buzbuzzer

The United States Gasoline ETF, LP (NYSEARCA:UGA) is an exchange-traded fund (“ETF” or the “Fund”) created to provide an exposure to gasoline futures contract prices.

According to the Fund’s General Partner, United States Commodity Funds, LLC. (“USCF”):

The investment objective of UGA is for the daily changes in percentage terms of its shares’ NAV to reflect the daily changes in percentage terms of the price of gasoline (also known as reformulated gasoline blendstock for oxygen blending, or “RBOB”), for delivery to the New York harbor, as measured by the daily changes in the price the Benchmark Futures Contract, less UGA’s expenses.

The Benchmark Futures Contract is the futures contract on gasoline as traded on the NYMEX. If the near month contract is within two weeks of expiration, the Benchmark will be the next month contract to expire. The RBOB contract is for delivery to the New York harbor.

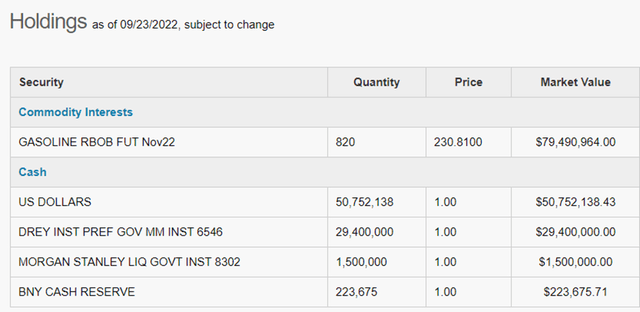

UGA invests primarily in listed RBOB futures contracts and other gasoline-related futures contracts, and may invest in forwards and swap contracts. These investments will be collateralized by cash, cash equivalents, and US government obligations with remaining maturities of two years or less.”

The current holdings are listed below.

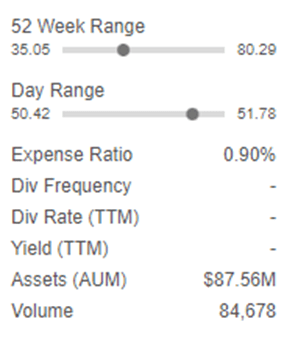

Many investors do not want to manage an oil futures account. There are margin calls to potentially meet, requiring continuous monitoring, at the very least. The Fund manages the margin calls for investors for a fee. The Fund charges an Expense Ratio of 0.90% and has about $85 million in Assets Under Management (“AUM”).

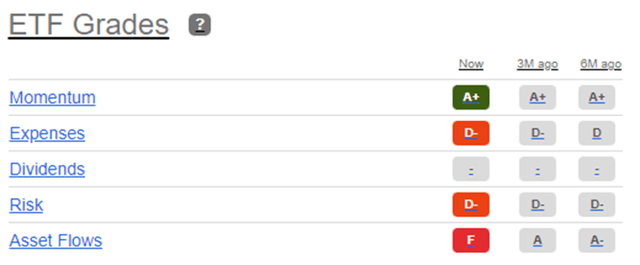

Seeking Alpha

Seeking Alpha has rated the ETF’s expenses a “D-“.

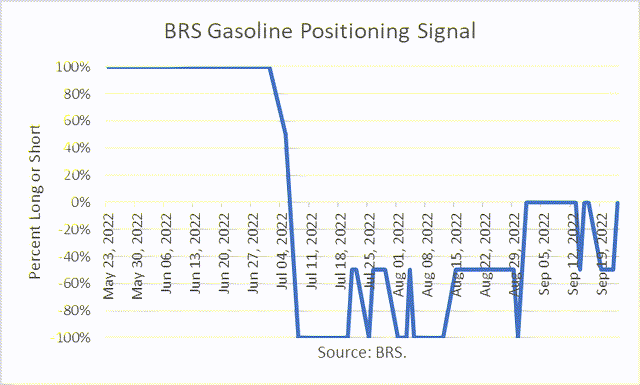

In May 2022, I wrote an article, UGA: Making The Long Case With Behavioral Finance, which appeared on Seeking Alpha. In that article, I explained that “I applied my algorithmic trading (AT) strategy for systematic positioning, which I call the ‘BRS’ strategy.”

I concluded that my algorithmic trading strategy is based on such an approach and currently provides a “Long” signal. However, I also quoted economist Larry Summers, former Treasury Secretary and past president of Harvard University, “there is a significant likelihood of a recession in the not-too-distant future.”

The UGA price did continue its rise after that article appeared on May 23rd. However, it peaked on June 3rd in that price cycle.

My AT signal switched from long to short on July 6th.

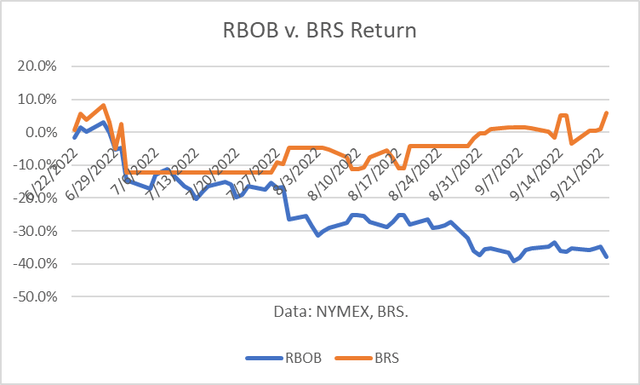

As I previously explained in another article, I commenced trading in a futures market account on June 23rd. I have had many other oil futures trading accounts going back to 1980 when I began trading NYMEX heating oil (“HO”).

The market has been highly volatile and challenging. I captured a profit of 5.8% against a loss in NYMEX gasoline futures prices of about 38%.

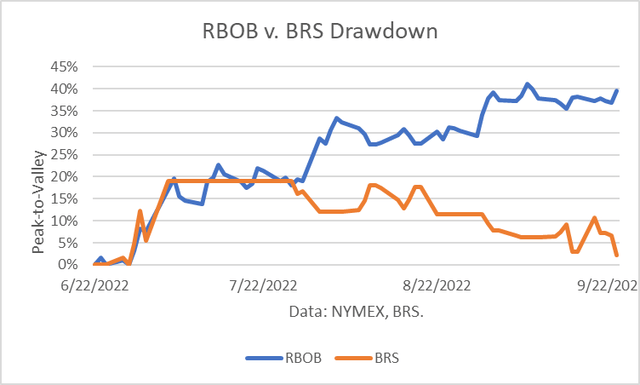

I believe that the Maximum Drawdown (“MD”) is then key risk parameter since it measures how much an investor would have lost at the worst time. Investors are prone to and should control losses, exiting positions. An MD of 30% or more is generally considered unacceptably high by hedge funds.

Since June 23rd, the MD of a long NYMEX RBOB position would have been about 41%. The MD of the BRS account was 19%.

Gasoline Fundamentals

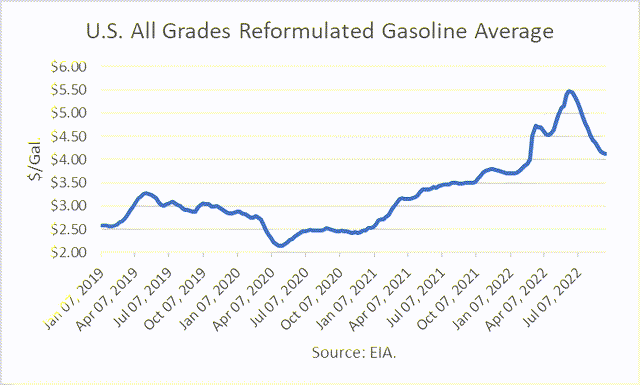

Retail gasoline prices spiked in the US and around the world, topping out in June.

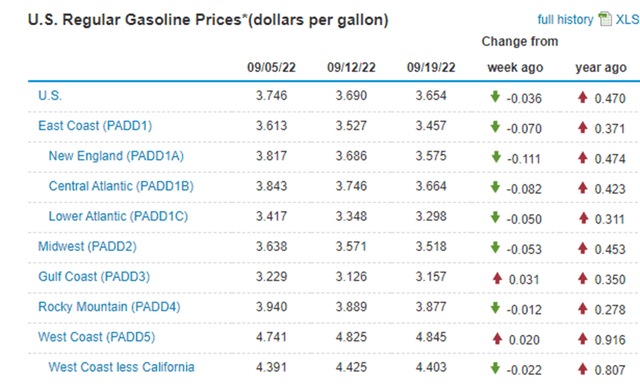

Although prices have come down, the national average in the US still remains almost $0.50/gal higher than a year ago.

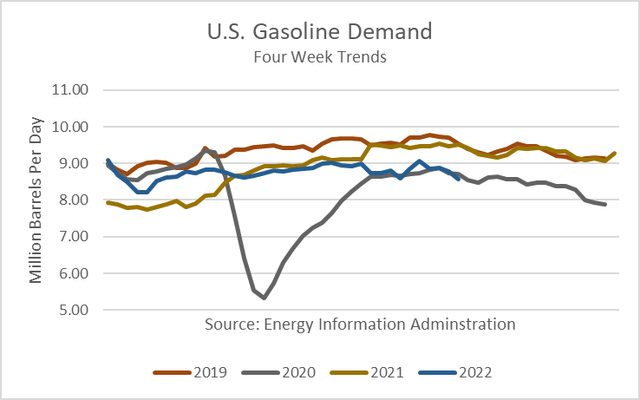

High retail prices have made a dent in gasoline consumption. US gas demand is about 7.7% lower than a year ago over the past 4 weeks. Moreover, it has fallen to the pandemic level for this time period in 2020.

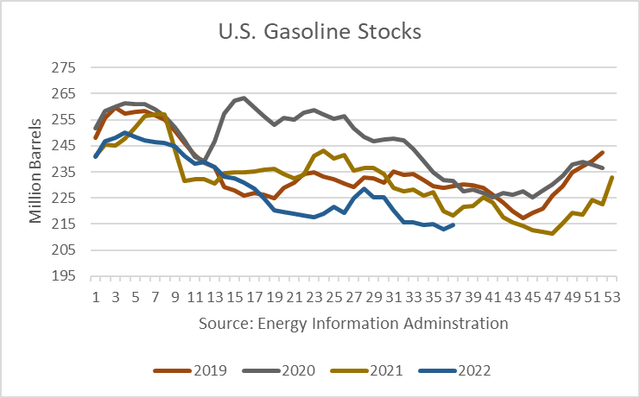

Gasoline inventories have been the lowest in 4 years. However, the stock deficit is being corrected.

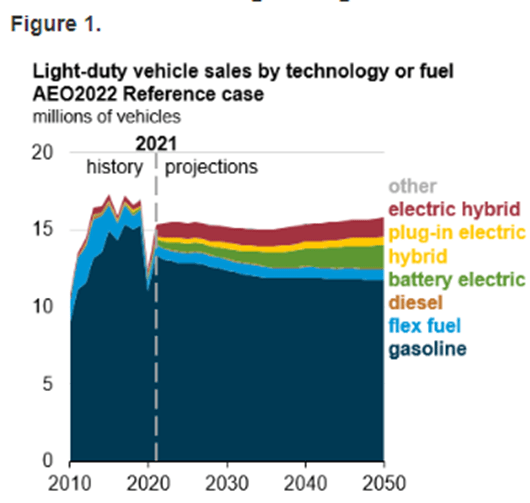

The EIA has projected in its 2022 Annual Long-Term Outlook through 2050 that:

Gasoline Remains The Dominant Light-duty Vehicle (Ldv) Fuel, But Consumption Does Not Return To Pre-pandemic Levels During The Projection Period”

EIA

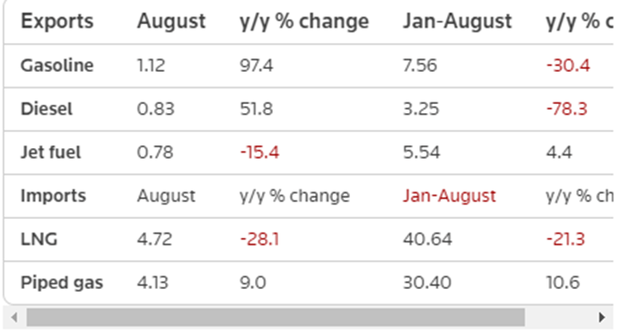

In addition to lower US gasoline demand, it was reported that China’s August gasoline exports rose 97.4% from a year earlier.

General Administration of Customs

Inflation, Interest Rates and the Economy

The Fed has a dual mandate of full employment and stable prices (i.e., low inflation). And so it has been signaling the markets that it will take action to tame inflation this year. It was reported on July 6th, that the “Federal Reserve officials in June emphasized the need to fight inflation even if it meant slowing an economy that already appears on the brink of a recession.”

Gasoline futures prices have been declining since peaking earlier in the summer. And on Friday, September 34rd, NYMEX gas futures prices tanked. The news report below explains their observations.

Crude Plunges on Recession Concerns and Dollar Strength:

Crude oil and gasoline prices Friday sold off sharply, with crude plunging to an 8-month low and gasoline falling to a 2-week low. A rally in the dollar index Friday to a 20-year high undercut energy prices. Also, the energy markets are worried about a global recession due to the sharp increase in global interest rates. In addition, a slump in global equity markets Friday curbed confidence in the economic outlook and was bearish for energy demand.” – Barchart

Rebuttal

In an article dated July 18, 2022, UGA: The Gasoline ETF Product – Fill Up Those Tanks On The Dip, being on the long side of UGA was based on:

Markets across all asset classes move higher and lower based on the economic and geopolitical landscape. In 2022, inflation, the growing odds of a recession, and pandemic-related supply chain issues continue to plague the global economy. High oil and oil product prices only exacerbate the economic challenges. Meanwhile, the geopolitical dynamics are a mess, with tensions rising to the highest level since World War II.

The bottom line is economics and politics support higher oil prices in mid-2022.”

The decline in the gasoline futures arena could be short-lived, as compelling reasons could lead to higher highs and new all-time peaks in 2022 and 2023. I favor the long side in the UGA ETF, leaving plenty of room to add on further declines. It is impossible to pick bottoms during corrections, but the factors supporting higher gasoline and oil prices continue to favor the upside.”

While the article recognized inflation and the growing odds of a recession, the article did not mention any possible impact of the Fed’s response to inflation and the recessionary expectations it would create, nor the impact of high gasoline prices on gasoline demand.

Essentially, the article ignored basic economic principles. Since the article was published, UGA has sunk 19.59%.

Seeking Alpha

Conclusions

NYMEX gasoline prices have been highly volatile, causing losses to both long and short positions. On balance, being on the long side continuously has proven to be a losing proposition.

UGA provides investors with an opportunity to gain an exposure to gasoline futures prices through an ETF, eliminating the need for investors to trade futures contracts. However, the risk to gasoline futures prices is embedded in the ETF.

Gasoline futures prices peaked earlier in the summer and have dropped, which has resulted in lower retail gasoline prices in the US. But consumers have responded by driving less. And the Fed has raised interest rates to combat inflation, but that raises the risk of an economic recession, another negative in the gasoline price outlook.

I have traded gas futures prices from the short side with overall success. I anticipate that we will continue to see gas prices correct lower, but it is certain to be a rocky road along that path. I post my futures trading account activity in my Seeking Alpha Marketplace service, Boslego Risk Services.

Be the first to comment