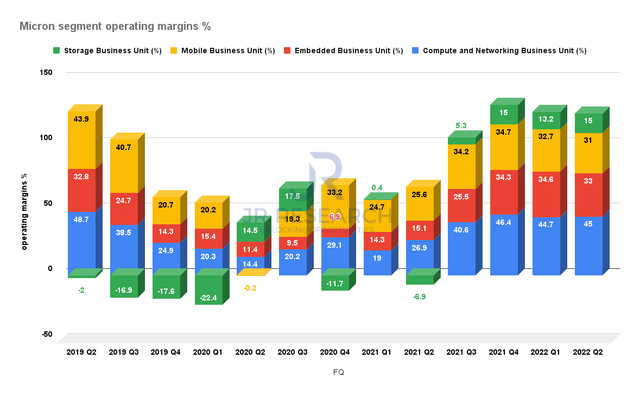

Micron segment share of revenue % (Company filings) Micron segment operating margins % (Company filings)

Micron reported robust earnings that outperformed consensus on revenue and earnings (adjusted and GAAP). Therefore, it was another quarter of solid performance across its DRAM and NAND portfolio. Notably, the performance continued to look solid across all its segments. Compute and Networking continues to be the primary growth driver for DRAM, while its Storage Business Unit has lifted NAND’s growth metrics.

It’s vital to note that Micron expects NAND to continue growing markedly faster than DRAM moving forward. CEO Sanjay Mehrotra articulated (edited):

We expect calendar 2022 industry bit demand growth to be in the mid-to-high teens for DRAM and at approximately 30% for NAND. We anticipate underlying demand in calendar 2022 to be led by data center, ongoing adoption of 5G smartphones, and continued strength in automotive and industrial markets. (Micron’s FQ2’22 earnings call)

Still, investors need to note that NAND’s operating margins are much lower than DRAM’s margins, as seen above. Nonetheless, its technological leadership in DRAM and NAND has allowed it to leverage meaningful cost reductions. It also expects such cost mitigations to persist moving forward. Nonetheless, the rising raw material costs and supply chain uncertainties could impact its efforts.

Overall, Micron investors can still be assured that its growth has been broad-based. Furthermore, the reopening cadence has also lifted enterprise and data center spending, adding to hyperscaler growth momentum. We also discussed in a recent Broadcom (AVGO) article highlighting similar momentum as people returned to offices in droves.

Nevertheless, the company expects some weakness in its mobile business unit (MBU), given the weakness in China in 2022. However, the weakness has already been well reported, given the macroeconomic uncertainties afflicting the Chinese economy. Furthermore, Micron also alluded to “flattish” PC growth in 2022. In addition, the leading pure-play logic foundry TSMC also emphasized these observations in a Nikkei report on Wednesday. TSMC Chairman Mark Liu accentuated (edited):

The slowdown is emerging in areas such as smartphones, PCs, and TVs, especially in China, the biggest consumer market. Moreover, the costs of components and materials are rising sharply, pushing up production costs for tech and chip companies. Such pressures could eventually be passed on to consumers. – Nikkei Asia

We have anticipated such weaknesses since the start of the year, as they were well reported. We also discussed these headwinds in a recent AMD article, explaining the criticality of focusing on higher-value markets in 2022.

Therefore, we were pleased to know that Micron has also been reallocating capacity to focus on higher-margin products, given the supply and costs headwinds. DIGITIMES reported (edited):

NAND flash chip vendors including Samsung Electronics and Micron Technology have moved to increase more of their controller chip production to third-party suppliers, such as Phison Electronics and Silicon Motion Technology (SIMO), due to their focus on data centers and other high-end device applications, according to industry sources. The overall supply of NAND flash device controllers has been constrained, prompting memory chip vendors to step up their purchases from flash device controller specialists. – DIGITIMES

But, Valuations Would Likely Remain At Lower Levels

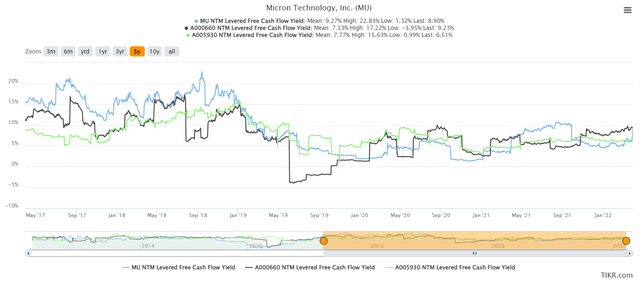

MU stock NTM FCF yield % (TIKR)

It’s critical for MU investors to note that Micron is a strong FCF generator. Notably, MU stock’s NTM FCF yield of 8.9% is broadly in line with its 5Y mean of 9.3%. Furthermore, its South Korean peers also traded at similar valuations. SK Hynix stock’s (KRX: A000660) NTM yield read 9.2% (5Y mean: 7.3%). In addition, Samsung stock’s (KRX: A005930) NTM yield came in at 6.5% (5Y mean: 7.8%).

Investors can hardly go wrong with high FCF yield companies in a rising interest rate environment. Therefore, we think Micron stock deserves high marks for its robust fundamentals and reasonable valuations.

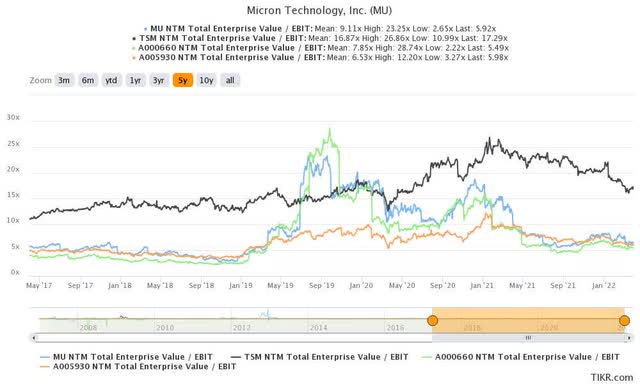

MU stock NTM EBIT multiples (TIKR) MU stock NTM EBIT comps (TIKR) MU stock NTM EBIT comps part 2 (TIKR)

However, we believe investors need to note a key caveat when valuing MU stock. We observed the valuations of the leading memory makers’ stocks have been on the lower side over time. Therefore, investors have also been reticent in re-rating the sector to a much higher valuation than its leading pure-play logic peers. The bifurcation is evident as MU stock’s NTM EBIT multiple of 5.9x pales in comparison to TSM stock’s EBIT multiple of 17.3x. Furthermore, Samsung is just one of three logic foundries that can produce leading-edge process nodes.

In addition, investors should also be circumspect in comparing it with the leading chip designers AMD and Nvidia. Both companies are leaders in their own right as they expand further into data center, hyperscaler, and automotive use cases. AMD is also leveraging further into the semi-custom business with AMD’s purchase of Xilinx. In addition, Nvidia is pursuing $1T worth of market opportunities in its recently expanded roadmap. As a result, investors have been willing to accord higher multiples to these chip design companies, given their rapidly expanding TAM.

Hence, we were not surprised that SK Hynix highlighted it was considering forming a consortium to purchase Arm. We think the company believes Arm is a critical architecture to broaden its ambitions in the logic sphere. SK Hynix CEO Park Jung-ho articulated (edited): “I want to buy Arm, even if not entirely. It doesn’t have to be buying a majority of its shares to be able to control the company. We are reviewing possibly forming a consortium, together with strategic partners, to jointly acquire Arm. I don’t believe Arm is a company that could be bought by one company.”

Is MU Stock A Buy, Sell, Or Hold?

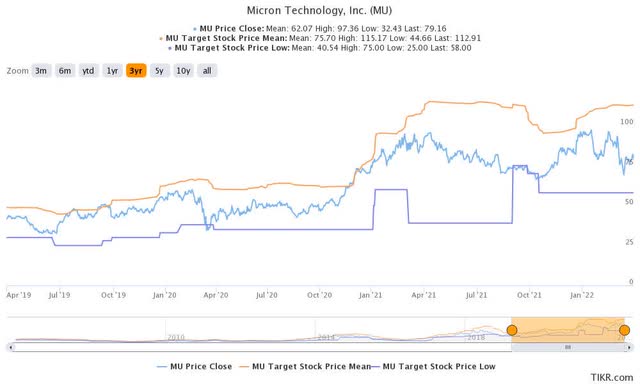

MU stock consensus price targets Vs. stock performance (TIKR)

Investors should be cautious in using the average consensus price targets (PTs) in adding exposure. Over the last three years, the average PTs have proven to be solid levels to take profit. Moreover, we also noticed a stubborn resistance level at about the $100 mark, that MU stock had failed to break twice over the past year.

Given the recent digestion of MU stock post-earnings, we think MU stock looks attractive again. With a target price of $100, it offers an implied upside of about 26.5%.

As such, we rate MU stock at Buy.

Be the first to comment