LeoPatrizi/E+ via Getty Images

Thesis

I am convinced that the market is misconceiving the profitability potential of Uber’s business model. Uber operates in a fragmented market, which is a wonderful place to build a business at. The management has done some tremendous work since Dara Khosrowshahi became CEO. Their strategic decisions to sell international losing operations for stakes in the number one player in the respective markets is yet another wonderful move by the management that demonstrates their sophistication and obligation to profitability. Moreover, the CEO’s recent purchase of stock in the secondary market only reassures my thesis. Lastly, the November launch of the Uber pass subscription is a potential game-changer moving on.

Throughout my early journey as an investor, I came across several investors’ unrequited love stories of potential stocks they had known had a bright future but for some reason decided not to invest in. From my research, the thing many of these stocks was that they were well known, and as a result investors underestimated their future earnings potential.

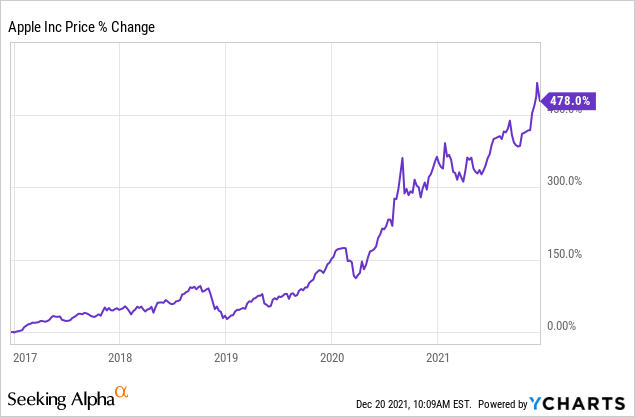

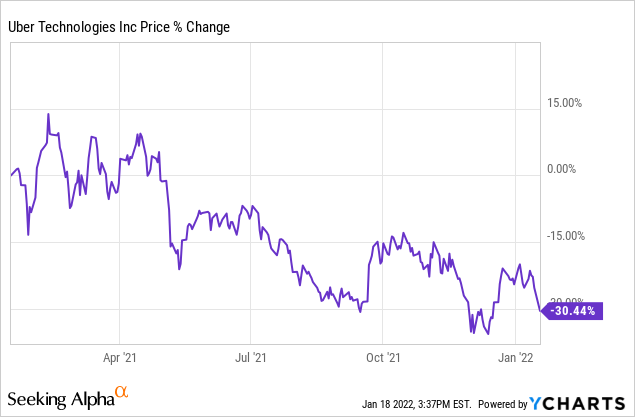

Look no further than Walmart (WMT) in the ’90s. Or Apple (OTC:APPL) in 2016. Although everyone knew about Apple, Mr. Market had the courage to price it so poorly:

I see the same exact characteristics in Uber. From its use as a verb, the fact that many couldn’t picture their lives without it, and their enormous TAM. But still so many underestimate the company. Therefore, I strongly believe that in 2026 we will speak about Uber in the same manner that we spoke about many mega-caps throughout the years.

Segments

Uber has three main segments – mobility, delivery, and freight – that offer a variety of services that range from ridesharing, delivery of all kinds of goods, and connecting carriers with suppliers.

Mobility

Mobility is the core of Uber, the first business, the first app, the most profitable segment, and in a non-COVID environment also the largest. The mobility side connects drivers with riders through an app’s marketplace that offers mobility on a variety of vehicles such as cars, minibuses, and rickshaws. Uber has the No. 1 position in the ride-sharing category in every major region where they operate. Moreover, it also has minority-owned affiliates who, at the time of the transaction, had the No. 1 position in their related market.

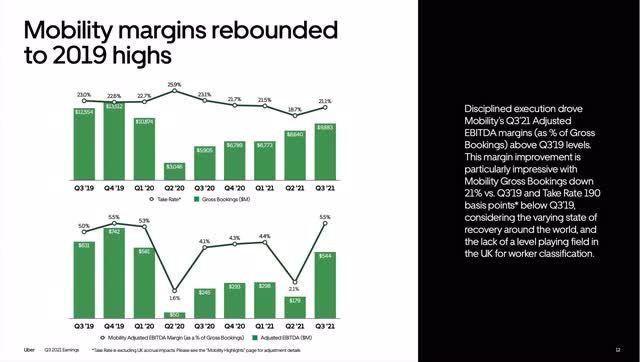

Contrary to popular opinion, Uber’s mobility segment has a wonderful and profitable business model. In 2019, mobility generated ~$50B in gross bookings with 20%+ take rates and around 20% adjusted EBITDA. Uber has low fixed operating costs as you can see in the most difficult pandemic quarters. The Mobility segment has matured and is headed toward operating costs stagnation and meaningful GAAP profit. Q3 gross bookings are at ~80% of 2019’s and margins are shy from that level while trending upwards. I won’t make COVID-19 predictions, but I will say that you should always bet on humankind to prosper. Because transportation is such a fundamental part of our society I can’t assume anything but a thriving environment for Uber’s operation.

Delivery

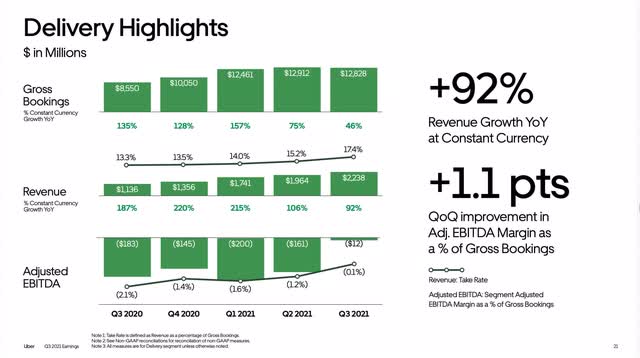

As a close follower of Uber and an enthusiastic reader of seeking alpha since 2019, I can’t but remember the criticism around Uber eats during its IPO’s days. I will give critics the benefit of the doubt as Covid played a big role in the massive expansion of Uber’s Delivery business. But as investors, we must assess possibilities while adapting to reality, and I don’t see the trend around deliveries of food and goods regress. As the CEO mentioned during the latest conference call, food delivery complement dine-in in re-opened cities. Third-party food delivery has continued to grow even in cities where dining trends have fully recovered.

During Q3 2021 Uber’s Delivery business posted revenues of ~$2.2B (+92% YoY) on gross bookings of almost $13B (+46% YoY) which resulted in an adjusted EBITDA of (-)$12m, touching brake-evening. And the most astonishing part is the gap between the growth of revenues and gross bookings. Or in other words, the growth in the segment’s take-rates, who grew 31% YoY to 17.4%.

The spectacular growth in take-rates is the ultimate testament to the vivaciousness of Uber Delivery’s marketplace. Restaurants can’t afford to be left out of Uber Eats, which serves as much more than just a delivery business. Covid-19 served as a booster (got it?) for a paradigm shift in the perception of take-out and food delivery. Instead of deciding what to eat and then calling the chosen restaurant, more often than not people use their food delivery app of choice to select a restaurant. Hence, Eats became a crucial awareness springboard for many restaurants. In the not-so-far future, I see all kinds of on-demand goods on Uber’s marketplace in an equivalent shift to what happened to food delivery. Uber’s recent M&As and expansions toward grocery, liquor, and cannabis support my thesis.

Freight

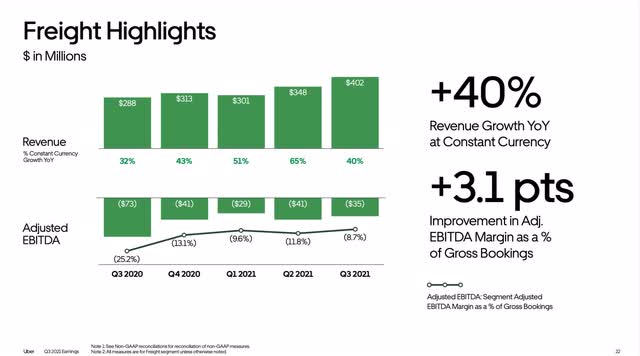

Freight is Uber’s shot at revolutionizing the logistics industry. The highly fragmented freight industry is an inefficient outmoded industry that strives for innovative disruption. Uber tries to connect carriers with shippers with their on-demand proven marketplace. Instead of the clumsy, and less profitable old-fashion way of negotiating through faxes and phone calls with countless middle-mans, Uber is simplifying things with an end product that mitigates the “dead-head” miles, and is also transparent and convenient for both sides. Freight’s Q3 revenue grew 40% YoY to $400mm.

To be honest, I think Uber’s plate is full, so while I believe Freight offers a favorably profitable business that is suited for Uber’s nature, I am not sure how much time Uber’s Board and management spends on the Freight side of the business. Please, do not misinterpret my statement. I believe that while there is good potential in Freight, Uber is rightfully focusing on the Mobility and Delivery sides of their business as they are more mature and offer the best potential today. Thus, I will purposely leave out Freight from my future assumptions and valuation, as I consider it an addition to my margin of safety.

Uber’s Ecosystem

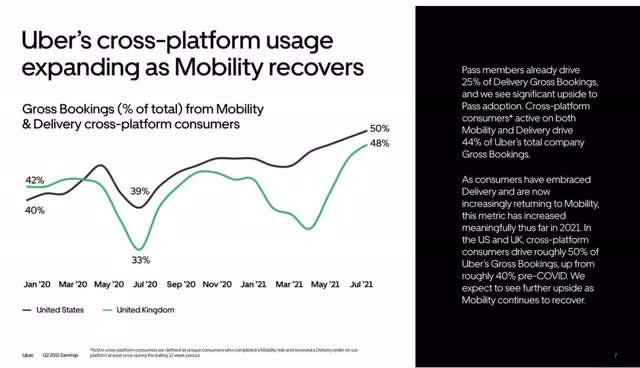

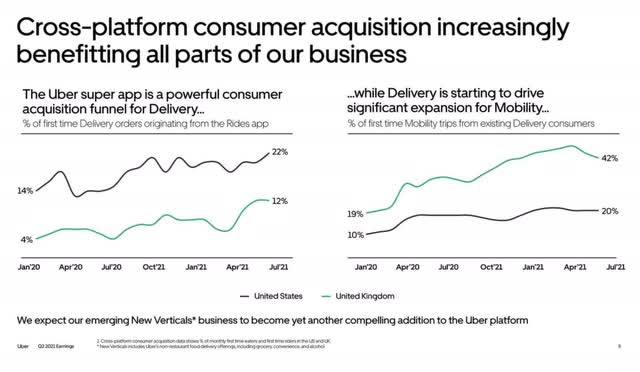

Comparisons between companies are tricky because of the anticipation it creates in our minds, past actions won’t repeat in the future. Well, not in a precise way. But, I still can’t wrap my head around the disregarding of the market toward Uber’s Ecosystem and what is evident from it. Uber is the best-positioned company in the cross-point of both Delivery and Mobility, which makes it much easier for them to scale their marketplaces than to their competitors. Eco-System which is a buy-product of network effect and switching cost is a wonderful and proven moat. Uber through its unique position can offer both drivers/curriers and riders/eaters a complete delivery (of everything) solution that its competitors, who are focused on one era of delivery, just can’t compete with. And the scale of Uber’s Eco-system solution is only in its early innings.

One example from a driver’s perspective is Uber’s offering to start earning money as an Eats carrier while waiting to get approved for Mobility. In the latest CC, they noted that Uber’s average wait times are now below 5 minutes which is their “magic mark”. I chose to bring it up because it proves leadership’s wonderful decision-making. In the prior quarter (Q2), after Uber posted an adjusted EBITDA loss of ~$500mm the market questioned their decision to step up drivers incentives, which according to management was necessary for balancing the marketplace. One quarter later and Uber crashed their Q2 adjusted EBITDA guidance (better than a $100mm loss vs actual results of $8mm) and the supply side of the marketplace came back to more normal levels. As a long-term investor, I want the management of my investments to do what is right for the business with no concern for short-term stock price movements (as they did).

The second Eco-System derivative is Uber’s recently launched Uber One their whole subscription program. Finally, Uber launched a subscription program that merges mobility with delivery. I see Uber One as the embodiment of Uber’s moat with an Amazon prime potential, primarily if the long-term vision of the delivery of everything would evolve. One would give Uber the final edge over Lyft while more importantly, it could be the game-changer against their delivery competitors like DoorDash (DASH).

Possibly the worst problem with the nature of Uber’s business is the high accusation costs for supply and specifically demand, and the worst part is that the accusation doesn’t end in the first ride or order because Uber has poor switching cost economics. With One there will be, One could reduce Uber’s cost of maintaining customers while being the springboard for Mobility users toward Delivery and the other way around.

The last important potential that already came into existence is Ads. I could write a whole article on the potential of Ads for Uber, but for now, I’ll try to summarize it.

There are four main parts for Uber’s potential Ads business, with some already in existence:

- In-car advertising, a simple straightforward way of advertising using real estate on vehicles.

- Restaurants marketing in the Eats app, payment for placement inside the app.

- Ads on the Uber Rides app, a new addition of ads when finalizing a booking and when starting a ride. This is a tricky one because it mustn’t harm the user experience to the point of switching to the competitors. But it also has enormous potential as Uber has a huge amount of data regarding users’ behavior and preferences which they could leverage as “stop for coffee around the corner” suggestions during a ride.

- The last one is the potential CPG advertising in their grocery deliveries. Which some suggest could return $3-$3.5 for a big basket delivery and $2 for a small basket of groceries.

Risks

There are several risks for Uber’s long-term performance.

First of all, Uber is operating in an enormous market. The problem is that it can take you out of focus, Uber has lost so much money over the years because they tried to capture the entire market, and only recently management has changed its priorities toward controlled expansion with care for profitability. While Uber mustn’t rest on its laurels, it should also persist with its goal for profitability. It might sound like a rich people’s problem, but it is situation management has to operate delicately.

Second, I have lofty expectations from Uber One and their future margin expansion. But, as of the writing of these pages, it is still within the realms of expectations.

Third, in the great discussion about Uber’s business in the “Business Breakdown” podcast, I listened to an interesting point regarding Uber’s workplace environment. According to Ram Parameswaran Uber has lost its position as the desired destination for many young engineers with great minds and a hunger for success. The quality of the average worker can decide the direction to the future of a business, but it is something we as investors can’t precisely measure. Uber is in a different place from its early inning when it was the glory child of silicon valley, and while it might entice fewer young engineers Uber must preserve its quality workers. I would note that according to Peter Lynch the boring the better when it comes to investments.

Fourth, the regulatory risk, as seen in the UK and in California’s Proposition 22, Uber had and would face regulatory pressure. I do not see it jeopardizing my thesis, it is reasonable to assume regulation on a disrupter with such scale. But, at the end of the day, no one wants to return to a world without Uber, Lyft, DoorDash, and their peers… Therefore, as seen in the UK, those companies would adapt to regulation, and on a personal note, investors panic over-regulation talk because we are terrified of the unknown. But, in most cases, from a rearview mirror, regulation isn’t bad, especially when it is evident that no one wants to return to the prior state.

Lastly, to prevent me from getting roasted at the comments I will note the risk/blessing of self-riding vehicles. A new company can be the sole winner to self-riding capabilities, then to figure out a solution for building the car fleet through: a) Convincing owners to register their car on their marketplace instead of on the scaled competitor (Uber). b) Building the fleet with their capital. While doing the entire thing at scale worldwide with the legislation concerns. I don’t find it both likely and doable in the foreseeable future (for me – 5 years).

Valuation

Let’s start with a relative valuation using Lyft (LYFT) and DoorDash.

| Company | Uber | Lyft | DoorDash |

| Market cap | ~$80B | ~$14.5B | ~$51B |

| Revenue (ttm) | ~$14.8B | ~$2.8B | ~$4.56B |

| Growth | +~36% | -~0.1% | +~105.9% |

| Revenue (2022 estimate) | ~$25.15B | ~$4.4B | ~$6B |

| Growth | +~48% | +~38.5% | +~23% |

| Gross Margin (ttm) | ~38% | ~33% | ~54% |

| Gross Margin last quarter | ~40% | ~45% | ~54% |

| P/S | ~5.5 | ~5.2 | ~8.9 |

| EV/Sales | ~5.8 | ~4.7 | ~10.25 |

Uber trades with a slight premium to Lyft while DoorDash trades at the highest valuation from the bunch, from a sales standpoint. Now, one can claim that Uber should have the highest valuation as it has the highest projected growth rate, a $13.1B equity stake in competitors, and by playing in both Delivery and Mobility an edge that its competitor simply can’t match. But, instead, I’ll just compare Uber’s Mobility side with Lyft’s valuation and the Delivery side with DoorDash’s.

In Q3 Uber’s mobility revenues grew 59% as compared to Lyft’s 73%, and adjusted EBITDA margin (compared to revenue, not gross bookings) came at ~24.5% while Lyft’s came at around 8%. Applying a P/S ratio of 5.2 (Lyft’s) on Uber’s ttm mobility revenue of $6.75B (excluding the $600mm resolution in the UK at Q1 2021) generates a value of ~$35B for Uber’s mobility segment. Though I believe Uber’s Mobility segment is worth much more as I’ll show later.

Next, Let’s apply DoorDash’s P/S ratio of 8.9 on Uber’s ttm delivery revenue of ~$7.3B, do note that in Q3 Uber’s delivery revenue grew 92% while DoorDash’s grew “only” 45%, both companies are roughly break-even from an adjusted EBITDA perspective. Calculating the above generates a market cap of $65B for Uber’s Delivery segment.

Adding the above returns an overall market cap of ~$100B for Uber, but it doesn’t enclose the Freight segment and the company’s equity investments.

Next, I’ll try to give some sense for my own projection and implied valuation for the stock. In 2019 Uber’s Rides business generated revenue of ~$10.6B (+16% YoY), in Q3 mobility’s gross bookings were 80% of 2019’s levels I assume them to return to 100% until 2023 with at least 15% revenue growth afterward, and I believe it is conservative. Uber’s future EBITDA margin is really tricky to determine, it includes many variables like “take rates”, insurance costs, and the mix between the US and International (International is more profitable). In Q2 CC I noticed some interesting remarks about the company’s earning power, one point that stood out to me was his statement around Mobility’s and Delivery’s EBITDA margins (from gross bookings) of 10% and 5% respectively, with a $2B run rate unrelated to a specific segment. 10% EBITDA margins from gross booking are equivalent to 40% EBITDA margins with take rates of 25%, it might sound astonishing to some but in the same CC he also mentioned that:

For context, in major markets like Australia, Canada, France, and UAE where supply was organically recovering without significant investments from Uber, our Mobility EBITDA margin in Q2 exceeded long-term targets, ranging from 46% to 67% of revenue (Uber’s Q2 investor Conference Call)

International insurance costs are typically lower than in the US, therefore it is reasonable to see some markets with higher margins, but it is too early to conclude if it is an anomaly.

Based on my research I see a 15%-25% Mobility EBITDA margin as highly doable in the next 3 years, based on a 22.5%-25% take rate. With a 22.5% take rate, gross profits should be 60%, SG&A (including S&M) 30%, and R&D 15%.

Keep in mind that the difference between a take rate of 22.5% and 25% translates to around 10% incremental profits because the difference goes straight to the bottom line.

To make a good observation on Delivery margins would be even harder. Because take rates would probably be lower, but insurance costs are also lower. To be conservative I would say that 10%-20% EBITDA margins based on take rates of 17.5%-20%. Take rate of 17.5% would achieve gross margins of at least 55% (similar to DoorDash’s).

Now I’ll try to give a lower and upper range for Uber’s profitability In 2025:

Lower End

| Business | Mobility | Delivery |

| Take rate | 22.5% | 17.5% |

| Revenue | $16.5B | $18B |

| EBITDA margin | 15% | 10% |

| EBITDA | $2.475B | $1.8B |

| Price/EBITDA | 25 | 25 |

| Market cap | $62B | $45B |

Upper End

| Business | Mobility | Delivery |

| Take rate | 25% | 20% |

| Revenue | $16.5B | $18B |

| EBITDA margin | 25% | 20% |

| EBITDA | $4.125B | $3.6B |

| Price/EBITDA | 25 | 25 |

| Market cap | $103B | $90B |

My market cap assumptions range from $107B to $193B.

As I previously mentioned, I am purposely leaving out Freight and also the Equity stakes. I also didn’t account for the future potential contributions from both Uber One and the future Ads business.

Just as perspective, In 2019 Advertising and marketing accounted for ~9% of Expedia Group (EXPE) Revenues and in Q3 2021 for ~7%. Moreover, Amazon’s (AMZN) “Other” segment (composed mainly by advertising) has generated 7% of the company’s Q3 revenues, while growing 50% YoY compared to total sales 15% YoY growth. I chose Expedia and Amazon because both are well-known marketplaces with Expedia being Khosrowshahi’s (yep, I wrote it again) last CEO role, prior to his job in Uber.

Regarding Uber One potential, besides the higher user engagement and lower costume accusation and retainment costs, it will create, assuming a 30% utilization from the current ~110mm MAPC’s times ~$100 yearly price, an additional $3.3B of revenue. Though this statement wasn’t entirely fair because I didn’t subtract the current subscriptions contribution from my Revenue projections (which I can’t precisely do) but you get the point. More importantly, is the fact that both Ads and Subscription businesses possess wonderful operating margins.

Lastly, I didn’t account for future dilution, I anticipate around 5% average future dilution, which will fade dramatically 3-5 years out with future profitability around the corner.

Conclusion

To summarize my thesis, Uber Is a wonderful well-run business. The strong unit economics and vivaciousness of Uber’s marketplace are the perfect recipe for a future profit machine. The paradigm shift that Covid-19 created in our daily life will lead to a massive future on-demand market that Uber is at the forefront of capitalizing from. Mobility will return to pre-Covid levels (and higher) and the recently launched Uber One subscription is an absolute game-changer. Uber is the type of investment that you can sleep well with for the next 3-5 years.

Khosrowshahi is buying and so am I.

Be the first to comment