Olivier Le Moal/iStock via Getty Images

Investment thesis

UiPath (NYSE:PATH) generates sales growth inefficiently and the outlook for profitability remains low. Current consensus forecasts do not indicate major undervaluation in our view. We believe RPA as a technology has its applications but is prone to substitution risk, and UiPath’s low return profile highlights that the market is commoditized. With a decelerating sales growth profile, we rate the shares a sell.

Quick primer

UiPath is the world leader in cloud-native robotic process automation (RPA) software with market share of around 30% worldwide. Founded by CEO Daniel Dines and CTO Marius Tîrcă in Bucharest in 2005, the company IPOed in April 2021 raising USD1.8 billion. Key peers include unlisted Automation Anywhere and Blue Prism (acquired by Vista Partners in September 2021). The company is said to have over 9,630 customers in October 2021. The business model has a recurring subscription-based revenue model.

The company will announce Q4 FY1/2022 results on 30th March 2022.

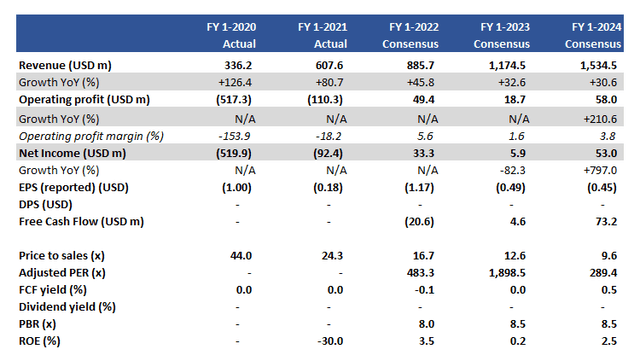

Key financials

Key financials (Company, Refinitiv)

Our objectives

UiPath’s shares have experienced a 57% drawdown since it was priced at USD69 on the first day of trading. Growth stocks are currently out of favor, but with strong SaaS growth metrics, could UiPath be able to buck the trend? In this piece we want to assess the following:

- use the Magic Number formula to see how efficiently UiPath is generating sales growth.

- the outlook for profitability given the continued scaling being executed by the company.

We will take each one in turn.

Growth investment yielding mixed returns

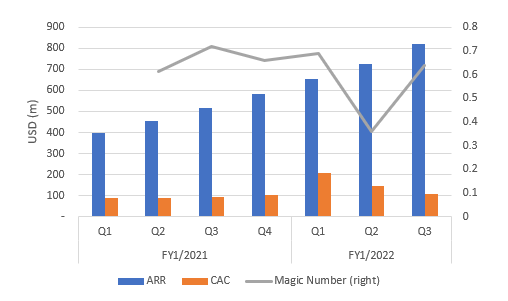

The Magic Number formula is not a perfect measure, but as an indicator, it does reveal how efficient a business is at generating sales growth by looking at the relationship between annual recurring revenue (known as ARR) and customer acquisition costs (or CAC). The equivalent measures at UiPath are called Annualized Renewal Run-Rate (amount of invoiced annual subscriptions) and sales & marketing costs (non-GAAP). The Magic Number target is to be above 0.75 – levels below this highlight a need to evaluate whether you are on track to achieve solid sales efficiency. Unfortunately, since Q2 FY1/2021 the company has not been able to reach this level.

Quarterly Magic Number analysis

Quarterly Magic Number analysis (Company, Karreta Advisors)

On the surface, this result indicates that UiPath is off track to achieve satisfactory sales efficiency. Business growth is being generated relatively poorly, raising questions over how marketing spending is being undertaken and whether it makes sense to do so.

However, there is another view. The company is awash with cash post IPO with a net cash balance of USD 1.7 billion in Q3 FY1/2022. It does not have to be overly concerned over marketing costs as its runway (the time taken to run out of cash) is currently very long. Becoming sales efficient is clearly not a high priority.

The ideal situation is that when the Magic Number reaches 0.75 then this is the moment to ramp up your sales and marketing functions. When this materializes, it may result in significant outperformance. As of now, we surmise that UiPath is not at the stage where it can leverage marketing spend into growth very effectively, which dampens the outlook for future sales growth.

Next, we look at the scope for profitability in the business.

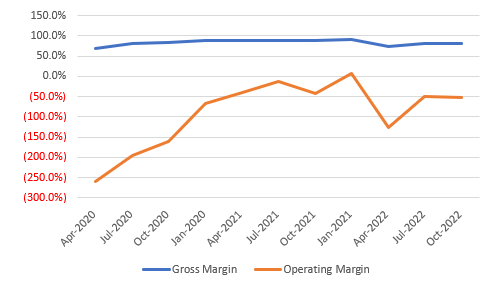

Margins are yet to stabilize

A cloud-native SaaS business should be targeting operating margins in excess of 20%. The company is not that new and considering it was listed after completing series F financing, we expect to see better profitability and stability for a maturing business. Reported operating margins remain in negative territory with no clear direction to positive margins.

Quarterly gross and operating margin trend

Quarterly gross and operating margin trend (Company)

The negative operating margins are explained by high sales & marketing costs, highlighting that despite high investments here the impact on sales growth has had a limited effect (as per Magic Number analysis).

Consensus estimates pencil in only 3.8% operating margin in FY1/2024, despite the company expected to generate USD1.5 billion of sales volume – this is a very low return model. Perhaps this is where more controversial views need to be aired with regards to RPA in general, with some highlighting RPA project failure rates being as high as 30% to 50%.

We believe that RPA has been significantly hyped as a technology which led to unrealistic expectations in some quarters of the market. Perhaps RPA is a useful but limited offering for a business embarking on digital transformation, and consequently, there is a need for significant marketing and promotional activity to bring customers on board. We conclude that RPA is not an ‘easy sell’, and consequently, we do not expect to see high double-digit margins in this product for the longer term.

Valuation

On consensus forecasts, the shares are trading on a price to sales multiple of 12.6x for FY1/2023. This multiple has dropped significantly since IPO, but with a decelerating sales growth profile, we do not believe it is cheap enough.

The company is expected to generate some positive free cash flow in the medium term. This is good news as financing risks will be low, but conversely, a free cash flow yield of 0.5% in FY1/2024 is an unattractive level.

Risks

Upside risk comes from a major demand spike in RPA as businesses embark on full digital transformation post-pandemic. With more use cases and experience, the company has a better track record to convert new customer wins.

With significant amounts of cash, UiPath may embark on an aggressive campaign to win greater market share which may result in higher profit opportunities in the longer term.

Downside risk comes from sales growth deceleration and limited profitability improvements, highlighting a failure to meet the ‘rule of 40%‘.

Limited sales growth could result in returning to a cash burn profile, which raises the risks of dilutive financing.

Conclusion

Being a cash-rich company is allowing UiPath to generate sales growth inefficiently. Whilst this may not be a huge red flag, the outlook for profitability remains low and consensus forecasts do not indicate major undervaluation in our view. We believe RPA as a technology has its uses but is prone to substitution risk through other digital transformation technology, and its low return profile highlights that it is already commoditized. With a decelerating sales growth profile, we rate the shares a sell.

Be the first to comment