Chris Hondros

The headlines in the business press about UBS (NYSE:UBS) earnings results were highly pessimistic and made me feel as if the bank’s earnings were horrible indeed. For example, CNBC wrote that the past 2Q2022 was one of the “most challenging quarters for investors in a decade“. But that impression changed when I saw the bank’s press release and its earnings presentation. Although I understand the market’s concern with the economic outlook, the results are decent and the stock is undervalued. But let me explain this in some more detail.

UBS second-quarter results and the bank’s earnings history

I agree with my fellow Seeking Alpha contributor Mare Evidence Lab that the earnings results were quite good. But I think it would be helpful to see the bank’s earnings and revenues history.

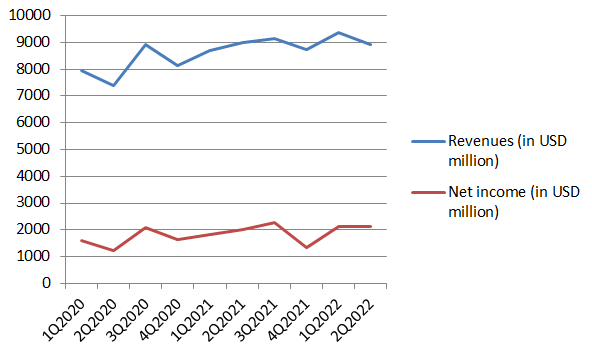

I prepared a graph covering the last two years, including the pandemic. You might argue that it is inappropriate to compare the recent results to the past quarters. Right now, the global economy is in a far better condition than it used to be during the pandemic quarters. But funny enough, the recently reported results are also not much worse than they used to be for the 1Q2022 when the global economy was not really affected by the lockdowns. The 2Q2022 results can be compared to the 2021 earnings and the ones for 2020. That stability is due to the bank’s leading position and its wealthy clients. We can see from the graph below that both the bank’s net income and revenues increased.

Net income and revenues history graph (1Q2020 – 2Q2022)

UBS earnings presentations

Source: Prepared by the author based on the bank’s earnings announcements

I decided to present these data in two formats: in the form of a graph and also as a table.

Earnings and revenues history table (1Q2020 – 2Q2022)

| Quarter | 1Q2020 | 2Q2020 | 3Q2020 | 4Q2020 | 1Q2021 | 2Q2021 | 3Q2021 | 4Q2021 | 1Q2022 | 2Q2022 |

| Revenues (in USD million) | 7934 | 7403 | 8935 | 8117 | 8705 | 8976 | 9128 | 8732 | 9382 | 8917 |

| Net income (in USD million) | 1595 | 1232 | 2093 | 1636 | 1824 | 2006 | 2279 | 1348 | 2136 | 2108 |

Source: Prepared by the author based on the bank’s earnings presentations

Over the two years’ time, the revenues rose by more than 12%, whereas the net income jumped by 32% over the same period. On average, that means 6% revenue growth per annum and 16% net profit growth per annum. This is not bad for a large bank at all. Plus, as I have mentioned before, the growth was stable. Only the 4Q2021 was sufficiently worse than all the other periods. As concerns the recently reported 2Q2022 results, they were only somewhat worse than the 1Q2022 revenues and earnings.

Not surprisingly, the other accounting indicators of UBS were not much worse either.

|

2Q2021 |

3Q2021 |

4Q2021 |

1Q2022 |

2Q2022 |

|

|

Diluted EPS (USD) |

0.55 |

0.63 |

0.38 |

0.61 |

0.61 |

|

Effective tax rate |

22.4% |

20.1% |

21.4% |

21.4% |

19.0% |

|

Return on CET1 capital |

19.3% |

20.8% |

11.9% |

19.0% |

18.9% |

|

Return on tangible equity |

15.4% |

17.2% |

10.0% |

16.0% |

16.4% |

|

Cost/Income ratio |

71.8% |

68.7% |

80.5% |

70.7% |

70.6% |

|

Total book value per share (USD) |

16.90 |

17.48 |

17.84 |

17.57 |

17.45 |

|

Tangible book value per share (USD) |

15.05 |

15.62 |

15.97 |

15.67 |

15.51 |

Source: Prepared by the author based on the bank’s presentation

Even the diluted EPS (earnings per share) stayed at the level they were at in the 1Q2022. Remember that 1Q2022 was a very strong quarter. And so were the efficiency ratios, including the Cost/Income ratio and the return on CET1 capital. In fact, even the return on tangible equity – 16.4% – was higher compared to 1Q2022’s 16.0%. In fact, I would say that just the total book value per share and the tangible book value per share were only slightly below the indicators reported in the previous two quarters.

In that respect, we can say that the only major source of disappointment in the results reported was the fact they were below many analysts’ expectations. So, for example, the bank posted a net profit of $2.108 billion, which came below analyst expectations of $2.403 billion.

UBS stock valuations

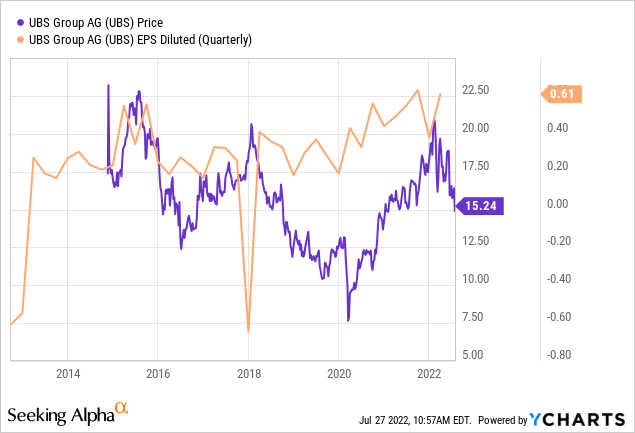

UBS stock is ridiculously undervalued right now. Why am I saying this? Well, the bank’s quarterly EPS are very high compared to the levels seen just a few years ago. At the same time, the stock price is below the levels seen four or six years ago.

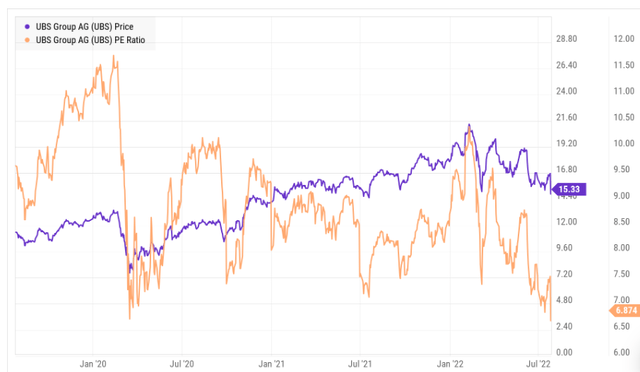

If we take the price-to-earnings (P/E) measure, it will also show us that the stock is very undervalued. A P/E of less than 7 is very low for a bank like UBS. It can now be only compared to the levels last seen during the pandemic-related recession in 2020. Right now, this is ridiculously low.

UBS – P/E history

If we take the price-to-tangible book value per share measure, we will also see that the stock is not expensive. An indicator around 1 is quite good. It is not record low, but lower than it used to be in 2015 and 2018, for example.

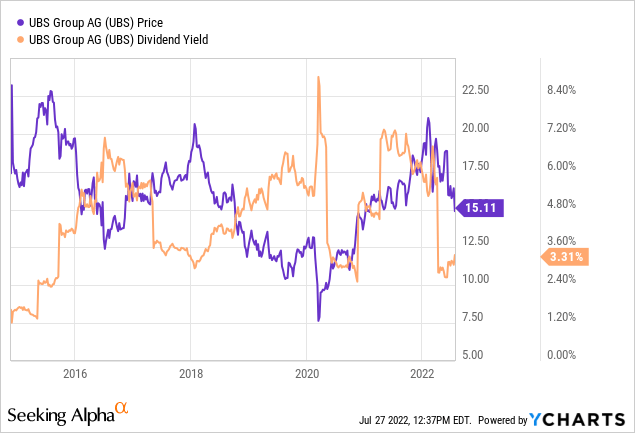

The only indicator that does not suggest the bank’s undervaluation is probably the current dividend yield of around 3%. But fortunately, the bank did not cut its dividends.

The bank also confirmed the plans to carry on with its $5 billion stock buyback program have remained unchanged.

Economic outlook

Another source of worries for investors was the economic outlook the management gave. It is safe to say that the fears of a recession are in the air and make many investors feel nervous. As UBS’s CEO Ralph Hamers said, “private clients stayed on the sidelines“, whilst institutional clients increased their trading volume. After all, inflation is still high, the war in Ukraine is ongoing. What is more, there are strict Covid policies in parts of Asia, especially China. Recession fears made many private clients stop investing. So, the bank’s trading fees were not particularly high. The banking sector suffers a lot when there is a recession because many assets fall in value and banking clients incur capital losses. However, UBS is a bank with conservative clients that do not borrow much. This means Switzerland’s top bank is much less exposed than many of its peers. The fact many central banks all around the world hike the interest rates is also a positive since the net interest for many banks gets higher.

Conclusion

Whilst the outlook is not very certain, the bank delivered sound results. The earnings, however, were lower than many analysts had expected them to be. The conservative economic outlook given by the management also triggered UBS stock crash. The thing is that the management of UBS has always been cautious and conservative in giving forecasts. I personally think that a recession will be a negative for UBS, but the bank will be in a much better shape than many of its peers. If we do not have a recession in the near future, rate hikes would raise the bank’s net interest income. In my view, UBS stock is highly undervalued and could be a great opportunity for value investors to buy.

Be the first to comment