halbergman

The Plan To Profitability Is There, The Question Now Is Can U.S. Xpress Deliver

U.S. Xpress Enterprises, Inc. (NYSE:USX) has had a treacherous year, down over 71% since last November. The company, which operates as an asset based truckload carrier, has actually done well in growing revenues over the last year (up nearly 10% YOY) by expanding trucks and loads, but has struggled delivering on profitability, missing on earnings per share estimates over the last eight straight earnings releases, an abysmal streak.

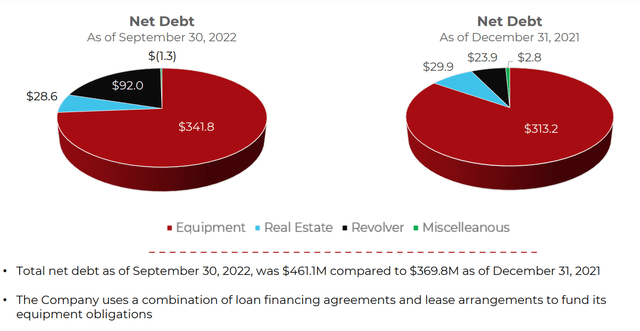

The struggle to find profitability has pushed the market cap down to a measly $120 million despite the company delivering over $2 billion in annual revenue over the last 4 quarters. This discount assigns a price to book value below 0.5x book value for USX, signaling the stock is priced well below the total value of their assets. Some of this is due to their hundreds of millions of dollars in total debt, with only part of this being long-term debt and the rest short term due within the next 12 months (Figure 1).

Q3 Conference Call Presentation

Figure 1. Much of USX’s debt comes from purchasing of trucking equipment, which they could explore the option of partially selling off to raise cash if needed.

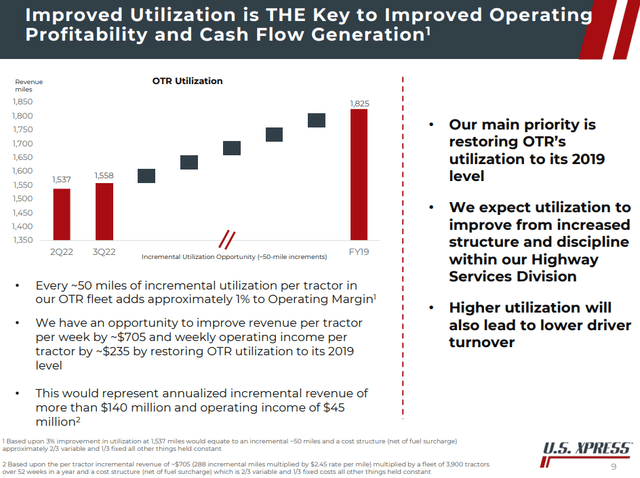

We believe if U.S. Xpress can turn things around and become even slightly profitable in 2023 (0.01-0.1 EPS), to show they can return to 2019 profitability metrics (0.39 EPS), the stock could have upside potential of nearly 100% and approach the $5 range by the end of next year. The company has laid out a solid plan to reach profitability by increasing overall truck count, reducing fixed costs, improving upon their variant investments, and reducing total costs through a realignment of assets (Figure 2). It now comes down to execution.

Q3 Conference Call Presentation

Figure 2. The company has a great plan to reach profitability on paper, but we have not seen this take shape in earnings results thus far.

The combination of these factors should easily push U.S. Xpress into the lower range of profitability by late next year – if the company delivers – and from there if they can reach historical profitability levels. The stock could be a multi bagger come 2024.

Current Valuation

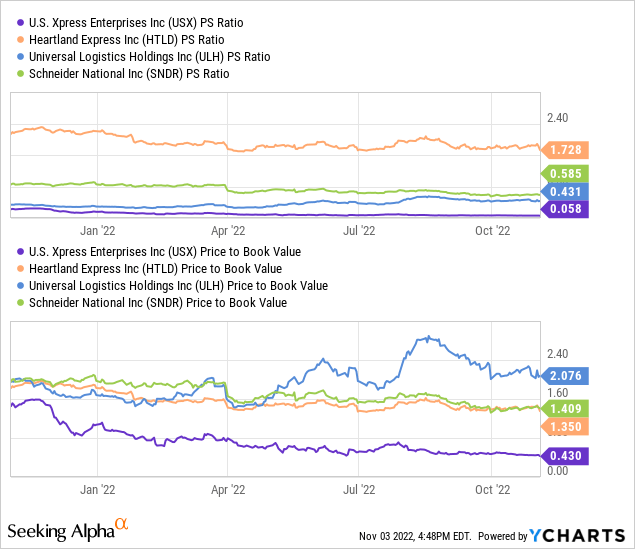

Diving into the valuation of USX stock, you see the enticing price to sales ratio of less than 0.06x sales, 95% below that the rest of the trucking sector (Figure 3). Their valuation metrics, such as price to book value and enterprise value to sales, all paint the same picture of USX being deeply discounted – if they can get their profitability back in check and begin making money once again.

Figure 3. USX trades as if they are on the verge of bankruptcy despite being one of the nation’s top-10 largest trucking companies.

Reestablishing profitability would then allow USX to begin working towards paying off their debts, and could potentially turn the entire narrative of the stock around. With heavy assets in over 6,400 tractors, 13,600 trailers, and utilizing thousands more independently owned contractors, the company has a massive breadth of book value as one of the largest trucking companies in the nation. That is one of the reasons why we believe the $120 million market cap significantly undervalues U.S. Xpress despite the company struggling over the last year, year and a half. The core is there they just need to get “back to the basics” as their most recent mission implies.

Wall Street analysts’ place price targets are between $3 and $5. We believe somewhere in the middle of that range fairly values the stock, assuming they reach profitability in 2023. That would indicate somewhere between 65% and 90% upside at the current price of $2.22. This again assumes that the company’s plans to reach profitability through scale in reduction of costs work out as expected, which has not been the case over the last eight or so quarters.

If the company were to be able to get things back in check and return to their December 2020 annual EPS of around 0.4, their price to earnings ratio would be around 6x earnings. That is a lot of ifs, but at where the P/E average for peers currently sits around 16x earnings, this would leave room for the stock to double if not more, if they can again push through their own microeconomic headwinds.

Risks

As mentioned prior the stock comes with significant risks, which is why it appears at first hand to be deeply discounted. The company has very little cash on hand, is currently losing money at an accelerating clip, and carries around $700 million in debt. Leo Nelissen does a good job of breaking this debt down in his Seeking Alpha article on USX. We believe that this debt, although a large number, does not pose significant balance sheet issues as long as the company’s move towards profitability shakes out as planned over the next year. Other risks include growing competition in the trucking industry, driver shortages, and an increase in accident-related claims.

Another potential positive note for the company’s battle toward profitability is the developments of artificial intelligence and driverless vehicles. U.S. Xpress has been a prominent player in the AI truck industry, partnering with a number of companies to bring about driverless trucking, as this would help aid the company’s push towards profitability, although it likely will not become a major factor for another two to five years.

In summary, investors must know going into U.S. Xpress that it is a high risk, high reward investment. Therefore, only small plays should be made in the stock. Similar names such as USA Truck, Inc. had a similar story and were bought out, although that likely will not be the case with U.S. Xpress due to their large amount of assets and size in comparison to competitors – though it is worth noting that it is a very small possibility just based off the sheer discount the market is giving USX stock at current prices.

Takeaways

We believe USX still has nearly 100% upside over the next year to year and a half for investors willing to take on the risk of a struggling company’s turnaround. Management has outlined in depth plans with quantitative goals to reach profitability, and it seems more likely in our opinion, that they reach those goals than fail. Pushing towards their historical highs and profitability will be the difference-maker between whether or not the stock can be a multi-bagger over the next two to three years. For investors looking to ride the wave of turnarounds in small cap stocks as markets near the years lows, U.S. Xpress appears to be one of those choices of names right around their bottom, as it would take even more unexpected bad news and further declines on profitability for the stock to fall further.

Therefore, overall, we estimate somewhere between 65%-90% upside with as little as 10 to 20% further downside over the next year to year and a half. We do not expect the stock to fall much below the $2 mark purely based on the sheer size of the business. Investors must monitor the next two to three quarters of conference calls to follow the turnaround, and if profitability does not appear near within that timeline, it may be worth looking for other names, as at that point debt and losses will likely become a very concerning issue. USX stock is a buy due to its appealing risk vs. reward, not because of outstanding performance but instead based off of the potential to unlock deep value through a turnaround and the defense against significant downside that U.S. Xpress Enterprises’ mass of assets offer.

Be the first to comment