Torsten Asmus

NEW YORK (September 29) – Prime Minister Liz Truss’ planned tax cuts, announced last week, caused rates on the UK gilt to spike as markets saw them as inflationary. As values fell, pension funds that had leveraged their bond holdings suffered margin calls, forcing them to sell off assets, further reducing bond values. The virtual feed-back loop in bond values caused the Bank of England (“BOE”) to intervene to halt the downward spiral.

The bailout seems to have stemmed the tide of the sell-off and rate rises, at least for the time being. Several commentators called it a near “Lehman moment”, after the 2008 trigger point of the Great Recession.

The “Japanification” of the G7?

Truss’ plans for fiscal stimulus (she wanted the tax cuts to boost UK GDP to 2.5%) ran counter to the BOE monetary policy. That’s something we’ve seen in Japan for the last few years, where the Ministry of Finance has been spending as the Bank of Japan at least purports to be fighting inflation.

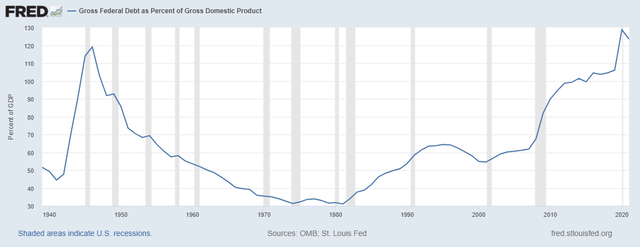

In the United States, we see much the same, with national debt of $31 trillion and debt levels just barely coming off the highest debt-to-GDP ratios in the last 80 years (currently 123%); even higher than the ratio that existed in WWII.

In August, the president signed a $400 billion spending bill that included $700 million in new taxes, but has also said he will spend upwards of another half trillion dollars on student debt relief. While the US has been able to maintain these debt levels because of its “exorbitant privilege” as the world’s reserve currency, tensions with Russia and China put that status at risk, particularly as China advances its e-CNY Central Bank Digital Currency to bypass SWIFT and evade US geopolitical sanctions.

Inflation takes a back seat?

The Fed has tried to keep inflation at bay while avoiding the proverbial “hard landing”; recession. But there may be extraneous factors — fiscal policy or geopolitical events — that force the Fed’s hand to loosen its grip in monetary policy, as the UK was forced to do yesterday.

But the greater concern beyond a hard landing is that the Fed has to intervene to rescue markets from the kind of feed-back loop that we saw in the UK yesterday morning, with margin calls causing sales, triggering greater margin calls, triggering greater margin calls…. a dangerous market melt-down. If the Fed had to intervene to stop such a melt-down, it would effectively signal that the Fed has effectively lost control of monetary policy; it means the Fed has had to “blink” and give inflation free reign to stabilize the markets.

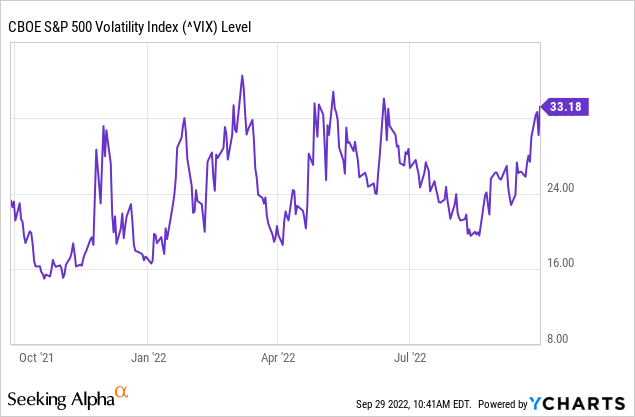

So much of the market is set against the 10 Year Treasury as a baseline “risk free rate” that volatility in that market — or risk — can cause volatility everywhere. Markets are volatile now, with the VIX at one of its highest levels in the past year.

Investors need assess their risk appetite and be particularly alert to vulnerabilities in their portfolios. The traditional 60/40 portfolio is at risk. They should have stop-loss orders in their long accounts and consider going to cash, even as inflation eats away value. After all, it is better to lose single digits net, in a money market, to inflation than to lose double digits in the kind of sharp market downturn that could happen as markets are unsettled.

___________________________________________________

Note: Our commentaries most often tend to be event-driven. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing and include strategies that we would recommend were the companies our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions with respect to such companies here, however, assume the company will not change).

Be the first to comment