ipopba

A Quick Take On uCloudlink

uCloudlink (NASDAQ:UCL) went public in early 2020, raising approximately $36 million in gross proceeds from an IPO priced at $18.00 per ADS.

The firm provides mobile data-sharing options to consumers and mobile carriers.

Management needs to reignite revenue growth for the stock to receive a meaningful upside catalyst to the stock price.

Until we see revenue growth in its financial results, I’m on Hold for UCL.

uCloudlink Overview And Market

Hong Kong-based uCloudlink was founded to operate an online marketplace to connect mobile carriers to connect and share data at the country and carrier level.

Management is headed by founder and Chief Executive Officer Mr. Chaohui Chen, who has been with the firm since and was previously SVP at Huawei and an R&D engineer before that.

The firm aggregates mobile data traffic allowances via mobile network operators in 144 countries using its cloud SIM architecture.

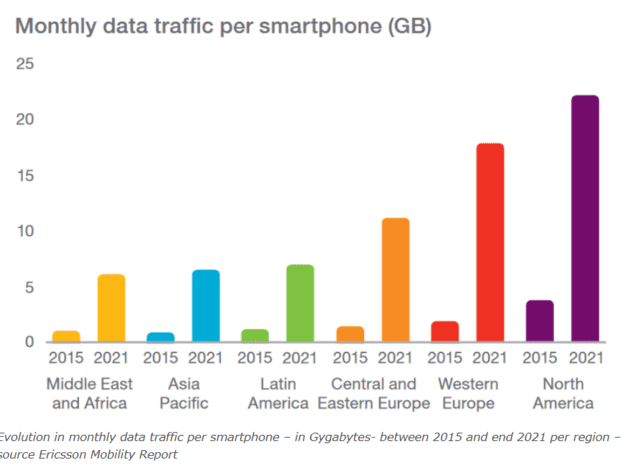

According to a 2016 market research report referenced by i-Scoop, the market for mobile data is expected to grow by a factor of 12 between 2015 and 2021.

Monthly data traffic per smartphone is expected to grow most sharply in the western regions of North America and Western Europe, as the chart shows below:

Smartphone Data Traffic (i-Scoop)

The main drivers for this expected growth are the increase in the viewing of video over mobile devices as well as the continued growth of social networking.

uCloudlink’s Recent Financial Performance

-

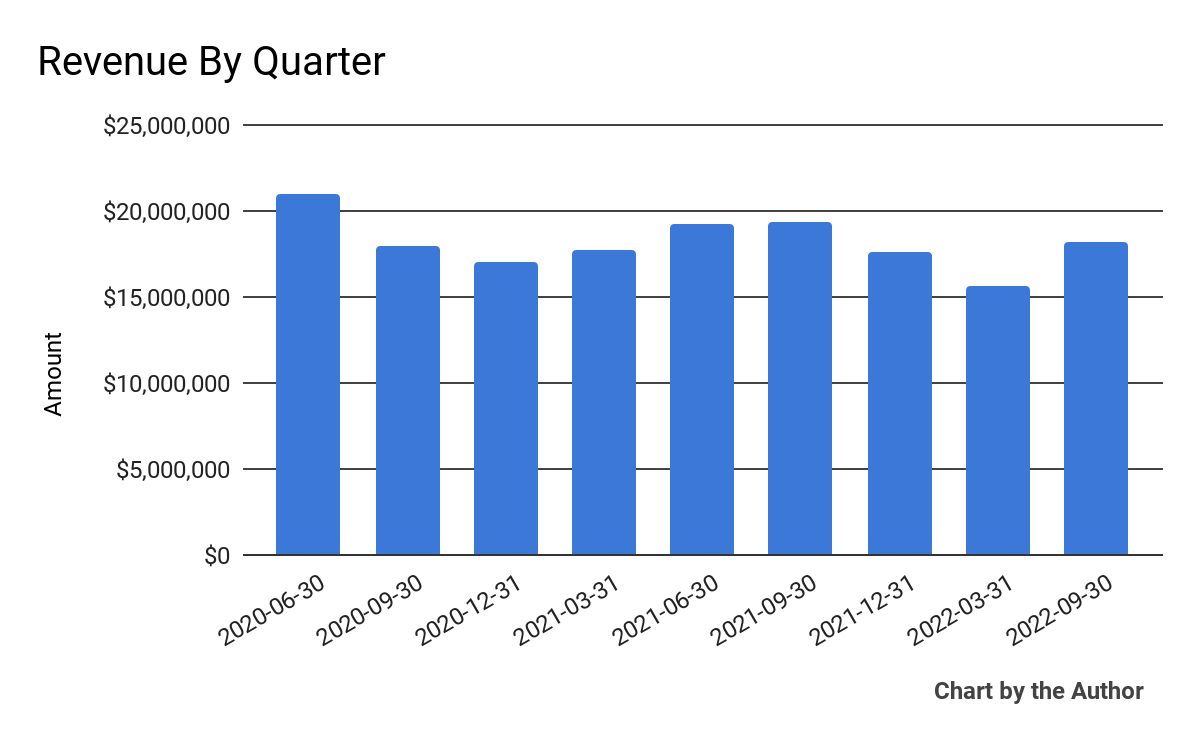

Total revenue by quarter has largely plateaued in recent quarters:

9 Quarter Total Revenue (Financial Modeling Prep)

-

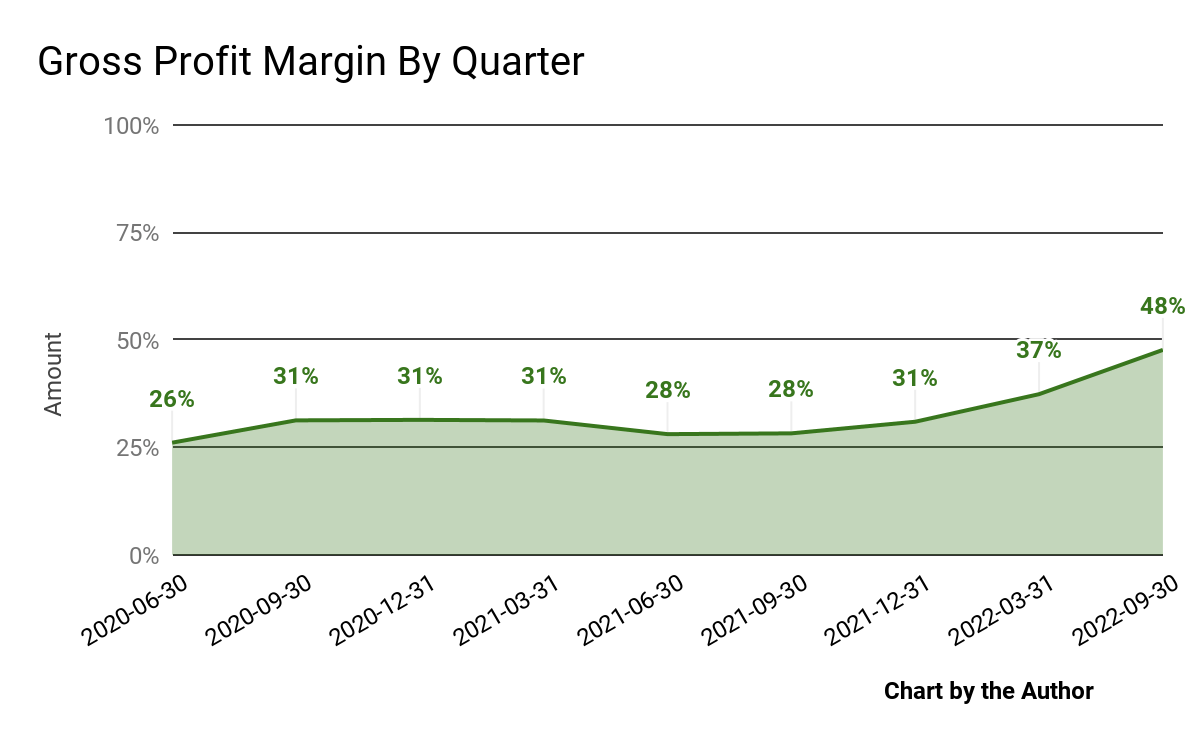

Gross profit margin by quarter has risen in the last few quarters:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

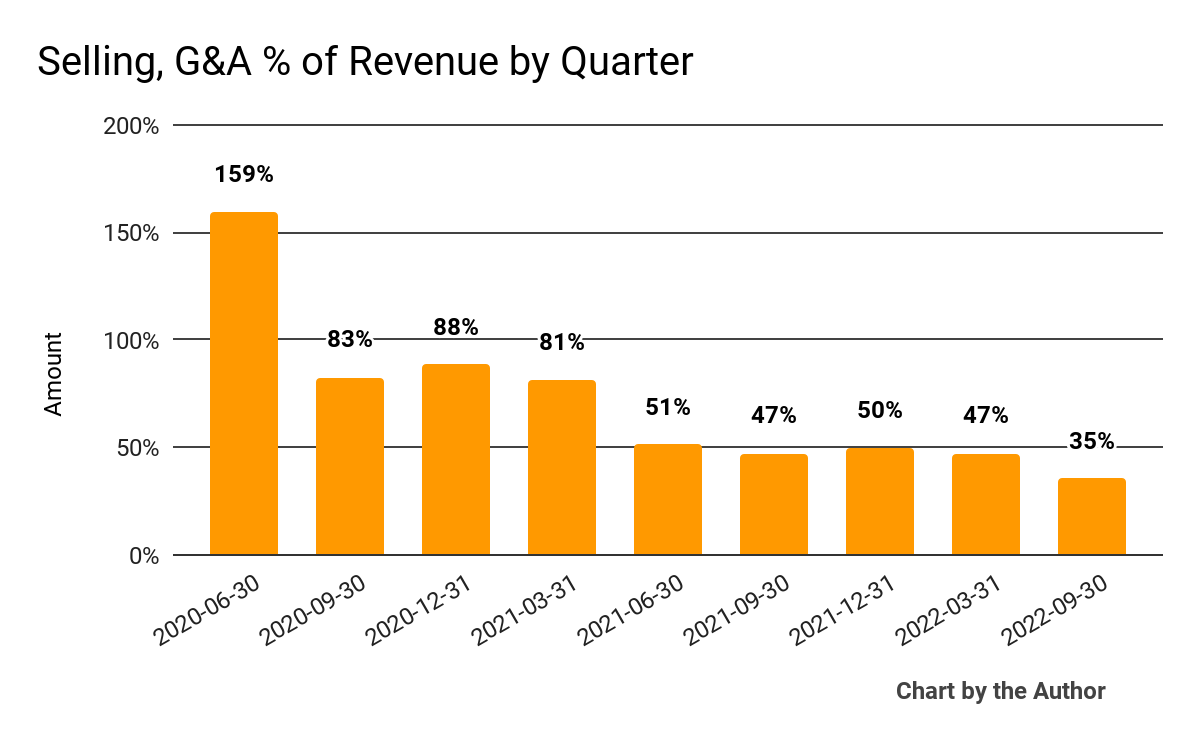

Selling, G&A expenses as a percentage of total revenue by quarter have trended substantially lower over time:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

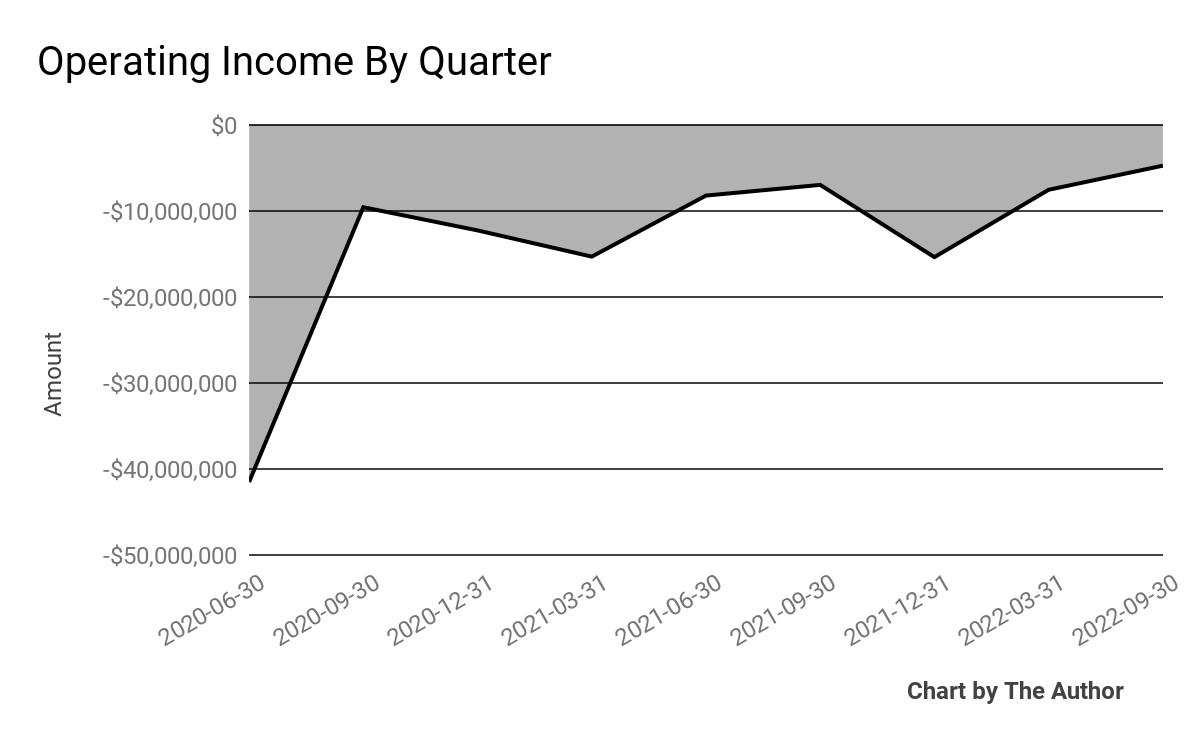

Operating losses by quarter have trended toward breakeven:

9 Quarter Operating Income (Financial Modeling Prep)

-

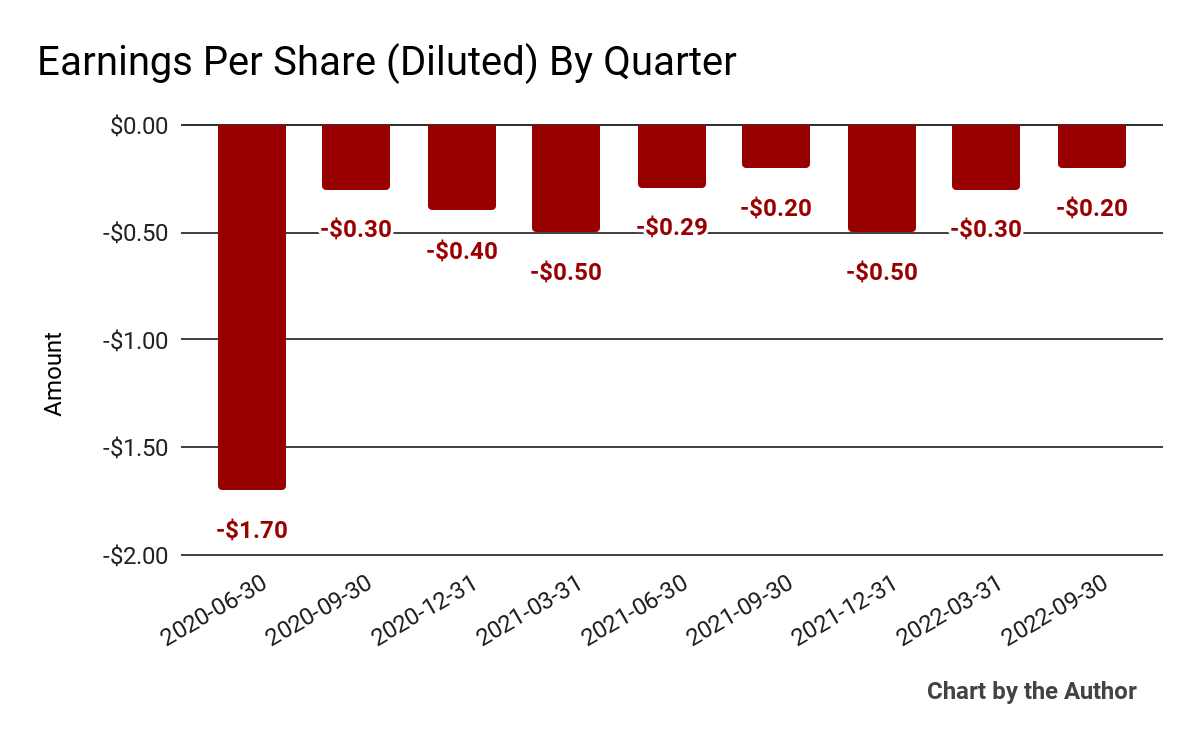

Earnings per share (Diluted) have remained significantly negative, as the chart shows below:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

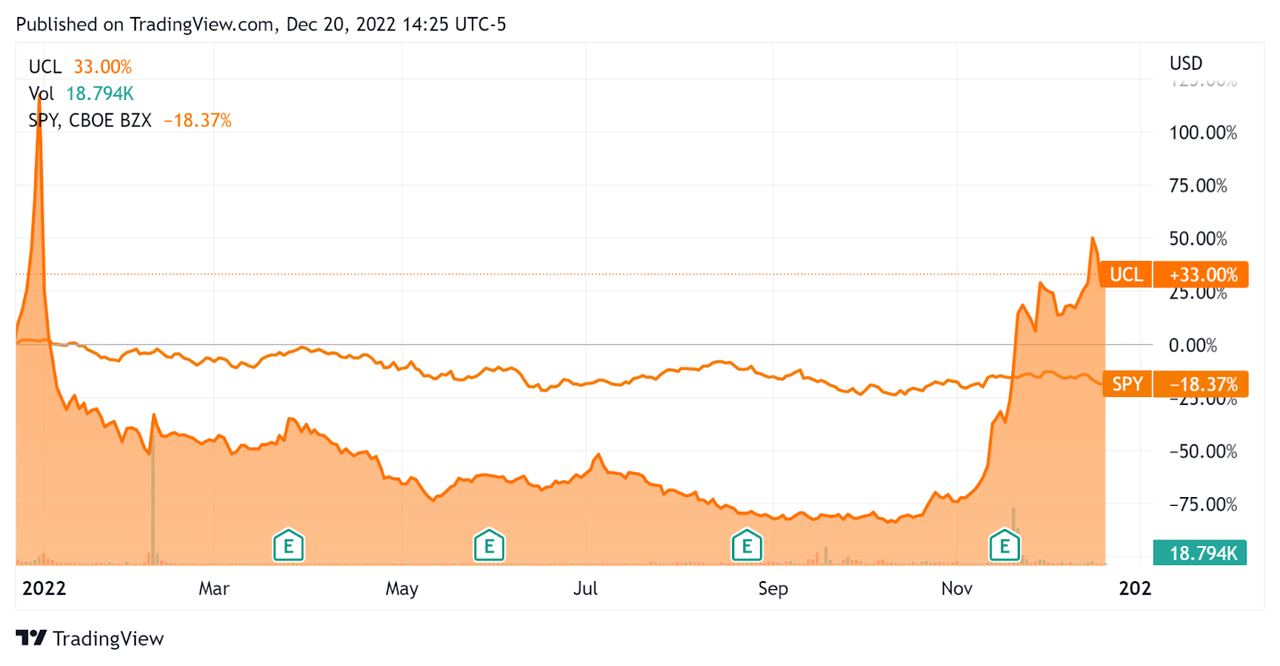

In the past 12 months, UCL’s stock price has risen 33% vs. the U.S. S&P 500 index’s drop of around 18.4%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For uCloudlink

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.6 |

|

Enterprise Value / EBITDA |

-3.3 |

|

Revenue Growth Rate |

-1.7% |

|

Net Income Margin |

-49.5% |

|

GAAP EBITDA % |

-48.7% |

|

Market Capitalization |

$144,136,287 |

|

Enterprise Value |

$113,627,612 |

|

Operating Cash Flow |

-$12,142,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.20 |

(Source – Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

UCL’s most recent GAAP Rule of 40 calculation was negative (50.4%) as of Q3 2022, so the firm has performed poorly in this regard per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

-1.7% |

|

GAAP EBITDA % |

-48.7% |

|

Total |

-50.4% |

(Source – Financial Modeling Prep)

Commentary On uCloudlink

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted slight revenue recovery in Mainland China for its 1.0 business, while Japan and Southeast Asia showed greater growth due to the lifting of certain travel restrictions.

The firm’s 2.0 connectivity solution produced a 38.7% revenue growth year-over-year as customers adopt the system for the Internet of Things connectivity efforts.

As to its financial results, total revenue decreased by 5.7% year-over-year due to reduced sales of ‘certain terminal and data-related products.’

Management did not disclose any company retention rate metrics, so we don’t have visibility into product/market fit.

The firm’s Rule of 40 results have been extremely negative, due in large part to its poor EBITDA performance over the past 12 months.

Gross profit margin grew sharply due to the company’s international data connectivity services, while SG&A as a percentage of total revenue continued to drop.

As a result, operating losses were reduced and negative earnings also improved to ($0.20) per share.

For the balance sheet, the firm finished the quarter with $25.8 million in cash, equivalents, and short-term investments and $6.0 million in short-term borrowings.

Over the trailing twelve months, free cash used was $4.8 million, of which capital expenditures accounted for $800,000 of cash use.

Looking ahead, management has been focusing its efforts on the U.S. market, as it has found opportunities to improve service coverage there versus the generally better coverage in China and Japan.

Regarding valuation, the market is valuing UCL at an Enterprise Value / Sales multiple of 1.6x.

The primary risk to the company’s outlook is a downturn in the U.S. economy in 2023, which may reduce the growth ramp of revenue contribution from this increasingly important market for UCL.

A potential upside catalyst to the stock could include further revenue growth from its U.S. activities.

UCL has reduced its headcount in recent quarters as the firm seeks to lower its operating losses.

So far, it is accomplishing those results.

However, management needs to reignite revenue growth for the stock to receive a meaningful upside catalyst to the price of the stock.

Until we see revenue growth in its financial results, I’m on Hold for UCL.

Be the first to comment