simarts

Earlier on in July, I wrote about the earnings results of UBS Group AG (NYSE:NYSE:UBS). In fact, most of my articles about the bank have been devoted to its financial performance. Now, I would like to touch upon the general outlook for the bank and its Seeking Alpha rating.

In my view, most of the pessimism around the stock is due to the recent results that fell below many analysts’ expectations. However, the results were not bad themselves. Also important is the fact central banks around the world are getting hawkish. Investors fear this may trigger a recession and are getting bearish on the stock market and especially the financial sector. I will explain this major Swiss bank’s general position, investors’ perception of it, and the stock’s likely destiny should a recession happen.

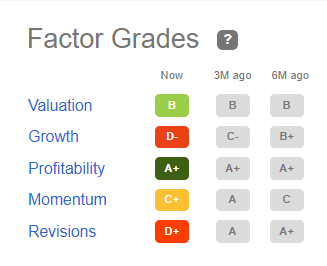

Seeking Alpha’s rating

Some existing investors and those only considering buying UBS shares may be discouraged by the following factor grades from Seeking Alpha’s web-site and its general quant rating of “Hold.” But, in my opinion, this rating does not reflect the bank’s true value and is too pessimistic, given the current fundamentals.

Seeking Alpha

Let us look at the following criteria Seeking Alpha uses to value the bank. Do not get me wrong: the factor grades are useful and take some important factors into account. But the growth and revisions criteria, the ones marked in red and therefore the most threatening ones, were substantially affected by the recent earnings results.

Analysts quickly change their forecasts when a company reports worse-than-expected results. In my previous article on UBS, I wrote about the bank’s earnings results. In short, the results were not bad. In fact, UBS reported a sound quarterly profit but it did not quite meet the analysts’ estimates. Soon after the results were published, the stock plunged by about 8%, which is a lot, given the stock’s usual low volatility. So, many analysts revised their estimates lower after the results were published.

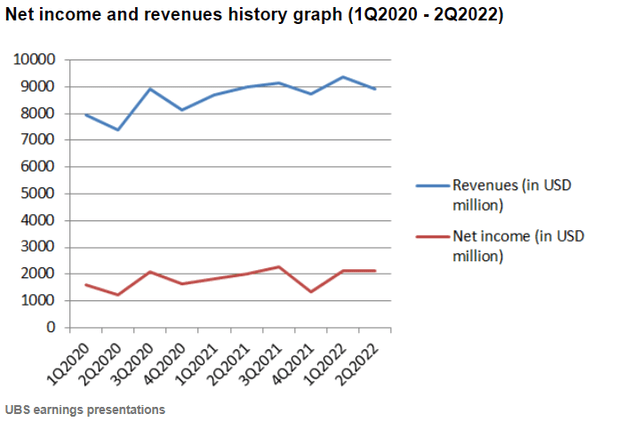

The fact the bank’s earnings did not rise by much compared to the previous quarter made UBS underperform according to the growth criterion. In order to get a good growth grade, a company has to raise revenues and earnings every consecutive quarter. This did not happen in the case of UBS. Instead, the bank’s results stayed practically unchanged from the previous period.

Source: prepared by the author based on the company’s data

The “momentum” criterion is also not in favor of the bank due to the high volatility on financial markets. After the Federal Reserve cancelled its monthly bond purchases, also known as quantitative easing program (“QE”), the stock markets started feeling uneasy. Many investors are now suspecting a recession may be near. The financial sector UBS belongs to will clearly suffer as well. But I will explain this in some more detail below.

Looming recession

A recession may be looming soon enough due to the Fed’s hawkish stance and looming rates hikes. This is all due to inflationary pressures. The truth is that this is not just America’s problem. In fact, many countries – developed and developing ones – are having record high inflation readings. Many central banks, including the ECB and the Bank of England, are forced to do the same as the Fed.

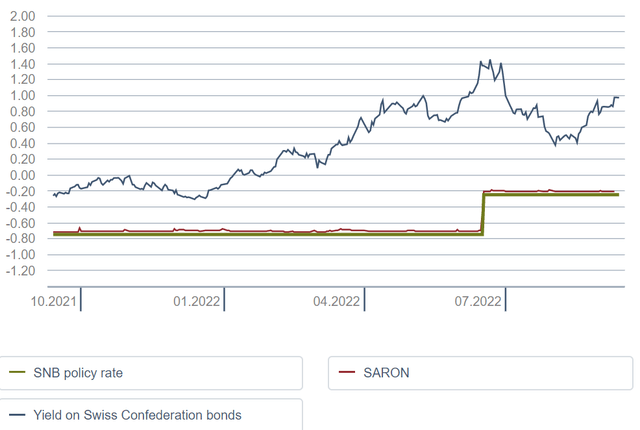

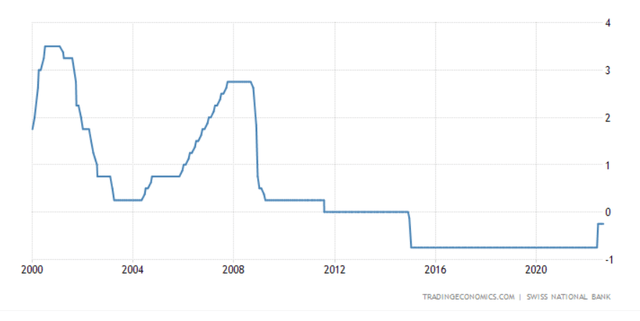

However, the SNB, Switzerland’s central bank, is still keeping its interest rates at negative levels.

The SNB policy rate is the base interest rate. It is now at -0.25%, but it used to be -0.75% some time ago. The SNB had to raise the interest rates somewhat due to the fact the inflation rate in Switzerland is rising. But as opposed to the EU and the U.S., the base interest rates in Switzerland are still negative.

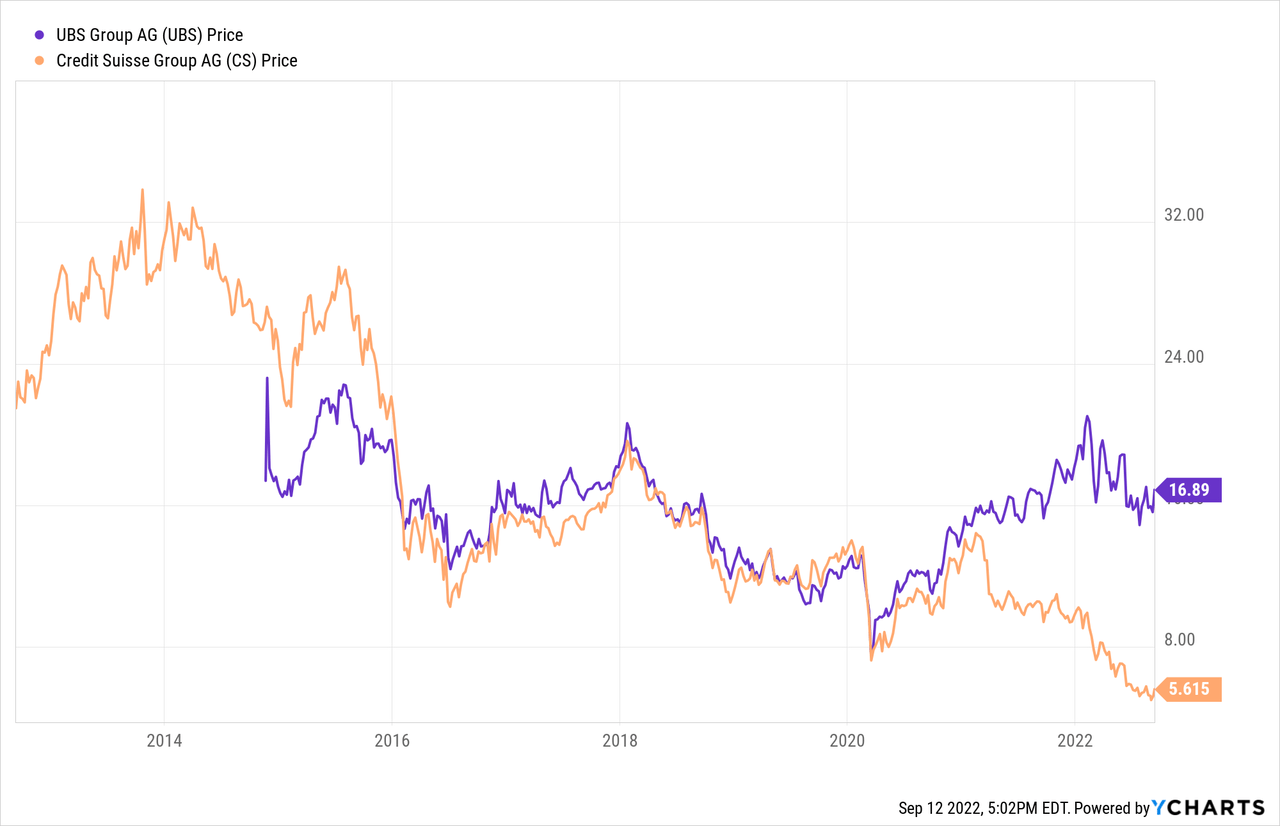

As can be seen from the diagram above, Switzerland’s base interest rate became negative in 2015. This was certainly due to the condition the Swiss economy was in. But concurrently, the stock prices of two major Swiss bank, namely Credit Suisse (CS) and UBS, fell as well.

This was due to the economic situation, but also partly due to the low interest rates since these have had a bad effect on the profits banks earn. The fact they increased somewhat in Switzerland and in many countries around the world is, therefore, a great positive for the bank’s profits since the bank is present in Switzerland and globally.

Higher interest rates to combat inflation, might, indeed, trigger a recession. At the same time, if central banks manage to avoid one, the higher rates will be positive for UBS’s profits.

Recent news

As I have mentioned above, the Wealthfront (WFRPX) acquisition was cancelled. On 2 September, UBS and Wealthfront, a U.S.-based robo-adviser, announced that the previously planned $1.4 billion takeover would not go ahead. In my view, this is good news since the technology sector is still somewhat overvalued, whilst many analysts predict a recession may be near. That is why UBS could have ended up overpaying for this company.

This decision also allowed the major Swiss bank to spare cash and also to share it with its stockholders. So, it was recently announced UBS Group plans to raise its dividends by 10% to $0.55 per share. According to the bank, the 2022 buyback program would also exceed $5 billion. The bank’s stock price rose somewhat after the news was reported.

But it’s not all good news. The decline of the global economy’s growth rate also affected the financial industry’s condition. This also had a negative effect on UBS. For example, it was recently announced that UBS had to make half a dozen of its China-based employees redundant. So, six top-managers had to quit from the bank’s Hong-Kong office. This is mostly due to the fact China’s economy is slowing down and many businesses and investors have to decrease the number of deals they make. Sure, China is the second-largest economy in the world. It offers plenty of growth opportunities for UBS since in the last few decades the number of millionaires has been increasing in this country. The fact that right now the level of business activity in China is not rising is a negative for the bank, of course. But China has been suffering from a decline in the housing sector and also the regular lockdowns in its largest cities. So, as soon as the economic slowdown is over, UBS will probably enjoy sound profits in China.

Valuation

By all means, UBS stock is not overvalued.

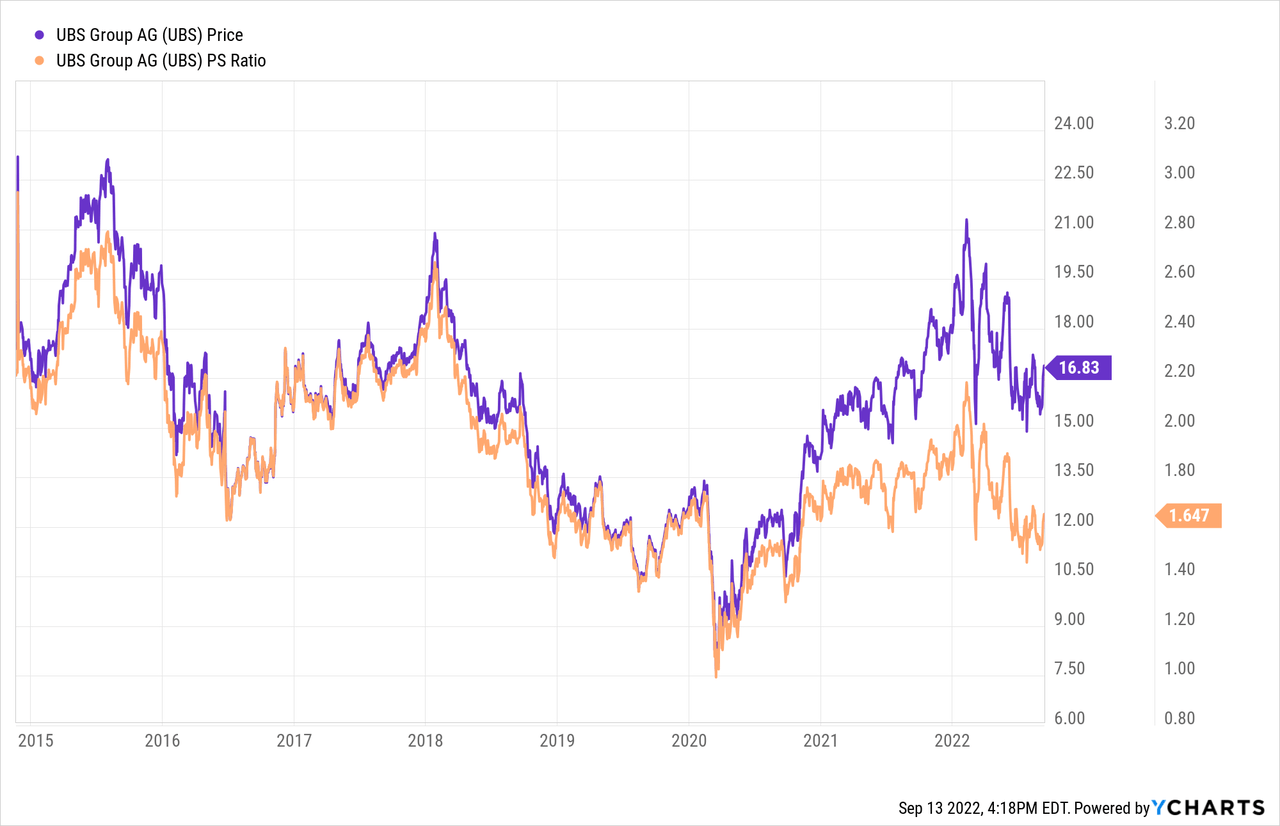

This is especially true of its price-to-sales (P/S) ratio. After all, it is even below 2, whilst some time ago it was almost 3. A price-to-sales of a moderately valued company is usually between 1 and 3. UBS fully meets this criterion.

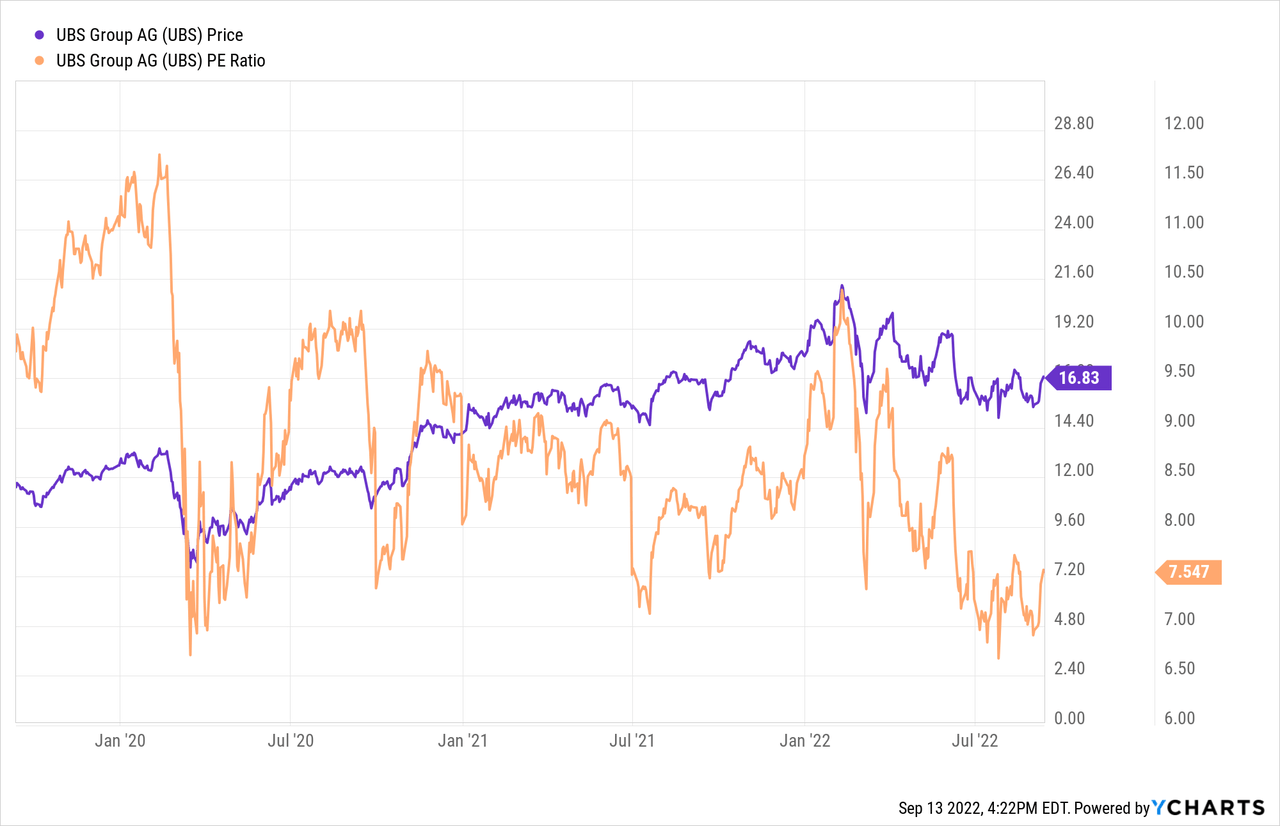

The average price-to-earnings (P/E) of S&P 500 is currently around 16. The P/E of UBS, Switzerland’s largest and most stable bank, is 7.5. In my view, that is not much at all. This indicator is also below the bank’s historical average.

So, I would say that UBS shares are not overvalued.

Conclusion

To conclude, I would say UBS is still in a very good position in spite of the recently reported results and the slowdown of the global economy. It raised the dividends and is successfully completing its share buyback program. The only downside factor I see is the global recession resulting from the higher interest rates. But UBS is a bank for the rich and it is enjoying stability. The bank would certainly be affected by the global recession. But the effect would highly likely be not as dramatic as it would be for its peers.

Be the first to comment