akinbostanci/iStock via Getty Images

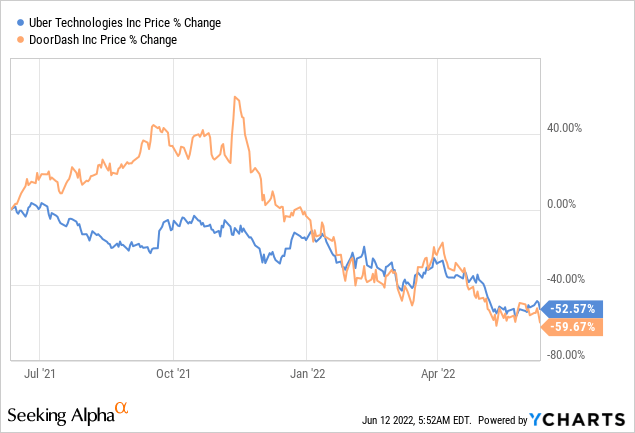

In the short term, the market can be very bad at discriminating good businesses from bad ones, but in the long-term it tends to get it right. For the last year, both Uber (NYSE:UBER) and DoorDash (NYSE:DASH) have seen their share prices decline by similar amounts. Yet, we would argue this is a lot more deserved for DoorDash than it is for Uber. We previously wrote an article warning investors about the lack of operating leverage DoorDash was displaying, and shares are now down 44%, while the S&P 500 has only declined 12% since we wrote that article. In any case, we continue to believe that DoorDash has a flawed business model, and we think that a pair trade of buying Uber and selling DoorDash can be an interesting idea.

Uber currently has about twice the market cap compared to DoorDash, at around $46 billion versus ~$21 billion for DoorDash. Nonetheless, Uber is a much bigger business with trailing twelve months revenue of ~$21 billion, compared to only ~$5 billion for DoorDash. In other words, Uber has about 2x the market cap, but about 4x the revenues. We find this absurd since we consider Uber a much better business compared to DoorDash.

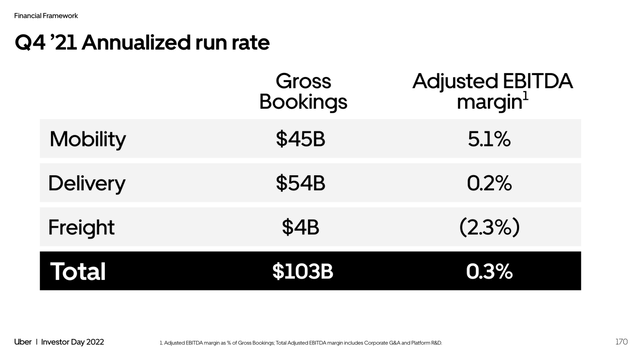

Part of the reason we consider Uber a superior business is that about half its business comes from the more attractive mobility segment (i.e. the original Uber service), whereas DoorDash is more of a pure play delivery app. As can be seen below, in Uber’s case the delivery segment operates close to break-even, despite bigger revenue scale, while mobility has a decent ~5.1% adjusted EBITDA margin. The freight segment can be forgiven for having negative margins today, since it can be argued it still has not reached the necessary scale, in any case since it is much smaller it does not have that much of an impact in the company’s valuation.

Uber Investor Presentation

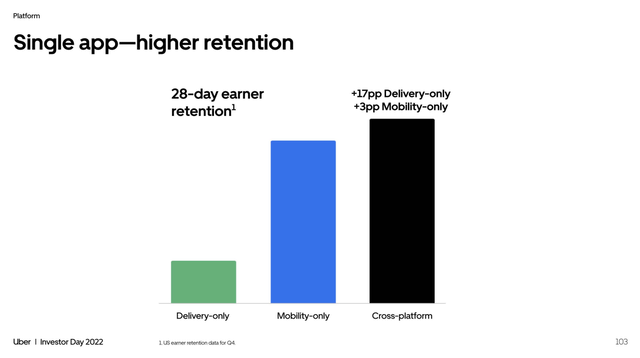

Despite operating close to break-even, the delivery segment does provide Uber with some advantages. It has some synergies with the mobility segment, for instance, drivers/earners have a higher retention rate when they work using both Uber and Uber Eats, compared to when they deliver for only one of the apps. It is also interesting to see how delivery-only has much lower retention than mobility-only. In any case, what we want to show here is that there are some synergies from having both businesses, and that is an important advantage Uber has over DoorDash.

Uber Investor Presentation

Competitive Advantages

While both companies operate what can be argued are two-sided platforms, and these platforms tend to generate competitive moats thanks to the network effects, we believe the network effects are much stronger for Uber than for DoorDash. For starters, Uber’s platform is much larger, and it has more functionality offering mobility and deliveries versus only deliveries. Promotion between apps lowers costs and improves retention. Then there is the benefit of the international operations. If a person travels, they can continue to use the Uber app in more than 10,000 cities around the world. So, if a user does not want to have a huge number of apps installed, they will tend to favor the one they can use both locally and when they travel. Uber can also benefit from sharing technology and best practices between its two business segments, and achieve better margins and reinvestment potential.

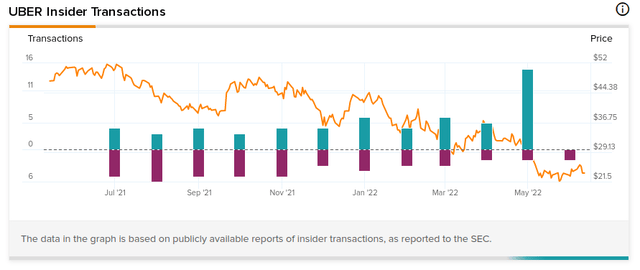

Insiders

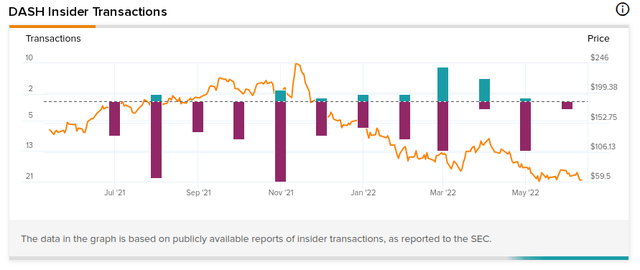

It looks like corporate insiders agree that Uber is undervalued while DoorDash is not, by looking at the number of buy/sell transactions for each company. As the share price of Uber declined, the number of insider buy transactions increased, while the number of insider sell transactions decreased.

TipRanks.com

The same cannot be said for DoorDash, where insider sales have out-numbered buy transactions by a very significant margin.

TipRanks.com

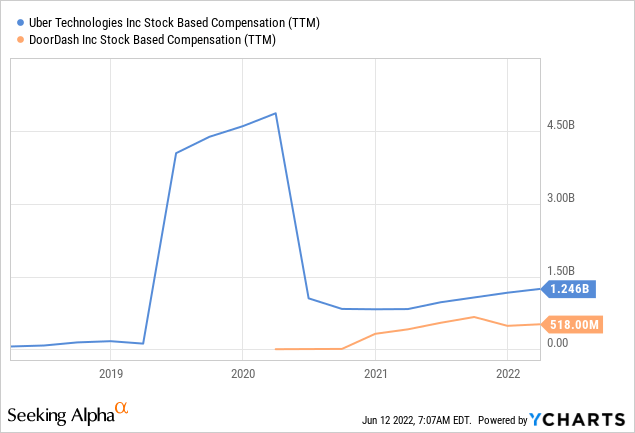

As a side note, we believe both companies are using stock-based compensation excessively, and that is one reason we dislike adjusted EBITDA numbers. By doing a pair trade, this is neutralized to a certain extent, since the dilution affects one of the positions but benefits the other.

Financials

Uber reported solid first quarter results, and gave upbeat second quarter guidance. It now expects to generate free cash flow for the full year.

DoorDash also posted strong revenue growth, and while contribution margin increased year over year, the firm missed on the bottom line as investments in new markets significantly increased costs. DoorDash’s take rate increased nearly 1 percentage point to 11.8% and DoorDash reported that monthly active users and their ordering frequency reached new highs. Net revenue increased 35% to $1.5 billion. The company continues to enter new markets such as groceries, alcoholic beverages, flowers, and retail, in addition to adding new regions such as Europe where it acquired Wolt. Many of these markets where DoorDash is expanding are incredibly competitive.

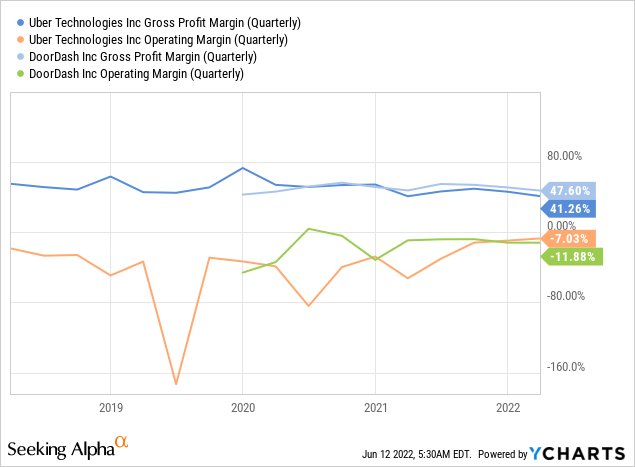

Looking at profit margins, we see that DoorDash currently has a higher gross profit margin compared to Uber, but has a much worse operating margin.

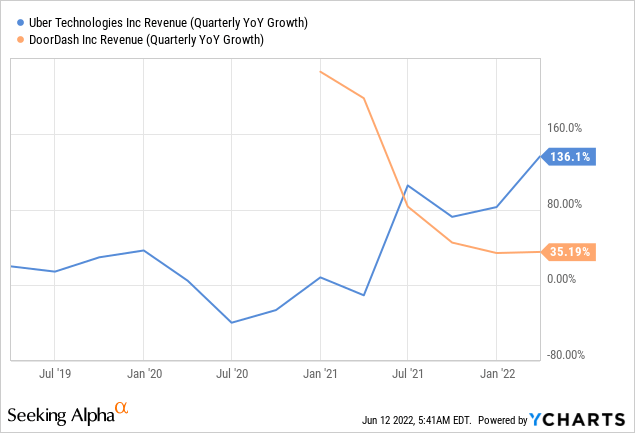

One of the advantages DoorDash used to have over Uber was its much superior growth rate, but with the re-opening of the economy this has now reversed, and it is Uber the one posting higher growth rates.

Operating Leverage

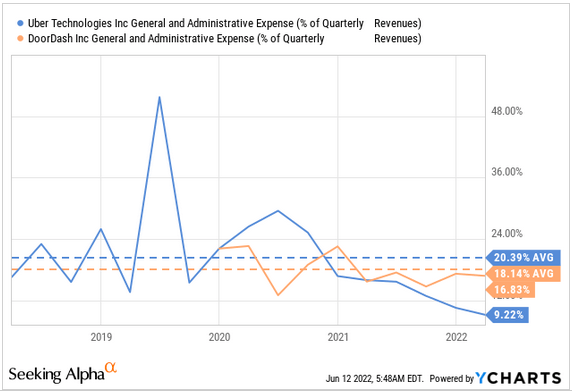

We believe that a healthy growth business, even when it is still losing money, should display some level of operating leverage. Otherwise, it is difficult to see a path to profitability for a company, or for improved operating results. It appears to us that Uber started to be managed better with the arrival of its CEO Dara Khosrowshahi, since it is now displaying operating leverage. For example, Uber’s G&A expenses used to average ~20% of revenues, but have recently been decreasing when measured this way to ~9%. Meanwhile, DoorDash continues to show very little operating leverage with its G&A expenses.

YCharts

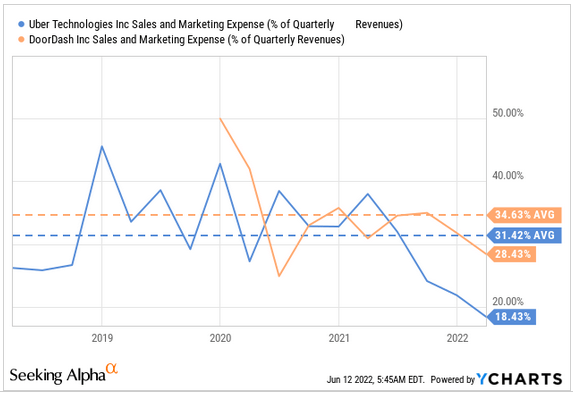

Similarly, we see sales and marketing as a percentage of quarterly revenues meaningfully decreasing for Uber, from an average of ~31% to about 18% currently. In DoorDash’s case, the reduction is a lot less significant.

YCharts

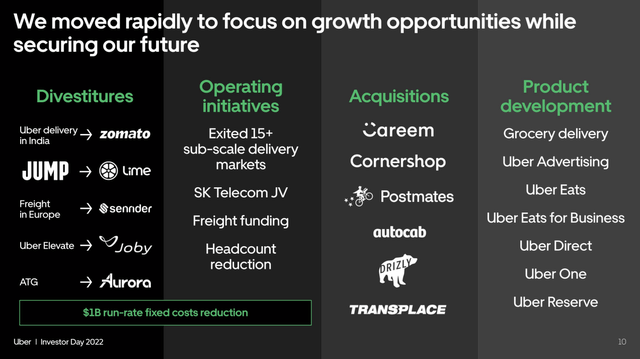

Part of this improvement we believe is the result of selling some of the least attractive businesses, such as Uber delivery in India, Jump bikes, Freight in Europe, Uber Elevate, etc. These are businesses that were not strategic, were likely losing significant amounts of money, and were far from reaching the critical mass they needed.

Uber Investor Presentation

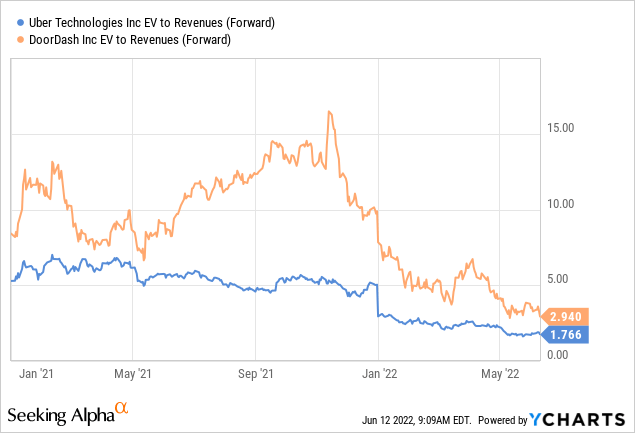

Valuation

DoorDash is trading with almost 2x the valuation of Uber, when measured using forward EV/Revenues. Given that Uber is now growing faster compared to DoorDash, and that we believe it is a vastly superior business, we see no reason for this premium. We think a pair trade could be maintained until Uber has the higher EV/Revenues multiple. In the past, there were times the valuation difference was even more extreme, but at least then it could be argued that the premium was the result of the faster growth DoorDash had.

Risks

The main risk we see is if DoorDash figures out a way to re-ignite hyper growth and returns to its much higher valuation, but we see this as relatively unlikely to happen. There is of course the risk that even if the valuation gap eventually closes, that it could take so long that the return on investment could be disappointing.

Conclusion

We believe a pair trade of buying Uber and selling DoorDash is a lot more attractive than a long-only position in Uber. It is a way to artificially reduce Uber’s exposure to the less attractive delivery segment, while retaining the synergy benefits of having both businesses. In our opinion, Uber is a much better business compared to DoorDash, with a stronger competitive moat. We do not believe it is warranted for DoorDash to have a higher valuation multiple compared to Uber. This valuation difference has been closing, and we believe it will continue to do so.

Be the first to comment