bankkgraphy

By James Smith, Developed Markets Economist & Antoine Bouvet, Senior Rates Strategist

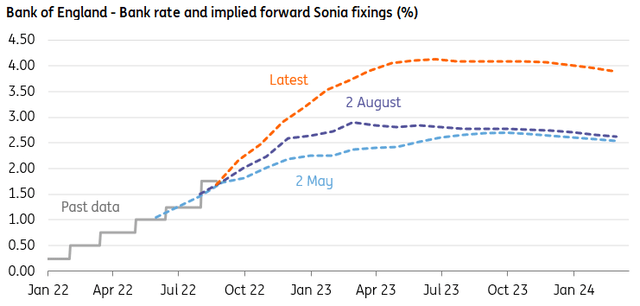

UK markets now expect bank rates to exceed 4% next year

Even by the standards of 2022, it’s been a crazy week in sterling interest rate markets. Swap rates now suggest that the Bank of England will need to hike rates as high as 4.2% (from 1.75% currently). Not only that, it implies the Bank will need to take rates even higher than the US Federal Reserve; it’s the first time investors have taken that view since early this year.

This trend has undoubtedly been exaggerated by very poor liquidity which means it’s hard to gauge exactly how realistic investors think a 4%+ Bank Rate really is. Nevertheless, we think some of this recent reappraisal can be traced back to the eyewatering surge in gas prices and increased focus on how the government may be forced to react.

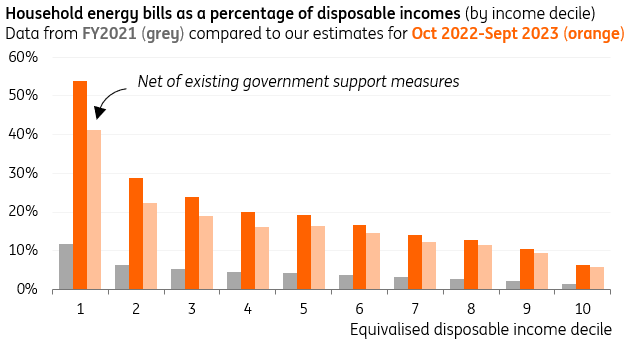

The chain of logic goes something like this: higher energy costs increase the chances of a big support package from the government. And given it will hit households hard right across the income spectrum, blanket support measures (in addition to targeted payments to those on low incomes) may well be required. That, coupled with possible tax cuts depending on which candidate becomes Prime Minister in September, would materially reduce the risk of a deep economic downturn.

But the Bank of England would also view it as inflationary, and may well be forced to increase interest rates even further in the autumn.

Markets expect the Bank of England to hike beyond 4% next year

We tend to agree with this assessment – even if the scale of the rate hikes required will probably fall well short of what markets expect. We think a 50bp hike in September, coupled with another 25-50bp in November looks more likely at this stage. Let’s break it down in more detail:

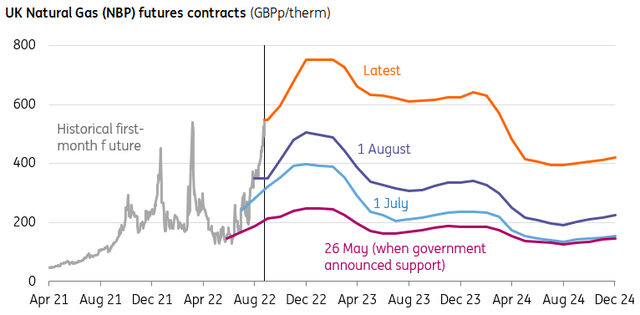

So far, the government has announced £37bn worth of support, through a combination of direct payments to low-income households, coupled with a £400 discount for all households on their energy bills from October. When that support was announced in late May, energy bills were expected to peak at a little under £3000 in the autumn.

Using that figure, a quick back-of-the-envelope calculation suggests that households would have paid roughly £65bn in aggregate on their energy bills in the period between October 2022-October 2023. For context that compares to roughly £30bn in the fiscal year 2020-21, which came before energy prices began increasing. In other words, the support measures announced to date looked, at the time anyway, like they would go some way to offsetting the energy bill increases coming down the track.

Gas prices have reached dizzying levels

Consumers may need up to £65bn extra in government support

Fast forward a couple of months, and the picture looks much more extreme. The energy regulator Ofgem has announced the average household bill will surpass £3,500 from October, and further sharp rises look inevitable.

Indeed, our own estimates based on gas and electricity futures contracts this week point to an average annual household energy bill of around £5,300 across that same 12-month period from October (peaking at roughly £6,500 on an annualised basis in the three-month period between April-June 2023). That takes our aggregate household cost estimate up to around £130bn – a £65bn increase on May’s projection – and this estimate is rising on an almost daily basis.

Admittedly that figure is a bit of a simplification – it relies on a number of assumptions, not least that those wholesale futures contracts provide an accurate gauge of where prices will land this winter. Many of those contracts are trading fairly illiquid right now. But it gives a sense of what the new Prime Minister will be faced with when they take office in early September. Roughly speaking, the average household would see need almost £2,700 extra, were the government to match the level of support offered in June.

One option would be to increase the value of payments being given to those on income support/benefits, and that seems quite likely. But in practice, a much broader response will also be needed. We’ve run a rough calculation in the chart below, and what’s striking is that across large parts of the income distribution, households may have to devote more than 10% of their disposable incomes to energy bills on average (between Oct 2022 and 2023), even accounting for existing support available.

Some of these households will be able to tap savings accrued during the pandemic. That ‘excess savings’ level still stands at roughly 8% of GDP.

But it’s hard for the government to target support on this basis, and it may find that the most practical option would be to dramatically increase the £400 energy bill discount being offered to all households.

Households in most income deciles will be spending more than 10% of disposable incomes on energy

ING analysis of ONS Living Costs and Food Survey, Effects of Tax and Benefits, Ofgem, UK Treasury

Extra government stimulus would likely prompt additional rate hikes

Whatever happens, the Bank of England will be looking at all of this through the lens of inflation. Broad-based government support would considerably reduce the chances of a recession – or at least of a deep downturn – especially given it may also be coupled with a cut to national insurance (a form of income tax) if Foreign Secretary Liz Truss becomes Prime Minister in September. The assessment also depends on what support is offered to businesses, something we’ve not discussed here.

But broadly speaking, we agree with markets that the Bank of England would view reduced recession odds as raising medium-term inflation forecasts, and thus would likely feel obliged to hike rates further.

To be clear, all of this is guesswork at this stage. Neither candidate, Rishi Sunak nor Liz Truss, have said in detail yet what level of support they’d implement this autumn. It’s not clear whether we’ll get an emergency budget before the Bank of England’s meeting on 15 September, but assuming we don’t, we expect the Bank to opt for another 50bp then.

We’ve recently argued that the Bank is reaching the latter stages of its tightening cycle. The BoE’s own August forecasts suggest inflation will be below target in a couple of years’ time, regardless of whether it increases interest rates further. Inflationary pressures associated with ‘core’ goods are easing, given lower commodity costs, higher inventory levels, and reduced consumer demand – even if wage growth will keep pressure on services inflation.

But the arrival of fresh government support would provide the BoE with further impetus to hike rates aggressively in the near term, and probably into late autumn. We expect the Bank Rate to peak at roughly 2.5-2.75% in November, albeit far less than current market pricing is suggesting.

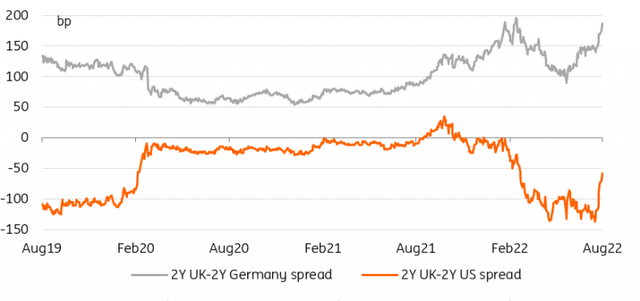

Gilts are skidding off-road

The jump in energy futures, as well as the surprise UK inflation report, are still being digested by the gilt market. These have brought about a rise in BoE hike expectations, an aggressive flattening of the gilt curve, and a sharp underperformance of gilts relative to US and European peers. In light of greater hike expectations, curve inversion is no surprise, and indeed the US curve has been there recently too. Worse inflation dynamics, as well as more immediate recession fears, should lead to a further flattening of the gilt curve compared to its US counterpart.

With US inflation expectations looking more under control than in Europe, the spread between US and UK rates seems more directional to short-term European energy developments. The spread to EUR rates on the other hand is harder to explain. The UK is by no means the only country contemplating shielding its consumers from higher energy bills. Indeed, the measures floated so far in the UK pale in comparison to some continental alternatives. Similarly, energy inflation is a problem faced by all European countries. In short, the spread that has opened between GBP and EUR short rates has to narrow, and we think it will most likely be with lower GBP rates.

The underperformance of 2Y gilts relative to Germany is overdone

The magnitude of these moves raises financial stability questions. We’ll refrain from drawing broader conclusions about the effect on the valuation of other assets beyond bonds but will simply stress that manageable rates volatility tends to be a pre-condition in many investment decisions. Closer to home, the latest moves will dash hopes of a return to more functional gilt markets.

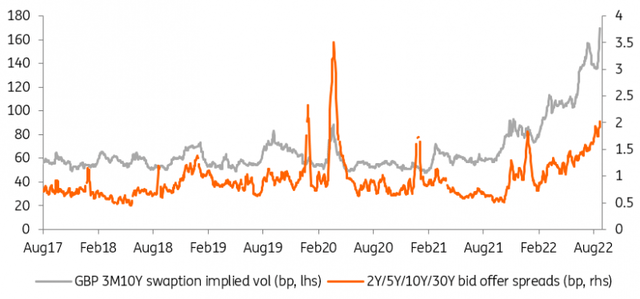

Gilt liquidity conditions continue to deteriorate

Bid-ask spreads have been propelled to new wides, and implied volatility continues to climb. These developments cast a long shadow on the Bank of England’s plan to sell gilts out of its Asset Purchase Facility portfolio, even in small sizes. We don’t argue that the plan should be shelved but a clearer circuit-breaker, which helps avoid adding to market stress, would make sense in our view. One could of course argue that the current episode is a one-off and that the BoE plans the sale of only £10bn per quarter in the first year.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment