JHVEPhoto

CD Rates Moving Up

Just last week I secured a six-month CD from Discover Bank yielding 3.25% and a three-month CD from Zions yielding 2.85%. These two banks are subsidiaries of Discover Financial Services (DFS) and Zions Bancorporation, National Association (ZION).

Rates are on the move up and that is certainly good news for depositors and investors looking to park money.

However, rising rates is not good news to some U.S. banks.

No doubt, a few bankers and directors are starting to sweat.

For the first time in a long time, deposits are not dirt-cheap.

Deposits are to banks what energy is to the U.S. economy.

When energy is cheap and abundant, we take energy for granted. When energy is no longer cheap and abundant, the game changes.

When deposits are cheap and abundant, inexperienced short-term focused bankers and directors take them for granted. Until they don’t.

FDIC Data: Four Charts

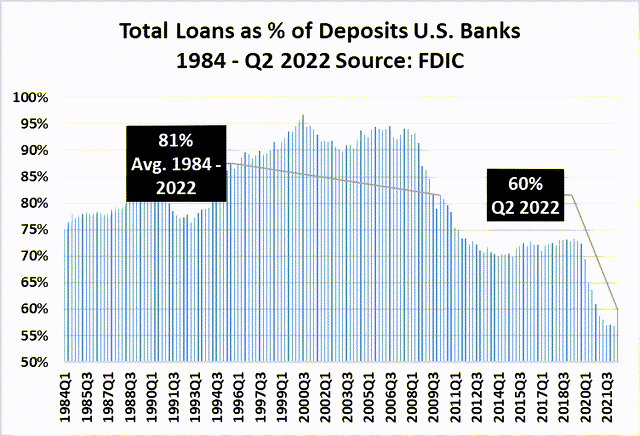

The first chart shows the industry’s aggregate loan-to-deposit ratio by quarter from 1984 to Q2 2022.

- Historic average: 81%

- Q2 2022: 60%

- All-time Low: 57% Q2 2021 – Q1 2022

- The loan-to-deposit ratio jumped to 60% in Q2, while a big jump, the ratio remains historically low.

Loans/Deps All US Banks (FDIC)

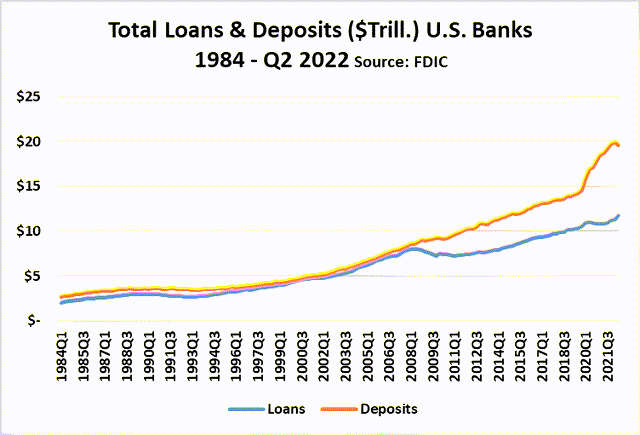

The next chart shows another view of loan and deposit trends among U.S. banks.

- From 1984 to 2008 (the Great Financial Panic), loan and deposit growth moved in parallel.

- From 2008-2011, total loans shrank about 10% in aggregate as regulators and politicians forced banks to increase capital ratios. (See my “JPM Morgan Chase: Jamie Dimon’s Warning” article July 15 for more color on this topic).

- In 2020, as the economy slowed from COVID, loan growth again stalled out.

- In 2020 to early 2022, in a zero-interest rate world, deposits flowed into banks at an unprecedented level, resulting in the lowest loan-to-deposit ratios in the modern era of banking.

Run Chart Loans & Deps. US Banks (FDIC)

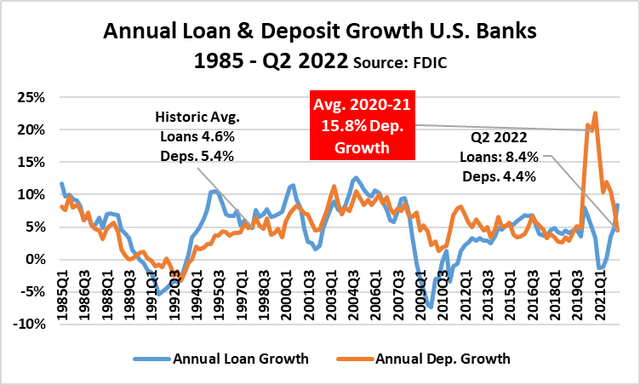

This third chart shows that annual deposit growth averaged almost 16% in 2020-21. Never in history have deposits grown at such a rate. But that is about to change.

- Loan growth did not get back on track until 2022.

- Year-over-year loan growth as of June 30, 2022, hit a 15-year-high of 8.4%.

- Total deposits in U.S. banks actually declined by $370 billion Q2 versus Q1 2022.

Aggregate Loan and Dep. Growth (FDIC)

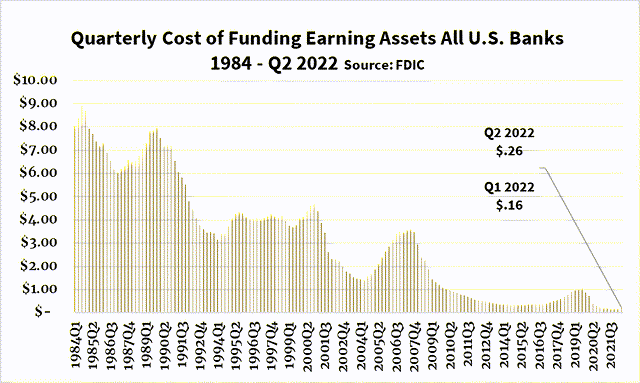

Here comes a wild chart: Funding costs by quarter from 1984 to Q2 2022.

- Bank funding costs have been close to zero for the past six quarters.

- While Q2 funding costs increased $.10 (per $100 earning assets), at $.26, funding costs remain at historic lows.

- So, everything is just fine, right?

758 Publicly Traded Banks

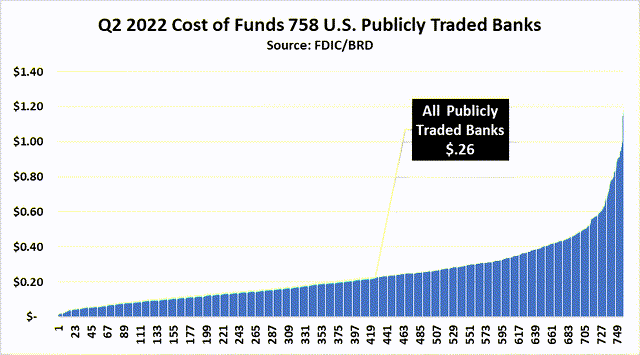

There were 4,488 banks operating in the U.S. on June 30, 2022. Of those, 758 are publicly traded.

Below is the cost of funds for each of these 758 publicly traded banks as of Q2 2022.

- Industry-wide cost of funding is $.26.

- Among the 758 banks, the range in funding costs is a low of $.0132 and a high of $1.186.

Funding Costs 758 Banks (FDIC/BRD)

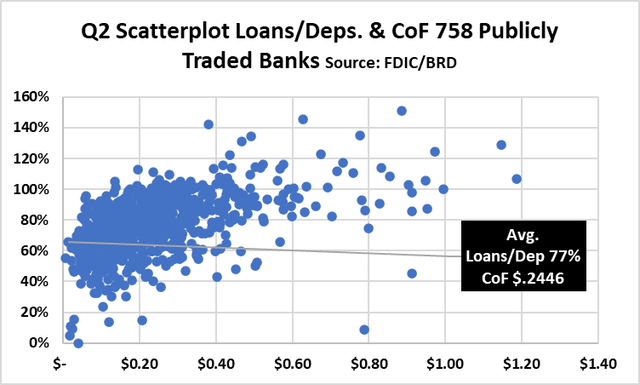

Knowing funding costs is only half the story. The next chart is a scatterplot depicting funding costs and loan/deposit ratios for the 758 banks.

- The “average” bank has a loan/deposit ratio of 77% and a cost of funds of $.2446.

- The lowest decile of banks (with lowest cost of funds) has an average cost of funds of $.05 versus the highest decile with an average cost of $.64.

- The lowest decile in banks (with lowest cost of funds) has an average loan/deposit ratio of 60% versus the highest decile with an average of 96%.

Loan/Deps & Funding (FDIC/BRD)

Closing Thoughts

The worm has turned.

Funding costs are moving up.

Banks with the highest loan-to-deposit ratios have discovered deposit gathering is a full-time job.

As banks with high loan-to-deposits strive to ensure adequate funding, funding costs across the industry will continue to move up.

Banks that most aggressively grew loans in recent years are most exposed to the risks associated with an increase in interest rates.

These banks could be in for tough times. Some more than others.

Future articles in this series will examine banks at both ends of the spectrum.

Given my risk profile as a bank investor, I always prefer banks with sticky, low-cost “core” deposits and low-to-moderate loan-to-deposit ratios. I like them more today than ever.

My guess is that more investors will too in the months ahead.

Be the first to comment