Noam Galai/Getty Images Entertainment

A month ago, I published a deep dive on UiPath (NYSE:PATH). Despite my bullish stance, I wanted to wait for the company’s Q4 earnings update before making an investment decision. That said, here’s my take on UiPath’s most recent earnings release.

Investment Thesis

UiPath is the leader in Robotic Process Automation (RPA) and it has the vision to deliver the Fully Automated Enterprise. The company showed strength during its Q4 earnings update. However, guidance was dismal as UiPath faces headwinds from the Ukraine-Russia war and unfavorable foreign exchange (FX) rates. Although I mentioned geopolitical tensions as one of the risks in investing UiPath, I underestimated the level of impact that the war has on UiPath. As such, I am downgrading UiPath as the next two quarters will likely be ugly for UiPath, which may lead to more short-term pain. However, the fundamentals of the business remain solid, setting the company nicely for long-term gains.

Earnings Review

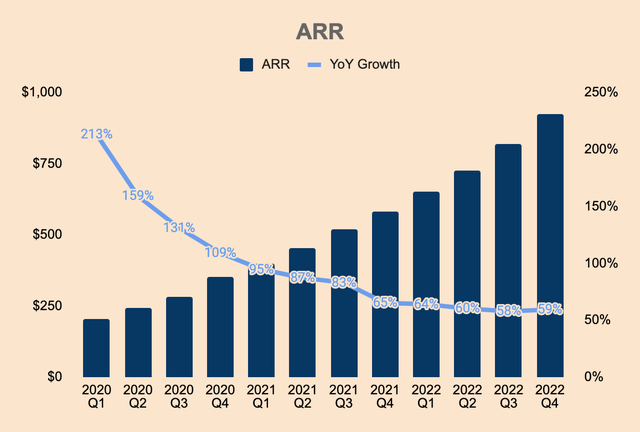

Annual Recurring Revenue, or ARR, grew 59% YoY, which is also a 1 percentage point acceleration from Q3’s YoY growth rate. End-of-year ARR stood at $925 million, which beat management’s guidance of $902 million.

Source: UiPath Investor Relations and Author’s Analysis

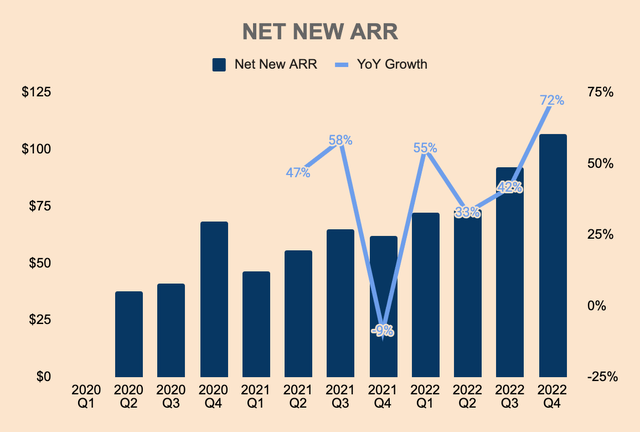

What’s more impressive, Net New ARR also accelerated, growing 72% YoY. The company secured $107 million Net New ARR in Q4 as new and existing customers continue to invest in RPA.

Source: UiPath Investor Relations and Author’s Analysis

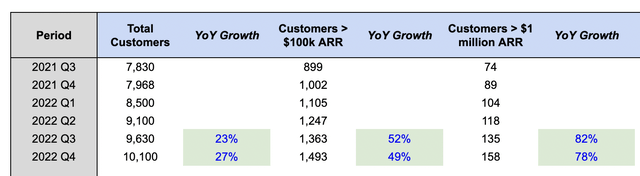

Here, we can see how UiPath’s customer count has fared over the last few quarters. Total Customers grew 27% YoY, to 10,100. Larger customers continue to invest in UiPath with Customers with more than $1 million ARR growing 78% YoY, to 158. This robust customer growth speaks volumes about UiPath’s value proposition and land-and-expand strategy. In fact, UiPath’s Net Retention Rate (NRR) and Gross Retention Rate (GRR) were 145% and 98%, respectively, which are very high considering tough YoY comps as well as rising competitive threats from the likes of Automation Anywhere and Microsoft Power Automate (MSFT).

Source: UiPath Investor Relations and Author’s Analysis

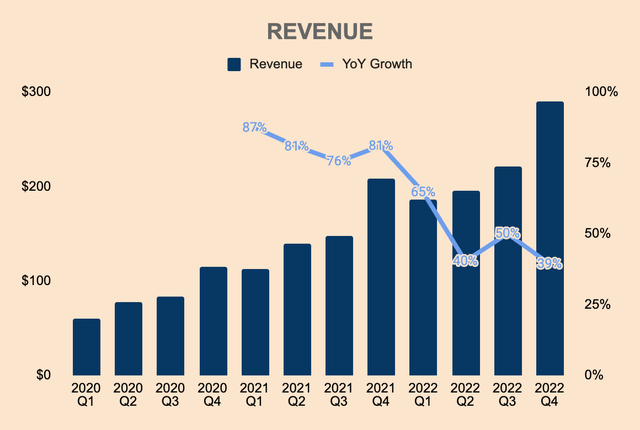

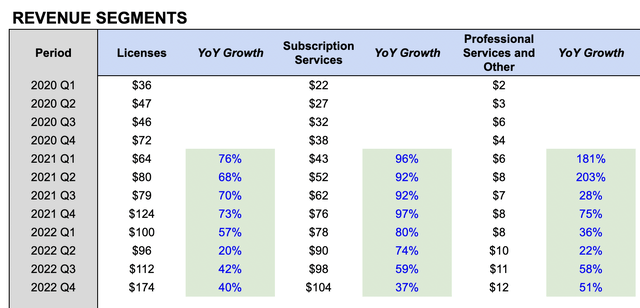

While ARR and Total Customers numbers look excellent, Revenue growth was not very encouraging. In Q4, Revenue was $290 million, up by 39% YoY. Despite an FX-related headwind of 600 basis points, UiPath beats both internal and analyst expectations, which were $282 million and $283 million, respectively.

Source: UiPath Investor Relations and Author’s Analysis

Breaking down the components of Revenue, we can see that all the segments showed continued strength. However, growth in Revenue may show signs of slowdown as the company transitions to the Automation Cloud, or cloud-based SaaS offerings. It is important to note that Licenses Revenue is recognized upfront when the software is delivered to the customer while Subscription Services Revenue is recognized ratably over the contractual period of the agreement. Thus, we may see Licenses Revenue decelerate meaningfully, while Subscription Services Revenue continues to grow at a consistent rate. This is positive as the SaaS offering is more predictable and stable.

Source: UiPath Investor Relations and Author’s Analysis

Management pointed out that cloud ARR has grown to $140+ million with more than 3,800 participating customers. In Q4, 55% of new customers, including Snowflake (SNOW) and Recipe Unlimited, also choose the cloud option, as opposed to in-premise license software. Of course, cloud ARR makes up only a small portion of total ARR, but the cloud product is showing rapid adoption despite being launched only 2 years ago. The appointment of Chris Weber, a former Microsoft executive, as CBO should also accelerate UiPath’s Automation Cloud adoption.

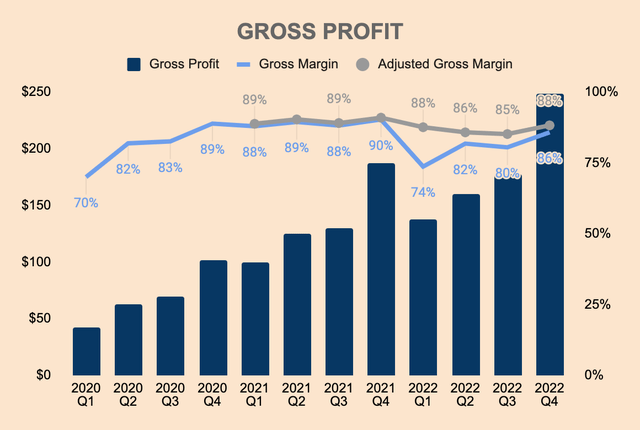

Turning to profitability, GAAP Gross Profit rose to 86% as the company pared back share-based compensation (SBC). I have also included Adjusted Gross Margins below, which was an impressive 88% in Q4.

Source: UiPath Investor Relations and Author’s Analysis

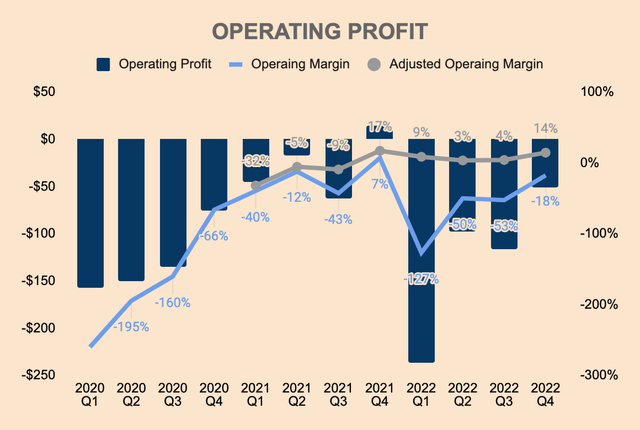

GAAP Operating Margin is still negative due to high SBC. In Q4, Adjusted Operating Margin improved to 14%, from Q3’s 4%. This is encouraging to see as the company gains operating leverage.

Source: UiPath Investor Relations and Author’s Analysis

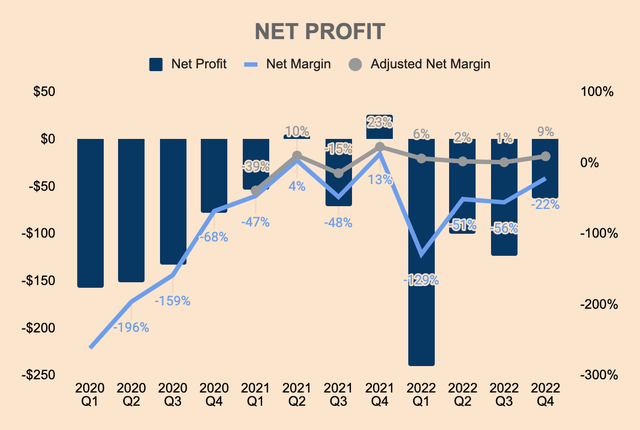

Here is what Net Profit Margins looked like over the last few quarters.

Source: UiPath Investor Relations and Author’s Analysis

Overall, I give UiPath’s Q4 two thumbs up as the business continues to execute, posting excellent Revenue growth, customer growth, NRR, and profitability metrics. However, UiPath’s strong Q4 was overshadowed by management’s guidance, which saw investors rushing toward the sell button.

Outlook

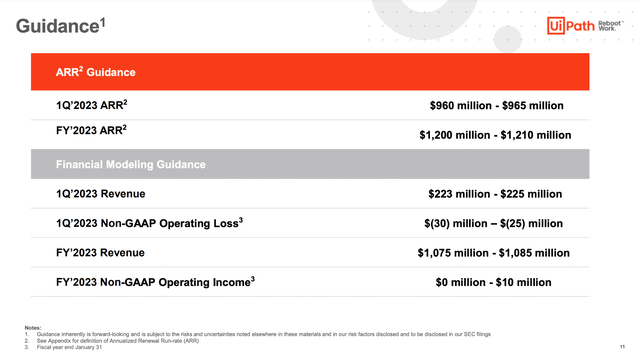

In discussing UiPath’s guidance, I will be using the upper-end of management’s guidance.

UiPath guided for Q1 and FY2023 ARR of $965 million and $1,210 million, respectively, which is a 48% and 31% YoY increase, respectively. That is a Net New ARR of $285 million, compared to last year’s $345 million – not a good sign at all. Furthermore, 65% of Net New ARR in FY2023 is expected to come in the back half of the year. Management also noted that the company has paused operations in Ukraine and Russia. Thus, the next two quarters will likely look miserable, which may lead to short-term pain for the stock. In total, management expects a $40 million ARR headwind due to Russia and FX for the next year.

Source: UiPath FY2022 Q4 Investor Presentation

On the other hand, management expects Q1 and FY2023 Revenue to be $225 million and $1,085 million, respectively, which is just a 21% increase YoY for both periods. This is a sudden deceleration from FY2022’s 47% annual growth rate. Again, management expects a $30 million negative impact from Russia and FX, in FY2023.

In the Q4 earnings call, CFO Ashim Gupta provides additional details on the guidance:

Our roots are in Romania and the European market, which was a major focus from the beginning and is an important part of our growth profile. Approximately 30% of our business is in Europe, and we serve customers across the eastern part of the region and in Russia.

We also price in local currency, which has created FX headwinds, given the recent strengthening of the US dollar. Both have a direct impact on our growth profile and guidance.

For fiscal year 2023, we have included the impact of pausing business in Russia, which is approximately a $15 million reduction in ARR, of which $5.5 million will be in the first quarter.

Additionally, UiPath guided for an Adjusted Operating Loss of $(25) million in Q1 due to two reasons: 1) higher corporate bonus and sales compensation, and 2) higher marketing and travel expenses as the economy reopens. While UiPath still expects to end the year with a positive Adjusted Operating Income of $10 million, it is still a big drop from FY2022’s $74 million.

On a positive note, management is seeing a “healthy pipeline” in terms of deals, seeing little to no “pauses”. Most of management’s weaker-than-expected guidance is seemingly due to “prudent guidance philosophy” and “uncertainty” in the macro environment. Here’s CFO Ashim Gupta explaining further:

We’ve got an affirmation that automation continues to be an important part of a cornerstone of digital transformation, that’s why we see these deals remain in our pipeline. I met just actually with eight of our customers in one of our advisory boards within the financial industries. We spent an entire day today together. Use cases are expanding. They’re innovating. This is something that continues to be in the C level.

One metric we didn’t talk about, but our $1 million-plus customers continue to expand as does our $100,000-plus customers. So, we crossed 1,493 customers greater than $100,000, that’s up 49% last year, that customer bases brought you know, in our minds, automation continues to be a really strong, a really strong part of our program. Our guidance really reflects just the prudence that we feel on the large deal specifically, given the macro environment. There’s nothing beyond that in our minds.

Given the CFO’s remarks above, perhaps, management’s guidance does not take into account the growth of smaller deals in their pipeline. As such, UiPath could easily beat their guidance, especially if the Russia-Ukraine conflict improves.

Furthermore, the company is not seeing major competitive pressures, as so many bears have claimed about the rise of Microsoft Power Automate and other alternatives. My gut tells me that UiPath caters to larger, more established customers while Microsoft Power Automate is more suitable for smaller, lower-budget businesses. Here’s CEO Daniel Dines on the competition:

We are not seeing really any increase in the competition. On the contrary, we are seeing less competitive pressure in the deals. We are-so we can comment if you are interested on various major players that we are seeing in the business. And in terms of the — our traditional specialized competitors, we are really seeing less and less of them. We are replacing Blue Prism and Automation anywhere in many customers. And speaking about the new entrants like Microsoft and ServiceNow, we are — we really — we are not seeing them that much.

CFO Ashim Gupta also added:

And then just on the numbers basis, I think it’s really important. We see — when you look at our win rates, we continue to look and analyze win rates between where Microsoft and where some of these large players are playing and where they’re not. We don’t see them a lot. But even when we do, our win rate has no difference compared to where they are not playing. So we’re really — the trend of continuing to feel us is the dominant player in the industry. Right now, that is continuing from the data that I see and that we see as a team.

All in all, the fundamentals of the business have not changed as demonstrated by UiPath’s strong pipeline and competitive positioning. I still believe UiPath has a long growth runway ahead, supported by its strong technology, network effects, and switching cost moats. Weak guidance was all due to Russia and FX-related headwinds, not due to competition. Not surprisingly, the next few quarters’ numbers may look grim because of the ongoing war, and thus, the markets may react negatively.

In the near term, there may be more pain. On the contrary, rising interest rates and a looming recession may actually be a tailwind for UiPath. This is because businesses may be forced to cut spending and lay off staff – the best way to compensate for these losses is to hire robots, and UiPath is well-positioned to serve the needs of these businesses. Furthermore, the RPA market is still in its early stages, and being the leader in the industry, the future for UiPath seems bright.

Conclusion

In the context of a fragile economic environment, any bad news – no matter how severe – will be deemed catastrophic. That is what happened to UiPath recently: the company announced weak guidance and the markets decided that UiPath no longer deserves a premium valuation, causing the stock to plunge 25%, on top of a 70% drawdown prior to the earnings release.

The question is: has the fundamentals of the business changed? Absolutely not.

In fact, UiPath is executing brilliantly. Recently, UiPath landed customers such as Snowflake and the IRS, and established partnerships with Coursera and IDC. UiPath was also named a leader in the Worldwide Cloud Testing Vendor Assessment. More importantly, UiPath was awarded the Customer Relationship Management Institute’s NorthFace ScoreBoard Service Award, receiving a Customer Satisfaction score of 91% (versus the average software organization score of 77%).

UiPath is performing well internally, but unfortunately, external circumstances brought the stock to its knees. If the Ukraine-Russia war persists, the next two quarters may be ugly, which may lead to more short-term pain. However, the fundamentals of the business remain strong, and when the war subsides, long-term gains will follow. Furthermore, management may be sandbagging guidance, as they always have.

Today, UiPath trades at an EV/Gross Profit of 12.9x, a reasonable valuation for a high-quality company with a long growth runway ahead. Perhaps this is an opportune moment to accumulate shares.

Be the first to comment